Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

2.86% 918,792 Clients

Motilal Oswal Account Opening Enquiry

FREE Account Opening + FREE Intraday Trades + FREE Personal Advisor & Research + FREE for 1st Year Demat AMC Open your FREE Demat Account in 5 Minutes.

Motilal Oswal is one of the most trusted and experienced financial services companies in India. With over three decades of experience, the financial services provider offers comprehensive financial solutions to NRIs across the globe. Motilal Oswal offers a wide range of services such as NRI demat accounts, stock trading, mutual fund investments, portfolio management and NRI banking. Furthermore, the company also provides research-based advice and insights to help NRIs make the best investment decisions.

Key USPs about Motilal Oswal NRI Account Opening

Motilal offers a 2-in-1 NRI Trading Account that combines a trading and a demat account. NRIs need to open NRE & NRO bank accounts as well as get a PIS letter before opening Motilal Oswal NRI trading account. Motilal Oswal has tied-up with HDFC Bank for NRI bank accounts.

Those interested in derivative trading needs to get a Custodial Account (CP Code). IL&FS Securities is the third party custodian that provides CP Code to Motilal Oswal's NRI customers. All your assets are under the custody of IL&FS.

The NRI Motilal Oswal Account includes:

The demat account holds all the securities purchased by the NRIs in electronic format. The demat account helps in faster online transactions (buy/sell) securely.

Motilal offers NRI demat accounts through its NSDL and CDSL membership.

Read NRI Demat Account Explained for more details about Demat Account for NRIs.

Benefits of opening NRI DEMAT Account with Motilal Oswal

The trading account allows a customer to access BSE & NSE and trade across various securities like stocks, mutual funds and bonds etc. The NRI trading account is a mandatory account for NRIs to trade/invest in India. It is linked with demat account and bank account.

Once you have opened NRI Bank accounts and Motilal 2-in-1 trading account, you're set for online trading. Following is the step-by-step Motilal Oswal NRI trading procedure for trading-

You need to first transfer funds from NRE or NRO bank account to your PIS Bank Account. The bank will inform MOFSL on the funds you have in your PIS account. Your trading account is then updated with the available limit.

Use any trading software (i.e. Motilal Oswal App or website) to place an order to buy/sell shares.

At the end of the day, Motilal Oswal sends a contact note to your bank. Based on the contract note, the bank debits fund from the PIS account and credits it to MOFSL. For a Sell order, Motilal Oswal sends a sell contract note to the bank. Motilal Oswal also credits the PIS bank account with the sale proceeds. Note that two separate contract notes, each for all buy and sell transactions, are sent to the bank at the end of the day for onward reporting to RBI.

Motilal Oswal debits/credits the stock in the NRI demat account. It takes T+2 days, with T being the day of trading, for the settlement process to complete.

Motilal Oswal NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | Free |

| NRI Account AMC | Rs 999 |

| Equity Delivery Brokerage | 0.50% |

| Equity Future Brokerage | 0.05% |

| Equity Options Brokerage | Rs 100 |

| Other Charges |

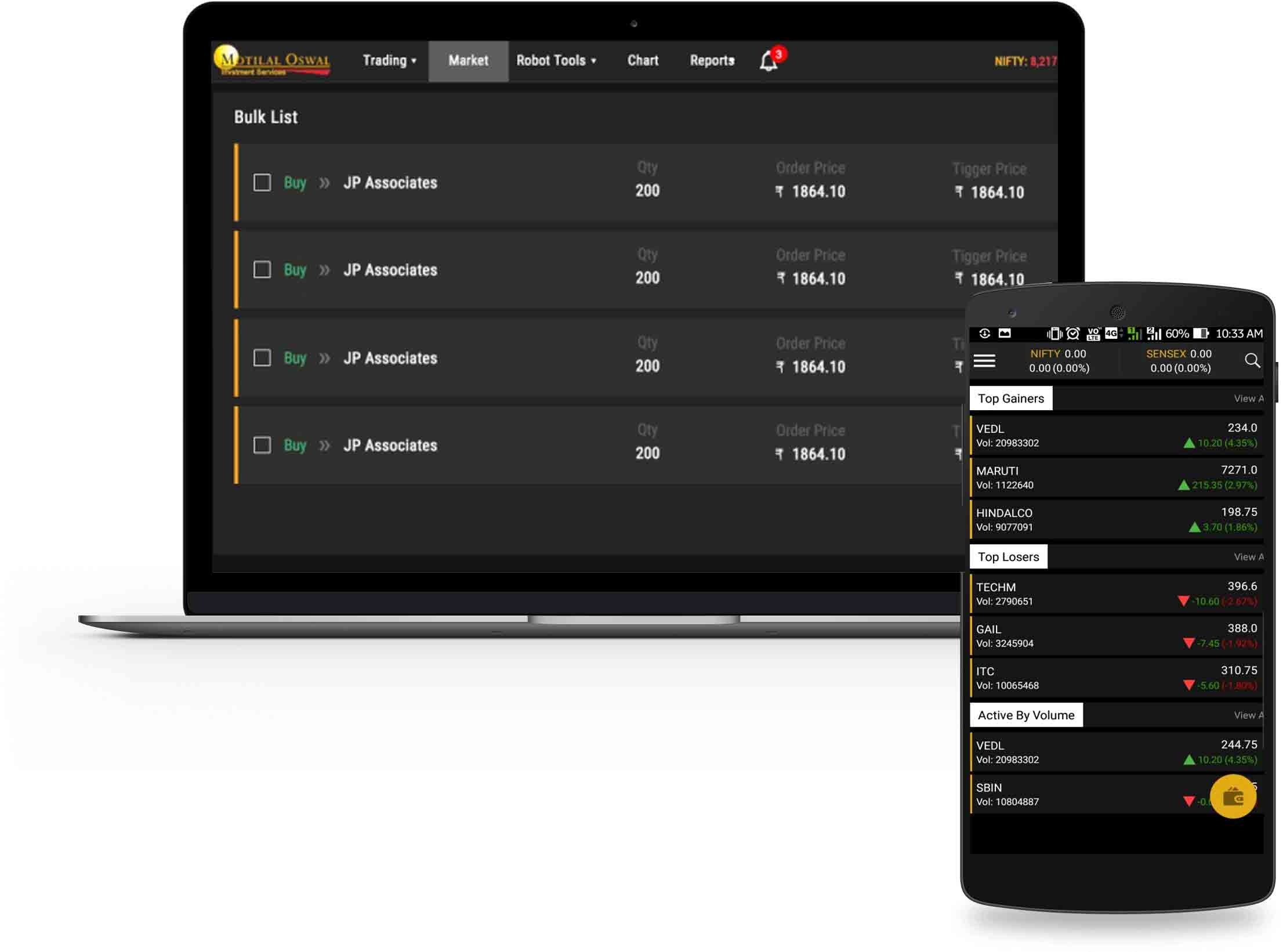

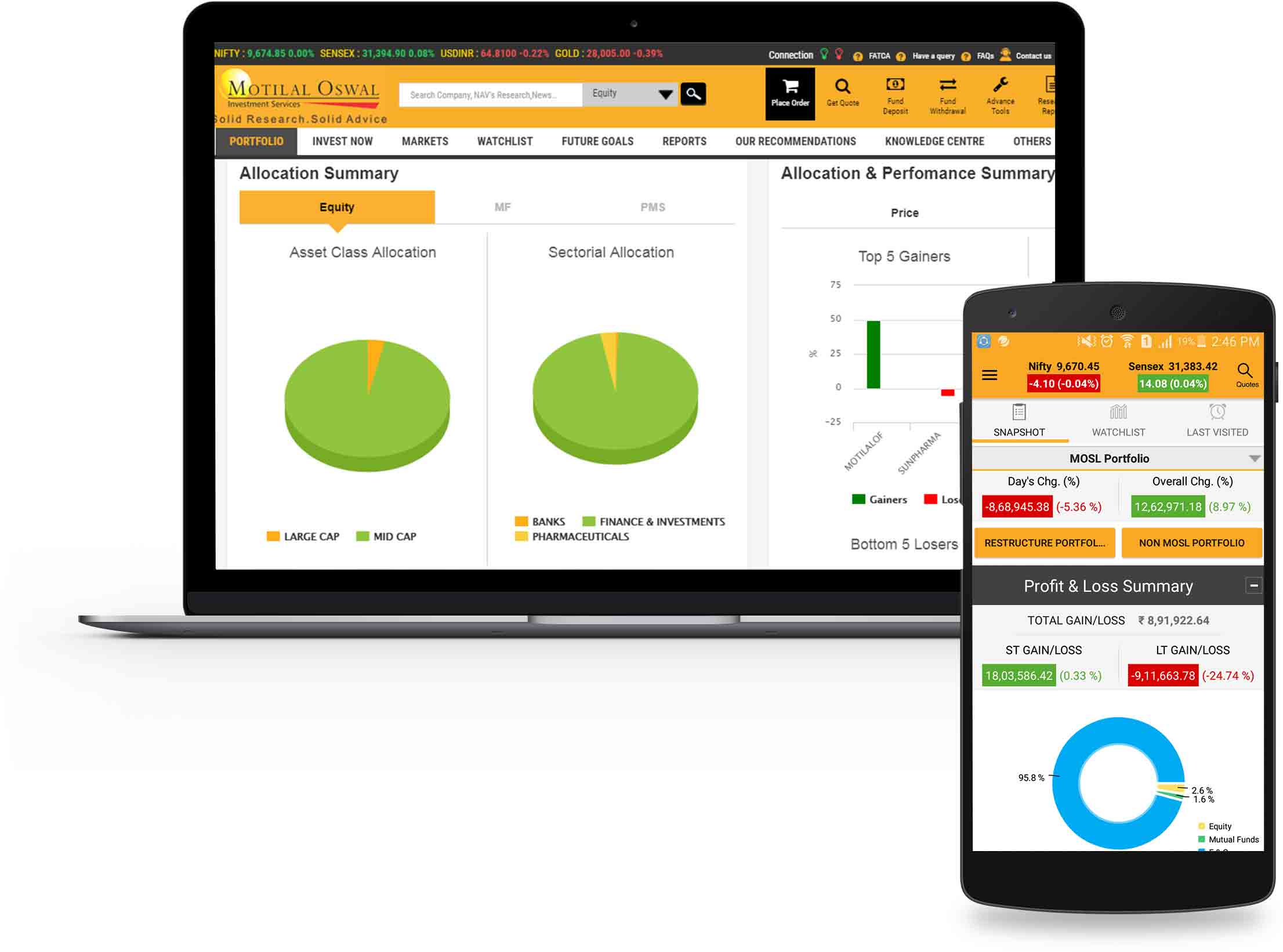

The trading platforms offered to NRIs by Motilal Oswal is the same as it is offered to the resident accounts. Motilal Oswal offers a range of online trading software and tools:

The investment options available to an NRI at Motilal Oswal.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others | Unlisted Equity (Stocks), ETF, Ready-made Investment Portfolios (IAP), Smallcases, Stock baskets |

MOFSL account opening process for NRIs is simple. However, the paperless online account opening is not yet available.

Note: Motilal Oswal doesn't offer NRI 3-in-1 account as it doesn't have a banking license.

Before opening a Motilal trading and demat account, an NRI has to open the following accounts:

Note: NRIs who are only looking to trade in F&O don't need PIS permission or PIS-enabled saving bank accounts.

To open an online NRI DEMAT Account with Motilal Oswal, you will have to follow the given steps:

Before an NRI can proceed with the opening of his/her DEMAT Account, he/she is required to submit relevant documents for KYC purposes. These documents act as a proof of evidence for the identity and nationality of the individual. The documents required for processing an NRI Demat Account are:-

Note:

| Feature | Status |

|---|---|

| 3-in-1 Account | No |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

For NRI investors, Motilal Oswal offers convenient online Mutual Fund investment. Below are key facts:

Motilal Oswal NRI Support Desk contact information. Find Motilal Oswal NRI contact number.

| Motilal Oswal NRI Helpline | Number |

|---|---|

| Motilal Oswal NRI Customer Care Number | |

| Motilal Oswal NRI Customer Care Email ID |

Motilal Oswal is a popular name in the financial services industry in India. The company offers a range of online trading and investment services to NRIs. NRIs get free access to the trading platform and dedicated research team that provides market insights through published reports on the economy, market trends, and sectors. Higher brokerage makes it expensive for investors/traders who don't need advisory services.

This is a limited-time offer. Simply Open your FREE Demat Account in 5 Minutes.

No, Motilal doesn't offer a 3-in-1 account to NRIs. It offers a 2-in-1 account combining a trading and a demat account. The company doesn't have a banking license nor is a part of a banking group like ICICI Direct, SBI CAP etc. So, it cannot open bank accounts for NRIs.

NRIs who want to open a trading and a demat account with the company needs to first open PIS, NRE & NRO bank accounts with a bank.

No, the online account opening is not available to NRIs.

The paperless account opening facility is only available to people with Aadhar card and current mobile number linked to it.

NRIs need to take the following steps to open Motilal Oswal NRI Trading account-

It will take 7 working days to open the account from the date of receipt of the application form.

Motilal Oswal Account Opening Enquiry

FREE Account Opening + FREE Intraday Trades + FREE Personal Advisor & Research + FREE for 1st Year Demat AMC Open your FREE Demat Account in 5 Minutes.

Information on this page was last updated on Wednesday, May 29, 2024

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|