Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

1.58% 74,112 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Yes Bank, India's fourth-largest private sector bank, offers NRI 3-in-1 Account to NRIs. Yes Bank is an RBI designed bank for PIS, which makes it very easy for NRI customers to invest online into Indian Stock Markets. Yes Bank offers brokerage services through Yes Securities.

Yes Bank 3-in-1 Account for NRI includes NRI Bank Account, NRI Trading Account and NRI Demat Account. These 3 accounts are linked together to offer a seamless online trading experience to an NRI. The NRI Trading and Demat Account are offered by Yes Securities, a subsidiary of Yes Bank. Through this Yes bank 3-in-1 account, you can invest in equity, equity derivatives, mutual funds and other investment options offered for NRIs.

Yes Securities is a full-service stock broker. Along with the online trading and demat account, Yes Sec also offers research and advisory services, relationship manager assistance and call & trade facility.

NRI investors do not require any minimum balance to open PIS account with Yes bank. They can easily transfer money from NRI account to PIS account online. The bank also offers 6% interest on the balance maintained in the NRI account.

YES Remit is a feature of NRI account with Yes securities. It offers an easy, fast and secure gateway for NRIs residing in UAE, Australia, Singapore, Switzerland, UK and Canada to transfer money to India online.

Yes Bank's 3-in-1 NRI Trading Accounts offer a wide range of investment options to NRI customers. This includes trade/invest in Indian stock markets; invest in Mutual Funds, IPO, NCD and bonds. This 3in1 account includes bank, demat and trading accounts which are required for stock market investment in India.

These three accounts are opened together and linked to each other. For an NRI investor, they work like a single account with seamless integration in the backend.

NRIs can open both NRE Account and NRO Account with Yes Bank. NRIs can access Yes Bank accounts online using Mobile Banking App and Internet Banking website. The bank also allows an authorized resident Indian to do banking transactions on behalf of NRIs.

Yes bank also offers the Portfolio Investment Scheme (PIS). The PIS certificate is required for NRIs to invest in the Indian Stock Markets.

Unlike most other banks, Yes Bank PIS account is offered with zero minimum balance.

An NRI Demat account is for NRIs to keep the shares purchased in a centralized repository for convenient and secure online transactions. Yes bank NRI Demat account can be an NRE or NRO type based on their requirements.

To know more, read Demat account opening process and benefits,

NRI Trading Account with Yes securities helps the NRI investors to trade and invest in India. The Trading Account with a stock broker (SEBI registered member of stock exchanges like NSE and BSE) is for NRIs to invest in equity, derivatives, bonds, mutual funds, debentures and IPOs in India.

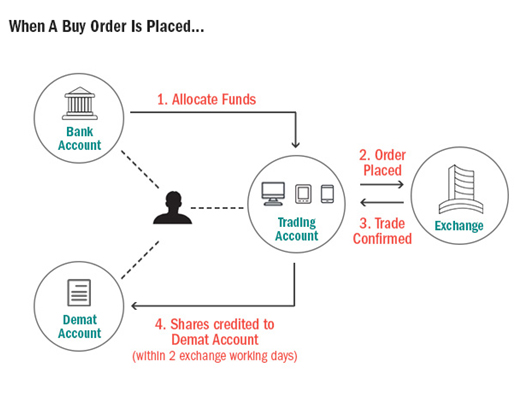

Yes Bank's NRI 3-in-1 accounts help NRIs to invest/trade online with zero hassle. They can start investing in the equity delivery or F&O segment. Below is the process of investing in stocks with Yes Bank:

Login to the Yes securities trading platform and place a buy/sell order. The system checks the linked bank account for the availability of funds. The order gets executed.

After completing the buy order, it will take t+2 days for settlement of securities to be credited in the Demat account automatically.

All transactions in NRE or NRO PIS Account are reported to RBI by the Yes securities.

Similarly, when you place a sell order, the bank account is credited with money and the Demat account is debited with shares.

Yes Securities NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | |

| NRI Account AMC | ₹0 |

| Equity Delivery Brokerage | |

| Equity Future Brokerage | ₹100 per contact |

| Equity Options Brokerage | ₹100 per contact |

| Other Charges |

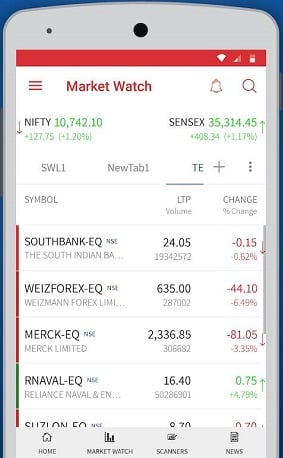

Yes Securities offers following free online trading software to NRI investors:

Yes Invest (Online Trading Website)

Yes Trader (Mobile Trading App)

The investment options available to an NRI at Yes Securities.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others |

NRIs are permitted to invest in Shares, NCDs, Mutual Funds and IPOs in India. The NRIs has to invest under the PIS on repatriation and non-repatriation basis. Yes bank is authorized by RBI to provide PIS permission to NRIs to transact in the Indian stock market

NRIs can open NRE or NRO account with Yes bank at zero minimum balance.

To trade in India, an NRI need following 3 accounts:

OR

Note:

| Feature | Status |

|---|---|

| 3-in-1 Account | Yes |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

NRIs can purchase, hold, switch and redeem mutual funds online at any time with Yes Bank. The dividend/interest earned is credited automatically to linked NRI Bank account.

Note:

Yes Securities NRI Support Desk contact information. Find Yes Securities NRI contact number.

| Yes Securities NRI Helpline | Number |

|---|---|

| Yes Securities NRI Customer Care Number | +91 22 7112 3123 |

| Yes Securities NRI Customer Care Email ID | customer.service@ysil.in |

Yes Bank is a full-service broker offering 3-in-1 NRI account for convenient online investing in India Stock Market. Online banking, trading and demat account make transactions easy for NRI customers. The broker also provides free research tips for stocks and mutual funds. Yes Bank NRI Investment account is recommended for Casual Investors who are ready to pay a higher brokerage for convenience.

NRIs need Trading, Demat and Bank Account to trade/invest in India. Technically all these 3 accounts can be opened with different organizations. But this results in operational challenges.

It is recommended to open all 3 or at least 2 accounts (trading and demat account) with one broker/bank.

The most convenient way is to open 3-in-1 account with a bank which includes all 3 accounts. These accounts are integrated well to offer a seamless trading experience to NRIs. But the brokerages charged by the 3-in-1 account are very high.

For frequent traders, it is recommended to open trading and demat account with a discount stock broker (i.e. Zerodha, ProStocks) and bank account with any bank (i.e. HDFC, ICICI). This reduces the cost of trading.

NRIs can transfer funds from the NRI Bank Account to PIS account through internet banking. When the NRI transfers money from the NRI account to PIS bank account, the bank informs the broker about the funds available for trading. Then, the broker updates the NRI trading account with the available limits. When you place buy request, the money is debited from the Trading account automatically.

Note: PIS account is required for investing in equity on repatriation basis.

Yes the bank asks for a minimum balance of Rs 10,000 for opening the NRE Non-PIS Bank Account. There is no minimum balance required for NRE PIS Account.

India is one of the fastest-growing economies. Here are the benefits to NRIs for investing from abroad.

NRI can invest and manage mutual funds online from anywhere across the world. They can buy, sell, redeem, and switch mutual fund schemes independently without any restrictions.

When rupee value increases as compared to the resident country's currency, NRIs will receive adequate profit by currency conversion.

Mutual funds are handled by a team of professionals. NRIs can invest in mutual funds for long-term capital appreciation and choose the scheme accordingly.

Yes, NRIs are allowed to open NRE Bank Account in any currency which can be converted to Rupees. They can invest in equity delivery options through this account. Both the interest and principal amounts are fully-repatriable in the NRE account.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Thursday, November 23, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|