Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

12.99% 7,223,525 Clients

Zerodha Account Opening Enquiry

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Zerodha offers online IPO applications to its customers. Zerodha customers can apply for IPO using UPI (Unified Payment Interface) through the Zerodha Console website. While the process is not as easy as the ASBA IPO application through the 3-in-1 account, the Zerodha UPI IPO application offers an option to Zerodha customers to apply in IPO online.

Zerodha launched Online IPO application services on Aug 6, 2019. Since then it becomes the largest broker by the number of IPO applications being applied.

Applying in IPO through Zerodha is simple and convenient. It's a 3-step process:

Zerodha IPO application process (step-by-step guide) is described as below:

Zerodha offers IPO applications through UPI as a payment gateway. Read UPI for IPO Application (Unified Payments Interface for IPO) for more detail.

Zerodha customer first has to create a UPI ID, if they don't have one. UPI ID can be created using BHIM UPI App or using the online mobile banking app of any bank including ICICI, and HDFC where you hold your account.

You can apply for an IPO without UPI. You can apply using the ASBA net-banking services provided by the company and give your Zerodha demat account number so that the allotted IPO shares are credited to your account. We have detailed IPO application process for some major banks here-

Zerodha DP name for IPO is Zerodha Broking Limited.

An IPO application requires the depository (DP or demat account) details to get the credit of stocks. The depository details include the DP ID, DP Name, and Client ID. These details get auto-picked from your profile when applying for an IPO using the UPI route. However, when you apply using any other mode (offline or ASBA Net banking), you need to provide the Zerodha DP details to get the credit of shares in the Zerodha Demat account.

You can find your Zerodha DP details under your Profile >> Demat in Console.

DP details of Zerodha for IPO application:

The IPO window in Zerodha is open from 10 AM to 4.30 PM. You can apply or modify an IPO application anytime during this window through Zerodha Console while the IPO is open. If you want to delete the application, you can cancel your IPO application between 12 PM to 4:30 PM.

Zerodha IPO application service is free. Zerodha doesn't charge any fees from its customers for applying in an IPO.

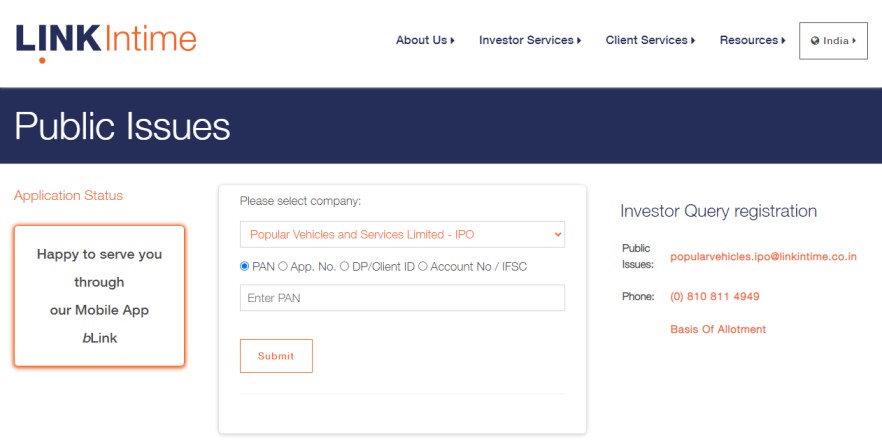

Zerodha IPO status check can be done from the IPO registrar's website. Registrar of the IPO (i.e. Karvy, Link Intime) is responsible for IPO share allotment. They publish the allotment status on their website once the share allotment process is complete.

You can also check the Zerodha IPO Allotment Status here on our website at IPO Allotment Status Page.

While IPO allotment status is not available on the Zerodha website, you get an alert from CDSL when IPO allocated shares are credited in your demat account.

Zerodha offers easy and convenient online IPO application services through their website and mobile app using UPI as a payment gateway. You can also apply using the ASBA facility if you do not have the UPI ID or are facing issues using UPI.

This is a limited time offer. Open an instant Zerodha account online and start trading today.

Yes, Zerodha provides an online IPO application service using UPI as a payment gateway. Zerodha customers can apply for an IPO online from within Console and pay using any UPI 2.0 enabled app. You need to take the following steps to apply for IPOs online with Zerodha:

Yes, Zerodha offers IPO since Aug 2019 through UPI as a payment method. Once you setup your UPI ID, it's convenient to apply in IPO through Zerodha Console.

Visit Zerodha IPO Review page for more detail.

Yes, Zerodha allows its customers to apply for IPO online from Zerodha Console website. The investment amount needs to be paid using a UPI 2.0 enabled app. Here are the steps to apply in an IPO:

Zerodha customers can apply in IPO in 4 easy steps. Before applying in IPO, please make sure that you have a UPI id.

Zerodha doesn't charge any fee for applying in IPO. As Zerodha offers brokerage-free equity delivery trades, they don't charge any commission when you sell allocated IPO shares through Zerodha.

Note: When selling IPO shares through Zerodha, you still have to pay government taxes and demat debit transaction changes.

Zerodha doesn't provide the IPO allotment status on its website. However, you can check the status on the IPO Registrar's website by entering your PAN card number or Application number. Read on for more information.

You can check your registered email address for IPO allotment status notifications. Click here to check IPO Allotment status.

The following steps must be followed to check the allotment status on the registrar's website.

Below is a screenshot for your reference.

Zerodha offers only UPI based IPO application. If you do not have UPI, you could create it for free from your banking mobile app (i.e. ICICI, HDFC) or BHIM UPI app. Creating UPI is a simple process.

Alternatively, you could apply in IPO's using the net banking of the bank where you have an account. Steps to apply in IPO using net banking are provided below:

The IPO Cut-off Price is the price of a share decided by the issuer company based on the demand of its share during the IPOs where the range of price is given.

An option is given to retail investors to apply at a cut-off price in IPOs. This means the IPO applicant doesn't have to choose a price. They can simply choose the 'cut-off' option and the shares are allocated at the cut-off price.

For example; a company came up with an IPO with a price range of Rs 80 to Rs 90. Instead of choosing a number between 80 and 90, a retail investor can choose Cut-off. In this case, the investor will get the shares based on the price at which shares are allocated in other categories i.e. Institutional investors.

Once you submit the IPO application in Zerodha Console, you should get a mandate in the UPI app to approve. It takes up to 24 hours to get the mandate. The process of getting the mandate to approve payment is not instant. The IPO application completes only when you approve the UPI transaction (mandate).

To buy IPO via Zerodha follow 3 steps:

Yes. Zerodha offers online IPO investment using UPI as a payment gateway. You could also apply in an IPO using your Zerodha demat account and ASBA facility offered by any bank like ICICI, HDFC or Axis where you have an account.

Visit Zerodha IPO Review page for more detail.

No, you cannot use the funds in Zerodha Trading Account to apply in an IPO. Zerodha uses UPI as a payment option for online IPO applications. The UPI is a unique ID for your bank account. When applying in an IPO with UPI ID, the funds are locked in your bank account.

Zerodha offers UPI based IPO application that has a limit of a maximum of Rs 2 lakh per transaction. It means you cannot apply in the HNI category using the Zerodha IPO application. You have to use ASBA offered by the banks to apply in the HNI category.

Zerodha does not maintain the IPO allotment status check on their website.

You can check for the Zerodha IPO allotment status from the IPO registrar's website or visit our website page - IPO Allotment Status Page for the update.

Zerodha offers its customers to invest online in IPO through Zerodha Console using UPI.

Steps to invest in IPO through Zerodha:

Accept the UPI mandate request once received to complete the IPO application process.

You can fill IPO online in Zerodha through Zerodha Console using the UPI. Since Zerodha offers IPO through UPI, you cannot apply for an amount of more than Rs.2 lakhs.

Steps to fill IPO in Zerodha:

You can find the IPO application number in Zerodha under the historical bids in the IPO section in Zerodha Console.

Steps to find the IPO application number in Zerodha:

The process to sell IPO shares in Zerodha is similar to the placement of any CNC sell order.

Steps to sell IPO shares in Zerodha:

You can sell the IPO shares on the listing day itself. However, the timings for IPO trading on the listing day are a bit different.

You can subscribe for an IPO in Zerodha from 10 am to 4.30 pm during the IPO offer period using the UPI through Zerodha Console.

To subscribe for an IPO in Zerodha, you need to go to the IPO section under the Portfolio tab in Zerodha Console and select the IPO you wish to apply. Enter the IPO bid details and submit. You will receive a mandate request on the UPI app that needs to be accepted to complete the IPO subscription process.

You can modify the IPO bid in Zerodha anytime between 10 am to 4.30 pm through Zerodha Console while the IPO window is open.

Steps to modify IPO bid in Zerodha:

You can cancel the IPO application in Zerodha through Zerodha Console while the IPO window is open between 12 pm to 4.30 pm.

Steps to cancel IPO application in Zerodha:

Zerodha Account Opening Enquiry

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Zerodha Order Types & Product Types Explained

Zerodha Order Types & Product Types Explained Zerodha Account Closure Online - Explained

Zerodha Account Closure Online - ExplainedInformation on this page was last updated on Tuesday, February 13, 2024

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|