Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Sunday, March 15, 2015 by Chittorgarh.com Team | Modified on Sunday, August 9, 2020

NRI (Non-Resident Indian) are Indian citizens who are temporarily immigrated to another country for six months or more. NRI's are allowed to invest in India Stock Market, Mutual Funds, Bonds, and other instruments through a different set of rules designed by RBI and SEBI. This article provides information about how NRI's can invest in India.

Yes, the NRI's can invest in equity shares, ETF, debt funds, mutual funds and IPO's in India. NRIs can also trade in Equity Derivatives (F&O) at the exchanges like BSE, NSE and MCX.

NRI's are permitted by RBI to invest and trade in the India Stock Market through the PIS route and Non PIS route on non-repatriation basis. NRI's are also now permitted to trade in Currency Derivatives as RBI circular issued in Feb 2017.

In this article we will try to address common questions asked by the NRI's regarding investment and trading in the India Share Market. We will also explain the process of opening the trading and Demat account for NRIs. This could be your best NRI trading beginners guide.

Note: RBI has provided guidelines for trading and investments by NRI customers in India. Each broker in India interprets the RBI guideline in a different way. This confuses terms of offerings. It is important to ask as many questions as you could before opening an account with a broker.

Let's begin with a clarification about who is qualified as NRI.

NRI (Non-Resident Indian) is Indian citizen holding an Indian passport and has temporarily immigrated to another country for six months or more for employment, residence, education or any other purpose. NRI's can maintain bank accounts in India, Invest in shares, and deposits with Indian companies and invest in immovable properties in India. A person of Indian origin (PIO), who were born in India or other countries but have Indian ancestry but is not a citizen of India and is the citizen of another country.

A trust and a partnership firm incorporated outside India and owned and controlled by non-resident Indians, may also acquire and hold, on non-repatriation basis, equity shares in an Indian company.

In June 2013, SEBI instructed, the PIS route, a foreign investment route to simplify the registration and investment procedure by bringing all categories of foreign investors under a single channel called PIS.

Foreign investors investing under the PIS route are classified into three categories; category I, II and III investors and the Know Your Customer (KYC) procedures varies by them.

To trade in stock market in India, NRI investor has to open 3 different accounts and link them together.

The NRI Equity Trading account include:

There are 3 types of financial institutions in India whom with you can open these accounts:

Some of the banks in India (ICICI, HDFC, Kotak etc.) offers 3-in-1 account. This means all 3 accounts can be opened with the same financial institution. These accounts are extremely popular because of the seamless transactions among the accounts. The ease of use comes at the cost of higher AMC and brokerage charges. Note: ICICI Bank is no more allow opening online 3-in-1 NRI account from foreign land. If you are an NRI and present in India, you could open the NRI 3-in-1 account with them.

Some brokers in India offers 2-in-1 account which include a trading account and a Demat account. These brokers also have an exclusive partnership with a specific bank for seamless-integration. (i.e. Sharekhan offers 2-in-1 account and have partnership with HDFC for NRI Bank Account). These brokers are cheaper than the brokers who offer 3-in-1 account.

These brokers are specialised in trading only and provide only trading account. They offer excellent trading platforms, extremely cheap brokerage fees and free software for trading. They have exclusive partnership with the DP service provider (for demat account) and the banks (for NRI bank account).

ProStocks, a Mumbai India based discount broker offers 2-in-1 NRI trading account. They offer excellent trading platform and cheapest brokerage charges for NRI (Rs 100 per trade).

Zerodha is another popular broker in this category.

Note:

Here are the step by step guide to open these accounts:

Contact any bank in India (or its foreign branch) which offers the NRI Bank Account under the PIS (Portfolio Investment Scheme) for investing on a repatriation basis or NRO Non-PIS Account for investing on non-repatriation basis.

For investing on a repatriation basis, NRI needs approval by the RBI to open this account through the PIS route. Banks with whom which you are opening the account usually takes care of it. Once you get the necessary approvals through the bank, you will be given the PIS (Portfolio Investment Scheme) Letter. This PIS letter is required to open the trading and demat account.

Note:

ICICI Bank, Axis Bank, HDFC Bank, Kotak Bank etc are the popular banks offering NRI Bank Account.

Choose the right broker and contact them to open the trading account and Demat account.

If the stock broker doesn't offer the Demat Account Services (DP Services), they direct you to the preferred DP service provider (i.e. IL&FS). You can open the Demat account with the DP service provider and link it to the trading account.

That's it. Once you have the NRI Bank Account, the Demat Account and the Trading Account opened and linked together, you are all set for trading.

Note: If you are interested in trading in F&O segment, please read the next section for additional requirement.

NRIs are allowed to trade in the Futures and Options segment only on a non-repatriation basis using the NRO account. PIS permission is not required to invest in F&O. To start investing in F&O, you are required to open an account with a custodian or a broker who offers in house trading and clearing services. The custodian or the broker can help obtain CP code for you from the clearing agency which is required to start trading in F&O.

Note:

Yes you can continue using the same account. If your residential status has changed to NRI with your bank account, then you will need to open a NRI trading account too.

| Broker | Account Opening Charges |

|---|---|

| ICICI NRI Account Opening Fee | Rs 4000 |

| ICICI NRI Bank Account AMC | Rs 1000 per year |

| Kotak Security Account Opening Fee | Rs 3750 |

| Kotak NRI Bank Account AMC | Rs 1000 per year |

| Kotak NRI Demat Account AMC | Rs 75 + tax per month |

| Broker | Segment | Brokerage Charges |

|---|---|---|

| ICICI | Equity Delivery | 1.25% to 0.50% |

| Equity Future | 0.05% to 0.03% | |

| Equity Options | Rs 95 to Rs 75 | |

| Kotak Securities | Equity Delivery | 1% |

| Zerodha | Equity Delivery | Flat Rs 200 per trade |

| Equity Derivatives (F&O) | Flat Rs 200 per trade |

ProStocks, a popular discount stock broker based out of Mumbai offers 2-in-1 NRI Trading account.

ProStocks NRI Brokerage Charges: Rs 100 Per Trade (All Segments)

ProStocks NRI Account Charges:

ICICI offers a 3-in-1 account for NRI's to invest in India. This include the seamlessly integrated Bank Account, Demat Account and Share Broking Account. This online account allows you to invest in Stocks, Mutual Funds, IPOs, Bonds, EFTs and trade in equity derivatives (futures and options) in India Stock Market.

ICICI NRI Account Charges:

| Total Turnover (per month) | Equity Delivery |

|---|---|

| Above Rs 50 lakhs | 0.50% |

| Rs 25 lakhs to Rs 50 lakhs | 0.75% |

| Rs 10 lakhs to Rs 25 lakhs | 0.90% |

| Rs 5 lakhs to Rs 10 lakhs | 1.00% |

| Up to Rs 5 lakhs | 1.25% |

| Total Turnover (per month) | ICICI NRI Brokerage Charged |

|---|---|

| Above Rs 20 Crores | 0.03% |

| Rs 10 Crores to Rs 20 Crores | 0.035% |

| Rs 5 Crores to Rs 10 Crores | 0.04% |

| Up to Rs 5 Crores | 0.05% |

| Total Turnover (per month) | Per Lot Brokerage |

|---|---|

| Above Rs 20 Lakhs | Rs 70 |

| Rs 10 Lakhs to Rs 20 Lakhs | Rs 75 |

| Rs 5 Lakhs to Rs 10 Lakhs | Rs 85 |

| Up to Rs 5 Lakhs | Rs 85 |

How to open the ICICI NRI trading Account?

Sharekhan, India's leading stock broker offers NRI Investment Service though partnership with HDFC Bank for NRI Bank Account.

Kotak securities offers NRI 3-in-1 Account (known as Trinity Account), a combination of Bank, Demat and Trading Account to provide you a seamless platform to trade and invest in India Stock Market.

| Purpose | Charges |

|---|---|

| Account Opening Charges | Rs 3750 |

| Bank Account maintenance fee | Rs 1000 per year |

| Demat Account maintenance fee | Rs 75 per month |

| Brokerage Charges | 1% of the turnover or 10 Paise per share, whichever is higher |

For more information, visit:

NRIs are allowed to trade only in following trading segments in the India Stock Market:

Note: NRIs are NOT permitted to do intradaytrading (day trading) in equity or derivatives.

Note:

Yes, NRIs are permitted to invest in IPO, FPO and other public issues provided the issuer company allows NRI to subscribe to their issue. There is no restriction from RBI on the NRI IPO/FPO investment.

However, generally, the issuer company is reluctant to allow NRIs to invest in IPO /FPO due to the additional compliance requirement on the part of the issuer company to inform RBI on NRI shares allocation. Hence, an NRI should check the Red Herring Prospectus (RHP) of the issuer company to check for NRI eligibility for investment.

Yes, NRIs are permitted to trade in Exchange Traded Currency Derivatives as per RBI circular

Intra-day trading leads to speculation thereby creating volatility in the markets and increasing risk for the investors. Hence as per the RBI guidelines, NRIs are not allowed to do intraday trading in India. However, NRIs can do the Intraday Trading in the F&O segment restricting to square off their positions and not for speculative purposes.

Zerodha brokerage charges for the NRI trading account is flat Rs 200 or 0.1% (whichever is lower) per executed order in the equity segment and Rs 100 per trade in the F&O segment. Besides brokerage, an NRI customer has to pay taxes, clearing fees, exchange transaction charges, PIS charges, etc.

ICICI charges a brokerage fee of 0.50% to 1.25% based on your monthly transactions for equity delivery trading. For Equity derivatives, ICICI charges 0.03% to 0.05% for equity futures and Rs 70 to Rs 95 per trade for equity options.

Stock brokers charge higher brokerage to NRI customers because of additional complexity with NRI trading due to RBI and FEMA regulations.

While trading on a repatriation basis through PIS-NRE Account, every time a customer buys the shares, the broker sends the Contract Note to the bank and then the bank release the funds to the broker.

The process is more complicated when NRI trading on repatriation basis in equity derivatives segments (F&O's). An NRI needs an additional account with Clearing Agents who does the settlement of the trades instead of the broker.

Note:

Shares purchased under the PIS route shall be sold on the stock exchange only. Such shares cannot be transferred by way of sale under private arrangement or by way of gift to a person resident in India or outside India.

Once investor opens NRI account, the PIS received is mapped with the trading account. When NRI investor does this, the bank shares the account balance with the broker. This available balance is updated on the trading platform.

When NRI investor buy the shares, the Contract Note is shared with the Bank by the broker. Once bank receives the Contract Note, they transfer the money to the broker.

When NRI investor sells the equity shares, the funds are automatically credited to the NRI Account.

Yes, the PIO and OCI can invest in the same way as NRIs. The rules applicable to NRIs for investing in Indian stock markets get applied for PIO and OCI as well.

As per section 6(5) of FEMA, an NRI can continue to hold the securities which they had purchased as a resident Indian, even after they have become a non-resident Indian, on a non-repatriable basis. However, in case an NRI wishes to make any fresh investments, an NRI cannot use the resident Demat account and is required to convert the existing Demat account to the Non-Resident Demat account.

An NRI can convert the existing Demat account to NRO Demat account for trading on a non-repatriation basis or open a new NRE Demat account for trading on a repatriation basis. Note the shares purchased as resident Indian can be transferred only to the NRO Demat account only and not NRE Demat Account.

Yes, an investor needs to open a new trading account with the broker with the change in their residency status. An NRI cannot invest with a normal resident trading account and requires to open an NRI trading account and a resident Indian cannot invest with an NRI trading account and requires a resident trading account.

Following are the document needed to open the NRI Trading Account. Please note that this list is just for reference. Your broker will provide you the actual list at the time of account opening.

Opening an NRI Investment Account is a complex process and the charges for opening and maintaining the account are high. If you are on a short term assignment and are not a frequent trader, you can use some workarounds to avoid this complexity. Here are few suggestions:

These approaches are commonly used by people who are on short term assignment in foreign or frequently visit oversees i.e. software professionals, students etc. You can still use international address for correspondence. Trading and Demat account can be easily managed online.

Though the above approaches exist as a workaround, it is always recommended to trade via NRI accounts on becoming an NRI. This is to avoid any issues in the future in case of any investigations since the investments done by an NRI are closely monitored by the Government of India.

As such there is no problem with this kind of arrangement (proxy account) as long as the IT Returns are filed (when income exceeds the exemption limits) in the name of the family member who owns the trading account.

Even though you are using the account, technically you don't own the account.

Note that moving money between your personal accounts and your family members account in large amount could also be problem.

Yes, you can open the NRI trading account with the discount broker and move the shares from your existing demat account to new demat account through offline transaction.

Technically, there are no problems in continuing to operate with residential trading/Demat/bank accounts if proper documents are submitted to prove that investments are done in the capacity of resident Indians.

You can open an account in your mother's name but you cannot link your bank account to her trading account. As per law, the trading linked bank account should belong to the same person.

You would have to first transfer funds to your mother's bank account and from there to her trading account for trade.

Following are two main types of bank accounts which can be maintained by NRI / PIO in India:

Any person resident outside India (including NRI or foreign national or non-Indian origin visiting India) can open NRO bank account with an authorized bank in India for the transactions in Indian Rupees. NRO Account can be of types including current, savings, recurring or fixed deposit accounts.

NRI/PIO can remit money (transfer money to their foreign account) from the NRO account as long as they paid taxes in India.

Any Non Resident Indian can open NRE Account. NRE account is usually opened by NRIs with their resident close relatives in India. The resident close relative are eligible to operate the account as a Power of Attorney holder for the limited purpose of withdrawal of local payments or remittances through normal banking channels to the account holder himself. NRE Account can be of types including current, savings, recurring or fixed deposit accounts. NRE account is maintained in Indian Rupees.

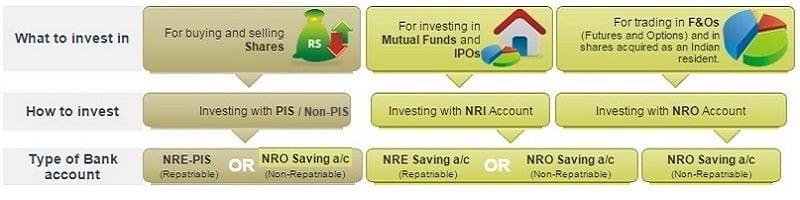

Both NRO and NRE accounts can be used to trade in the India Stock Market.

| NRE (Non Resident External) Account | NRO (Non Resident Ordinary) Account | |

|---|---|---|

| Who can open this Account? | Any NRI (Indian passport holder) can open NRE account. A Power of Attorney is usually given to a close relative in India to allow them to operate the account. | Any person resident outside India (including NRI) can open NRO account. |

| Repatriation of Fund | Both the principal and interest amount is freely repatriable. | Only the interest is repatriable. |

| Exposure | Account is exposed to the fluctuations in the value of the Indian Rupees for both the principal and interest. | The account holder is exposed to the fluctuations in the value of the Indian Rupee only for the interest component. |

Click here to read the detailed comparison of NRE and NRO Bank Account.

To open a Custody Account you need to complete certain documents.

No, NRIs do not require any PIS permission to purchase shares in the primary market. The application money can be paid through a regular NRE / NRO bank account or inward remittance.

Yes, NRI can receive the shares in inheritance without any RBI permission. The shares so obtained are to be held on a non-repatriable basis.

As per FEMA, a Non-Resident Indian (NRI) cannot operate and maintain a resident savings account. Hence as soon as an individual becomes an NRI, the existing resident bank account should be either closed or converted to NRO Bank Account. Moreover, when a resident Indian person moves abroad and becomes an NRI, the easiest and efficient way to access and use the money and investments already made in India, is to convert the savings bank account with the Indian bank into an NRO bank account.

The NRO accounts can receive foreign remittances (money transfers from aboard to India), can have a joint holder who is a resident Indian, and RBI also permits repatriations abroad limited by a maximum annual amount.

An NRI Bank account can be either opened online or offline by approaching your bank requesting them for conversion for an existing resident bank account or to open a new NRI Bank account. To open any non-resident account in an Indian bank, it is important to provide proof that the account holder is now a non-resident as defined in the Indian tax laws.

The conversion of a resident account into a non-resident account requires submitting identity proof, NRI status proof, proof of foreign address, and two photographs. The applicant has to provide proof of residence abroad in the form of employment details, student status, dependent visa status, or a copy of the resident permit in the overseas destination. This proof has to be attested by the Indian embassy, notary, or an Indian bank with an overseas branch. If the applicant wants to mention a local Indian address for ease of operation, in addition to an overseas address, proof of such an address should also be provided with attestations.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|