Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

3.65% 7,662,920 Clients

Zerodha Account Opening Enquiry

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Zerodha demat account is one of the services offered by the company. The service is part of its 2-in-1 accounts that offers the customer an integrated trading account and demat account for seamless transactions.

Zerodha is a depository participant (DP) with Central Depository Services Limited (CDSL).

Zerodha charges Rs 300 per annum as annual maintenance charge (AMC) for the demat account. The fee is automatically debited quarterly from the balance of the trading account.

|

Type of Account |

Zerodha AMC |

|---|---|

|

Individual, HUF, and partnership firms |

Rs 300 |

|

Non-Resident Indians (NRI) |

Rs 500 |

|

Corporates, i.e. LLPs and private & public companies. |

Rs 1000 |

Zerodha DP id is 12081600. To know more detail about your Zerodha demat account, log in to Zerodha Console >> My Profile >> Demat.

Zerodha demat account number is a 16 digit number. It is a combination of Zerodha CDSL DP ID and your Client ID. Both are of 8 digits each. The Zerodha DP id is 12081600 for all customers. You can know your client ID by contacting customer support. For example, if your client ID is 12345678, your demat account number will be 1208160001234567.

Zerodha charges Rs 13.5 per scrip debited from the demat account when you sell your stocks.

For Mutual Funds, Zerodha charges a CDSL Fee of Rs 5.5 per mutual fund debited from demat on redemption.

To trade with Zerodha, you need to open a trading and Demat account. Zerodha offers online as well as offline account opening to its customers. If you have your Aadhar Card linked with your current phone number, you can instantly open a Zerodha account online. If not, you may have to fill out a paper form and send it to the Zerodha office.

Steps to open Zerodha account online

The broker will send a notification as soon as the account is set up and ready to trade.

Zerodha Demat Account Opening Demo

In case you do not have your mobile number linked to your Aadhar card, you can opt to open a Zerodha account offline.

Steps to open Zerodha account offline

The broker will initiate the account opening process on receipt of the form. The sales manager assigned to you will keep you posted on the status of your account.

The following documents are required to open a demat account with Zerodha:

Note: Income proof is required if you are planning to trade in Futures & Options.

The online Zerodha demat account can be opened within a few minutes of successful verification of the documents on any weekday.

For offline account opening (paper forms sent to Zerodha, Bangalore office), the account opening takes up to two working days once the documents are received by Zerodha.

Zerodha is a discount stock broker offering trading services in Equity, Derivatives, Commodity, and Currency segments at BSE, NSE & MCX to stock market investors in India.

Zerodha started its operations in 2010, offering discounted brokerage service by leveraging the technology of online trading to keep the cost low. Zerodha disrupted the traditional online brokerage industry within just three years of its inception by making the discount brokerage model actually work. As of Jan 2023, Zerodha has a market share of over 19% of trades done at BSE & NSE.

While Zerodha is primarily focused on equity and commodity trading services, it also started offering add-on services like depository services (or demat account) and mutual funds.

To open a new Demat account with Zerodha, the customer may have to pay Demat account opening charges. The broker may also charges Annual Maintenance Charges (AMC), a yearly fee to maintain the Demat account.

| Service | Charges |

|---|---|

| Demat Account Opening Fee | Rs 0 |

| Demat Account Annual Charges (AMC) | Rs 300 |

Zerodha Demat Charges

Zerodha trading and demat account opening fees are Rs 0. Zerodha charges Rs 300 per year demat account AMC. Zerodha demat debit transaction fee of

| ID | Transaction | Charges |

|---|---|---|

| 1 | Demat Account Opening Charges | Rs 0 |

| 2 | Transaction Charges (Buy) | |

| 3 | Transaction Charges (Sell) |

|

| 4 | Annual Maintenance Charges (AMC) | Individuals/Non Individual (except Corporate) - ₹300 + GST |

| 5 | Demat + Courier charges | ₹150 per certificate (+ ₹100 Courier charges) |

| 6 | Remat | ₹150 per certificate + CDSL charges + ₹100 Courier charges |

| 7 | Pledge Creation | ₹30 per request + GST |

| 8 | Pledge Creation Confirmation | ₹0 |

| 9 | Pledge Invocation | ₹20 |

| 10 | Failed Transactions | ₹50 per ISIN |

| 11 | Other Charges |

Note: Interest at 18% p.a is charged on the outstanding bill amount if not paid within the due date. |

This is a limited time offer. Open an instant Zerodha account online and start trading today.

Zerodha offers both online (instant) and offline (paper-based) demat account opening. The easiest way to open an account with Zerodha is by Request a callback from Zerodha

You could also visit the Zerodha.com website to open an instant online account for trading. The process is simple, cheaper and fastest.

Yes, Zerodha provides a demat account to its customers as part of a 2-in-1 account. Zerodha is a member of CDSL and the membership allows it to offer depository services to its customers. A demat account is used to keep the securities in electronic format. It is similar to a bank account but instead of money, it holds shares, mutual funds, bonds etc.

Yes, you can open a demat account with Zerodha. Zerodha is a DP member of CDSL, a national depository that manages the account. Zerodha, like other brokers, only facilitates demat account opening. You can open Zerodha demat account online through a paperless process and start trading with-in a couple of days.

Zerodha charges a demat AMC (Annual maintenance charges) of Rs 300/year for maintaining your demat account. The AMC is charged every 3 months on a proportionate basis at Rs 75.

Yes, Zerodha charges AMC for a demat account at Rs 300/year. The AMC charge is deducted every quarter. Every quarter Rs 75 is deducted from customers trading account balance with Zerodha.

Zerodha charges demat account annual maintenance charges (AMC) at Rs 300/year as yearly fees. These AMC charges are charged on quarterly basis by deducting Rs 75 from the trading balance account with Zerodha every quarter. All other charges are either based on transactions or are one-time fees.

The DP charges in Zerodha consist of account opening, AMC and various other charges. Click here to check the list of major DP charges in Zerodha.

Zerodha charges Rs 13.5 per debit transaction from the Demat account. This fee is also known as DP charges. While Zerodha offers brokerage-free equity delivery trading, every time you sell a share (that is withdrawn from your demat account), you have to pay the DP debit transaction fee of Rs 13.5.

Zerodha also charges a demat annual maintenance charge (AMC) of Rs 300 per year. All Zerodha customers have to pay demat AMC.

Steps to avoid DP Charges at Zerodha

Other discount brokers like Prostocks offer zero AMC demat account where you don't have to pay any AMC.

Zerodha DP id is 12081600. You can find more detail about your demat account with Zerodha by login into Zerodha Console >> My Profile >> Demat.

Zerodha DP name is CDSL. You can find your demat account information by login into Console >> My Profile >> Demat.

The demat information includes:

Note:

The Zerodha DP charges consist of charges levied by CDSL (Depository), Government Taxes and Fees charged by the broker. Click here to check the list of major DP charges in Zerodha.

Zerodha is a depository participant of the CDSL depository. This means Zerodha works as a service agent for a demat account which is held by CDSL, one of two central depositories.

A Power of Attorney (PoA) for Demat Account is a legal document that gives limited legal authority to the Zerodha to operate your demat account. It authorizes Zerodha to debit/credit shares from your account when you buy/sell online or when you want to pledge the shares.

In online trading, a PoA is required by the broker to meet the obligation of delivering the shares in T+2 days, when the customer sells them online. PoA is mandatory by all the brokers if you are selling stocks with them online. The PoA can be revoked anytime by the customer.

Your Zerodha demat account number is a 16 digit number consisting of DP ID and Client ID. Both are of 8 digits each. The Zerodha DP id is 12081600. It is the same for all customers. You can find your demat account information by login into Console >> My Profile >> Demat.

A sample Zerodha demat account number is 1208160001234567, wherein the first 8 digits is DP ID and the next 8 digits is the client ID 01234567.

Yes, Zerodha offers demat account services to its customers. You can open a 2-in-1 account consisting of demat and a trading account. The account can be opened online. The demat account is mandatory to invest in the stock market. It holds the Equity Shares, Mutual Funds, ETF and bonds in electronic format.

Yes, you can open a demat account with Zerodha and avail various depository services offered by the company. Zerodha offers the demat account through its membership with CDSL.

The BO id in Zerodha is a demat account number of the customer. It is beneficiary owner identification number which is a 16 digit number provided by CDSL (the depository) at the time of account opening.

Sample Zerodha BOID: 1208160002420841

In this sample,

Steps to get BO ID in Zerodha

The demat account balance in Angel One is checked by login into the Angel One trading platform or by login into the CDSL website.

Angel website and mobile app have 'Holdings' section which provides the details of the balance in the demat account.

Angel One is a Depository Participant of CDSL. The demat accounts are managed by CDSL. The central depository offers EASI (Electronic Access to Securities Information) which allows registered demat account owners to access their demat account online and check their details anytime anywhere, through CDSL's website.

Steps to check demat account balance in Angel One

Zerodha charges AMC for a Demat account even when you are not using it unless your Demat account qualifies as a Basic Service Demat Account at Zerodha (BSDA).

For an account to qualify as a BSDA, you need to satisfy two conditions:

| Holding Value | AMC charges |

|---|---|

|

Upto Rs 50,000 |

Nil |

|

Rs 50,000 - Rs 2,00,000 |

Rs 100 |

|

Above Rs 2,00,000 |

Rs 300 |

At any time, if you open a new Demat account with another broker, an AMC of Rs 300 gets charged to you even when there are no holdings in the existing Demat account at Zerodha. If the value of holdings exceeds the above limits, AMC gets applied as per the above table.

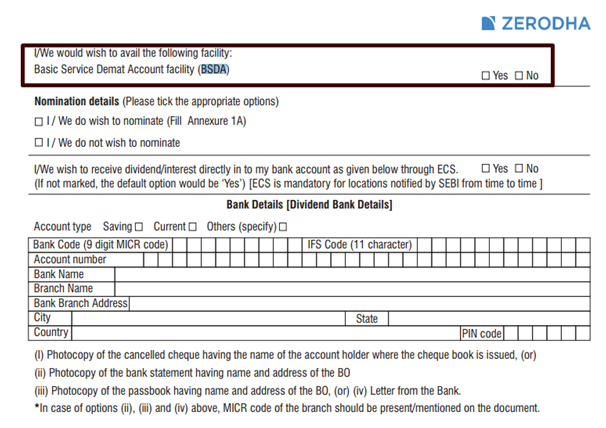

To open a BSDA account at Zerodha, tick the highlighted box in the account opening form as Yes.

You can keep the Zerodha Demat account idle as long as you hold the Demat account and do not request to close it or freeze it.

The Demat account does not become inactive or dormant even when there is no activity or holdings in it. As specified by CDSL and SEBI, the DP needs to independently verify the instructions with the account holder before its execution if an instruction is received for a Demat account that has not been operative for more than six months.

The dormancy policy applies only to a trading account wherein, if there are no trades carried out by a client in the last twelve months across all Exchanges, the broker marks the trading account as Dormant.

No, you cannot open two different Demat accounts with one mobile number with Zerodha. But you can open another Demat account with any other broker with the same mobile number.

As per SEBI regulations, you cannot open more than one Demat account with the same broker in the same name. Even when you look to open a Demat account for another person with the same broker, you cannot provide the same mobile number registered for any of the existing Zerodha accounts.

As per recent NSE guidelines, every client registered with a broker should have a different mobile number.

Zerodha Account Opening Enquiry

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Zerodha Order Types & Product Types Explained

Zerodha Order Types & Product Types Explained Zerodha Account Closure Online - Explained

Zerodha Account Closure Online - ExplainedInformation on this page was last updated on Saturday, July 13, 2024

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|