Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Monday, December 31, 2018 by Chittorgarh.com Team | Modified on Monday, November 6, 2023

Zerodha Account Opening

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

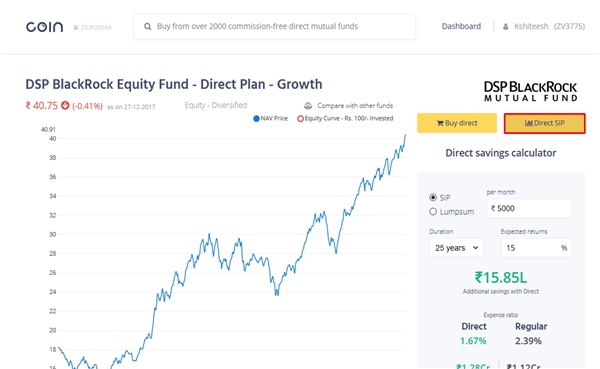

Zerodha is a leading online discount broker in India. It also offers Mutual Fund investments to its customer through its platform 'Zerodha Coin'. This brings Zerodha customers the convenience to trade in stocks, currencies, derivatives, and mutual funds from one account. And manage it from a single Demat account.

Mutual fund investment is a key offering from Zerodha. Zerodha offers direct mutual funds through its Coin platform.

7 reasons why you should buy Mutual Funds from Zerodha Coin:

Zerodha Coin lets you buy mutual funds online directly from asset management companies. There's no commission charged on buying Mutual Funds. Customers who buy from Zerodha can save up to 1.5% in annual commissions.

Zerodha mutual fund brokerage is Rs 0 (brokerage free). The service is available free of costs. There are no account opening and maintenance fees.

Customers can buy Mutual Funds from Zerodha free of cost. There are no charges on investing in Mutual Funds at Zerodha Coin platform.

Exit Loads are penalties charged by the Asset Management Companies. Exit Load is a way to discourage investors from premature withdrawals or redemption. The exit load rates vary from fund to fund. Also, not all funds charge exit load. You can find the exit load info on the scheme related document. It is also available on the particular fund's page on Zerodha Coin.

Systematic Investment Plan or SIP allows you to systematically invest in a fund. You can start with a fixed amount and invest weekly, monthly, and quarterly. Most mutual fund SIPs start at a minimum of Rs 500 per month.

SIP offers many benefits to investor's like:

There are no charges on investing through Zerodha. This can help you save up t0 1.5% annually on charges and commissions when compared with other platforms.

Zerodha provides SIP in stocks directly through its investment platform Kite.

The stock SIP feature can only be used for delivery trades in the cash market.

Zerodha customers can invest in Mutual Funds using the Zerodha Coin website.

In 2017, Zerodha launched the 'Coin' Mutual Fund platform. The platform offers Zerodha customers access to over 2000 funds. And no commission is charged on investing in these funds. The platform provides access to funds from all popular Mutual Fund companies. But, there are a few things you should know before investing in Zerodha Coin

Mutual fund SIP is the best way to invest in equity markets. It is especially useful for those who are new to markets and lack the expertise to select the right stocks. Such people can invest in Mutual Fund SIP with a small amount and gain the benefits of investing in equity.

Mutual Funds SIP also saves investors from timing the market. As you invest over a long period of time, your investments in the market up and down conditions average out. You buy more units with the same fund when markets are down and buy fewer units when markets are up. So, over a period of time, your investments balance out.

Mutual Fund SIP is also useful for people who:

Zerodha mutual fund services are excellent for investors looking to cut down their investment costs. They can easily save 1 to 2% in commission as Zerodha doesn't charge any fees or commissions for its services. However, the platform doesn't offer research or recommendation services. This may make it difficult for beginner investors to choose the fund as per their financial goals and needs.

Read more about Zerodha

Zerodha Streak Review - Algo Trading for Retail Investors

Zerodha Streak Review - Algo Trading for Retail Investors NFO (Nifty Futures & Options) in Zerodha

NFO (Nifty Futures & Options) in Zerodha GTT in Zerodha Kite (Zerodha GTT guide)

GTT in Zerodha Kite (Zerodha GTT guide) Direct Mutual Funds Explained (Meaning, Charges & Taxation)

Direct Mutual Funds Explained (Meaning, Charges & Taxation)This is a limited time offer. Open an instant Zerodha account online and start trading today.

Click here to request a callback from Zerodha for account opening.

Zerodha doesn't collect ECS/NACH mandate for SIP auto debits from bank accounts. So, the auto debit facility is not available with Zerodha Coin. It utilizes the funds available in your trading account to pay for your SIP.

To automate the SIP payments for your Mutual Funds on Coin, you can set standing instructions at your bank to credit a particular sum on a particular date every month to your Zerodha trading account.

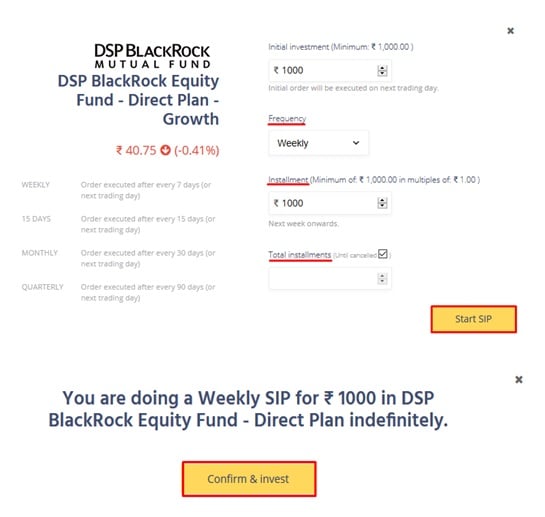

You can start SIP in Zerodha in three simple steps through Zerodha Coin, an online mutual fund investment platform.

Steps to start SIP in Zerodha

You can do SIP in Zerodha either through the Coin website or the Coin mutual fund app. Zerodha offers only Direct mutual funds.

To invest in SIP in Zerodha, you need to select the desired mutual fund in the Coin and enter the required details like initial investment amount, SIP date, and SIP amount to create the SIP.

To start a SIP in Zerodha, you need to have sufficient balance in your account for the initial investment amount. You also need to maintain the required balance in your account by the next SIP due date. In case of insufficient funds on the SIP date, Zerodha tries placing the same order for the next five days, post which the order gets cancelled.

You can also modify, cancel, pause, resume or stop the SIPs through Zerodha Coin.

You can invest in SIP through Zerodha using the Zerodha Coin web or the Coin mobile app.

Zerodha has only Direct mutual funds. Zerodha also offers its investors to invest in normal SIP and AMC SIP.

The process to invest in both the SIPs is the same. However, there are few peculiarities of AMC SIP that you should take note of:

To buy SIP in Zerodha, you need to log in to your Zerodha Coin mobile app or web.

Steps to buy SIP through Coin web:

Steps to buy SIP through Coin app:

Once the order gets placed, you can modify, cancel, edit, pause, resume or stop the SIP as required.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|