Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

-19.85% 1,869,925 Clients

ICICIdirect Account Opening Enquiry

ICICIdirect Neo Plan - Flat Rs 20 per trade brokerage (Intraday and F&O) + Free Account Opening + Get funds in 5 minutes from sell orders + Free trading tips. Open Instant Account Now

ICICIdirect is one of the largest full-service stock brokers in India. It is part of ICICI Securities that caters to over 8.4 lakh active customers. ICICIdirect offers a complete range of trading and investment services including Equity, Derivatives, Currency, Mutual Funds, ETFs, Bonds, Insurance and Loans etc. The stockbroking company offers trading services across NSE and BSE.

ICICIdirect offers a 3-in-1 account to its customers wherein the trading account, demat account and the bank account is linked to each other. This ensures faster transactions and good trading experience. As a full-service broker, ICICIdirect also offers research services to its customers. The research team of the company regularly provides trading and investment recommendations, market insights and market outlook etc., to its customers.

The other key offering of ICICIdirect is investor education programs. ICICIdirect Centre for Financial Learning (ICFL) offers financial learning programmes on a range of Investment and Trading focused skills such as Stock investing, Technical Analysis, Derivatives Trading, Financial Planning and Wealth Management.

ICICIdirect offers both, online trading and offline trading services to its customers. Traders who prefer online trading have the flexibility to choose from desktop, web-based and mobile app platforms. Customers who wish to trade offline can use call-n-trade as well as branch services of the company.

ICICIdirect has 200+ branch offices (called ICICIdirect Super Store) spread across 87 cities and towns in India. ICICI customers can visit these stores to avail of various services offered by the company.

ICICIdirect offers a range of online trading software and tools to its customers including:

All the ICICIdirect Trading Software enables traders to trade in equity, derivatives and currency etc., across NSE and BSE. These trading software's are available free of charge to all the customers.

ICICIdirect Mobile is a mobile trading app that allows customers to trade from anywhere. The mobile trading software is available for Android and iOS smartphones.

ICICIdirect customers can download the mobile trading app and analyze and trade on-the-go. The app offers many essential trading features such as:

ICICIdirect Mobile App Download

The ICICIDirect mobile app is available for Google Android and Apple iOS smartphones. The mobile app can be downloaded for free from:

Trader Racer Web is an online trading website from ICICIdirect. ICICI customer can access this website from any computer browser. The trading website offers a range of features to traders to analyze and trade including:

ICICIdirect also provides a low bandwidth website for those users who stay in poor internet connectivity areas. The low bandwidth website provides many useful trading features like:

Trade Racer is desktop trading software for ICICI Sec customers. Designed for the frequent trader, trader racer is an exe based installable trading terminal. It offers all critical features which are required for a high-frequency trader. The key features of ICICIDirect trading terminal include:

ICICIdirect Trade Racer Download (Trade Racer Desktop App Download)

ICICIdirect Trade Racer offers many useful features to analyze and trade. The Trade Racer Desktop App can be downloaded from the website.

Steps For ICICIdirect Software Free Download For PC

ICICIdirect Trade Racer Desktop App Demo

The Trade Racer desktop trading software is designed for experienced and active traders. The platform has many advanced features which would need learning and understanding before it can be optimally used by traders. ICICIdirect Trade Racer Desktop App Demo is a video that explains all the features and functions of the platform.

Steps to View ICICIdirect Trade Racer Desktop App Demo Online-

The ICICIdirect Call-N-Trade facility allows you to place buy/sell orders over the phone. You need to dial the customer support number provided on the company's website, enter your trading account number on the IVR and on successful verification a company executive will place the buy/sell orders.

ICICIdirect doesn't provide commodity trading services. However, you can trade in exchange-traded funds (ETFs) of some commodities like Gold ETFs.

The customers can use any of the available ICICIdirect trading software to invest in Gold ETFs.

ICICIdirect offers currency derivatives trading in four pair of Currencies- Dollar, Euro, Pound and Japanese Yen against Indian Rupee at BSE and NSE.

Customers can use any of the available ICICIdirect trading software online to trade in currency futures and options. The steps to download ICICIdirect trading software is discussed above.

Key Takeaways

Open a 3-in-1 account with Neo Plan for:

Interested in opening a trading account? Open Instant Account Now

To trade in ICICI Direct, you need a 3-in-1 account with ICICI Bank. Once you have the account setup, you can use one of the online trading software to trade in ICICI Direct. ICICI provides a mobile app, website and installable trading software for free.

To buy/sell stocks, you have to first allocate (or block) funds to your trading account from your bank account for trading. You can now place buy/sell orders by filling an order form. Once the order is placed, you could check the order status in 'Order Book' or 'Trade Book'. Once the order is complete, the shares you bought are transferred to your demat account in 2 days and money gets deducted from your bank account the same day of order execution.

Steps to trade with ICICIDirect Website

The high-level process of trading using the ICICIDirect Mobile app and trade terminal is the same as the website. You have to log in, allocate funds and place an order.

You can also use Call & Trade services of the company wherein you can place orders by calling ICICI Direct. The service is open between 08:30 AM - 06:00 PM (Monday to Friday). Extra charges may apply for orders placed through call & trade.

When placing a buy or sell order with ICICI Direct customer has to choose the period of the validity of an order. The order could be valid for a day, IoC (Immediate or Cancelled) and VTC (Valid Till Cancelled).

A Day order is valid till the end of the trading day. It gets cancelled automatically if unexecuted before the closing of market hours.

An IoC (Immediate or Cancelled) order is either executed immediately or else get cancelled. A part of the order may be executed on price match availability and the rest cancelled.

For example, say you placed an IoC order for 200 shares at Rs 100. At that time, only 150 shares were available at that price. The system will execute the order for 150 shares and cancel the rest of the order for 50 shares.

A VTC (Valid Till Cancelled) order is valid for 45 days. The order gets automatically executed when the stock reaches the desired set price or else gets cancelled after 45 days.

To convert an intraday position to delivery (Cash segment), you need to click on the 'Convert to Delivery' (CTD) link on the 'Margin Positions' page. You can convert a position in full or part. CTD would require full payment of the trading value.

ICICI Direct offers online trading and investment. You can buy shares online using ICICI Direct website or its mobile trading app. It is easy, convenient and safe to buy shares with ICICI Direct online.

Steps to buy shares using ICICI Direct Website

To sell shares using ICICI Direct, login to ICICI Direct website or ICICI Direct Mobile App, go to Demat Allocation page under equity, click sell in front of the share you would like to sell, enter sell order info and click sell.

ICICI Direct offers online buying/selling of shares and mutual funds. You can sell shares using ICICI Direct website or its mobile trading app.

Steps to sell shares using ICICI Direct

ICICI Direct customers can place a stop-loss order in the ICICI Direct website or mobile app using the regular buy/sell order form. You just have to fill an additional field 'Stop Loss Trigger Price' in the order form and place the order.

A stop-loss (SL) order gets activated only when the set trigger price is reached. The SL order type is used to limit the loss of a position.

Example:

You buy a stock Rs 250 in the expectation that the price will go up. However, in the event the price falls, you would like to limit your losses.

You may place a limit sell order specifying a Stop loss trigger price of Rs 205 and a limit price of Rs 200. Once the last traded price touches Rs 205, the sell order gets converted into a limit sell order at Rs 300.

When placing an Intra-day buy order, ICICI Customer can choose from two square-off modes; broker and client mode.

Under client square off mode, all unexecuted Margin Buy orders and Margin Buy positions are not be cancelled/squared off by ICICI Direct during by the end of the day. These orders or positions stay in the system for up to 365 days. The responsibility to square off such positions remains with the client.

Under Broker square off mode, all unexecuted Margin Buy orders are cancelled and Margin Buy positions are squared off by the broker at the end of the day.

Note that the client mode is only available for the Intraday Margin Buy Orders.

Broker square off mode is a facility on intraday (margin buy) positions. Under Broker square off mode, all unexecuted orders are cancelled and open positions are auto-squared off by the broker at the end of the day.

When placing an Intra-day buy order with ICICI Direct, you could choose from one of the two square-off modes; broker and client mode.

Under client square off mode, the unexecuted intra-day orders or open intra-day positions are expected to close by the customer. ICICI Direct does not cancel such order or auto square-off such positions. These orders or positions stay in the system for up to 365 days.

Note that all intraday sell orders or positions are marked under the Broker square off mode only.

'Convert to Delivery' (CTD) in ICICIDirect is an option wherein you can convert your intraday positions (margin buy) into a cash delivery. You can convert the entire order or a part of it. You need to pay the entire trading value (100% margin) while converting the order.

The disclosed quantity entered while placing a buy/sell order is the quantity made public in the market depth or pending order list for the selected share. It is a facility wherein you can decide on the quantity of a buy/sell you want to disclose to the public.

Example:

Suppose you are placing a large order of 1 lakh shares. If this number is disclosed to the public, the sellers may increase the price or stop selling all together. If you place this order with disclosed quantity as just 1000, the sellers may not over-react. While your order quantity remains the same as 1 lakh shares, the sellers won't know about this as the market depth only showing 1000 shares. After the first order of 1000 shares is executed, another 1000 share order is shown in the market depth. The process continues until the full order is executed.

Note:

The ICICI Direct Price Improvement Order helps you to get a better price while buying and selling in a highly volatile market. It uses an auto-trailing stop loss facility. The system automatically updates the Stop Loss Trigger Price and Limit Price based on the price movement. This dynamic pricing ensures better profits from the trade.

This feature allows you to place orders with an auto-trailing stop loss facility where the stop-loss price for your order would decrease automatically with the fall in market price. If the market rebounds upward, then your order will get executed as per the new stop-loss price which would be a better price for your orders.

For example, you place a price improvement order for selling a stock. The share is trading at Rs 510, and you put a Stop Loss order of Rs 500. You want to benefit from the upward movement in stock price. Now as the stock prices move up, your stop loss will also move up. So, when the price moves to Rs 520, the stop loss would automatically move to Rs 510. When the price moves to Rs 540, the SL would move to Rs 530. Now, the share price falls, stop loss would get triggered at Rs 530 and you would gain Rs 20 more than your initial position.

To place a Price Improvement order, visit the 'Advanced Order' under the Equity or Futures trading section. The orders can also be placed from cash buy/sell and BTST wherever the 'Place Price Improvement Order' link is available.

Note:

IOC order in ICICIDirect is an abbreviation for 'Immediate or Cancelled' order. It is a type of order validity that you have to select while placing a buy or sell order. The other options in order validity are 'Day' and 'VTC (Valid Till Cancelled).

IOC orders are immediately executed or cancelled if the price at which the order is placed is not available in the market. Partial orders may be executed if the price match is available.

For example, if you place a buy order for 100 shares of a company at Rs 50 per share and at the time only 70 shares are available then the system will buy 70 shares while the rest of the order for 30 shares will get cancelled.

If there are no shares available in the market at Rs 50 at the time order is a place, the complete order is cancelled.

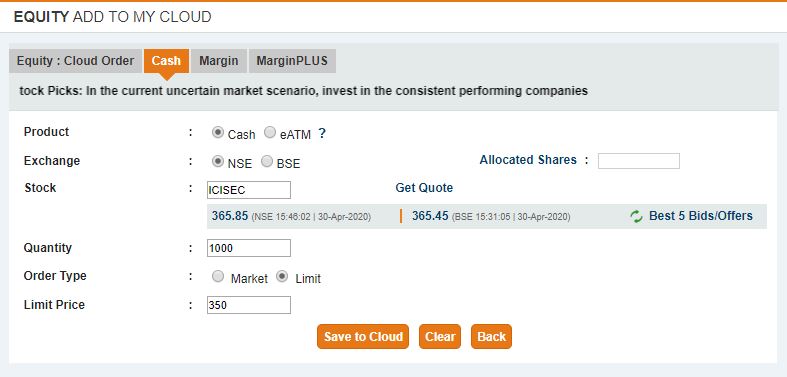

ICICI Direct Cloud Order facility designed for placing quick orders. Instead of filling the order form while the market is on, you could prepare and save a number of orders well in advance. These orders remain in the cloud order queue until you delete them. These orders are not sent to the exchange until you place the order.

You can save orders anytime post-market or before market hours or even during market hours just once to save time on filling order details during market hours. These orders can be placed in a single click. You could reuse the same order.

You can place cloud orders in Equity Cash, eATM, Margin and MarginPLUS products.

Steps to place a cloud order

Limit price (or limit order) is an order to buy or sell shares at the specified price or a better price. The better price for a buy order will be the lowest possible whereas, for a sell order, it will be the highest possible.

You need to specify a maximum price for a buy order and a minimum price for a sell order. The order will be executed at the specified price or a lower price for buy orders or a higher price for sell orders.

For example, you placed a limit order to buy a company's share at Rs 100. The order will be executed only if the stocks are placed at Rs 100 or lower.

Valid Till Cancelled (VTC) defines the validity of an order. The VTC order remains in the system until the entire quantity is executed or till the validity expires, whichever is earlier. The feature allows you to specify the number of days during which you wish to place the orders. The unexecuted order can be cancelled by the customer at the point of time.

The VTC 'Order Validity Date' is the date selected while placing VTC order. Any unexecuted VTC order by this date gets automatically cancelled.

Example:

You place a VTC order to buy 100 shares of a company at a limit price of Rs 1800 per share. You specified a validity date of 60 days from now. Your VTC order will be valid until 60 days. Anytime within the validity period if the shares are available at the specified price, the system will execute your order. In case the stocks are not available at the price, it will get cancelled on the specified date.

VTC Order Facts:

Advantages of VTC Order

With this facility, if your order remains unexecuted on a specific trade date you are not required to log in again and place the same orders again. ICICI Direct will keep submitting your remaining order to the exchange everyday morning.

The Stop Loss Trigger Price (SLTP) is a price entered at the time of placing a Stop-loss order. When the price of the security reaches the SLTP price, the stop-loss order is activated and sent to the exchange for execution.

A stop-loss (SL) is an advance order type that is used to limit the loss of a position. An SL order remains passive till the SLTP is reached. Once the price reaches the SLTP, the order gets activated and placed to the exchange.

Note that the SLTP is not the price at which the order gets executed. The order is executed at the limit price. The order only gets activated and sent to the exchange when the share price hits the trigger price.

Example:

You buy SBI shares at Rs 525 expecting its price to rise in the coming days. However, you're also concerned about the prices going down. In such a scenario, you can place an SL order to limit your losses, if the prices go down. While placing the SL order, you have to enter an SLTP (Stop loss trigger price) and limit price. Say you put an SLTP of Rs 510 and a limit price of Rs 500. Your order will get activated and sent to exchange as the SBI price reaches Rs 510. As soon as the exchange finds a buyer at a limit price of Rs 500, the SL order gets executed. This saves you from the losses you may incur if the share falls further and thus limit your maximum loss.

ICICIdirect Account Opening Enquiry

ICICIdirect Neo Plan - Flat Rs 20 per trade brokerage (Intraday and F&O) + Free Account Opening + Get funds in 5 minutes from sell orders + Free trading tips. Open Instant Account Now

Information on this page was last updated on Friday, November 17, 2023

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

Please do something positive.