Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

2.86% 918,792 Clients

Motilal Oswal Account Opening Enquiry

FREE Account Opening + FREE Intraday Trades + FREE Personal Advisor & Research + FREE for 1st Year Demat AMC Open your FREE Demat Account in 5 Minutes.

With over 35 years of experience and a client-base which expands to more than 50 lakhs, Motilal Oswal Financial Services Ltd. (MOFSL) has become synonymous with India's investment partner. Incorporated in the year 1987, the financial services firm offers trading services in Equity, Commodity, Currency and Derivatives. It also offers other products like Mutual Funds, IPOs, US Stocks, Gold, Insurance, Fixed Income products and readymade portfolios such as Stock Baskets, Intelligent Advisory Portfolios and others.

Motilal Oswal's key USP is its deep industry experience and research advisory. The company has won multiple awards for its research services. The research division has published over 80,000 reports covering 100 stocks across 45 sectors. It regularly publishes reports on companies, sectors, thematic investing and market analysis.

Apart from having retail investors as their clients, Motilal Oswal is known for having a diversified client base that includes High-Net worth Individuals, mutual funds, foreign institutional investors, financial institutions and corporate clients.

|

Edelweiss Account Opening Charges |

Nil |

|

Edelweiss Mutual Fund AMC Fees |

Nil |

|

Edelweiss Mutual Fund Brokerage Charges |

Nil |

|

Edelweiss Mutual Fund Commission |

1.5% to 2% for regular mutual funds |

|

Edelweiss Mutual Fund Demat Charges |

Rs 999 (2nd Year Onwards) |

|

Other Charges |

|

There are no charges involved for opening a Motilal Oswal Mutual Fund account. Investors can open an all-in-one account to invest in Equity, Commodity, Currency, and Mutual Funds. If you want to open a separate account for mutual fund investment, you can do so by selecting only equity investing while opening the account.

Motilal Oswal allows both online and offline account opening.

Investors who want to invest in Mutual Funds can open an online account with Motilal Oswal, via.

For offline account opening, you have to download the form online. Next, fill the form online and send it to the Motilal Oswal office address along with the required documents.

Motilal Oswal allows investing in both lump sum and SIP mode of investments. Both new and existing investors can start investing in a mutual fund through SIP. You just need to be KYC verified to start investing in Motilal Oswal Mutual Funds.

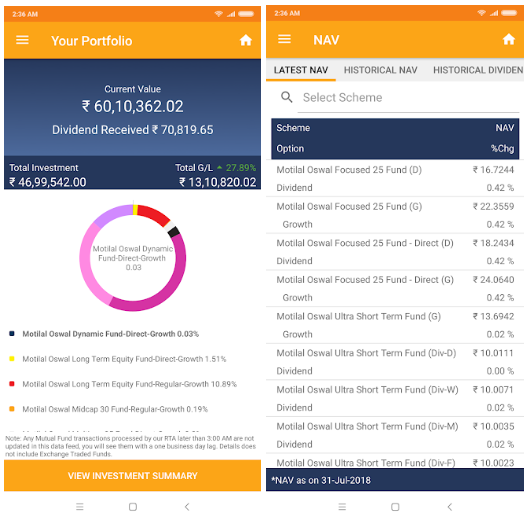

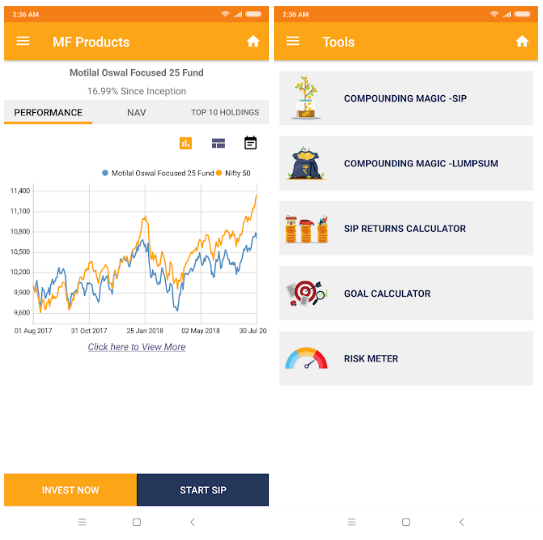

Motilal Oswal AMC- MF & PMS app provides a platform to invest in in-house mutual funds. You can invest in both the direct and regular mutual funds offered by Motilal Oswal AMC. Investing with an MF & PMS app is quite easy. Both the new and existing start in a mutual fund with Motilal Oswal MF in a few clicks.

The Motilal Oswal AMC Mobile App is a free app available for iPhone and Android users. You can download the app with the following steps-

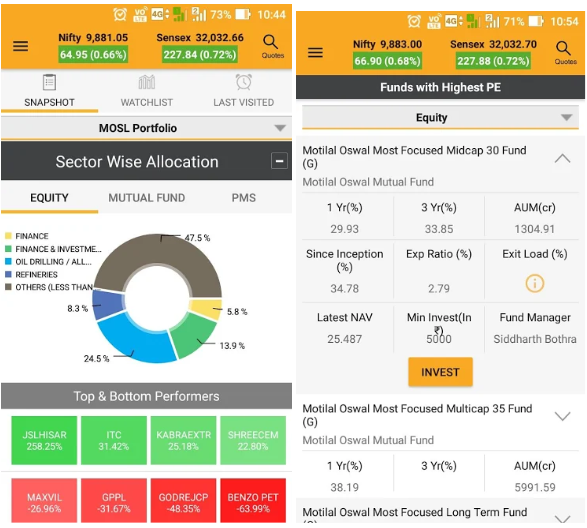

This is a mutual fund and share market investment app offered by Motilal Oswal Financial Ltd. For seasoned and new investors, the app provides a complete solution for managing mutual fund investments. It provides the facility to track all the investments through a single account.

The mobile app of Motilal Oswal is available for Android and iOS mobile phones.

Motilal Oswal provides dedicated customer support for mutual fund investing. You can call on 91-22 40548002 | 8108622222 for any mutual fund related queries. Investors can also get in touch with customer care at mfservice@motilaloswal.com. For account opening related queries, call on 022-40548383.

Motilal Oswal offers both regular and direct mutual fund schemes from Motilal Oswal Mutual Fund and other fund houses. It doesn't charge any subscription fee separately for investing in direct mutual funds. The company also provides research and recommendation services. However, you cannot invest in direct schemes from other fund houses. Also, a demat AMC of Rs 999 per annum is on the higher side when compared with other stock brokers in the market.

This is a limited-time offer. Simply Open your FREE Demat Account in 5 Minutes.

Motilal Oswal is a widely known financial services provider. It offers its customers the opportunity to invest in almost all securities available in the Indian market. These include equities, derivatives, mutual funds and many others. Motilal Oswal offers investments in direct mutual funds of its own AMC as well as regular mutual funds.

The first mandatory requirement for investing in mutual funds with Motilal Oswal is a demat account.

Once your demat account is set up, you can invest in mutual funds online in the following ways:

Motilal Oswal Asset Management Company Limited temporarily restricted lump sum investments and switch-in of money into certain foreign investments. These include Nasdaq Fund of Funds (FoF), the S&P 500 Index Fund, and Motilal Oswal EAFE Top 100 Select Index Fund.

The action was taken as the company is close to the market regulator's overall $1 billion investment limit in foreign stocks.

Motilal Oswal is a stock brokerage firm operating in the Indian market for decades, helping both aspiring and experienced traders and investors. The company offers a wide range of products and services and is constantly adding more to cater to its customers.

The company adapts to the latest technology and new innovations in the Indian stock market. Motilal Oswal is a reliable and trustworthy stock broker for a variety of reasons, some of which are listed below:

To download Motilal Oswal mutual fund follow the steps below:

You can cancel a Motilal Oswal Mutual Fund online or offline. For steps to cancel online or to stop SIP, follow the below mentioned steps:

Adding new or additional bank account information is a very simple and quick process.

To transfer money from your trading account to your bank account:

Motilal Oswal Account Opening Enquiry

FREE Account Opening + FREE Intraday Trades + FREE Personal Advisor & Research + FREE for 1st Year Demat AMC Open your FREE Demat Account in 5 Minutes.

Information on this page was last updated on Wednesday, May 29, 2024

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|