Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

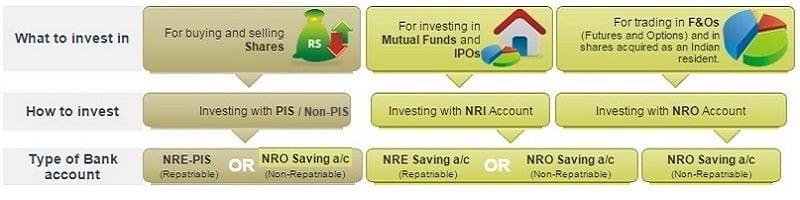

Following are two main types of bank accounts which can be maintained by NRI / PIO in India:

Any person resident outside India (including NRI or foreign national or non-Indian origin visiting India) can open NRO bank account with an authorized bank in India for the transactions in Indian Rupees. NRO Account can be of types including current, savings, recurring or fixed deposit accounts.

NRI/PIO can remit money (transfer money to their foreign account) from the NRO account as long as they paid taxes in India.

Any Non Resident Indian can open NRE Account. NRE account is usually opened by NRIs with their resident close relatives in India. The resident close relative are eligible to operate the account as a Power of Attorney holder for the limited purpose of withdrawal of local payments or remittances through normal banking channels to the account holder himself. NRE Account can be of types including current, savings, recurring or fixed deposit accounts. NRE account is maintained in Indian Rupees.

Both NRO and NRE accounts can be used to trade in the India Stock Market.

| NRE (Non Resident External) Account | NRO (Non Resident Ordinary) Account | |

|---|---|---|

| Who can open this Account? | Any NRI (Indian passport holder) can open NRE account. A Power of Attorney is usually given to a close relative in India to allow them to operate the account. | Any person resident outside India (including NRI) can open NRO account. |

| Repatriation of Fund | Both the principal and interest amount is freely repatriable. | Only the interest is repatriable. |

| Exposure | Account is exposed to the fluctuations in the value of the Indian Rupees for both the principal and interest. | The account holder is exposed to the fluctuations in the value of the Indian Rupee only for the interest component. |

Click here to read the detailed comparison of NRE and NRO Bank Account.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|