Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

3.65% 7,662,920 Clients

Zerodha Account Opening Enquiry

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Zerodha offers a range of trading software and tools to its customers. It has also partnered with other companies to provide 3rd party platforms to its customers. Various platforms and tools offered by Zerodha includes:

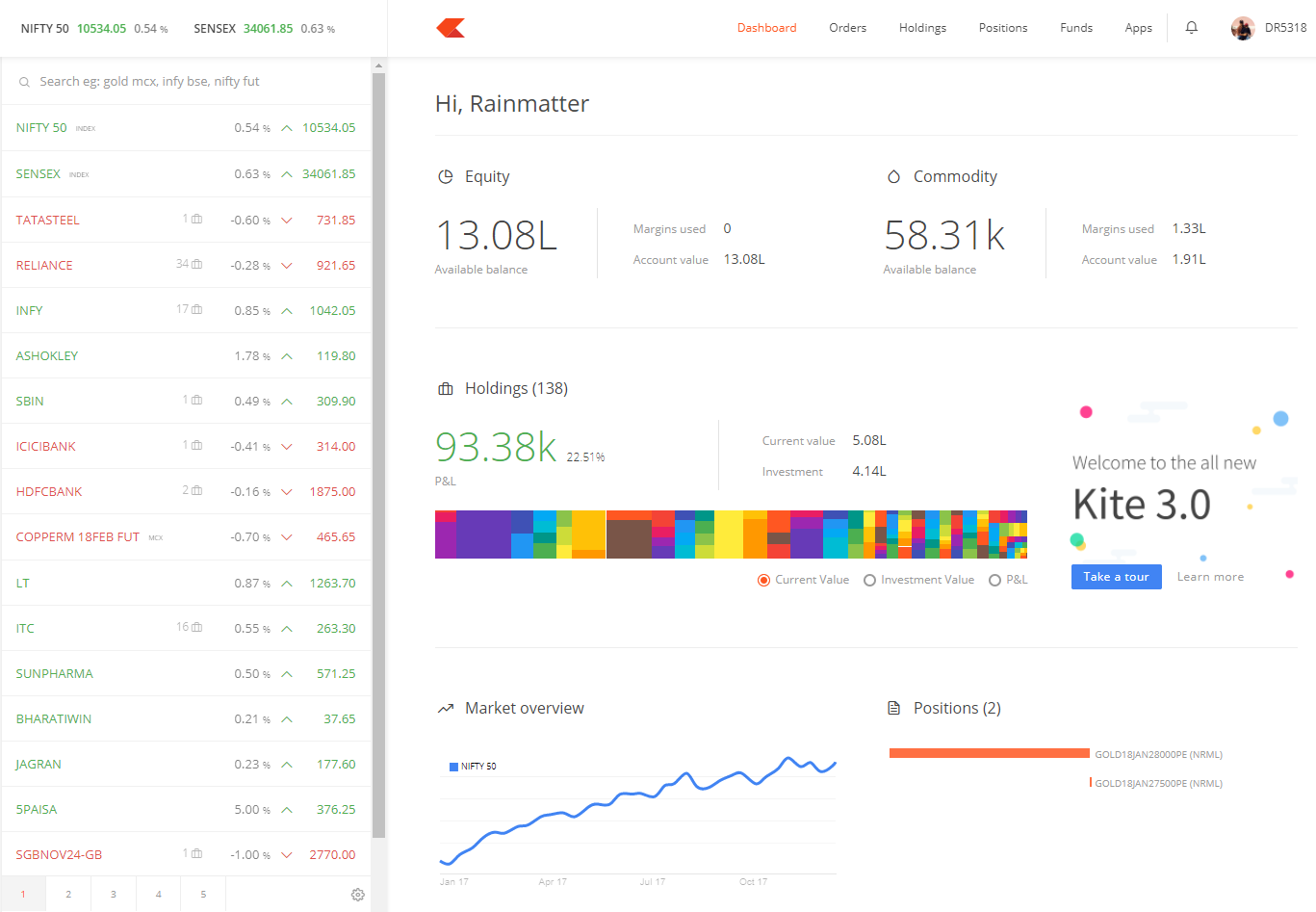

Kite is a powerful web-based trading platform offered by Zerodha. The platform is built in-house by the company and offers a fast and reliable trading experience to traders. It has a range of new and essential features such as:

Zerodha Kite Demo (Zerodha Kite User Manual)

Zerodha Kite is an advanced trading platform with a range of features. Traders who are new to the platform would need some understanding of the various features and functionalities of the platform to use it. Zerodha Kite User Manual explains all the features of the Kite platform in a simple way.

Zerodha customers can learn about Kite platform.

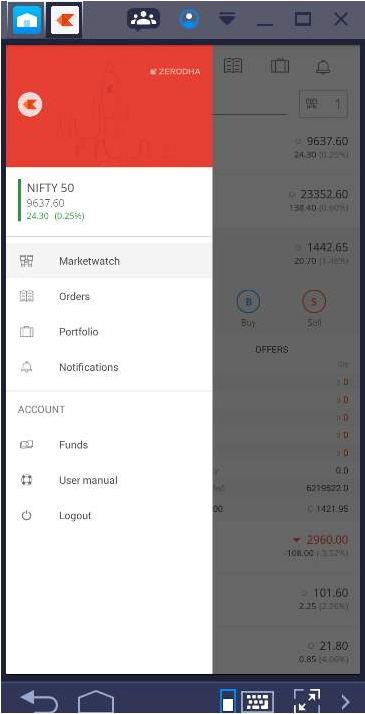

Kite Mobile is a mobile trading app by Zerodha. It brings Zerodha's flagship trading platform Kite Web on Android and iOS smartphones. Zerodha customers can download the mobile app and use it to analyze and trade. The app offers many essential trading features such as:

Zerodha Mobile Trading Software Download

The Zerodha mobile app is available for Google Android and Apple iOS smartphones. The Zerodha trading mobile software can be downloaded for free from:

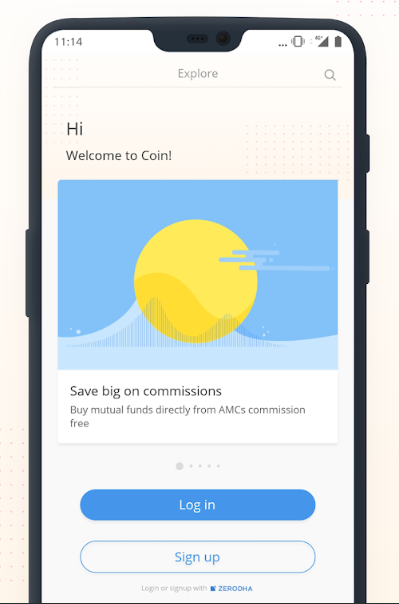

Zerodha Coin is a mutual fund investment platform that lets you invest in various funds online. Investors can directly invest in mutual funds from the companies at zero commission. Various features of the mutual fund platform from Zerodha includes:

Coin Mobile App

Coin is also available as a mobile app for Zerodha customers. The Coin mobile app provides you with convenience to invest in 3000+ mutual funds from 34 fund houses directly at zero commission. The app offers all the features available in the web-based platform of the Coin.

Coin Mobile App Download

The Zerodha Coin mobile app is available for Google Android and Apple iOS smartphones. The Coin app can be downloaded for free from:

Console is the back-office platform of Zerodha. It's a trade and reporting dashboard offering a range of features to Zerodha customers such as:

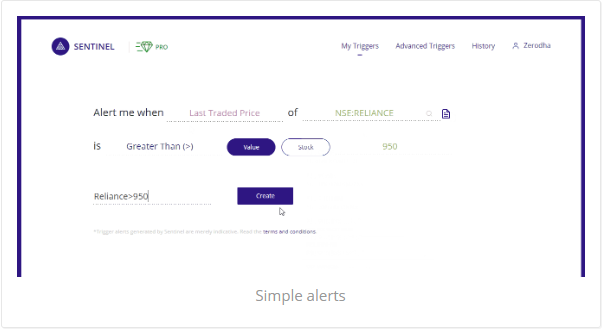

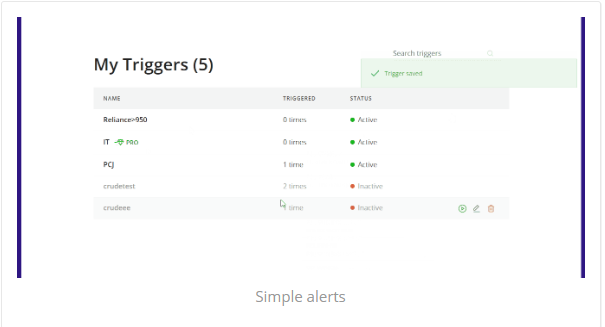

Sentinel is a cloud-based, machine-independent tool for setting up price alerts on stocks and contracts. The tool allows traders to set up price alerts that can be triggered for any time and even when your computer is off.

Zerodha Sentinel Features

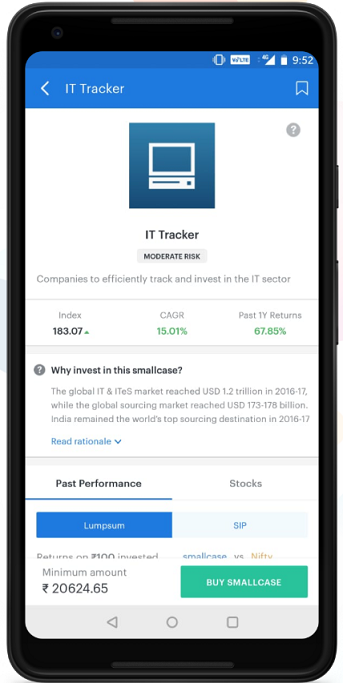

A smallcase is a portfolio or collection of stocks and ETFs built around a single idea, strategy or theme. A smallcase includes between 2 to 50 instruments. It allows you to invest in all the stocks included in a specific smallcase, monitor and manage it with one click. The product can be integrated with your Kite platform and operated using your Zerodha account.

Zerodha Smallcase Features

Zerodha Smallcase Pricing

One-time fee of Rs 100 per smallcase (no additional fees for investing more in the same smallcase). There's no fee for Weather Investing and Smart Beta smallcases. All other orders have a fee of Rs 50. Standard brokerage charge is also applicable.

It is a cloud-based platform for retail traders to create trading algorithms without coding, Backtest them on historical data and deploy them to live in the market. Some of the major features of the Zerodha streak algo trading platform includes:

Zerodha Streak Free Trial

Zerodha Streak Free Trial is available for a 7 day period. During the free trial period, you can do 20 backtests and 2 live deployments of strategies at a time.

Zerodha Streak Pricing & Charges

Customers have to pay a monthly fee depending on the chosen plan. There are 3 plans available Basic, Premium and Ultimate at a monthly fee of Rs 500, Rs 900 and Rs 1400.

Sensibull is an options trading platform. The platform is available for customers of several stock broking companies including Axis Direct, Kotak Securities, Edelweiss, ICICI Direct, Upstox and Karvy stock broking etc.

The Sensibull platform suggests a list of strategies based on your market view. For example, let's assume you think SBI share price is going to stay between 280 and 300 this week. But you are not sure which option strategy to deploy to profit. Sensibull will give you suggestions with a list of strategies on the type of option to buy, at what strike and expiry date with return potential and risks involved in each strategy. You can also customize the strategy by tweaking a few parameters as per your needs. Other features of the Sensibull platform include:

Zerodha Sensibull Demo (Zerodha Sensibull User Manual)

Sensibull is one of its kind platform for Option Trading strategies. It would take some learning for traders to master over its various features. Click here to learn Sensibull.

Zerodha Sensibull Pricing (Charges)

There are 3 subscription plans for Zerodha Sensibull: Free, Lite and Pro. The Zerodha Sensibull Free version has limited features. The Lite and Pro versions are available at Rs 800 and Rs 1300 per month.

GoldenPi is India's first free online platform for investments in bonds and debentures. The company has partnered with several banks, bond trading institutions, and large financial organizations to give its customers access to various bonds and debentures. The platform takes care of the entire process of bond investment starting from opening the account to bond units getting transferred to the customer's Demat account. Some of the key features of GoldenPi platform include:

Zerodha GoldenPi Pricing (Charges)

GoldenPi doesn't charge any fees or commission for investments in bonds and debentures.

Zerodha also provides a range of online trading calculators to its customers. The online trading calculators are useful in quickly calculating brokerage fees and margin etc. Trading tools offered by Zerodha includes:

Zerodha is a leading online discount broker offering commodity trading services at MCX and NCDEX. Zerodha trading platform for commodity includes:

Zerodha commodity trading software download is available on its website. Steps to download the Kite Mobile App has explained above.

Incorporated in 2010, Zerodha is a Bengaluru based online discount broker. The company offers online stock broking services in equity, currency, and commodities across NSE, BSE, and MCX.

Zerodha is the largest stock broker in India by active clients. Zerodha is popular among the trading community for its low brokerage fee and highly advanced trading tools. It charges zero brokerage fee for equity delivery trades and Flat Rs 20 per executed order for intraday and F&O trades across equity, commodity, and currency.

Zerodha offers a range of trading platforms and tools for traders to analyze and trade. It leverages new technologies to power its trading platforms and is known for introducing new trading features.

Zerodha is a member of Central Depository Services Limited (CDSL) and offers depository services such as demat account opening and other related services. It also offers online investment services in Mutual Funds and Fixed Income Bonds.

This is a limited time offer. Open an instant Zerodha account online and start trading today.

Yes, Zerodha Kite is available for free to customers. The trading platform offers many advanced features such as universal instrument search, Charts with 100+ indicators, studies, and tools, GTT (Good Till Triggered orders), etc.

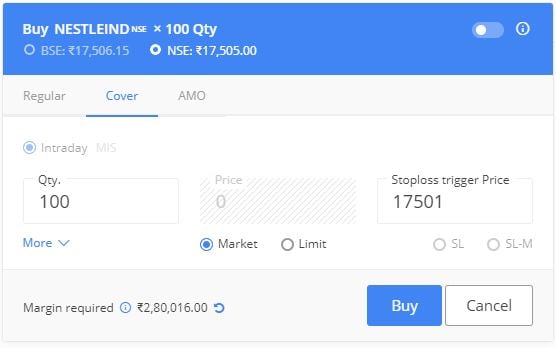

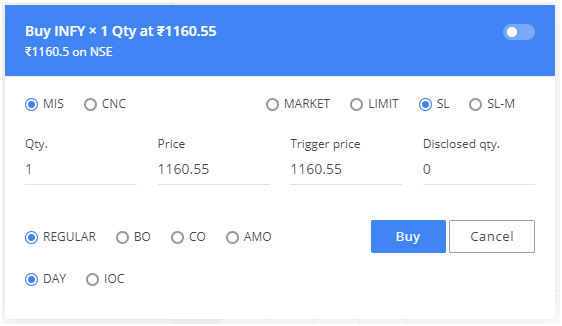

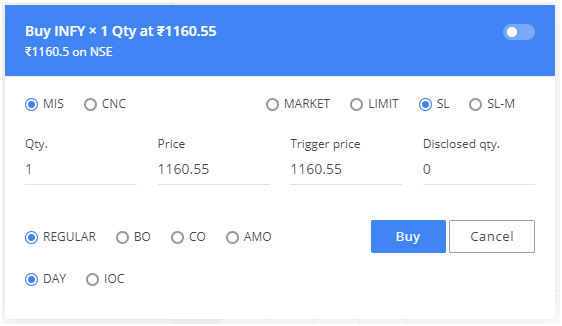

A Zerodha Cover Order (CO) is a type of order used to minimize the risk in a position in intra-day trading. In the case of CO, two orders are placed together as one order. The buy/sell order is placed with a compulsory Stop Loss order in a specified range.

Note:

LMT in Zerodha stands for the LIMIT order. It is an order to buy/sell shares or contracts only at the desired price. The LMT order is set below/above the CMP (Current Market Price) depending on whether you're buying/selling the order.

Yes, Zerodha allows BTST (Buy Today Sell Tomorrow) orders. It is a facility wherein you can buy a stock today and sell it tomorrow (before you get the delivery of the shares). This allows you to gain from a short-term price increase in stock.

To do BTST trade, you have to buy a stock using CNC product type (delivery trade) and the next day sell the stock using the CNC product type.

Note:

GTT in Zerodha Kite stands for Good Till Triggered orders. Orders placed under GTT get executed anytime (within 1 year) when the price set by the trader is reached. This gives your order a longer validity period. These orders can be cancelled by the trader at any time.

For example, Infosys is currently traded at Rs 780 but you would like to buy it for Rs 700. In this case, you can place a GTT order which will remain active until the price reaches 700 (or 1 year).

Similar to GTC (Good-till Cancelled) orders or GTV (Good-till valid) orders, the GTT order is very useful for the customer who does not track the markets actively.

Zerodha GTT Order (GTC Equivalent) Explained

Yes, Zerodha allows short-selling of shares. However, like short-selling with any broker, you have to buy back the shares or square off your position by the end of the market hours. If you fail to buyback or square off then you have to pay penalties.

The T1 in Zerodha holdings is the holding summary of the shares bought but not yet credited into your Demat account.

In India, we have a T+2 settlement cycle. When you buy the shares on T day, you receive them in your Demat account only on T+2 by evening. Thus, even when you have purchased a stock, you cannot claim to have the entire stock quantity until T+2. If you sell this stock before T+2, you always run a risk of shortage and thus short delivery.

Zerodha segregates the customer holding in two menus for ease of tracking. One is T1 holdings, and the other is Holdings (T2 shares). T1 holdings are the unsettled stocks for which the delivery is awaited, and Holdings (T2 shares) are the confirmed stocks in your possession. The purchased shares get reflected in T1 holdings on T day, T+1, and T+2 day. Once you receive the shares in your Demat account on T+2 evening, these get moved to Holdings after T+2.

For example, if you have bought 100 shares of ABC Ltd. on Friday (T day), these will reflect in T1 holdings till Tuesday (being T+2). After Tuesday, these will move to holdings.

Zerodha Kite Connect is a set of APIs built on top of the Kite platform. It allows investors to get programmatic access to the platform and its data to build trading platforms as per their own needs. Kite Connect comes at a subscription of Rs 2000 per month.

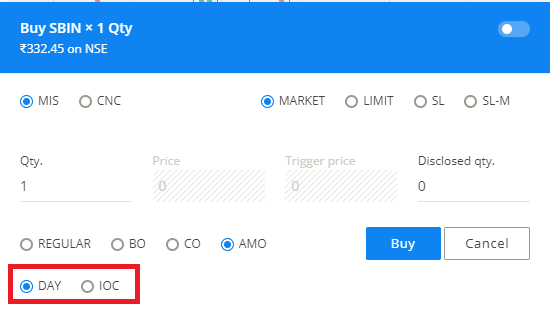

Validity in Zerodha Kite means the time until which an order, once placed, remains valid in the market. There are options such as daily orders and immediate or cancelled orders (IOC) or minutes. Zerodha also offers customers the option of placing GTT (Good Till Triggered) orders.

Day orders are orders that remain valid throughout the day until the market closes. Once placed, these orders wait until 3.30 p.m. for a matching order. The order is executed as soon as a match is found. Unlike IOC orders, day orders are not automatically cancelled. The order is terminated as soon as the market is closed for the day.

IOC orders allow an investor to buy or sell a security as soon as the order is released on the exchange. As the name implies, an IOC order is either executed immediately or automatically cancelled immediately, depending on whether or not it finds a matching order. IOC orders are not included in the pending order at any time. In the event of a partial match, the order is partially executed and the remainder is cancelled.

(Good Till valid Triggered) Orders are orders that remain valid until the trigger condition is met or one year, whichever comes first. If no suitable order is found within this period or the trigger conditions are not met, the order is cancelled and must be placed again.

Payin in Zerodha Kite is the funds transferred by the customer from his bank account into his trading account. The transferred amount is shown in the 'pay in' column on the website. The amount is also added to the 'margin available' column.

Withdrawable balance is the amount you can transfer back to your bank account from the trading account. For equity, it is calculated as:

Withdrawal balance = (Available balance) - (today's and yesterday's stock holding sell value) - (today's and yesterday's intraday profits) - (today's F&O profits) - (present day's payin).

Zerodha free cash is the funds available in your trading account which can be used for placing new buy/sell orders. Free cash is calculated as:

Free Cash = Cash margin Available + Pay In + Direct Collateral - Margin Used

LTT in Zerodha is an abbreviation for Last Traded Time. The last traded time shows when a particular share or contract was last bought or sold. It helps traders know the demand for a particular share on a particular day.

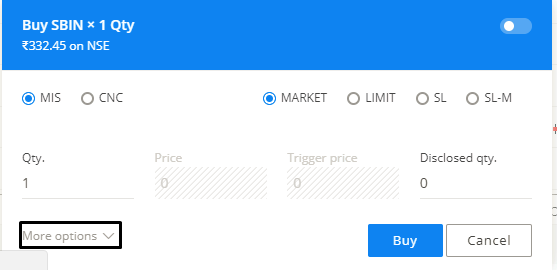

Disc quantity in Zerodha means the Disclosed quantity.

Disclosed quantity in Zerodha is an option that allows you to disclose a part quantity out of the actual order quantity while placing an order. The disclosed quantity gets displayed to everyone on the market screen as part of the market depth if your order is in the best five prices closer to the current market price. The disclosed quantity has no linkage with the trade execution. The trade gets executed in part or full of the actual quantity based on order matching.

The disclosed quantity cannot be greater or equal to the order quantity and cannot be lesser than 10% of the order quantity in Equity and Currency. In the case of Commodity, the disc quantity cannot be lesser than 25% of your order quantity.

The disclosed quantity is not allowed for F&O trading and in Pre-Open or Post-Close session. The disclosed quantity feature is advantageous for people trading in bulk. If the disclosed quantity field is blank, the market screen will display the actual order quantity which, if sometimes is very big, may alter the demand/supply and change the price to a great extent shaking the markets.

P&L stands for Profit and Loss Statement in Zerodha. It provides detailed information on the profit or losses incurred by you in your trades. The P&L statement can be accessed from Zerodha Console, a back-office website. The Zerodha P&L takes into account keep track of corporate actions, splits, and transfers.

As per SEBI guidelines, every broker must transfer any excess funds lying in your trading account back to your bank account once in a quarter. However, he can retain funds for the margin requirements of open positions. If funds retained, Zerodha needs to send an explanation which is called 'Retention Statement'

RMS in Zerodha is an abbreviation for Risk Management System. It is software that defines margin rules to ensure that traders don't default on payments & delivery of their orders. All orders placed by the customers go through the RMS software which approves or rejects orders based on multiple factors associated with risk in the trade.

You can short sell in Zerodha on an intraday basis in the Cash Equity segment. To place a sell order in Zerodha without holding stock in the Demat account, you need to place an order using MIS (Margin Intraday Square-off) product type.

You are required to square off your short position by buying back the stock on the same day by 3.20 pm. If you fail to do so, the system will trigger auto square-off and charge a penalty of Rs 50 per squared-off position.

There are no such restrictions in the F&O segment. You can take a short position in the derivatives segment and can square off the position later or hold till expiry as you desire.

Note: Zerodha does not allow STBT (Sell Today Buy Tomorrow).

To buy shares on Zerodha, you need to have a trading and Demat account with Zerodha and sufficient margins in your Zerodha trading account. You can purchase shares in Zerodha either through the Kite website or Kite mobile app.

Steps to buy shares in Zerodha

Zerodha Account Opening Enquiry

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Zerodha Order Types & Product Types Explained

Zerodha Order Types & Product Types Explained Zerodha Account Closure Online - Explained

Zerodha Account Closure Online - ExplainedInformation on this page was last updated on Saturday, July 13, 2024

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|