Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

3.45% 1,152,697 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

HDFC, a leading private bank in India, offers online trading and investment services in India Stock Market to NRIs located across the globe. HDFC NRI 3-in-1 Account offers a seamless trading experience to NRIs. It offers an integrated NRI trading account wherein an NRI Trading, NRI demat and NRI bank account are linked together to facilitate smooth and fast online transactions.

Important Note for USA & Canada based NRIs & PIOs

HDFC doesn't offer 3-in-1 NRI Account or online trading to NRIs located in USA and Canada. NRIs who are residents of the United States and Canada cannot invest in India Stock Market through HDFC Bank.

The HDFC Securities brokerage charges for NRIs is 0.75% for equity delivery trades. The Brokerage for Equity Future is 0.025% (Both Buy & Sell) and Equity Options is ₹100 per lot.

HDFC Product Offerings for NRI:

HDFC Securities offers a wide range of trading and investment services to NRIs. To invest through HDFC, an NRI has to open an NRI 3-in-1 account. The 3 in 1 account is a combo account which includes 3 accounts in it:

HDFC NRI Bank Account comes in two forms; NRE and NRO account. This account holds money.Read NRE vs NRO Account

HDFC NRI Demat Account is an online account to hold securities in electronic format. In India, a demat account is mandatory to invest in the stock market. Besides stocks and equity derivatives, the demat account is also helpful in investing in mutual funds, IPOs, and bonds.

HDFC NRI Trading Account provides you access to BSE & NSE to trade across stocks, equity derivatives, and ETFs.

HDFC offers two types of NRI Demat accounts:

10 Key Features of NRI Demat Account by HDFC

HDFC offers a completely online trading experience to NRI investors, except for those based in the US and Canada.

The step-by-step HDFC NRI trading procedure for trading in Equity Delivery segment is as follows-

Place a buy order using any of the HDFC trading platforms. The system will check the availability of the funds in your linked bank. If sufficient funds are available then your order will be executed.

After the order is executed, the traded securities will be credited to your demat account.

The transaction will be automatically reported to HDFC Bank for onward reporting to RBI, as per the Regulations.

When you place a sell order, the stocks are withdrawn from your demat account and delivered to the buyer by HDFC.

HDFC Securities NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹2500 |

| NRI Account AMC | ₹0 |

| Equity Delivery Brokerage | 0.75% |

| Equity Future Brokerage | 0.025% (Both Buy & Sell) |

| Equity Options Brokerage | ₹100 per lot |

| Other Charges | Minimum Brokerage: ₹25, PIS AMC: ₹1000 |

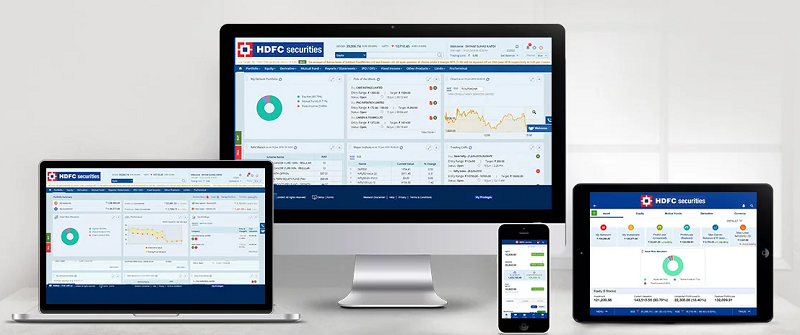

The trading platform offered by HDFC to NRIs is the same as it is offered to the resident Indians. HDFC offers a range of online trading software and tools:

The investment options available to an NRI at HDFC Securities.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others | Bonds, Equity F&O, ETFs |

HDFC Securities account opening process for NRIs is simple. Below are the steps to open NRI account with HDFC.

How to open HDFC NRI Trading Account?

One of the easiest ways to open an NRI account is by visiting HDFC Bank Branch if you are in India. If you are overseas then you could fill the enquiry form on the HDFC website and an HDFC employee will help you to go through the process.

HDFC Click2Talk facility is a free doorstep service for NRIs who want to open HDFC Bank accounts. Once you fill the enquiry form, you will receive a call in 3 hours.

Follow the below steps to open an NRI account:

The above documents need to be attested by a Notary Public, Any court of law, Magistrate, Judge, Local Banker - Bank Seal; Name; Designation; Employee Code of the Officer doing attestation, Indian Embassy / Consulate General of the country.

Note-

| Feature | Status |

|---|---|

| 3-in-1 Account | Yes |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

HDFC Securities offers online mutual fund investment services to NRIs. They can buy, redeem and switch funds online.

Key Features of HDFC NRI Mutual Funds

Note:

HDFC Securities NRI Support Desk contact information. Find HDFC Securities NRI contact number.

| HDFC Securities NRI Helpline | Number |

|---|---|

| HDFC Securities NRI Customer Care Number | +91 2267 6061 61 |

| HDFC Securities NRI Customer Care Email ID |

HDFC is a good choice for NRIs to trade and invest in stocks, mutual funds and other investment products in India. Barring NRIs from the USA and Canada, it offers a convenient way to invest online. HDFC is a full-service broker offering services like RM, NRI support desk, free research, and tips, etc., to help NRIs take informed trading decisions. It also offers loan against securities held in the demat accounts. The GTC and AMO order helps NRIs in placing orders as per their convenience.

An NRI can open HDFC NRI account by taking the following steps-

For more details, please read the Account Opening section on this page.

To close your HDFC 3-in-1 account, you need to-

Yes, US and Canada based NRIs can open a Trading account on fulfilling the below conditions:

As per RBI guidelines, NRIs are allowed to transfer funds from NRO bank account to NRE account up to a total limit of USD 1 million per financial year. To transfer funds from NRO to NRE, an NRI needs to submit the following documents-

Steps To Upload Form 15ca Online:

Your transfer will be made after the bank processes your application.

Note-

You need to pay 2 types of charges on NRI Trading account- Account Opening Charges and Brokerage Fees.

HDFC NRI trading charges For Account Opening

While opening HDFC NRI 3-in-1 account, the bank charges a one-time fee of Rs 2500 from NRIs. The bank also charges an one-time PIS approval issuance Fee of Rs 1,000.

NRI demat account charges HDFC

The HDFC NRI demat charge of Rs 750 is waived off for the first year. It will be applicable from next year.

The HDFC NRI demat and trading account charges are as follows:

Security Type | Brokerage Rates |

|---|---|

Equity Delivery | 0.75% or min Rs 25 or ceiling of 2.5% of the transaction value |

Equity Futures | Non-Square Off Trade: 0.05% or min Rs 25 or ceiling of 2.5% of the transaction value; Square Off Trades: 0.025% or min Rs 25 or ceiling of 2.5% of the transaction value |

Equity Options | Higher of 1% of the premium amount or Rs 100 per lot |

Yes, NRIs can take a loan against shares or other securities. However, the loan cannot be used for trading or investing. It should be utilized for meeting personal requirements or business purposes.

Yes, for opening HDFC 3-in-1 NRI trading accounts without visiting the bank, you need to keep IPV column on AOF 'BLANK' and all documents need to be attested by any one of the following: Notary Public, Any court of law, Magistrate. Judge, Local Banker with Bank Seal, Name, Designation, Employee Code of the Person doing attestation or lastly by Indian Embassy / Consulate General of the country.

You need to download the forms, fill it and courier it along with 2 sets of copies of documents attested by authorities discussed above.

Yes, you can make changes or corrections like change in the mobile number, address, email id etc., in your trading account without a branch visit. To make corrections, you need to send a letter along with copy of the self-signed supporting documents to their RM or Home Branch.

The copies of the supporting proof documents should be 'verified with original' by anyone of the Notary Public, Court, Magistrate, Judge, authorized officials of overseas branches of Scheduled Commercial Banks registered in India, Indian Embassy / Consulate General of the country where the client is residing.

HDFC offers 3-in-1 account to NRIs which allows them to open trading, Demat, and Bank account with HDFC.

An NRI can open an NRE (NRI Repatriable Demat Account)/NRO (NRI Non-Repatriable Demat account) as desired. The Demat account is opened at zero cost with no annual maintenance charges for the first year.

HDFC Securities offers an online and offline account opening facility to NRIs. The online account opening facility is available for all NRIs except for NRIs based in USA and Canada.

Steps for online NRI account opening with HDFC Securities:

Steps for offline NRI account opening for USA and Canada based customers:

Documents required for NRI account opening

Points to Note

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Saturday, November 18, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|