Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Monday, June 8, 2020 by Chittorgarh.com Team | Modified on Thursday, May 13, 2021

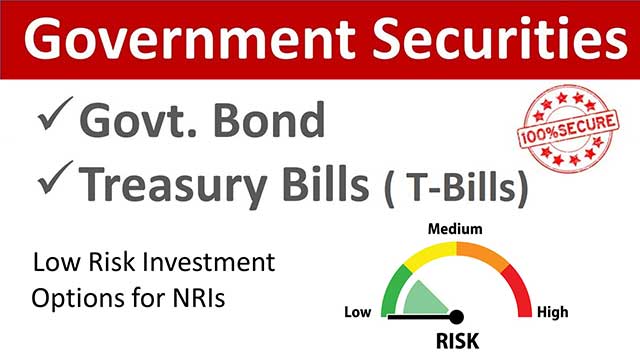

NRIs can invest in Government Securities (G-Sec) and Treasury Bills without limit on repatriation and non-repatriation basis, a long-term safe investment India.

The government securities are the securities issued by the central and state government to fund various projects, or the fiscal deficit. NRI investment is permitted in dated government securities and treasury bills.

Content:

NRIs are permitted by the Government of India to invest in securities issued by the government including dated government securities (G-Sec) and treasury bills without any limit on repatriation or non-repatriation basis.

The government securities are the securities issued by the central and state government to fund various projects, or the fiscal deficit. NRI investment is permitted in dated government securities and treasury bills.

Government dated securities are long term instruments issued by the government for mobilizing funds. These securities carry either a fixed or floating rate of interest (known as coupon rate) which is paid on the face value at regular intervals. The tenure for these instruments generally ranges between 5 years to 40 years.

Treasury bills (T-bills) are short term G-Sec instruments issued by the Government of India with tenure of 1 year or lesser. There is no interest payment on these bills. T-bills are issued at discount and redeemed at face value on maturity.

NRIs can invest in G-Sec either by utilizing funds from Non-resident External [NRE] account or Non-Resident Ordinary [NRO] account depending on whether an NRI wants to invest on repatriation or non-repatriation basis respectively.

The minimum amount required for applying in G-Sec is Rs. 10,000 and thereafter it should be in multiples of Rs. 10,000.

To apply for G-Sec, an NRI is required to submit their application through designated Authorised dealer bank branches. The bank so chosen is required to further apply to Reserve Bank of India (RBI) or any other institution notified for dealing in G-Sec before the close of banking hours on the specified dates.

An NRI can instruct the bank to debit their NRE/NRO account to make the payment for buying the G-Sec instrument. Alternatively, the payment can also be made by issuing a banker's pay order or cheque drawn in favour of RBI or any specified office of RBI.

The G-Sec issued by RBI can be held either in physical form or Demat form. Though the option for a physical certificate is available, it is always safer to hold the securities in electronic form for safe custody.

The interest payments are processed on a half-yearly basis which would be credited to the NRE/NRO account as directed by the NRI.

The government of India issues the G-Sec via various means viz. through an auction or with prefixed coupon rates or via tap sale. Of these, the issuance of the G-sec through auction is quite popular. Every time RBI issues a bond, it issues a notification to that effect on its website.

An NRI can participate in the auction in the competitive bidding category through a primary dealer or authorised bank branches. The auction held can be either price-based or yield-based.

Features of yield-based and price-based auction

|

Yield-Based auction |

Price-based auction |

|---|---|

|

This method is used in case of new issuance of G-Sec |

This method is used in case of re-issuance of G-Sec |

|

Bidding to be done in terms of yield up to 2 decimals. |

Bidding to be done in terms of price. |

|

Successful bids are the ones that are below or at par with the cut-off yield. |

Successful bids are the ones that are above or at par with the cut-off price. |

Auction for dated securities is conducted on Friday and that for T-bills is conducted every Wednesday. The settlement of such auctioned G-Sec is done on T+1 day.

An NRI can approach their bank where they have their NRI account to check on the services offered by them in terms of G-sec participation. Alternatively, an NRI can also check with any other authorized dealer bank branches or primary dealers for any clarifications or guidance.

Though NRIs are permitted to invest in G sec, it is not very popular due to liquidity issues, lack of awareness, and information on clear processes. Hence as an initiative to increase the NRI participation in G-sec, RBI has opened new gates for NRI in the budget of 2020 to invest in certain government bonds without any limit. This move by the government is expected to ease the access for non-residents to the Indian government securities market.

RBI (circular) has created a separate channel for NRIs called 'Fully Accessible route' (FAR) wherein an NRI can invest without any ceiling in certain specified securities along with domestic investors. The new route is made effective from 1st April 2020. Below is the list of securities eligible for investment under the FAR.

List of securities eligible for investment under the FAR

| S No. | ISIN | Security |

|---|---|---|

|

1 |

IN0020190396 |

6.18% GS 2024 |

|

2 |

IN0020180488 |

7.32% GS 2024 |

|

3 |

IN0020190362 |

6.45% GS 2029 |

|

4 |

IN0020180454 |

7.26% GS 2029 |

|

5 |

IN0020190032 |

7.72% GS 2049 |

In addition to the above, any new issuances of Government securities of 5-year, 10-year, and 30-year tenors will be termed as 'specified securities' and would be eligible for investment under the FAR.

An NRI who wants to invest in the said securities can approach the bank to apply for the G Sec.

As per RBI regulations, NRIs are permitted to invest in government dated securities and treasury bills without any restrictions on repatriation or non-repatriation basis.

The G Sec instruments can be held in either physical form or electronic form. Even though the option for a physical certificate is available, it is better to hold the securities in electronic form for safe custody. Thus, it is preferred to have a Demat account for G Sec investment.

The public debt office (PDO) of the RBI acts as the registry/depository of G- Secs and aids RBI in the overall administration of G- Sec. The PDO deals with the issue, interest payments, and redemption of securities at maturity.

The government of India has allowed NRIs to invest in dated government securities and treasury bills on a repatriation and non-repatriation basis. To further ease the access for NRI to Indian G-Sec markets, RBI has also created a separate channel called ' Fully Accessible Route' for NRIs to invest in specified government securities without any restrictions along with the domestic investors.

A primary dealer (PD) is an RBI registered entity that is authorized in buying and selling government securities. There are two types of primary dealers in India. Standalone primary dealers and bank primary dealers. The standalone primary dealers are either subsidiaries of scheduled commercial banks Indian subsidiaries of entities incorporated abroad or companies incorporated under companies act 1956 and are registered as Non-Banking Financial Company (NBFC). The bank primary dealers are the banks who wish to undertake PD business and do not have any subsidiaries doing PD business already.

Tap sale is one of the ways adopted by the government to issue G-Sec. There is no specific amount of securities notified for issuance. A certain amount of securities is made available for sale at a minimum price which is then modified based on the demand of the G-Sec.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|