Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

-1.49% 542,458 Clients

5paisa Account Opening Enquiry

FREE Account Opening (Rs 650 waived) + Brokerage-free Mutual Funds + Trade at flat Rs 20 per order. Open Instant Account with 5paisa and start trading today.

5paisa.com is Mumbai based discount stock broker offering trading, investment and advisory services to retail customers in India.

5paisa started offering its low-cost financial services in April 2016. Along with the stock and currency trading at BSE/NSE, 5paisa also provide online Mutual Funds and online Insurance distribution.

5paisa is a flat fee broker. They charge brokerage at fixed Rs 20 per executed order across the segments. Irrespective to the size of the trade, customer pays only Rs 20 brokerage. This is up to 95% less brokerage in comparison of traditional brokers.

In 1st year of is launch, 5paisa acquired over 7500 retail customers, which is very impressive in competitive discount brokerage space. 5paisa offers online paperless account opening which enables customer with Aadhaar card to open account and start trading online in just few hours.

5paisa depository services (or 5paisa demat account) is one of the key services offered by 5paisa. The 2-in-1 account offered by 5paisa includes a trading and a demat account.

Demat account holds shares, mutual funds, bonds etc. electronically, in a very similar manner where bank account holds money. The demat account allows customers to buy or sell the shares electronically without any paperwork.

5paisa is registered as a Depository Participant with Central Depository Services Limited (CDSL).

5paisa offers 2 demat account schemes:

| Holding value of Security as on Last Day of the Month | Basic Pack | Power Investor Pack | UltraTrader Pack |

|---|---|---|---|

|

Up to Rs. 50,000 |

Rs 0 |

Rs 0 |

Rs 0 |

|

Rs. 50,000 to Rs. 2,00,000 |

Rs 8 |

Rs 8 |

Rs 8 |

|

Above Rs. 2,00,000 |

Rs 25 |

Rs 25 |

Rs 25 |

DP transaction charges are applied at the time of selling delivery shares from your DEMAT account. 5paisa DP Charges levied are comparatively low.

| Nature of Transaction | DP Charges |

|---|---|

|

Transfer of shares from your demat a/c or Unpaid Securities a/c or Margin a/c or Margin Funding a/c upon selling of shares |

Flat Rs 12.5 |

|

Transfer of shares from your demat a/c to any other demat a/c as requested |

Flat Rs 12.5 |

All the above charges are not applicable for the customers who have taken premium subscriptions (value-add packs).

|

Transaction |

Charges |

|---|---|

|

Pledge for Funding |

Rs. 25 per scrip |

|

Pledge for Margin |

Rs. 12.5 per scrip |

|

Unpledge |

Rs. 12.5 per scrip |

|

Unpledge and Sell |

Rs. 12.5 + Rs. 12.5 (Rs. 25 per scrip) |

To open a new Demat account with 5paisa, the customer may have to pay Demat account opening charges. The broker may also charges Annual Maintenance Charges (AMC), a yearly fee to maintain the Demat account.

| Service | Charges |

|---|---|

| Demat Account Opening Fee | Rs 0 (Free) |

| Demat Account Annual Charges (AMC) | Rs 300 |

5paisa Demat Charges

5paisa trading and demat account opening fees are Rs 0 (Free). 5paisa charges Rs 300 per year demat account AMC. 5paisa demat debit transaction fee of

Rs 12.50 per transaction per script

per debit transaction.| ID | Transaction | Charges |

|---|---|---|

| 1 | Demat Account Opening Charges | Rs 0 (Free) |

| 2 | Transaction Charges (Buy) | |

| 3 | Transaction Charges (Sell) | Rs 12.50 per transaction per script |

| 4 | Annual Maintenance Charges (AMC) | Rs 300 per year |

| 5 | Demat + Courier charges | Rs 15 per certificate + Rs 40 as postal charges |

| 6 | Remat | Rs 15 per certificate or Rs 15 for every 100 securities or part thereof whichever is higher + Rs 40 for courier |

| 7 | Pledge Creation |

|

| 8 | Pledge Creation Confirmation | Nil |

| 9 | Pledge Invocation | Nil |

| 10 | Failed Transactions | Nil |

| 11 | Other Charges | Postal Charges: Rs 40 |

Open 5Paisa Trading Account and get Free Trading, Demat and Mutual Fund Account + FREE 1st year Demat AMC + Trade at flat Rs 20 per order.

Open Online Account Now! and start trading today.5paisa demat account is an online repository of securities including stock, ETF and Mutual Funds etc. It allows investors to keep securities in electronic form for safe and faster online trading.

5paisa offers Demat account through its membership with CDSL, a central depository. 5paisa works as a servicing agent for the demat account. 5paisa change demat transaction fee and demat account AMC for offering depository services.

Note: Demat Account is mandatory in India for trading or investing in the stock market. It is a safe, secure and convenient way to keep securities you own.

5paisa is a depository participant (demat service agent) for CDSL. It charges for various demat account related transactions. The common changes include:

5paisa charges demat maintenance charges for maintaining your demat account with CDSL. The demat maintenance charge is charged annually. It is known as Demat AMC. 5paisa demat AMC charges are Rs 300 per year. Irrespective of your uses of the demat account, you have to pay the fixed AMC charges.

The demat debit charge is a fee levied by 5paisa when you sell any of the stocks held in your demat account and the securities are debited from your demat account. The debit charges are 0.025% (minimum Rs 25 per transaction) of the value of the securities.

Every time a share is withdrawn (sell transaction) from your demat account, you have to pay demat debit charges. This charge is in addition to the brokerage changes and taxes you pay when selling stocks. These changes are only applicable for equity delivery trades.

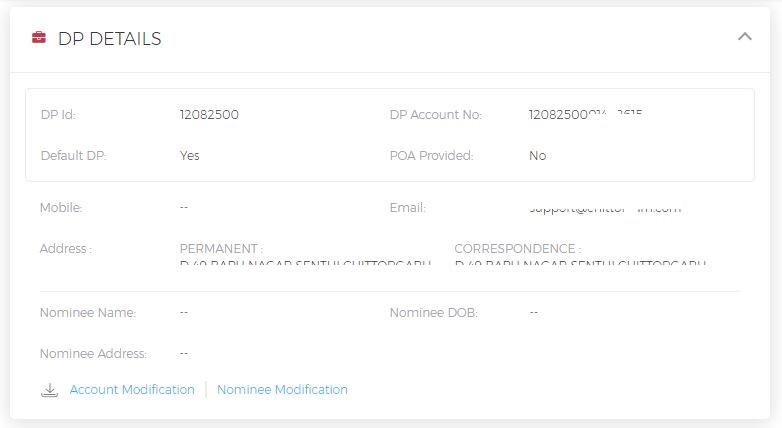

5paisa is a depository participant (DP) of CDSL, one of the two central depositories in India. The 5paisa DP ID is 12082500. You can get the information about your 5paisa demat account by login into the 5paisa.com or 5paisa mobile app and visiting the 'Profile > My Profile' page.

Power of Attorney (PoA) is a legal document signed on a paper by a customer and given to the broker. It gives limited authority to 5paisa to withdraw securities from a customer's demat account to process his online sell order or while pledging of securities.

PoA is a mandatory and important document in online trading. Without it, a broker cannot guarantee the completion of online sell transaction in T+2 days where T is the day of trading.

The PoA has to be signed on the physical paper and sent to the broker. It cannot be signed online. The PoA can be withdrawn at any time.

Read Power of Attorney for Demat Account - Explained for more detail.

To close your 5paisa Demat account, you need to send a signed account closure form in paper format to the company's address. Ensure you have squared off all your open positions and transferred held securities from the account before initiating the closure process.

5paisa Demat account cannot be closed onlineby email or phone call or chat.

Steps to close 5paisa Demat account:

Note:

The 5paisa BO ID is a unique 16 digit demat account number given to the customer's demat account with 5paisa. The BO

Sample 5paisa BO ID: 1208250001461915

In this sample,

Steps to get 5paisa BO ID

5paisa Account Opening Enquiry

FREE Account Opening (Rs 650 waived) + Brokerage-free Mutual Funds + Trade at flat Rs 20 per order. Open Instant Account with 5paisa and start trading today.

Information on this page was last updated on Saturday, November 18, 2023

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

Service Tax

STT

Stamp Duty

DP Charges

CDSL DP Charges