Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Monday, November 11, 2019 by Chittorgarh.com Team | Modified on Thursday, May 13, 2021

The Indian stock market offers a plethora of opportunities to trade and invest. NRIs are allowed to invest in stocks, Futures & Options (F&O), IPOs, and Mutual Funds, amongst other securities. However, they have to trade in a different regulatory framework and compliance process than resident investors.

NRI Trading Process

Once you have opened all the required accounts (NRI Bank, Trading and Demat Account), you are set for trading. The steps to trading in stocks depend on whether you're holding a 2-in-1 or a 3-in-1 account. We will explain to you both the steps:

In an NRI 3-in-1 account, the NRI Bank Account (PIS enabled), Trading and Demat account are opened with the same broker (or bank) i.e. ICICI, HDFC, SBI. These accounts are well integrated to offer seamless transactions between them. Some brokers also call it the NRI 4-in-1 account as they open 2 bank accounts; PIS and Non-PIS enabled bank account.

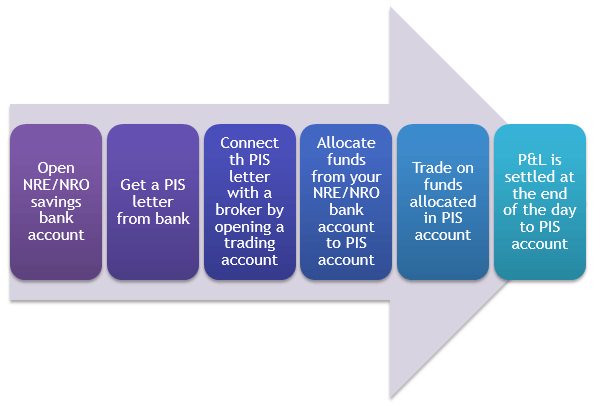

The NRI 2-in-1 account is a combination of trading and demat accounts. A broker who does not have a banking license offer this account. NRIs have to open NRE/NRO bank accounts and get PIS permission before opening the trading account.

One key difference between trading with a 3-in-1 account and the 2-in-1 account is that in a 2-in-1 account, the broker has to request the fund from the bank (3rd party) after the trade is done. In the case of the 3-in-1 account, the funds for trade are internally settled.

In an NRI 2-in-1 account, your funds are not directly transferred to your trading account. You need to transfer funds to the PIS enabled bank account before trading. At the end of the day, your broker will send a contract note to the bank detailing your buying transactions. The bank then credits money to the broker's account.

Note: The PIS letter is mandatory for the NRE account. As per recent RBI guidelines, the PIS requirement has been relaxed for the NRO mode of trades. Hence, you can check with your broker if trading without PIS is offered by them for the NRO route.

Note:

Yes, most stock brokers offer the online trading facility to NRIs. This mainly includes online discount brokers offering 2-in-1 account (trading and demat) i.e. Zerodha, Prostocks.

However, there are some stock brokers, mostly banks offering 3-in-1 account, who may not offer online trading services, particularly to US and Canada based NRIs due to additional compliance requirements. Please check with the stock broker before opening the trading account.

NRIs can use the online trading software provided by the stock broker to place buy/sell orders online. The trading software and process to place a buy/sell order are similar to resident Indian customers.

An NRI can place a buy/sell order in the Indian Stock Exchange in 3 ways:

Yes, NRIs can do intraday trading in Equity and Equity F&O using the NRO Non-PIS trading account.

| Instruments | NRI Permitted? |

|---|---|

| Equity Delivery (Cash & Carry) | Yes |

| Equity Intra-day | Yes (using NRO Non-PIS trading account) |

| Equity F&O | Yes |

| Equity F&O Intra-day | Yes (using NRO Non-PIS trading account) |

| Equity F&O Short Selling | Yes (using NRO Non-PIS trading account) |

| ETF | Yes |

| NCD / Bonds | Yes |

| IPO | Yes |

| Equity BTST (Buy Today Sell Tomorrow) | No |

| Currency F&O | No |

| Commodity F&O | No |

If the stocks sold were held on repatriation basis, the sale proceeds, after deduction of taxes, will be credited to his NRE /FCNR(B)/NRO accounts whereas sale proceeds of stocks held in the non-repatriable basis are credited only to NRO accounts.

The payment for buying stocks on BSE & NSE on a repatriation basis needs to be made through inward remittance of foreign exchange or out of funds held in an NRE/FCNR bank account.

For shares purchased on a non-repatriation basis, NRIs can use the funds in their NRO bank account.

Yes, NRIs are permitted to trade online in the Indian Stock Market. Many NRIs living around the world regularly invest and trade in India. NRI investment in equity on a non-repatriation basis is very simple. But the investment on repatriation basis slightly complicated due to RBI and SEBI regulations for this.

Once your NRI Trading, NRI Demat and NRI Bank Accounts are set up, the stock market investments are totally online. NRI customers can invest or trade from anywhere around the world.

If you recently become an NRI and use to trade in India before, remember that NRI trading is allowed only in limited segments and scripts. The brokerage for NRI accounts is higher than that for resident accounts.

Here are a few key things to know about what an NRI could do and what he could not:

Yes, NRIs can invest in India Stock Market. It's quite easy for NRIs to invest in Indian Stock Market. To invest in India, NRI needs the following accounts:

This is where the money is withdrawn and deposited.

Demat account is to hold your securities in electronic format. Unlike most developed countries where equity holding is kept with the broker, in India, they are kept in a separate account called demat account. The demat account is a secured online account. You have to provide limited Power of Attorney (PoA) to your broker so that he can withdraw shares when you sell to give it to the buyer.

To place buy/sell orders.

In additions, the NRI investor also needs the Portfolio Investment Scheme (PIS) permission by RBI for investments on a repatriation basis. Usually, the bank where you have an NRI bank account helps you get the PIS.

Yes, NRIs are not permitted to do intraday trading in the Indian stock market using NRO Non-PIS trading account. NRIs are permitted to trade in Equity Delivery, Equity Intraday, Equity F&O and Equity F&O Intraday . NRIs are also not permitted to trade in currency and commodities in India.

An NRI can redeem the invested amount either through cheques or by direct credit to the NRE/NRO bank account

The investment made through the NRE account is fully repatriable while in the NRO account only the interest earned can be fully repatriated. All earnings will be redeemed in INR.

| Order Type | NRI Permitted? |

|---|---|

| Equity Delivery (Cash & Carry) | Yes |

| Equity Intra-day | Yes (using NRO Non-PIS trading account) |

| Equity F&O | Yes |

| Equity F&O Intra-day | Yes (using NRO Non-PIS trading account) |

| Equity F&O Short Selling | Yes (using NRO Non-PIS trading account) |

| IPO | Yes |

| Currency F&O | No |

| Commodity F&O | No |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|