Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

9.98% 10,922,660 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Groww offers an online and paperless IPO application to its customers. Groww customers can instantly apply in an IPO using UPI (Unified Payment Interface) through the Groww website.

Groww is a Bangalore-based online discount broker that provides low-cost online trading and investment services to its customers. It started in 2016 as a direct mutual fund platform and is now expanding its services to add other investment products to its product base to help customers diversify their investments into multiple asset classes. Groww launched online IPO application services in Sep 2020. The IPO section is made available on the web as well as the app. However, the option to apply in IPO is currently available only on the web.

Groww does not provide any tips, recommendations, or advisory services. The company has a dedicated section for IPO wherein it maintains the list, details, and RHP of Groww open IPOs, Groww upcoming IPOs, and recently closed IPOs.

Below are the steps to apply online in an IPO through the Groww website.

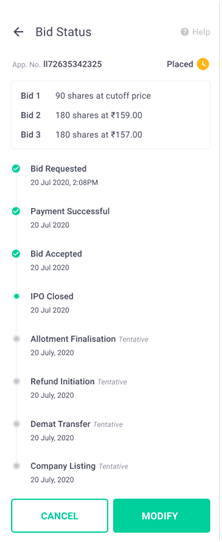

You can click on Status once the bid is submitted to track the progress of your order.

Key Features of Groww IPO application

You can also apply using your bank's ASBA facility and Groww Demat account. It is also a fully online process that can help you apply for an IPO in a few minutes.

Below are the steps to apply online in an IPO through the Groww demat account and net-banking of your bank.

In the ASBA IPO application, the bank blocks the application amount from withdrawal. The bank debits the money from your account on the allotment of shares. If there's no allotment, the bank unblocks the money. The money earns interest in the period.

The company will transfer the shares to your Groww Demat account on a successful allotment.

Groww offers free online IPO application services to its customers. There are no charges to apply for an IPO through the Groww trading platform.

Groww does not maintain IPO allotment status on its website. You can check for the Groww IPO application allotment status from the IPO registrar's website or on our website at IPO Allotment Status Page.

You would receive an e-mail and SMS on your registered mail id and mobile number informing you of the allotment status once the allotment process finalizes.

In case of a successful allotment in an IPO, you will receive the allotted shares in your Groww Demat account. The bid amount that was blocked by the bank will also get debited. In case you do not receive shares in the IPO allotment, the bid amount that was blocked by the bank will get released.

Groww offers an easy and convenient online IPO application using UPI as a payment gateway. You can also apply using the ASBA facility. Groww does not provide offline IPO application services. Currently, the IPO application service is available only on the web. The company is working on upgrading the app version for the said feature and is likely to be launched soon.

Yes, Groww offers to apply for an IPO online through the Groww website or the Groww App.

You need to have a UPI ID and an active Groww account to apply for an IPO through Groww at zero cost. Groww also provides the facility to check the detailed status of your IPO application and the allotment status.

You can also apply for IPOs by providing your Groww Demat account number in the net banking ASBA service provided by your bank, in case you do not have a UPI ID.

Yes, you can easily buy IPO from Groww through the Groww mobile app or the Groww website. Groww offers UPI-based IPO applications to its customers. When using the Groww IPO application, you can only apply in the retail quota of the IPO (Limit up to Rs 2 lakhs).

You also have an option to apply for IPO using the net-banking facility of your bank. While applying for IPO, you could provide your Groww Demat account number. The shares are credited to your Groww account after allotment.

Note:

Steps to buy an IPO from Groww

Groww IPO application process is an online, instant, and paperless process. Groww app allows you to apply for an IPO free of charge. You need to have a Demat and trading account with Groww to apply for an IPO through the Groww App.

Groww App maintains a list of Open IPOs, recently closed IPOs, upcoming IPOs, and recently listed IPOs.

You can apply for the desired IPO from the list of open IPOs using the UPI ID. Once applied, you can modify or cancel the IPO application till the IPO window is open.

Groww App allows you to place up to three bids. The App also displays the detailed status of the IPO application at each stage.

Note:

Yes, you can buy IPO on Groww using the UPI payment gateway.

Groww offers an online and paperless IPO facility to its customers. However, currently, this feature is available only on the web and will soon be launched on the app.

Groww offers an online and paperless IPO application facility to its customers. Retail individual investors can apply for an IPO through Groww using the UPI as a payment option.

Steps to apply in IPO through Groww using the UPI:

In case you do not have a UPI, you can also apply using the ASBA facility through Net banking and provide your Groww Demat account no. IPO applications in NII (HNI) category have to be made using the ASBA facility.

Note:

In case you do not have a UPI ID, you can apply in IPO using the ASBA Net banking facility and providing Groww Demat account no.

Steps to Apply in an IPO using the Net banking ASBA facility (without UPI):

Groww does maintain a real-time allotment status tracker on its website. Once the allotment gets finalized, Groww shows the status of the IPO application with a time lag in the status window of the applied IPO.

The status window shows the details of your bids, the status of your IPO, and the IPO schedule. In case of successful allotment, the status window will read as 'Allotted' against your application number.

Alternatively, you can check for the Groww IPO application allotment status from the IPO registrar's website or on our website at IPO Allotment Status Page.

Groww offers free online IPO application services to its customers. Groww does not charge any fees to apply in an IPO through the Groww trading platform.

Selling IPO shares in Groww is like any normal sell order. Once you get an allotment in an IPO, the shares get transferred to your Groww Demat account. You can sell these shares once they get listed on the stock exchanges.

Steps to sell IPO in Groww App:

You can cancel your IPO online in the Groww app anytime when the IPO window is open.

Steps to cancel IPO in Groww App

Once the IPO application gets cancelled, the blocked amount gets released in a couple of days for you to use.

You can check the allotment status of your IPO application on Groww once the allotment gets finalized.

Steps to check your IPO allotment in Groww:

Alternatively, you can also check the status of your IPO allotment on our website at IPO Allotment Status Page or from the Registrar's website.

If you get a successful allotment in an IPO, the shares get credited to your Groww Demat account by the date of the credit as specified in the IPO prospectus.

You can check the status of your applied IPO on the Groww app or Groww website under the IPO section. The Status button is visible only once you apply for an IPO.

Steps to check the IPO status in Groww

Groww offers an online and paperless IPO application facility to its customers. You can invest in IPO through Groww using the Groww mobile App or the Groww web.

Steps to invest in IPO using Groww:

After applying for the IPO, the equivalent application amount gets blocked from your bank balance. The amount will show up in your account, but it cannot be used or withdrawn.

Groww does not offer to apply for SME IPOs. It also doesn't allow trading in SME shares. You cannot buy or sell SME shares using your Groww account.

Note:

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Tuesday, October 17, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|