Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Thursday, July 4, 2019 by Chittorgarh.com Team | Modified on Thursday, May 13, 2021

A Demat Account is mandatory in India to invest in the stock markets. Whether you are a resident Indian or a non-resident Indian (NRI), you should have a demat account to invest in stocks, IPOs, mutual funds, Bonds, and NCDs etc.

Note an NRI is defined as a person resident outside India who is a citizen of India or is a person of Indian origin. All transactions by NRI's are governed by the FEMA regulations.

A Demat Account is an online account for holding securities in electronic format. It's very similar to a bank account but instead of money, it holds stock, MF, ETF, NCD and Bonds. A Demat Account makes online trading and investment easy, fast and secure.

To know more about Demat Account, visit below articles:

Let's take a look at how to open an NRI Demat Account Charges, Requirements, Benefits, Opening Procedure and Taxation, etc.

The Indian stock market is one of the attractive destinations for investors across the globe. Any NRI (including PIO, OCI) seeking to create wealth through investments in stocks and mutual funds cannot ignore the Indian stock markets.

The first step towards investing Stocks, Mutual Funds, IPOs, etc. in India, is to open NRI Demat account.

The Demat Account for NRI is same as the Demat Account for a resident Indians. It is opened and operated in the same way as resident Indian account. Even the NRI Demat Account Charges are the same as a resident Indian demat account. The only difference is while opening the demat account; a customer has to mention the type of demat account as Resident Indian or NRI (subtype as Repatriable or Non-Repatriable).

The demat account is opened and managed by Central Depositories in India. The National Securities Depository Ltd (NSDL) and the Central Depository Services India Ltd (CDSL) are government-approved central depositories (CDs) who manages the demat accounts in India.

The stock brokers are the registered members (authorized agents) of the central depositories. The role of a stock broker is limited to acting as an intermediary between the customer and the central depository.

The NRI Demat Account is linked with the NRO or NRE bank account. The proceedings from the sell of shares, dividends and earning are directly deposited in the linked bank account.

An NRI customer can open multiple demat accounts on the same name with different brokers. But only 1 demat account is allowed per depository participant (stock broker).

Note: As per RBI guidelines, an NRI must maintain two separate accounts for repatriable and non-repatriable investments. So, if you trade with funds from your NRE account then sale proceeds can be credited to your NRE account for repatriation. If you choose to trade on a non-repatriable basis, then, the proceeds will be credited to the NRO account.

The NRI Demat Account is classified into two major subtypes:

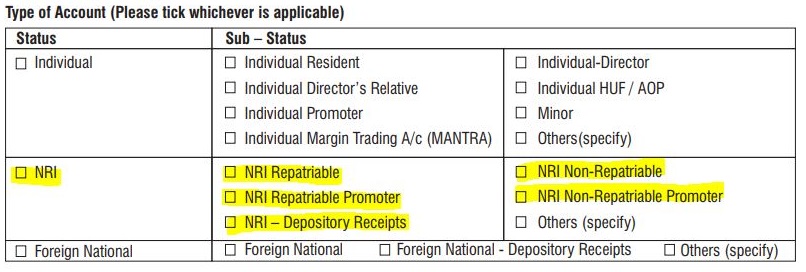

While opening the demat account, an NRI has to mention the account type as NRI and subtypes as Repatriable or Non-Repatriable. An NRI must open separate demat accounts for holding Repatriable and Non-Repatriable securities.

|

Repatriable Demat Account (NRE Demat) |

Non-Repatriable Demat Account (NRO Demat ) |

|

|---|---|---|

|

Purpose |

To buy/sell shares on repatriable basis. |

To buy/sell on non-repatriable basis. To hold securities which are bought as Indian resident before becoming NRI. |

|

Linked with Bank Account |

NRE Bank Account with PIS |

NRO Bank Account (Non-PIS) |

|

Dividend/Interest |

Both principal and dividend/interest are Repatriable |

The principal is not Repatriable. Dividend/interest is Repatriable. |

Detail comparison - NRE vs NRO Account in India for NRI

NRI Demat Account opening procedure is simple as it doesn't require any approval from RBI. NRI Demat Account can be opened with any of the stock brokers or banks registered with NSDL or CDSL as depository participant. All major banks and stock brokers like HDFC, Kotak, ICICI, Axis Bank, SBI, Zerodha, Sharekhan, Angel One, etc., offer NRI Demat Account Opening services.

NRI Customer should have the following accounts or permissions before opening a demat account:

The following documents are required to open an NRI Demat Account-

Note: All the documents must be verified by the local Indian embassy or any other competent authority approved by the banks.

An NRI Demat account attracts charges like a resident demat account. This includes fees by the Central Depository and Depository Participant (Broker). There are also government taxes to be paid on the demat account. Some key NRI demat account charges are:

Most brokers charge an NRI demat account opening fees for processing the account opening application. This fee is to be paid a one-time during the account opening process. Stock brokers, from time to time, run promotional programs wherein they give a discount on opening fees or waive it completely.

The Demat AMC is a fee charged by the broker for maintaining your demat account. It is an annual fee charged irrespective of whether you have done a transaction in your NRI demat account or not.

A fee charged when you sell shares and the shares are withdrawn from the demat account. Customer pay this fee for every withdrawal from the demat account. Some brokers charge a flat rate fee per transaction while other charges it in the percentage of the value of the transaction.

The Other changes for NRI demat account include Pledge Fees and Fee for modification of your personal info.

NRI Demat Account transactions charges are taxed under GST (18%). The GST is applicable on all charges except stamp charges for power of attorney.

HDFC, the leading bank and financial service provider in India, offers a range of NRI Products and services.

HDFC NRI 3-in-1 account is a key offering by HDFC group to NRI's who would like to invest in a wide range of securities such as Equity, FD, MF, etc. This account combines banking, broking and demat account which makes online equity trading seamless and hassle-free.

Read our HDFC NRI Account Review to know in detail about various NRI Trading services offered by HDFC.

Kotak, a leading bank and financial service provider offers online NRI account for trading and investing in India stock market, mutual funds, bonds, FDs etc.

The Kotak Securities' NRI account is a 3-in-1 NRI account. This includes a savings bank account, a trading account and a demat account. These accounts are interlinked to offer a seamless trading experience to the NRI customers.

Kotak offers free trading software including the mobile app, research reports and trading tips and hand-holding for beginners.

Read our Kotak NRI Account Review to know in detail about various NRI Trading services offered by Kotak Securities.

ICICI bank is a leading private bank in India with presence in almost every part of India and major cities around the world.

ICICI offers a unique 3-in-1 account by integrating banking, broking and demat accounts. This online NRI investment account offers a wide range of investment options including Stocks, FTF, Derivatives (F&O Trading), Mutual Funds, and an IPO. In addition, ICICI also offer services related to PAN Card, Portfolio Investment Scheme (PIS), NRI Taxes, Stock Research and Tips.

ICIC offer following type of accounts based on the need of NRI

4 steps to open NRI Account with ICICI

Read our ICICI Securities NRI Account Review to know in detail about various NRI Trading services offered by ICICI.

Axis bank is the third largest private sector bank in India. Axis Bank offers 4 in 1 NRI Investment Account which has multiple investment options such as equities, derivatives, IPOs, mutual funds and ETFs. The key feature of 4-in-1 account includes transactions with the ease of integrated account, being able to choose from a wide range of products and access to independent and third-party research.

Read our Axis Bank NRI Account Review to know in detail about various NRI Trading services offered by Axis Securities.

State Bank of India is the largest bank in India. SBI NRI customers can invest online in Equities, Derivatives, IPOs, and Mutual Funds through its 4-in-1 account consisting of:

While the SBI 4-in-1 account offers the convenience of investment and trading, the brokerage charges of 0.75% on the transaction is very high in comparison to the most other brokers.

Read our SBI NRI Account Review to know in detail about various NRI Trading services offered by SBI Capital.

Zerodha is India's largest stock broker offering discount brokerage services to stock market investors and traders. Zerodha is famous for its excellent trading platform, flat rate brokerage and lowest changes in the industry.

Zerodha NRI Account consists of a trading and a demat account. Zerodha serves only those NRI customers who have their PIS account with Axis Bank, HDFC bank or Yes Bank.

|

Segment |

NRI Brokerage Charges |

|---|---|

|

Equity Delivery |

Rs 200 per executed order (both side) |

|

Equity F&O |

Rs 100 per executed order (both side) |

Read our Zerodha NRI Account Review to know in detail about various NRI Trading services offered by Zerodha.

Sharekhan NRI Demat account is a key offering of India's one of the largest stock broker with presence in over 600 cities around India and abroad.

Sharekhan offers NRI trading and demat account. It has partnerships with Axis Bank, IndusInd Bank and HDFC Bank for NRI bank account.

Sharekhan offers a dedicated relationship manager to all NRI customers along with the free online trading platform. Sharekhan also offers research reports and recommendations.

|

Transaction |

NRI Charges |

|---|---|

|

Account Opening Charges |

Rs 3000 |

|

Account Service Charge |

Rs 2500 |

|

PIS Account AMC |

Rs 1000 |

|

Brokerage - Equity Delivery |

0.50% |

|

Brokerage - Equity Futures |

0.1% on first leg and 0.02% on second leg if squared off on the same day or 0.1% if square off on any other day. |

|

Brokerage - Equity Options |

Rs 250 per contract note |

Read our Sharekhan NRI Account Review to know in detail about various NRI Trading services offered by Sharekhan.

Angel One is one of the oldest brokerage houses in India with a wide physical presence across cities in India.

Angel offers NRI Trading and NRI demat account. Angel offers 2 types of account to NRI customers:

Read our Angel One NRI Account Review to know in detail about various NRI Trading services offered by Angel One.

Yes, NRIs can open a demat account in India. In fact, a demat account is must to invest in stocks, mutual funds, and derivatives, etc., in Indian stock exchanges.

The demat account is an online account to hold securities like stocks, MF, and debentures etc.

An NRI demat account can be opened on Repatriable or Non-Repatriable basis. These accounts are linked to NRE or NRO Bank account.

Yes, NRIs can open a joint NRI Demat Account. The joint holders in an NRI demat account can be either another NRI or a Resident Indian.

No, you do not need any approval from RBI to open a demat account.

But to trade or invest in India Stock Market on a repatriation basis, you need PIS permission from RBI. Portfolio Investment Scheme (PIS) enables NRIs to buy and sell stocks in India by routing these transactions through their NRE Bank. The bank that has your NRI Bank Account helps you to get this permission.

If you are planning to invest on a non-repatriation basis, you do not need RBI PIS Permission. You just need an NRO Bank Account linked to your trading and demat account.

Yes, you need to close the existing Demat Account opened when you were a 'Resident Indian', and a new NRI demat account needs to be opened. The securities held in your old demat account can be moved to the new NRI demat account.

You would need to present documents supporting the acquisition of the securities like contract note or a letter of allotment.

In case if you do not plan to make any fresh investments as an NRI, then you can continue holding the existing resident Demat account to hold the securities purchased in the capacity of a resident Indian on a non-repatriable basis with no plans to sell in near future.

Yes. For this, you have to give a Power of Attorney in favor of the person residing in India. Also, a copy of the Power of Attorney, duly notarized, must be submitted to your stock broker.

Yes, NRI's are eligible to open and operate the demat account in India.

While a demat account can be opened by NRI without any approval from RBI, the NRI customer needs RBI PIS approval to buy/sell shares in India on a repatriation basis.

Note that the demat account is an online repository of shares. It's an online account similar to a bank account. It holds shares, Mutual Funds, ETFs and, Bonds etc. in electronic format.

Yes, NRI's are permitted to have a demat account in India to hold securities in electronic format. These securities include shares of listed companies, mutual funds, ETFs, Bonds etc.

While opening a demat account, NRI has to choose account type as 'NRI Account' and subtypes as below based on the investment need:

An NRI has to link his demat account with an NRE or NRO bank account (PIS or Non-PIS) based on the requirement. The dividends and proceed from the sale are deposited into this linked account.

Note that if you have recently become an NRI and hold a Demat Account (Resident Indian), you will have to close the existing demat account and open a new NRI demat account. You could choose to sell all the holding in your existing account or transfer them to the new account. When transferring, you may have to provide the proof of purchase i.e. contract note.

Yes, NRI can maintain an NRI demat account.

If you are an NRI and still hold a demat account which you opened when you were in India, it's important to close that demat account and open a new demat account for NRI. However, in case you do not plan to make any new investments you can continue holding the existing securities bought as a resident Indian in resident Demat account on a non-repatriation basis.

In a similar way, if you were an NRI and now moved back to India, it is required by law to close the NRI demat account and open another demat account.

A demat account is a mandatory account for NRIs to invest or trade in the Indian stock market, Mutual Funds, ETFs, Bonds, NCDs, etc. Demat account is like a bank account but instead of money, it holds securities in electronic format.

NRIs need following accounts or permission to invest in Indian Stock Market:

There are 2 ways to open these accounts:

The 1st option of account opening is easy, convenient, and completely online. Visit the website of any one of the popular banks (prefer the bank you already have a relationship with) and fill their NRI Account inquiry form. You will get a call from them in 24 hours to assist you with account opening.

In the case of the 2nd options, first, follow the above steps to open the 2 bank accounts. Once you have them ready, choose a broker i.e. Zerodha, Angel One or Sharekhan to open the trading and demat account.

Note the 4-in-1 account offer convenience but their charges are very high in comparison to the brokers like Zerodha or ProStocks. Also, the trading tools available with discount brokers like Zerodha are way more superior then the banks.

Documents required to open an NRI Demat Account

No. An NRI must open separate demat accounts for holding repatriable and non-repatriable securities.

An NRI customer has to choose one of the following subtypes of NRI Demat account while opening the account:

Also, the NRI Demat account must be linked with a corresponding bank account.

Yes. Nomination in a demat account is possible in both the ways.

The following bank accounts may be given

The above details should be provided to the broker (DP) with whom you have the demat account. The DP uses this information to directly credit dividend or interest.

(Dividend/interest received on Investments made on repatriation and non-repatriation basis under the Portfolio Investment Scheme is an eligible credit to NRE (PIS) Account and NRO Account respectively).

An NRI can open a Demat Account with any stock broker in India who offers NRI services. Most stock broker and banks offer NRI Demat Account. This includes:

Visit NRI Demat Account Detail for more detail.

Demat Account is an online account to hold securities (i.e. Stock, Mutual Fund, NCD, Bonds) in electronic format. Demat Account is opened with one of the two depositories (CDSL and NSDL) through a depository participant (usually stock brokers).

Note that for trading / investing in the stock market an NRI needs 4 accounts:

NRI 3-in-1 Account, which includes bank, trading and demat account is the most convenient way to invest in India. Most large banks in India offer this account. They offer seamless online trading experience but at a higher brokerage charge.

No, NRIs don't need permission from RBI to open the demat account in India. The NRI demat account is similar to the resident demat account. but at the time of account opening, the NRI customer has to choose the account subtype as NRE or NRO. NRI Demat account should also be linked with the respective NRI Bank Account (NRE or NRO).

NRI Demat Account and Resident Demat Account are opened and managed in the same way. They carry the same transaction charges, AMC and taxes.

On Repatriation Basis

NRI need RBI permission (PIS) to invest on repatriation basis in the stock market. NRI can trade on repatriation basisin Equity F&O through a Custodial Participant (CP) using a CP code.

On Non-repatriation Basis

NRI doesn't need RBI/PIS permission to invest on the non-repatriation basis in the stock market or trading in equity derivatives (F&O) in India.

No, an NRI who already has a resident Demat account and is holding securities in it that were acquired in the capacity of a resident Indian is not required to move those securities into an NRI Demat Account or PIS account.

NRI can continue to hold the securities on a non-repatriable basis even after he becomes a non-resident Indian. It means that you can hold the securities but cannot transfer its sale proceeds either in foreign currency to your overseas account or your Non-Resident External (NRE) Account. The sale proceeds would be required to be credited to NRO Bank Account. As per laws, repatriation of funds up to USD 1 million per year is allowed, along with other assets for NRIs/ PIOs.

According to section 6(5) of FEMA Laws:

A person resident outside India may hold, own, transfer or invest in Indian currency, security or any immovable property situated in India if such currency, security or property was acquired, held or owned by such person when he was resident in India or inherited from a person who was resident in India.

However, if you would like to make any fresh investments in Indian Stock Market, you would need NRE PIS Bank Account, NRE PIS Trading Account and NRE Demat account to trade on a repatriation basis and NRO Non-PIS Bank Account, NRO Trading Account and NRO Demat Account to trade on non-repatriation basis.

Many NRI's ask, I am an NRI (Indian origin) residing in the USA. I already have Demat & Trading account, still, I need to open the PIS account (Portfolio Investment Scheme).

The answer to this is the same as above. If you are planning to make a fresh investment on a repatriable basis, you need an NRI Demat [NRE/NRO], NRI Trading [NRE/NRO], and PIS NRE or Non-PIS NRO Bank Account. However, if you just want to keep or manage your existing holdings as resident Indian, you can continue with the resident account you already have.

Most stockbrokers do not offer online account opening for NRI trading and demat accounts.

Some brokers like ICICI Direct offer online NRI account opening for customers residing in the USA and Canada. For all other countries, a customer has to fill the paper form.

Some broker offers online forms for NRI customers. In this case, customers have to fill a series of online forms, and once completed they are given a link to download the PDF. The customer has to print, sign, attach the supporting documents, and send these forms to the broker's Indian office.

Yes, the Indian companies are allowed to freely issue the rights/bonus shares to existing NRI shareholders. The issuing company needs to ensure that the issuance of such rights/bonus shares is within the sectoral cap limit allowed for NRI.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|