HDFC Securities Encash Order Facility Review

Published on Monday, May 20, 2019 by Chittorgarh.com Team

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Encash by HDFC Securities is a facility which allows customers to sell the stocks and get the money credited into the bank account on the same day. HDFC Securities offers this facility in the equity segment to fulfill urgent cash requirements of the customers.

In a normal sale proceed, an order takes t+2 days for settlement and the funds get credited in the bank account on the 3rd day of the transaction. Whereas, Encash order facility speeds up the process by getting the fund credited on the same day and increases liquidity for the investors/traders.

Clients are charged an additional 0.20% rate over and above the applicable equity delivery brokerage rate for using this facility.

HDFC Securities, A Full-Service Broker

HDFC Securities is a subsidiary of HDFC Bank, India's leading private bank offering a wide range of financial services. HDFC Sec offers offline and online stock trading services.

HDFC Securities is known among traders for its easy 3-in-1 stock broking services and research advisory. The company has a dedicated research team to provide stock recommendations and market insights to its customers. The research team regularly publishes reports on segments, markets and economy.

HDFC Encash Trading Facility – Key Facts

HDFC Securities provides many trading products & services to its customers. Encash is one such facility that helps traders get their sales proceeds credited on the same day of the transaction. This helps them manage their funds better and trade more.

- Encash facility can be availed through a special order type 'Encash'.

- The Encash product offering is only for equity segment and in BSE.

- Resident Indians who are allowed to place CNC order have the privilege to place Encash order as well.

- Encash order cannot be converted into CNC and CNC cannot be converted into Encash order.

- Encash facility is not available for NRI customers at HDFC Securities.

- Customers can only place a fresh sell order in Encash order.

- This facility cannot be utilized by the customers on clearing or bank holidays.

- An off-market order cannot be placed in Encash order.

- The sale proceeds of the Encash order will be credited to the customer's account on the transaction date.

- HDFC Securities offers the Encash facility only for listed security defined by the stockbroker. This list can be changed by the stockbroker from time to time.

- If the customer modifies the Encash order, he/she will be charged accordingly.

- Encash order is not considered as square off order, whether there is buy CNC order on the same day for the same stock.

- Investors can place Encash order along with market or limit order type.

Benefits of Encash Facility

Encash facility of HDFC Bank is very useful in many situations. Some of the benefits are as below:

- Funds from the sale of equity get credited on the same day.

- The actual settlement of the stocks which take t+2 days has been done on the trading day itself.

- Encash process increases liquidity as the funds are credited in account in advance.

- You can request for Encash instantly in case of urgent cash requirement.

Encash HDFC Securities – Key Features

- It is available only for equity segment.

- Encash trade allows only fresh sell order.

- This product is only available in the Bombay Stock Exchange (BSE).

- Only sale proceeds can be placed with the HDFC Encash order.

- The funds get credited on the trading day itself.

- It provides high liquidity for investors.

- Encash fulfills cash requirements of the investors as the funds are credited to the bank account on the trading day itself.

- The product is available with CNX 200 Index scrips on BSE and other scrips which are changed from time to time.

- There is a client-wise limit which is Rs. 25 lakh per order/ per day for a client.

- Encash order can be placed from the mobile app and mPowered trading platform.

How Does HDFC Encash Facility work?

The Encash order can be placed using HDFC Securities mobile app and its mPowered trading platform.

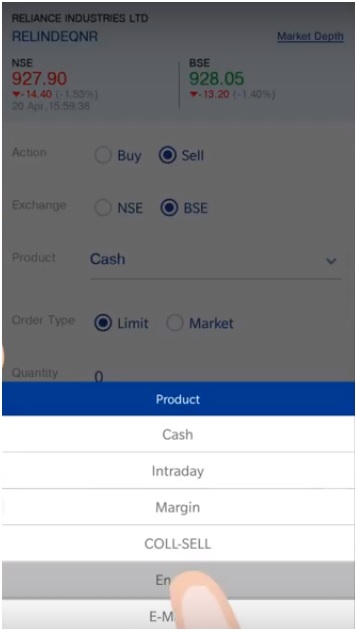

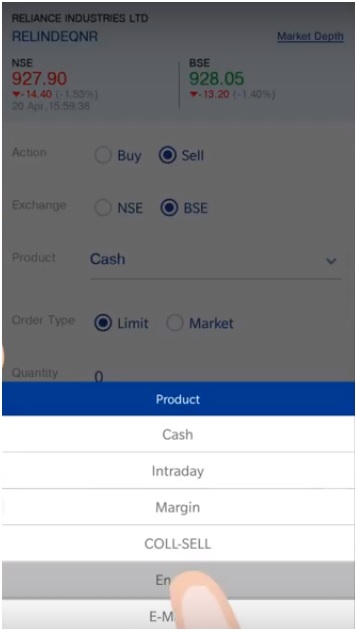

Steps to Place Encash Order on Mobile

- Login into your account. Post login, you will see the live market update screen.

- Click on search icon provided at the top.

- Enter first few alphabets of the stocks and select the stock from the dropdown.

- After selecting the stock, the screen will show the current price, previous close, Intraday low-high and 52-week low-high.

- Click on the 'Sell' button.

- On the sell screen, select product as Encash from the dropdown.

- Select the order type as a market order or limit order.

- Enter the price and quantity for the stock.

- Click on 'Place Sell Order' at the bottom.

- The screen will show order details. Check the detail and click on 'Confirm Order'.

- After successful order completion, you will get an order reference number.

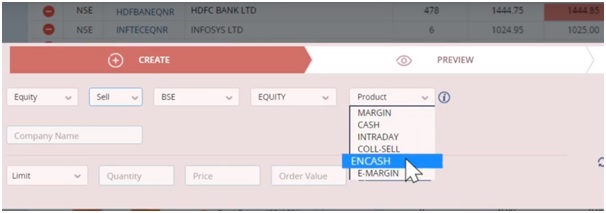

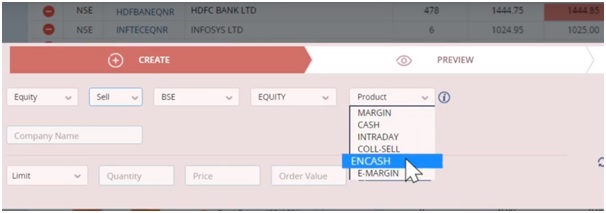

Steps to Place Encash Order on mPowered platform

- Login into your account with username and password. Post login, you will be directed to the home screen.

- Select the option 'Sell' from the box available over the home screen window.

- Select the exchange as 'BSE' (Encash facility only available on BSE).

- Instrument box is auto-populated as 'Equity'.

- Select product type as 'Encash' from the dropdown.

- Enter the first few alphabets of the stocks in the 'Company Name' box.

- LTP is auto-populated after selecting the stock.

- Select order type as Limit or Market order. Enter the price at which you want to sell if you have selected limit order.

- Enter 'Quantity' of the stock.

- Click on 'Place Order'.

- Review the order info and click on 'Confirm Order'.

Encash Order by Call & Trade

HDFC Securities allows you to place Encash orders over the phone. You can place the Encash order by calling the dealing desk given the company's website.

Encash Order through the Branch

The HDFC Encash facility can also be placed offline through the branch offices located across India. You can also visit the nearest branch in your area and get it done instantly with the help of trained executives.

Conclusion

Encash by HDFC Sec is the facility for customers to get the money from the sale of equity on the same day instead of waiting for T+2 days at a small additional cost of 0.02%. Though it has many limitations, it works out well if you are aware of the rules.

Read more about HDFC Securities

Special Offer - Free Equity Delivery and Mutual Funds

- Brokerage-free equity delivery trades.

- Brokerage-free Direct Mutual Fund.

- Pay ₹20 per trade for Intraday & F&O.

- The best trading platform in India.

Open Instant Demat Account Read Reviews

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)