Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

-1.49% 542,458 Clients

5paisa Account Opening Enquiry

FREE Account Opening (Rs 650 waived) + Brokerage-free Mutual Funds + Trade at flat Rs 20 per order. Open Instant Account with 5paisa and start trading today.

5Paisa is an online discount stock broker offering direct Mutual funds. By investing in direct MF schemes, investors can earn an additional 1% yearly. 5paisa charge flat Rs 10 per executed order brokerage for mutual fund orders.

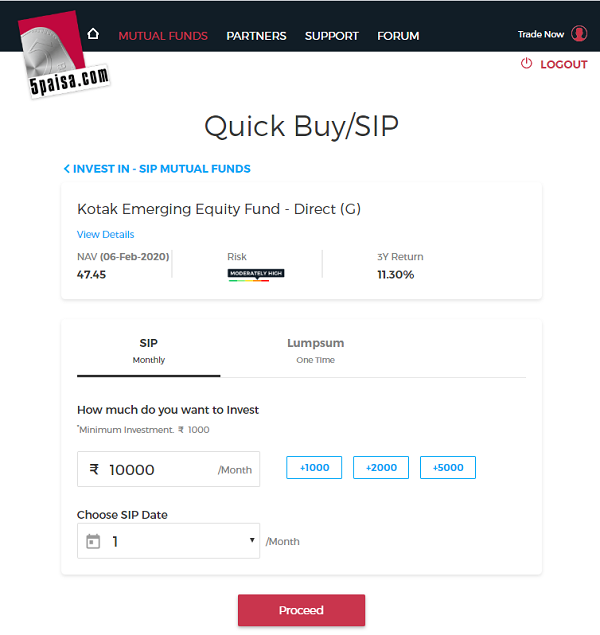

5paisa allows both SIP and lump sum investments in mutual funds. It offers different fund categories to invest in. You can invest in direct mutual fund and NFOs (New Fund Offer) from the same mutual fund account.

5Paisa offers an online mutual fund investment platform for investors. It has collaboration with 21 AMCs to offers various mutual fund schemes based on investment needs. Key features of 5Paisa Mutual fund platform are:

5paisa offers direct mutual fund at flat Rs 10 per executed order irrespective of the size of the order. By investing in a direct mutual fund with 5paisa, investors earn an additional 1% to 1.5% as AMCs don't pay the commission to the brokers.

|

5Paisa Account Opening Charges |

Rs 650 (one time) |

|

5Paisa Demat AMC |

Rs 540 per year |

|

5Paisa Mutual Fund Brokerage |

Rs 10 per order |

5Paisa offers two types of accounts for mutual fund investments, which are:

This includes demat, trading and mutual fund accounts. You can invest in stocks, mutual funds and derivatives through a single account using the same user id and password. All the holdings can be tracked through a demat account.

5Paisa also offers a separate account for investors who want to invest only in mutual funds. This account includes a demat and a mutual fund account.

5Paisa offers an instant paperless online account opening facility. To open an account with 5Paisa:

Investing in a mutual fund through a systematic investment plan (SIP) is a disciplined way to invest in mutual funds. 5paisa customers can start online SIP in just a few steps. The amount is deducted through the linked bank account on a particular interval and invested in chosen mutual funds automatically. The mutual funds are transferred to 5paisa demat account. The customer can sell (redeem) the existing MF holdings at the time.

To start a SIP of Mutual Fund with 5paisa, you need to take the following steps:

To stop your SIP with 5paisa, you need to take the following steps:

Note: After stopping the SIP, there will be no new investment in the scheme. Although, the invested amount will be stay invested. To withdraw the amount, you need to redeem (sell) the mutual fund units.

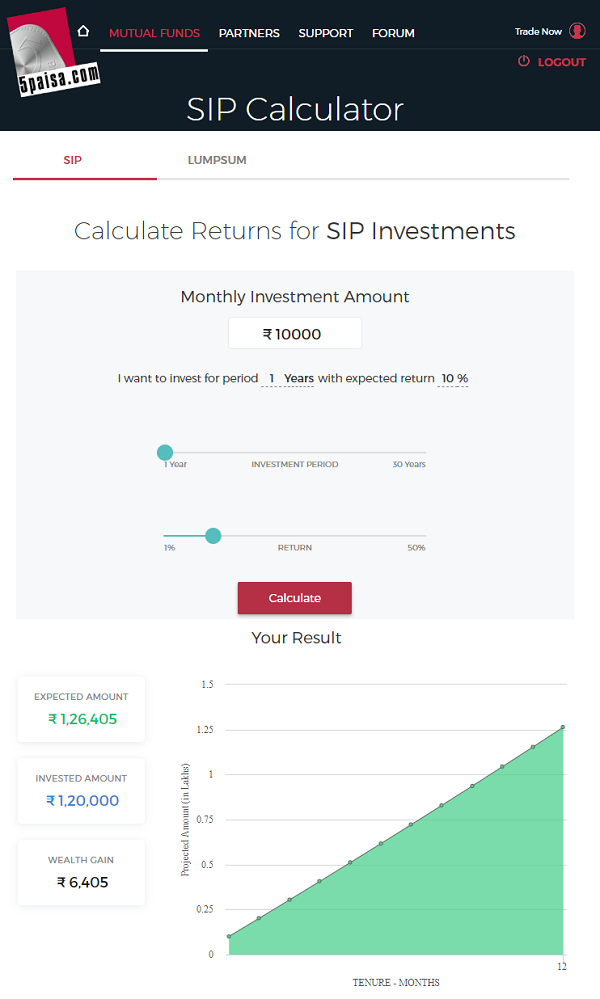

5paisa SIP calculator helps you to calculate required returns for a specific goal based on the entered investment amount, selected the investment period and estimated returns.

5Paisa offers a mobile trading app and trade station web-based platform. Investors can log in using their account credentials to start using any trading platform for mutual fund investment. Investment in mutual funds can be done through the following platforms:

5paisa offers a mobile trading application to invest across stocks, derivatives, commodities, currency, and mutual funds. Unlike Zerodha, 5paisa has one single app with a range of investment options. Key features of 5Paisa Mobile App includes:

5Paisa provides a browser-based website to invest in mutual funds. The integrated stock trading and MF investment website is simple and easy to use. The website also offers investment tools like fund screener, SIP calculator and lump sum calculator.

5Paisa offers direct mutual funds only. These funds give an additional earning of around 1% yearly in comparison to regular funds.

You can reach 5Paisa customer care at +91 89766 89766 or mail at support@5paisa.com. Note that 5paisa charges Rs 118 for every call to customer service as call center charges. This is unlike any other broker.

5Paisa provides direct mutual fund schemes to investors. This offers an additional 1% yearly earning on most of the funds. 5paisa has integrated trading and mutual fund investment platform which makes online investing easy.

Unlike Zerodha who offers brokerage free Mutual Funds investment, 5paisa charges Rs 10 per order brokerage. 5paisa also charges Rs 118 for every customer service call by the customer which is an unexpected high hidden fee.

Open 5Paisa Trading Account and get Free Trading, Demat and Mutual Fund Account + FREE 1st year Demat AMC + Trade at flat Rs 20 per order.

Open Online Account Now! and start trading today.To start investing in Mutual Funds with 5paisa, you have to open an online paperless account with them. 5paisa offers a 2-in-1 account which is a combination of Trading, Mutual Funds and Demat account. Once opened, customers can invest in Mutual Funds online through 5paisa mobile app or 5paisa.com website. 5paisa also offers mutual fund advisory services at an extra cost.

5Paisa allows adding funds through UPI, Net Banking and IMPS transfer. Add the funds in the ledger account in the following ways:

1. 5paisa Add Money using UPI

Steps to add funds in ledger account through UPI:

2. 5paisa Add Money using Net Banking

5Paisa has tied up with 44 banks to get payment gateway facility to add funds in a mutual fund account. You can easily transfer the funds from the bank account to a mutual fund account through net banking. Here are the steps to add funds through net banking:

Finally, the amount is deducted from the bank account and credited in the mutual fund account.

3. 5paisa Add Money using IMPS

You can instantly transfer the funds in the mutual fund account without any document through IMPS. You just need to add 5Paisa as a beneficiary in your registered bank account.

To close the mutual fund account with 5Paisa, you have to download the account closure form from the website, fill it, sign it and send the application to the Mumbai office. It takes around 2 working days once the application is received. You get a call and confirmation email once the account is closed.

Note: You cannot close or delete a 5paisa mutual fund account online. A manually signed paper form is required for closure.

5Paisa charge Rs 10 per order brokerage fee for mutual funds transaction. Rs 10 is changed on both the buy and sell-side.

Note that 5paisa also offers direct mutual funds along with regular mutual funds. The direct mutual funds offer an additional 1 to 1.5% earning every year as AMCs don't pay any commission to brokers for these and transfer them to the customers.

Investing in a mutual fund through 5Paisa is quite easy. You need to access 5paisa mobile app or trading website and visit the mutual fund section. Next, choose the fund house and mutual fund you want to invest in. You also have to provide some information regarding investment such as investment amount, mode of investment, time horizon, bank account details, etc. You can add money in the 5Paisa mutual fund account through UPI, Net banking and IMPS transfer.

No, 5paisa doesn't offer a free mutual fund account similar to other brokers like Zerodha. 5paisa Mutual Fund account charges are as below:

|

Account Opening Charges |

Rs 0 (Free) |

|

Demat Annual Maintenance |

Rs 300 yearly |

|

Mutual Fund Brokerage |

Rs 10 per order |

5paisa is good for mutual funds investment as it helps you save significant money on brokerages. The company also offers direct mutual funds wherein customers get an additional 1% to 1.5% yearly return. It charges Rs 10 per executed and Demat AMC of Rs 300 every year. Its competitor Zerodha doesn't charge any brokerage and offers lower Demat AMC of Rs 300 per year.

5paisa offers a mobile app and a website to invest in mutual funds online.

5paisa offers direct as well as regular mutual funds. 5paisa charge flat Rs 10 per executed order brokerage for mutual fund investment. The flat rate brokerage is irrespective of the fund type or order size. Separate brokerages are charged for buy and sell orders. Rs 10 brokerage is applicable for both lump sum and SIP investment.

Yes, 5paisa offer direct mutual fund as well as regular funds. Direct mutual funds are offered directly from AMCs and the broker doesn't get any commission from AMCs for these funds. The savings are passed on to the customers which results in an additional 1 to 1.5% earnings per year. The direct MF removes the middleman.

Clients can sale (redeem) mutual funds online at anytime using the following steps:

5paisa Account Opening Enquiry

FREE Account Opening (Rs 650 waived) + Brokerage-free Mutual Funds + Trade at flat Rs 20 per order. Open Instant Account with 5paisa and start trading today.

Information on this page was last updated on Saturday, November 18, 2023

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|