Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

27.7% 1,179,674 Clients

Kotak Securities Account Opening Enquiry

Kotak Securities - Pay ZERO Intraday Brokerage + F&O Rs 20 per trade. Open Instant Account Now

Kotak Securities is a full-service broker that offers a range of services to NRIs, from across the globe, including online trading in Equity, Equity Derivatives (F&O), Mutual Funds, Bonds, IPO, and ETF. Kotak securities NRI account (NRI 3-in-1 account) combines a Trading, Demat and Kotak Mahindra Bank NRI Saving Bank Accounts which offers hassle-free investment experience.

Kotak Securities NRI Services Benefits

Kotak Securities offers a 3 in 1 account (Trinity Account) to NRI investors to facilitate smooth trading. The Kotak 3 in 1 account NRI includes:

Top 10 Features of Kotak NRI 3-in-1 Trading Account

The Savings Bank accounts in NRI 3-in-1 Trading account are provided by Kotak Mahindra Bank. The bank offers 4 types of accounts-

Please read our article on NRE Vs NRO Bank Account for a detailed comparison of NRI Bank Accounts.

Each NRI bank account is also categorized as PIS (Portfolio Investment Scheme) or Non-PIS account. PIS is a scheme from RBI scheme through which NRIs can trade in shares, mutual funds, bonds, etc in India stock exchange.

Note-

Kotak NRI demat facilitates holding of bought securities in electronic format. The online demat account can be used to hold a variety of securities including stocks, IPO shares, and mutual funds, etc.

Kotak Securities is a depository participant with both NSDL and CDSL. The membership allows it to offer demat account related services to customers.

NRIs can open two types of Demat accounts with Kotak:

Please read our article NRI Demat Account-Online Opening Procedure, Charges & Rules to understand NRI demat accounts in detail.

Kotak Securities NRI Demat Account Review

Kotak NRI trading account enables NRI customers to trade in the shares of listed companies and their derivatives (F&O) at BSE and NSE stock exchanges.

Kotak Securities offers online trading services to NRI investors, except for those based in the US and Canada.

The step-by-step Kotak NRI trading process is as follows-

To buy stocks, you need to fund your PIS (NRE/NRO) account. Once the PIS account has enough funds, you will get a window to place orders in the market.

Place a buy order using any of the Kotak trading platforms. The system will check for the availability of the funds in your linked PIS bank account. If sufficient funds are available for the trade then your order will be executed.

When a buy order is placed the amount in the PIS account gets debited and the shares get credited in the Demat Account. Similarly, when a sell order is placed the shares get debited from the demat account and the funds are credited to the PIS account.

As per the Regulations, all the transactions at the end of the day will be reported to Kotak Bank for onward reporting to RBI.

Kotak Securities NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹3750 |

| NRI Account AMC | ₹0 |

| Equity Delivery Brokerage | 1.00% |

| Equity Future Brokerage | 1.00% |

| Equity Options Brokerage | 1.00% |

| Other Charges | Average Quarterly Balance: ₹10000 |

The trading platforms offered by Kotak to NRI customers are the same as those for resident Indians. Kotak offers a range of online trading software and tools:

NRIs can also use below-mentioned trading tools:

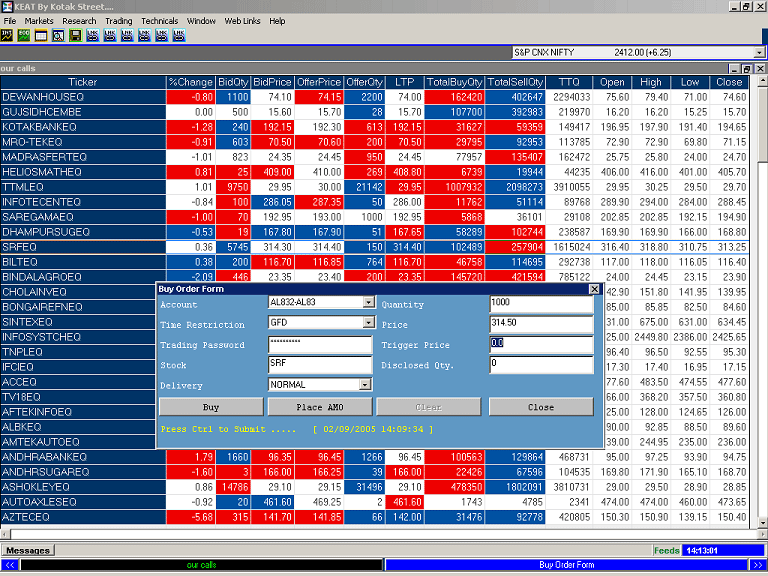

Kotak Keat Trading Software

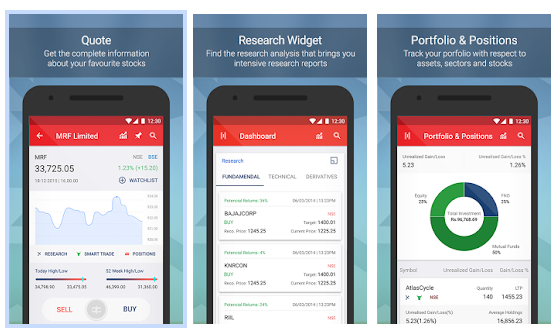

Kotak Mobile Trading App

TradeSmart Derivatives Application

The investment options available to an NRI at Kotak Securities.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others |

You can set up NRI Trading account in 2 ways:

You need to open an NRI trading account with Kotak Securities and link your bank and demat accounts with the trading account. This process can only be done in the offline mode.

You can open a Kotak 3-in-1 Trinity account using the process described below.

Opening a Kotak NRI 3-in-1 account is simple. An NRI can open Kotak Trinity Account in the following 3 ways:

You need to provide the following documents to open a 3-in-1 NRI account:

In addition to these, you can have to provide the following address proof documents:

Note:

| Feature | Status |

|---|---|

| 3-in-1 Account | Yes |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

Kotak Securities offers online mutual fund services to NRIs. They can use the Kotak NRI 3-in-1 trading account to invest in mutual funds.

Kotak NRI Mutual Fund - Key Features

Note:

Kotak Securities NRI Support Desk contact information. Find Kotak Securities NRI contact number.

| Kotak Securities NRI Helpline | Number |

|---|---|

| Kotak Securities NRI Customer Care Number | 022 6689 6000, 022 6652 9191 |

| Kotak Securities NRI Customer Care Email ID | nricustomerservice@kotak.com |

Kotak Securities is a full-service broker. It offers convenient stock trading and investment to NRI's through its 3-in-1 account. In addition, you get advanced trading software, researched advice and dedicated RM assistance. Kotak Sec brokerage charges are on the higher side. Kotak Sec has offices in New York, London, Dubai, Singapore, and Mauritius which makes it easy for NRIs based in these locations to avail services or get grievances redressed locally.

Open a 3-in-1 account and get:

Interested in opening a trading account? Open Instant Account Now

The Kotak NRI 3-in-1 trading account closure process is paper-based. Here's a step-by-step process to close Kotak NRI trading account:

The account will be closed, subject to no holdings in your account and signature verification. It takes around 10 working days from the date of receiving the completed application to close the account.

Kotak Securities offers online application status tracker wherein you can check the status of your trading account. You need to enter details like application number, application type, name, date of birth and PAN card number to get the account opening status.

There are various charges and taxes associated with Kotak NRI account. Here's a breakdown of charges.

|

Account Opening Charges (One Time Fee) |

Rs 3750 |

|

Brokerage (Equity Delivery) |

1% of the turnover or 25 Paise per share, whichever is higher |

|

Average Quarterly Balance in Savings Account |

Rs 10,000 |

|

PIS Account Maintenance Fee |

Rs 1000 per year |

|

Demat Account Maintenance Fee |

Rs 75 per month |

Note:

Kotak Securities doesn't offer online account opening process. To open an NRI account with Kotak, an NRI has to follow the below process:

Kotak Securities offer support to NRI customer through email, whatsapp and phone. In addition, each NRI customer has a dedicated relationship manager.

Kotak Securities NRI customer can reach customer care at 022 6689 6000 and 022 6652 9191.

Kotak Securities NRI customer can reach out to the customer services by:

Kotak Securities Account Opening Enquiry

Kotak Securities - Pay ZERO Intraday Brokerage + F&O Rs 20 per trade. Open Instant Account Now

Information on this page was last updated on Wednesday, January 10, 2024

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|