Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

1% 56,190 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

IDBI Bank, a leading private bank in India, offers a wide range of investment options to NRIs through a 3-in-1 account. IDBI Bank offers banking, loans, capital market, PMS, etc. services to NRIs. With the IDBI Bank PIS account, NRIs can buy/sell shares, debentures, and bonds on BSE and NSE stock exchanges.

IDBI offers investment banking and securities services (including stockbroking) through its subsidiary IDBI Capital. IDBIDirect.in is IDBI Capital's flagship portal for online investment. It is also popular as IDBI Direct.

Services offered by IDBI Bank to NRI customers include:

Note:

IDBI Bank's most popular offering to NRIs is the 3-in-1 NRI Account. This account links Banking, Demat and Trading Account. This integrated account makes the investment very easy as the transactions between these accounts are seamless.

IDBI NRI 3-in-1 Account Benefits

This account includes the following 3 accounts:

IDBI offers three types of bank accounts for NRIs; NRE, NRO, and FCNR accounts. These accounts can be opened as PIS or non-PIS accounts. PIS permission is required for investing in the equity delivery segment. NRO Non-PIS account is necessary to trade in the Equity Derivatives (F&O) segment.

The IDBI Trading Account is for NRIs to buy/sell shares, bonds, mutual funds and debentures in the Indian stock market. The trading account is required for any transaction in the stock market.

NRIs can also track the performance of the shares from their trading account. They can also access the technical charts and the research reports.

Demat account works as a storehouse to hold securities (purchased under various segments) in electronic format. NRIs can open Demat Account with IDBI under the repatriable or non-repatriable category. NRIs can access the Demat Account through the internet and phone from anywhere in the world.

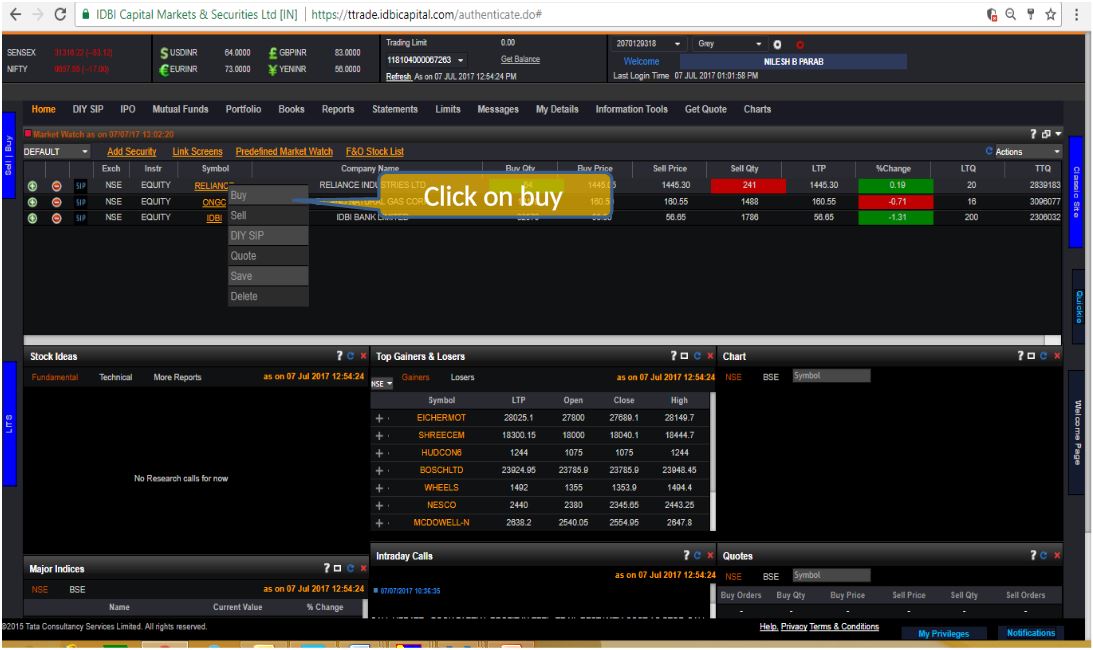

IDBI offers an online process to trade and invest through the trading platforms for NRI investors. After opening a 3-in-1 NRI account with IDBI capital, you can invest in the Indian securities following the below process:

NRIs are required to fund the PIS (NRE or NRO) account before placing a buy order. If the PIS account will not have sufficient funds, the order will be rejected.

NRIs can place buy or sell orders through IDBI online trading platforms or by calling the trading desk. The system first checks the availability of funds in the PIS account and then place the order to the exchange. Once the order gets executed the confirmation is sent to the customer.

In the case of a buy order, the PIS Bank Account is debited with funds and the Demat account is credited with shares.

In the case of a sell order, the PIS Bank Account is credited with funds and the Demat account is debited with shares.

A contract note (invoice) is shared with the customer at the end of the day. This bill includes the detail about all the transactions in the day, taxes and fees. Separate contact note is shared for sell and buy transactions in a day with the bank for onward reporting to RBI.

IDBI Capital NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹1500 |

| NRI Account AMC | ₹0 |

| Equity Delivery Brokerage | 0.50% |

| Equity Future Brokerage | |

| Equity Options Brokerage | |

| Other Charges | Processing Charge: ₹75 per transaction |

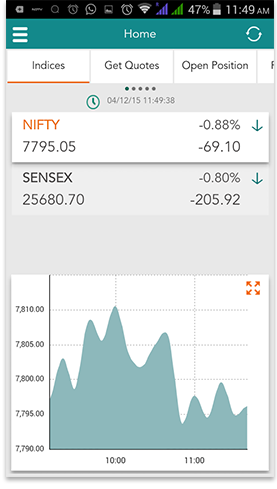

IDBI Capital offers online trading to NRI customers through its website IDBIDirect.in, IDBI Direct Mobile Trading App and IDBI Infinity installable trading terminal. All these trading platforms are available free of charge to all customers including NRIs. USA and Canada based NRIs however cannot trade online and have to trade through a relationship manager.

The investment options available to an NRI at IDBI Capital.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others |

To trade with IDBI, an NRI has to open 3 accounts; NRI Bank Account (PIS), Demat Account and Trading Account. All these 3 accounts can be opened together as a 3-in-1 account.

The NRIs can open the account in two ways:

The NRI-insta-online account is allowed for the non-residents residing in FATF (Financial Action Task Force) member countries. 40+ countries are part of this including the US, UK, and France etc.

IDBI bank allows instant account opening for NRIs living in 40+ countries. It is an instant, paperless account opening process.

Here are the steps to IDBI NRI account opening online:

Visit step by step guide for Online NRI Account Opening.

In case, you are not able to open an account through IDBI NRI Insta Online Account Opening then you have the option to follow the offline process of filling a physical form and sending it along with the required documents.

NRIs can open the NRI account offline with IDBI by following the below steps:

IDBI 3-in-1 Documents Required

NRIs will need to attach copies of the following documents to open NRI 3-in-1 account with IDBI:

| Feature | Status |

|---|---|

| 3-in-1 Account | Yes |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

IDBI offers NRI mutual fund services through the 3-in-1 account. IDBI Asset management also has a separate website to offer mutual funds to the resident as well as non-resident Indians.

Read more about the NRI mutual fund account in India.

IDBI Capital NRI Support Desk contact information. Find IDBI Capital NRI contact number.

| IDBI Capital NRI Helpline | Number |

|---|---|

| IDBI Capital NRI Customer Care Number | 1800-22-3366, 022-3913 5001 |

| IDBI Capital NRI Customer Care Email ID | custcare@idbidirect.in |

IDBI is a full-service broker offering a range of investment options to NRIs. IDBI NRI 3-in-1 Account makes stock market investment simple and hassle-free. NRIs also get RM assistance and investment advice from experts. It has a network across 40+ countries to offer NRI services. The broker also works as a custodian for trade clearance and settlement which reduces the extra cost for NRIs. IDBI is recommended for NRIs who are a casual investor and prefer convenience over the trading costs.

NRIs are allowed to open NRI Bank Account with only RBI authorized branches under PIS. Only a few key branches offer NRI account.

Note: The NRI account can be opened from any bank branch. The forms and supporting documents are prepared and send to the authorized branch where the NRI Account is opened.

An NRI can remit up to USD 2500 or equivalent in a single remittance from the IDBI NRI account. The maximum number of remittances in a year for NRI is restricted to 30.

No, the PIS permission is not life-long. IDBI or any other authorized banks are allowed to issue general permission only for 5 years. After 5 years, NRIs have to renew the PIS permission with a designated branch for another 5 years and so on for a concerned period.

The NRIs have to submit the PIS Application Form with IDBI to a designated branch in India. The authorized bank provides general permission for 5 years. There is no need to get permission from RBI.

The IDBI bank will inform about the transactions made under the PIS account to RBI on behalf of NRIs.

PIS permission is only required to trade in stocks on repatriation basis. NRIs don't need PIS enabled bank accounts to trade in equity derivatives and mutual funds.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Friday, November 17, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|