Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

21.55% 80,213 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Aditya Birla Capital Limited (ABCL) is a well-known financial services company offering trading, insurance, and mutual funds, etc. to non-resident Indians. Aditya Birla Money Ltd (ABML), a subsidiary of Aditya Birla Capital, offers stock broking services. The broker offers equity delivery, and F&O trading services to NRIs in BSE and NSE. It also offers Portfolio Management Services as a registered Portfolio Manager with SEBI.

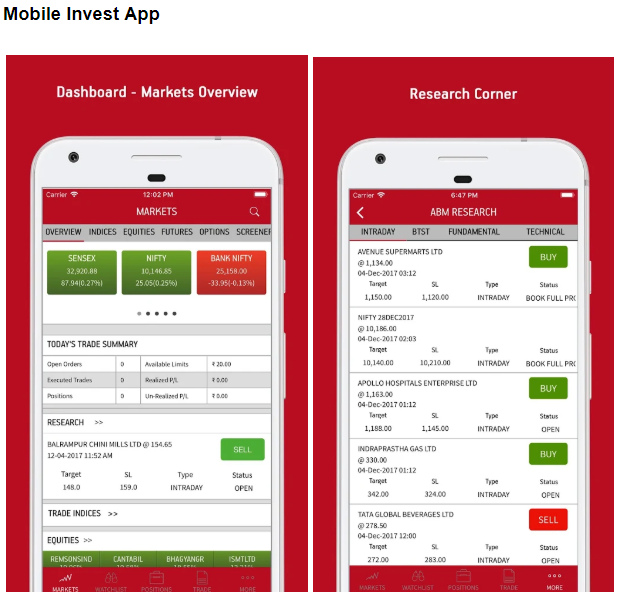

Aditya Birla provides mobile, web and desktop-based trading platform to make trading easy for NRIs. Express Trade is the company's online desktop trading platform, Mobile Invest- the mobile trading app and ABTrade is a platform for trading analysis.

Aditya Birla has a dedicated research division that offers stock recommendations and investment insights based on fundamental and technical analysis to NRIs.

Mutual Fund Services to NRIs is offered by Aditya Birla Sun Life Mutual Fund, another subsidiary company AMC of ABCL.

All investors, residents, and non-residents, investing in Indian stock markets are required to provide PAN numbers while opening trading and demat accounts. If you have a PAN number acquired when you were a resident Indian then you can use the same PAN as an NRI. In case you do not have a PAN card, you can apply online on NSDL and UTIITSL websites.

Aditya Birla doesn't offer banking facilities to the investors. NRIs have to open NRI bank accounts with other designated banks in India on their own and then link the bank accounts with ABML trading & demat accounts.

NRIs have to request for PIS permission with the help of a bank where NRI has opened the NRE bank account. Portfolio Investment Scheme (PIS) allows NRIs to invest in the Indian stock market. PIS permission is required to invest in the equity delivery segment.

NRIs who want to invest in the equity derivatives segment have to open a custodial account. Clearing member provides CP (custodial participant) code which is necessary to trade and invest in the F&O segment.

After opening the PIS account, NRIs have to open a trading account with Aditya Birla Money. A trading account is necessary to place a buy/sell request through the trading platform. Aditya Birla Money offers free trading platforms to trade online.

Aditya Birla Money offers a Demat account to keep securities in dematerialized form. The broker offers a Demat account with a CDSL depository.

Aditya Birla offers an online trading facility for NRIs. After opening the NRI account, here is the process of trading with Aditya Birla Money.

Transfer funds from the NRI bank account to the PIS account. Based on the money transfer request, the NRI trading account is updated with the investment limit.

Place a buy request through the NRI trading platform. As the system gets the request, it checks the availability of funds in the PIS account. If everything is correct, the order is executed on the stock exchange.

As it is a buy request, the NRI bank account is debited with money, and the Demat account is credited with shares. In case of a sell order, the Demat account is debited with shares and the NRI bank account is credited with funds.

At the end of the day, all the transactions are reported to RBI under the portfolio investment scheme. The broker sends contract notes for the buy and sell transactions separately. The contract notes details all your transaction for the day.

Aditya Birla Money NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹750 |

| NRI Account AMC | ₹450 |

| Equity Delivery Brokerage | |

| Equity Future Brokerage | |

| Equity Options Brokerage | |

| Other Charges |

Aditya Birla offers 3 trading software for online trading-

The investment options available to an NRI at Aditya Birla Money.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others |

Here is the process of opening NRI account with Aditya Birla Capital:

Note:

Here is the list of documents an NRI needs to attach for a Demat account and a trading account opening with Aditya Birla:

| Feature | Status |

|---|---|

| 3-in-1 Account | No |

| Free Research and Tips | No |

| Automated Trading | No |

| Other Features |

Aditya Birla Sun Life Mutual Fund (ABSLMF) is an asset management company. It offers in-house mutual fund products for residents as well as NRI investors. The broker has a wide range of mutual fund products to invest across equity, debt, hybrid and balanced securities.

Investors can choose any mutual fund based on their financial goals and invest through the Aditya Birla platform.

Aditya Birla Money NRI Support Desk contact information. Find Aditya Birla Money NRI contact number.

| Aditya Birla Money NRI Helpline | Number |

|---|---|

| Aditya Birla Money NRI Customer Care Number | 18002707000 |

| Aditya Birla Money NRI Customer Care Email ID |

Aditya Birla Capital is a well-known name when it comes to financial services. However, when it comes to trading & investment services for NRIs it doesn't measure up to its reputation. The company doesn't have a major USP for NRIs. It doesn't offer 3-in-1 accounts. The choices in trading platforms are limited. There are many better options available in the market.

Aditya Birla offers mutual funds to NRIs across the world. However, the US and Canada based NRIs need to be present in India to open the investment account before investing.

Here are some of the mutual fund types available for NRIs:

To invest in mutual funds in India, NRIs must have an NRE/NRO account. Please make sure that you have your PAN card and KYC documents for verification. NRIs also have to complete FATCA and CRS (Common Reporting Standard) declaration in place.

NRIs can open an online mutual fund account online with Aditya Birla right away and buy mutual funds immediately.

Similarly, NRIs can sell the mutual fund directly online. And, the money is automatically credited to the linked NRI account.

Yes, NRIs can redeem from the scheme and get the money back in the base country. The remit account depends on NRE and NRO accounts.

In the case of the NRO account, NRIs can remit up to 1 million USD per financial year. When it is an NRE account, there is no such limit.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Thursday, November 23, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|