Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

3.45% 1,152,697 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

HDFC Securities, India's leading full-service broker, offers both offline and online trading services. For online traders, the company offers a range of options to trade online including:

HDFC Securities trading website can be accessed from any browser across devices and offers a range of trading features including-

The HDFC Securities website offers a range of features to traders to analyze and trade. You would need some understanding of the features of the platform to use it optimally and intuitively. HDFC Securities provides a trading demo video which explains various features of the trading website.

Steps to Watch HDFC Securities Website Trading Demo

HDFC ProTerminal is a state of the art trading and analytics platform. The platform is available in web and mobile versions. Key features of the platforms are-

HDFC customers have to pay a yearly fee to access ProTerminal. The platform is available at an offer price of Rs 1999 annually.

The HDFC ProTerminal is available as a mobile app for Google Android and Apple iPhone users. HDFC customers can subscribe to ProTerminal platform by paying the fees and then can download the ProTerminal app and use it anywhere, anytime. The app can be downloaded from following app stores-

HDFC ProTerminal is an advanced trading and analytics platform. Both, new and experienced traders would need help in understanding its various features. HDFC Securities provides short demo videos explaining various features of the platform.

Steps to Watch HDFC Securities ProTerminal Demo

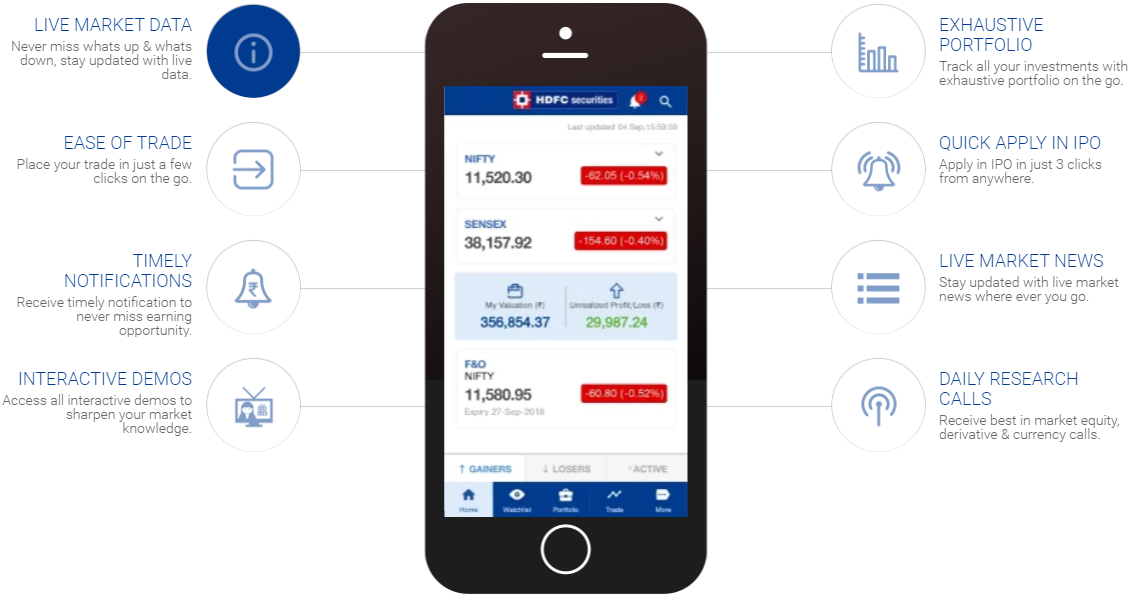

The HDFC securities Mobile Trading App by HDFC offers a range of essential trading features like real-time markets update, advanced charts, and investment ideas. Key features of the mobile trading software include-

HDFC Securities Mobile App offers a range of useful features to traders to trade on the move and keep an eye on their investments. Some traders may require some assistance in understanding various features of the app. There are several short videos available explaining how to use HDFC Securities mobile app on the company's website.

Steps to Watch HDFC Securities Mobile Trading App Demo (How To Use HDFC Securities Mobile App)

The HDFC Securities Mobile Trading App is available for Android and iOS smartphone users. The mobile app can be downloaded for free from the app stores-

HDFC Securities BLINK is a downloadable desktop trading software that offers high speed and performance to traders. After downloading the software and installing it, traders can use it to trade. Key features of HDFC Securities BLINK are-

The HDFC Securities BLINK Trading Software is a paid platform. HDFC customers need to pay a subscription fee to access the software. The HDFC Securities BLINK Trading Software Prices & Charges are as follows-

|

Product Plan |

Amount |

|

Blink for 6 months |

Rs 2999+ GST |

|

Blink for 1 year |

Rs 3999 + GST |

How To Use HDFC BLINK Trading Software?

HDFC Securities BLINK online trading software offers a range of useful features to traders to trade at high speed. Some traders may require some assistance in understanding various features of the terminal based software. There are several short videos available explaining how to use HDFC BLINK Trading Software on the company's website.

Steps to Watch HDFC Securities BLINK Trading Software Demo (How To Use HDFC BLINK Trading Software)

HDFC Securities also offers smallcases, a 3rd party investment product. This product is offered by many other brokerage companies like 5paisa, Zerodha etc. A smallcase is a prebuilt portfolio or a basket of stocks built around a theme, idea or strategy. It includes 2 to 50 instruments. Key features of the HDFC Securities smallcase platform are-

HDFC Securities is the first stock brokerage firm to introduce Virtual Assistant or voice-enabled investing facility for traders. Customers can talk to HDFC securities 'arya' through simple voice commands over Google Assistant, Google Home and Amazon Alexa powered devices.

Key Features of HDFC Securities Arya are-

HDFC securities Digify is a digital platform for quick and hassle-free Mutual Fund investments. Apart from investing, the online mutual fund platform provides you access to your portfolio to manage and track your investments from anywhere, anytime. Key features of DIGIFY mutual fund platform are-

How to start Mutual Fund investments with Digify?

HDFC Securities Digify is an easy to use mutual fund platform. However, if you are facing any difficulty understanding its features or want to know in detail on how to start mutual fund with Digify then there's a short video explaining the platform.

Steps To Watch HDFC Securities Digify Demo

HDFC Securities' Dial-N-Trade facility allows you to place orders over the phone. You need to dial the centralized dealing desk and a company executive will place the orders.

HDFC Securities is a leading stock broker offering commodity trading services at MCX and NCDEX. HDFC Securities trading platform for commodity includes:

HDFC Securities commodity trading software download is available on its website. Steps to download online trading software has been explained above.

HDFC Securities offers currency derivatives trading at BSE and NSE exchanges. Customers can use any of the available HDFC Securities trading software online to trade in currency futures and options.

Incorporated in 2000, HDFC Securities is a subsidiary of HDFC Bank and a full-service stock broking company in India. It offers stock broking services in Equity, Derivatives and Currency etc. It also offers investment services in Mutual Funds, IPO and Fixed Income products. HDFC's product portfolio also includes loans, NPS and insurance products.

HDFC Securities offers 3-in-1 account services wherein a saving, demat and trading account is linked to each other. The demat and the bank account are opened with HDFC Bank. HDFC Securities serves both retail and institutional investors and has a client base of more than 668,312 traders. The company is present across India with more than 270 branch offices.

The company also provides research advisory services to its customers. It has an experienced team of market analysts and experts who provide reports and insights on the economy, market and investment opportunities. The team also suggest investments ideas on equity, derivatives and mutual funds etc.

HDFC Securities offers a smooth and seamless online trading experience through its mobile app and web platforms.

For trading online in HDFC securities, you will have to:

The company lets you trade in Equities, Derivatives, Mutual funds, IPOs, Fixed Deposits, Bonds, and Digi gold.

HDFC Securities username is the login ID required provided by the broker to access the trading account.

HDFC Securities sends the HDFC Securities username and password over email once the account gets opened. If you forget your username or if it gets locked, you can unlock it online instantly through HDFC Securities mobile app or website with the help of your PAN and date of birth.

If you have not received your username, drop an email to services@hdfcsec.com or customercare@hdfcsec.com with your registered contact details.

HDFC Securities login ID is a unique username given to HDFC Securities clients over email post account opening.

The HDFC Securities login ID is required to log into the HDFC Securities Limited account to trade across multiple asset classes, portfolio tracking, fund transfer, and much more.

If you have misplaced or forgotten your HDFC securities login ID, you can generate the same by following these steps:

HDFC Securities client ID is the username assigned by the broker to each client on opening an account with HDFC securities.

The Client ID acts as an identification for you and your account that is required to access your HDFC Securities account, followed by the password and date of birth.

HDFC Securities Client ID is received over email after the account opening formalities with HDFC securities get completed.

Intraday trading in HDFC Securities is a type of trading that allows you to buy and sell the same stock on the same day.

Intraday trading is also known as Day trading, wherein you can place buy/sell orders using the product as Intraday. The Intraday orders in HDFC Securities can be placed up to 2.45 pm. If an intraday position is not closed by 3.00 pm, HDFC Securities will initiate to square off your open positions at the available price that can lead to profit/loss.

HDFC Securities offers to do online as well offline trading through the below modes:

To start trading in HDFC securities, you need to open a Demat and trading account with the broker. HDFC securities offer online and offline account opening facilities. You can either 2-in-1 accounts or 3-in-1 accounts. Once your account gets opened, you can choose to trade using either of the multiple modes as per your convenience.

To login to HDFC Securities for the first time, you need to generate your username and password using the link received on your registered email id. You will receive the email once your account opening application gets approved.

Steps to login into HDFC securities for the first time:

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Saturday, November 18, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|