Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

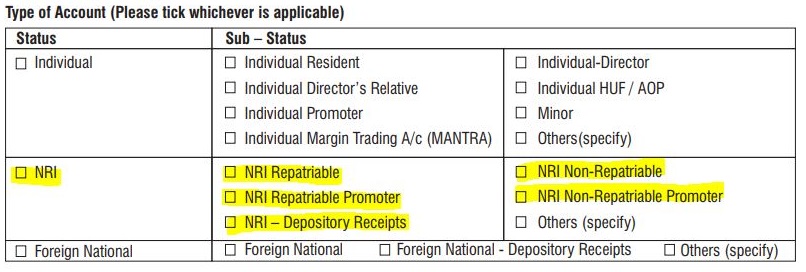

A demat account in India with sub-status as NRO Repatriable. This demat account is liked with an NRO Bank Account which is not fully repatriable.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

An NRI Non-Repatriable Demat Account is an ordinary demat account with sub-status as 'NRI Non-Repatriable'. This account is for NRIs to invest the money earned in India in the Indian Stock Markets.

Read NRI Demat Account to know more.

A demat account in India is an online account to hold securities like Stocks, Mutual Funds, IPO, NCD, etc. in electronic form. Demat account is like a bank account but instead of money, it holds securities.

A demat account must be linked with an NRI Bank Account. All the proceeds from selling in securities, bonuses and dividends are automatically credited to this linked NRI bank account.

There are 2 types of bank accounts for NRI; NRE (Non-Resident External) and NRO (Non-Resident Ordinary). An NRO Bank Account is opened to manage money earned in India by an NRI. The funds in the account are repatriable (i.e. can be transferred abroad) but with certain rules, regulations and limits.

The NRI Non-Repatriable Demat Account must be linked with an NRO Bank Account. This account is also called NRO Demat Account.

As per RBI regulations, an NRI has to open 2 separate demat accounts for repatriable and non-repatriable investments.

An NRO Demat account is also called a non-repatriable Demat account. This is because not all the funds can be transferred abroad. The principal amount of your investments can be repatriated after paying taxes. The RBI rules allow up to $1 million of funds transfer to abroad in a financial year. All the interest earned on the account is repatriable after TDS is deducted.

NRO Demat account (non-Repatriable) Key Facts

Answered on

A non-repatriable demat account is an NRI demat account linked with an NRO bank account. In this account, there are restrictions on transferring money to a foreign country. As per RBI rules, the dividend amount and interest earned are fully repatriable, however the principal is not repatriable. An NRI can transfer up to $1 million in a year.

Once you become an NRI, you have the following choices:

Please consult your stock broker for more details.

NRIs can sell your existing shares held in the resident demat account on a non-repatriable basis. Following are a few preferred ways to handle these shares:

Note:

An NRO Demat account is linked with a Non-PIS NRO Bank Account. PIS permission is not required to open NRO Demat Account.

An NRO demat account is used for non-repatriable investments, ESOPs and to keep stocks from old resident Indian demat account. In an NRO Demat Account, the principal is not repatriable. The dividend/interest is repatriable. An NRO Demat Account is linked with an NRO Bank Account (Non-PIS). Transactions in an NRO Bank Account are not reported to RBI.

NRIs usually maintain two demat accounts; NRE and NRO Demat accounts. The NRE accounts for repatriable investments and NRO account for non- repatriable investments.

No, an NRI cannot open a joint trading account in India. A trading account should be opened only in a single name for whom all the transaction monitoring will be done.

An NRI can open a joint Demat account and bank accounts. In the case of PIS bank accounts, some banks allow joint holders while a few others do not allow NRI to open joint accounts.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|