Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

9.98% 10,922,660 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

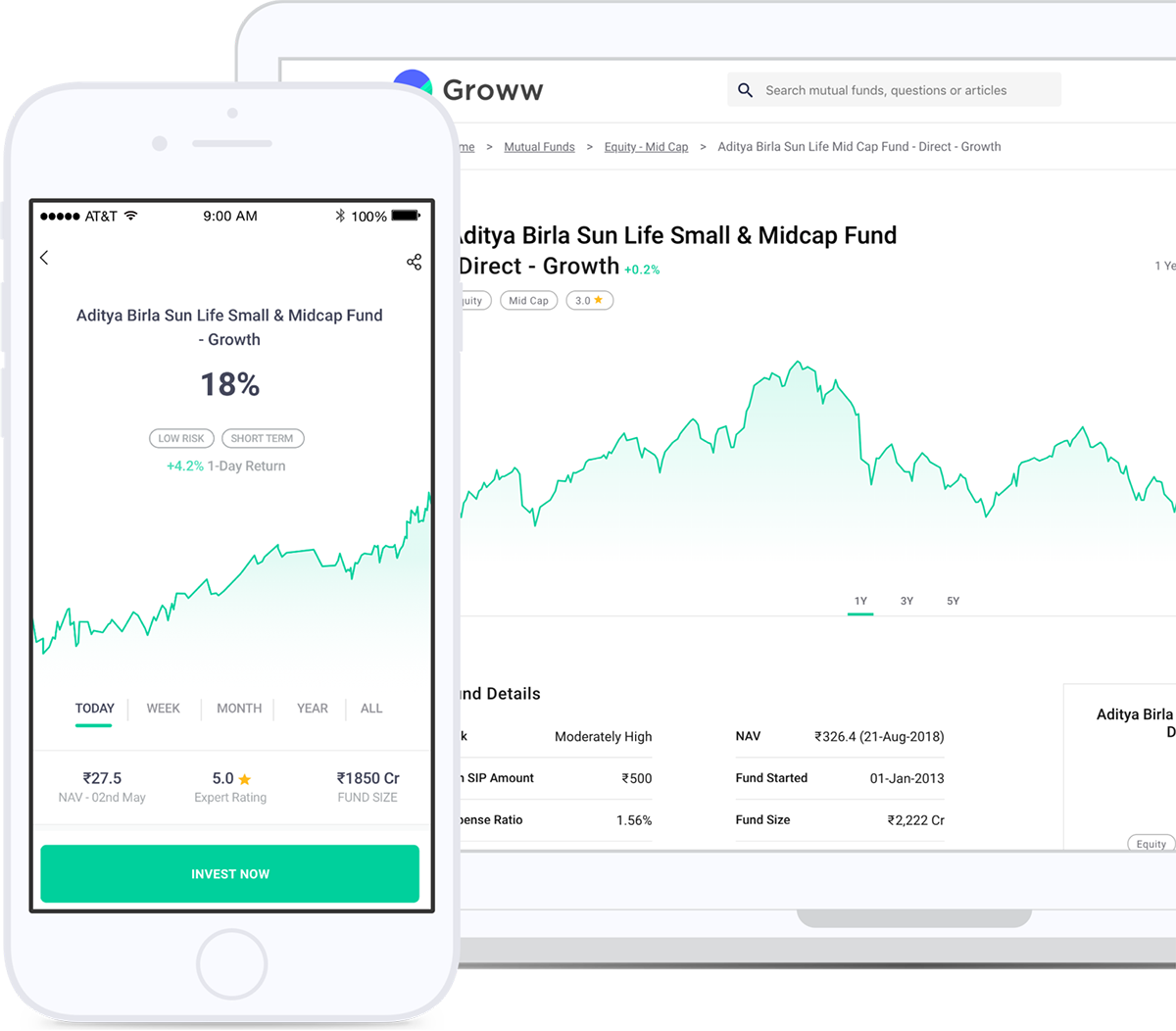

Groww is one of India's best apps for mutual fund investment. The company offers Direct Mutual Funds through the Groww platform. Customers can use the Groww website or Groww mobile app to invest in mutual funds. Groww is an all-in-one mutual fund app with 5000+ mutual funds available for investment through SIP or lumpsum mode. The company offers to switch your regular mutual fund plans to direct mutual fund plans and help you earn extra returns.

Groww started in 2016 as a direct mutual fund platform. By investing in direct mutual funds, investors can save significantly and earn 1.5% extra returns on their investments. Investing in Mutual funds through Groww is free, as there are no account opening charges, subscription fees, commission, or redemption charges. Groww offers a wide range of mutual funds from 35+ Asset management companies.

Groww offers brokerage free mutual fund investment. They don't take any transaction fees, redemption charges, or commission from their customers.

Groww offers only direct mutual funds. The direct mutual fund gives an additional earning to the investors by way of saving on the commission that an AMC is required to pay to the agents or brokers who act as mutual fund distributors in case of regular mutual funds.

| Head | Charges |

|---|---|

|

Groww Account Opening Charges |

Zero |

|

Groww Mutual Fund AMC Fees |

Zero |

|

Groww Mutual Fund Brokerage |

Zero |

|

Groww Mutual Fund Commission |

Zero |

|

Groww Mutual Fund DP Charges |

Zero |

|

Groww Other Charges |

No Hidden Charge |

Groww helps an investor to invest in a wide range of funds as per his financial goals and risk appetite through Groww trading platforms - Groww website and Groww mobile app. Groww offers the same investment platform to invest in MF and stocks. Groww started as a mutual fund investment platform and is well established in this space with a 90 lakh+ customer base. Groww mutual fund app is one of the highest-rated and fastest growing apps in the Indian mutual fund industry. Key features of the Groww platform include:

Groww mutual fund app is available for free in the Google play store or App store.

To download the app:

To access the Groww mutual fund account, you need to open an account with Groww.

Steps to open Groww mutual fund account:

Documents required for Groww mutual fund account:

Groww has various types of in-built calculators for mutual fund investment that help you calculate and analyse your fund requirements, returns, and final amount on your investment.

SIP Calculator is a tool that helps an investor determine the amount you need to save, the amount you have invested, and a rough estimate (excluding exit load/expense ratio applicable if any) on the maturity amount based on your monthly SIP investment.

A lump sum calculator helps an investor to calculate the estimated returns for the whole period on a one-time lump sum investment. These calculators help you make the best plan for your finances based on the estimated returns that may achieve your financial goals.

Before knowing about the SWP calculator, let us first understand about SWP. SWP stands for systematic withdrawal plan and is for retirees and senior citizens. Groww SWP is a type of mutual fund investment wherein you invest a lump sum amount for a specific period from which you have an option to withdraw a certain amount at a monthly interval. At the end of the period, you get a final accumulated value based on the rate of return post deducting your withdrawal from the lumpsum amount.

An SWP calculator helps you calculate your matured sum based on your monthly withdrawals. The calculator assists you set the withdrawal limits as per your needs with a cap based on the lump sum amount invested.

A mutual fund return calculator calculates the return on your mutual fund investments for different periods. It enables you to do future financial planning based on the estimated returns.

Groww has an in-built help and support section with a list of frequently asked queries that can help you resolve your issues. In case you do not have your issue listed, you can raise a ticket for the same.

Alternatively, you can also speak to Customer Helpline or the customer care team or chat with them through the website or app for your query resolution.

Groww Customer Care No.: +91-9108800604

The mutual fund cut-off timelines determine the NAV at which you can buy or sell a mutual fund. To ensure you get the mutual funds on the same day NAV, the funds should reach the AMC the same day before the cut off timings. In case the AMC does not receive the funds before the cut-off time, the next day's NAV gets applicable to you. The cut-off time differs based on the type of fund and value.

| Fund Type | Buy/Sell | Cut-off timings |

|---|---|---|

|

Liquid and Overnight Funds |

Buy |

12.55 PM |

|

All other funds for value >=2 Lakhs |

Buy |

2.25 PM |

|

All other funds for value < 2 Lakhs |

Buy |

3.00 PM |

|

Liquid and Overnight Funds |

Sell |

3.00 PM |

|

All other funds for value >=2 Lakhs |

Sell |

3.00 PM |

|

All other funds for value < 2 Lakhs |

Sell |

3.00 PM |

Groww provides a facility to mutual fund investors to compare mutual funds on specific key parameters like NAV, Risk, Rating, Returns, Expense Ratio, and Pros and Cons. It also provides the other details of the fund like launch date, fund manager details, holding details, etc. This unique feature offered by Groww helps the investors to have a better understanding of the mutual funds and help them select the right fund that suits their risk profile.

You can compare up to 3 mutual funds on Groww. To access this feature offered by Groww, visit Compare Mutual Funds - Groww.

NFO (New Fund Offer) is a subscription offer for a new fund launched by the asset management company (AMC) or mutual fund house to raise capital. Groww offers its investors to apply for NFO online through Groww mutual fund platforms. The company maintains a list of live NFO and recently closed NFOs.

Groww offers another unique feature to its customers to switch their external regular mutual funds to direct mutual funds for free. With this facility, Groww allows the investors to earn up to ~1.5% extra returns on their investments by saving commission on regular mutual funds.

The company provides a comparison between the direct and regular mutual funds that helps you know the commission saved if you opt for a direct mutual fund.

To switch to Groww direct mutual funds, you need to track your external mutual funds within Groww and then switch to direct mutual funds.

Groww does not provide any tips or advice. The company has a host of resources, educative and informative blogs for investors, beginners that help you select the right fund based on your risk profile and financial goal. Groww lists down the best/top mutual funds for each fund category based on the 1-year return and rating.

Through their blogs, Groww also provides a list of Groww Best Mutual funds, Best Groww Liquid Funds based on their analysis of historical returns and performance.

Groww offers 5000+ direct mutual funds with its partnership with 35+ mutual fund houses.

|

Axis Mutual Funds |

Kotak Mutual Funds |

Nippon India Mutual Funds |

HDFC Mutual Funds |

SBI Mutual Funds |

ICICI Prudential Mutual Funds |

Aditya Birla Sunlife Mutual Funds |

|

UTI Mutual Funds |

Franklin Templeton Mutual Funds |

IDFC Mutual Funds |

DSP Mutual Funds |

Tata Mutual Funds |

L&T Mutual Funds |

PGIM India Mutual Funds |

|

Sundaram Mutual Funds |

Invesco Mutual Funds |

LIC Mutual Funds |

J M Financial Mutual Funds |

Baroda Mutual Funds |

Canara Robeco Mutual Funds |

HSBC Mutual Funds |

|

IDBI Mutual Funds |

India bulls Mutual Funds |

Motilal Oswal Mutual Funds |

BNP Paribas Mutual Funds |

Mirae Asset Mutual Funds |

BOI AXA Mutual Funds |

Union Mutual Funds |

|

Taurus Mutual Funds |

Edelweiss Mutual Funds |

Essel Mutual Funds |

Mahindra Mutual Funds |

Quantum Mutual Funds |

PPFAS Mutual Funds |

IIFL Mutual Funds |

|

Quant Mutual Funds |

Shriram Mutual Funds |

Sahara Mutual Funds |

Principal Mutual Funds |

Groww is known to be one of India's best apps for mutual fund investments. The company offers only direct mutual funds of the fund houses with a feature to compare between funds for better analysis and an option to convert your regular funds to direct mutual funds. Groww offers free account opening with zero transaction fees and no other hidden charges.Groww gives you access to mutual funds from 35+ AMCs to help you invest as per your financial goals using SIP or lumpsum mode of investment.

Groww is one of the highly-rated apps for mutual funds investments with ratings of 4.5+. Groww started as a direct mutual fund platform and is one of its key offerings.

Groww gives access to 5000+ mutual funds from across 35+ AMC. Groww offers free mutual fund investments with free account opening, no transaction charges, redemption charges, zero commission.

Grows offers a unique facility of Switch to direct that helps investors convert their external regular mutual funds to Direct Mutual Funds and earn extra returns up to 1.5%.

Grows also helps investors compare mutual funds on Key parameters like Rating, Returns, NAV, Pros, Cons, and expense ratio and thus help choose the right mutual fund based on the investor's risk-taking ability and financial goal.

Overall, Groww is known to be one of the best of India's mutual fund investments platforms.

Groww Mutual Fund is a direct Mutual fund investment platform that allows users to invest online in Mutual Funds in over 5000+ mutual funds from 35+ fund houses in India. Groww App is a popular online Mutual Fund investment app in India.

Groww offers free mutual fund investments with no hidden charges and provides an option to switch your external regular mutual funds to direct mutual funds for free.

Groww also provides various types of in-built mutual fund calculators that help you calculate returns, savings, withdrawal proceeds on your various mutual fund investments. It also facilitates comparing different funds on Key parameters like NAV, risk, returns, ratings, and much more to help you make an informed decision.

In addition, the same Groww app for a smartphone can be used for investment in stocks, IPOs, Fixed Deposits and trading in equity F&Os.

Yes, you can invest in mutual funds using the Groww app or the web through SIP or lumpsum mode.

Steps to invest in Mutual funds through Groww:

Groww offers free mutual fund investment to its customers. Groww charges no transaction fees, commission, brokerage, redemption charges, or any other hidden charges to its investors for mutual funds.

No, Groww does not offer regular mutual funds. Groww offers only direct mutual funds. The company has 5000+ mutual funds with its tie-up with 35+ AMCs.

Groww offers a switch to direct facility to its customers to convert their external regular mutual funds to Direct mutual funds and earn extra returns up to 1.5% by saving on the commission cost.

Groww NFO is a facility offered by Groww to its investors to apply in New Fund Offer launched by the asset management company (AMC) or mutual fund house to raise capital. The company maintains a list of live NFO and recently closed NFOs.

Groww does not provide any tips, advise, or recommendations for investing in stocks or mutual funds.

However, Groww publishes a lot of informative and educative content on its website to educate, create awareness among investors to make the right choice.

You can buy Mutual Funds in Groww using the SIP or Lumpsum method as per your convenience.

Steps to invest in Mutual funds through Groww:

You can redeem your Groww mutual fund investments anytime and anywhere at your fingertips.

Steps to redeem mutual fund investments in Groww:

The redemption amount gets credited to your linked bank account within3-5 working days of the redemption.

Groww app is one of the top-rated mutual fund investments apps in India. Groww started as a direct mutual fund platform that offers 5000+ mutual funds from 35+ Mutual Fund partners for investment at zero commission, charges, or fees.

Key Features of Groww App Mutual Fund Investment

Groww offers an online NFO application facility to its customers to subscribe to the new fund offer launched by AMC using SIP or a one-time mode of investment. Groww maintains a list of Live and recently closed NFOs. The process of investing in Mutual funds and NFO in Groww is pretty much similar.

Steps for buying NFO in Groww:

Groww allows you to invest in Mutual Funds NFOs (New Fund Offer) online. You can invest in the new fund offer launched by AMC's through lumpsum (one-time) or SIP methods.

Steps to invest in NFO through Groww:

NFOs are similar to IPOs and are launched by AMCs to raise capital for launching a new mutual fund.

Groww allows you to edit your SIP investments date online with just a few steps.

You can change the date of your SIP payment two days before your scheduled payment date. If you make the changes post the mentioned cut-off, your change request gets executed in the next installment cycle.

Steps to change the SIP date in Groww:

A confirmation message gets displayed with an approximate date by which the changes are expected to get implemented.

Groww Mutual Fund account can be opened online through the Groww website or the Groww Mobile App.

Steps to open a Groww mutual fund account:

To help its customer achieve their investments goals, Groww also offers various in-built calculators to calculate and analyze your fund requirements, returns, and final amount on your mutual fund investment.

Groww is an online direct mutual fund platform that offers 5000+ mutual funds for investment through SIP or lumpsum mode.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Tuesday, October 17, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|