Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

-8.97% 437,829 Clients

IIFL Securities Account Opening Enquiry

Pay flat Rs 20 per trade for Delivery, Intra-day and F&O + FREE Account Opening Fee. Open FREE Instant Account online with IIFL and start trading today.

IIFL Securities is a full-service broker offering online trading services to NRIs. It offers 2-in-1 accounts, combining demat and trading accounts, to NRIs. The 2-in-1 account enables trading across stocks, equity derivatives and investments in Mutual Funds, IPOs, and Bonds.

The company is awarded Qadat Al Tagheer (QAT) awards by UAE in 2018 for offering the best NRI financial advisory services in the country. It has a global presence with offices in India, Canada, Hong Kong, Mauritius, Singapore, Switzerland, United States, UK, and UAE.

IIFL NRI brokerage charges for equity delivery are 0.50% per executed order.

IIFL NRI Investment USP:

To trade or invest in the Indian stock market, NRIs need to open the following account:

IIFL offers trading & demat accounts. The bank and custodial account have to be opened with other companies. In addition, NRIs needs PIS permission for investing in stocks and custodial participant code (CP code) to trade in equity derivatives (F&O).

IIFL supports Axis Bank HDFC Bank and Yes Bank for NRI Bank accounts. These banks are designated by RBI to provide PIS Certificate to NRIs.

IIFL supports ICICI for the custodial account which is required for trading in equity derivatives.

NRI Trading account is for NRIs to place buy or sell orders at stock exchanges in India. IIFL provides online trading platforms to invest/trade in equity, derivatives, mutual funds, bonds and IPOs.

NRIs need NRE account to invest in equity delivery segment and NRO account to invest in mutual funds, and F&O segments.

NRIs can open two separate accounts based on NRE/NRO benefits.

IIFL NRI Demat account is an online account used to hold the securities purchased through the IIFL trading account. This account ensures the safekeeping of shares from physical theft and damages.

IIFL is a depository participant (DP) of NSDL and CDSL, the central depositories. This membership allows IIFL to offer demat services to resident and non-resident Indians.

Read NRI demat account charges and rules to know more about demat accounts for NRIs.

Once all the accounts are opened, NRIs can trade online in desired stocks. Here are steps to trade online:

NRIs have to transfer the money for investing or trading in their PIS Bank Account. The bank will inform the broker about the account balance in PIS Account and the broker will update the trading limit accordingly.

Using any of the IIFL NRI trading software, place a buy or sell order. If the bank has sufficient funds to proceed with the order, the trade is executed per order basis. You will receive a confirmation message.

IIFL sends the contract notes for buy/sell transactions to the banks at the end of the day. The bank transfers the fund to the broker or broker transfers fund to the bank based on buy/sell order.

The stocks are credited or debited to/from Demat account in T+2 days based on buy or sell order request.

Note:

IIFL Securities NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹750 |

| NRI Account AMC | ₹400 + GST |

| Equity Delivery Brokerage | 0.50% |

| Equity Future Brokerage | |

| Equity Options Brokerage | |

| Other Charges |

IIFL offers free access to multiple trading software to NRIs.

Trader Terminal is an Installable Trading Software for high-frequency traders. It is the most advanced trading platform with superior charts, analysis and faster execution. IIFL NRI customers can use this platform to trade at BSE and NSE.

Trader Terminal Web is a browser-based website for IIFL customers. It offers convenient investing from any computer.

IIFL Market App is a mobile trading app by IIFL. This advanced trading app is designed for trading-on-the-go.

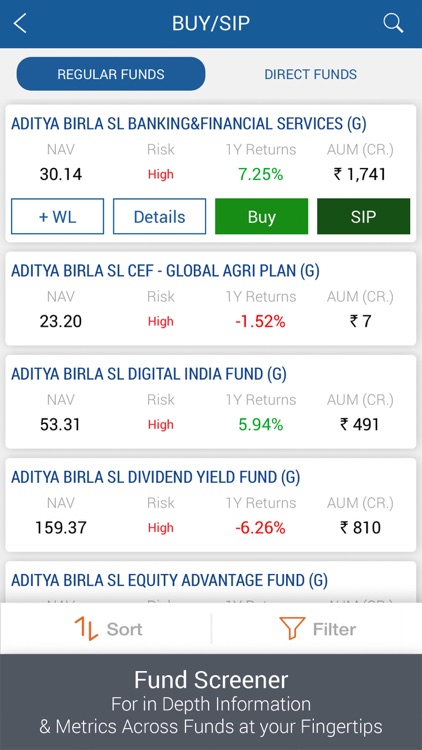

IIFL offers Online Mutual Fund (MF) investment to NRI through its website and mobile app. The IIFL Mutual Fund App offers online paperless MF investment from anywhere in the world.

The investment options available to an NRI at IIFL Securities.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others |

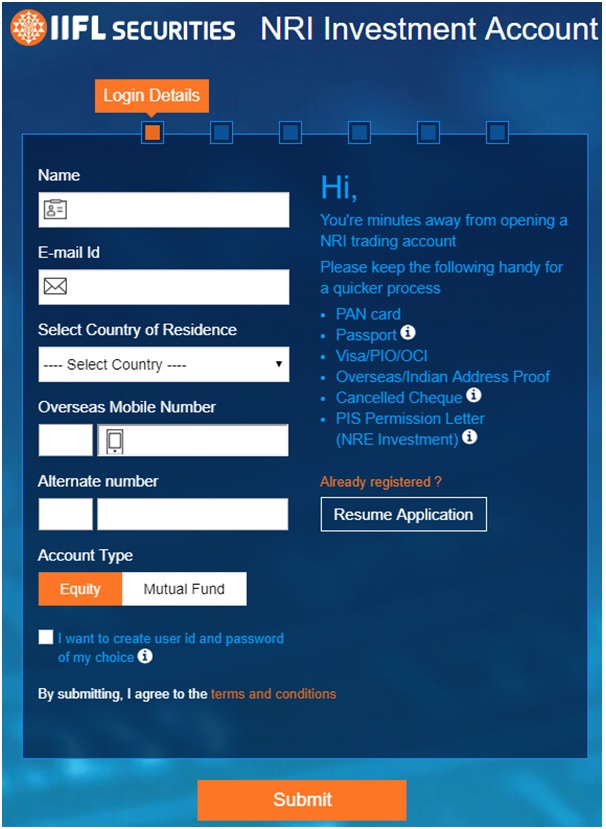

The IIFL NRI account can be opened online as well as offline. Follow the steps below for online account opening:

NRIs have to open NRE/NRO account with the designated banks (Axis, HDFC, Federal and Yes Bank) and get PIS permission from RBI through the bank.

Visit the company website and click on 'NRI' under 'Personal Finance' on the top menu. NRIs have to fill the Name, Email ID and mobile number to register with IIFL for the further process.

Just fill your PAN number, Aadhar number, and Date of Birth, and the rest of the details will be fetched from the ID cards.

NRIs have to mention their address to get in touch with the broker.

You have to fill NRE bank name, account number and branch name or IFSC code to add the bank.

If you are a US resident, then you have to provide a few details under FATCA as well.

Upload the required documents and submit the application.

Alternatively, NRIs can give a missed call on 08066719101 or fill and online inquiry form to get a call back from a Relationship Manager. The RM will assist you in account opening.

An NRI has to submit below-mentioned documents while opening an IIFL 2-in-1 account. All the photocopies should be attested by a notary public.

| Feature | Status |

|---|---|

| 3-in-1 Account | No |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

IIFL customers can use the IIFL Mutual Funds mobile app for investing in various schemes. With this app, you can Buy, Sell, Start SIP, Track and Monitor various types of Mutual Funds and get recommendations anytime, anywhere. Key features of IIFL NRI Mutual Fund includes:

IIFL Securities NRI Support Desk contact information. Find IIFL Securities NRI contact number.

| IIFL Securities NRI Helpline | Number |

|---|---|

| IIFL Securities NRI Customer Care Number | +91 22 4007 1000 |

| IIFL Securities NRI Customer Care Email ID | cs@iifl.com |

IIFL is a reputed full-service broker. It offers NRI Trading & Demat account facility for NRIs. IIFL also offers an online mutual fund platform to NRIs. IIFL Securities has a dedicated research team that provides insights on the economy and markets to its customers. The company has its offices in multiple locations across the globe that allows NRIs to avail branch services. The brokerage charges are on the higher side which makes it an expensive broker for NRIs.

This is a limited-time offer. Open FREE Instant IIFL Account online and start trading today.

IIFL Securities Account Opening Enquiry

Pay flat Rs 20 per trade for Delivery, Intra-day and F&O + FREE Account Opening Fee. Open FREE Instant Account online with IIFL and start trading today.

Information on this page was last updated on Thursday, November 23, 2023

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|