Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Monday, August 6, 2018 by Chittorgarh.com Team | Modified on Friday, August 13, 2021

ICICIdirect Account Opening

ICICIdirect Neo Plan - Flat Rs 20 per trade brokerage (Intraday and F&O) + Free Account Opening + Get funds in 5 minutes from sell orders + Free trading tips. Open Instant Account Now

ICICI Bank is one of the members of the SCSBs (Self Certified Syndicate Banks). SCSBs are allowed by the SEBI to accept online IPO applications from investors.

Steps to online IPO application through ICICI bank

The process to apply online for an IPO through ICICI internet banking involves following steps-

Details of ASBA application from ICICI bank

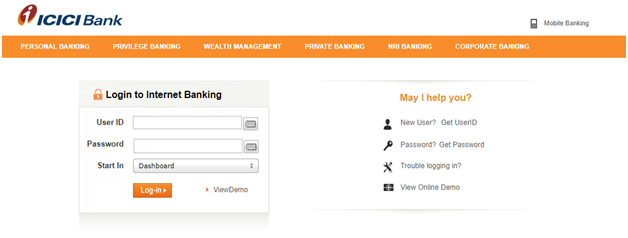

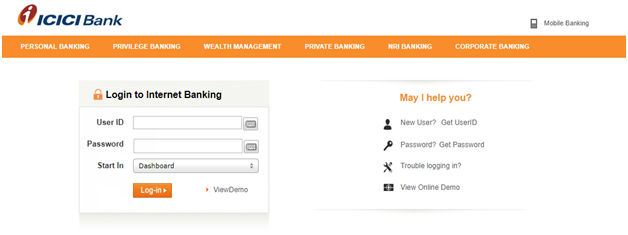

Login to your ICICI online account

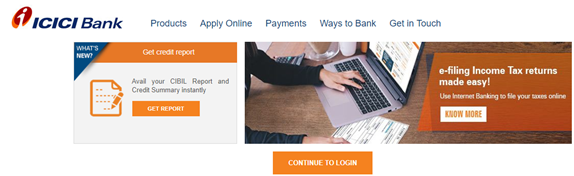

Visit www.icicibank.com and click on login button on the right side.

Click on 'CONTINUE TO LOGIN' button on the next screen.

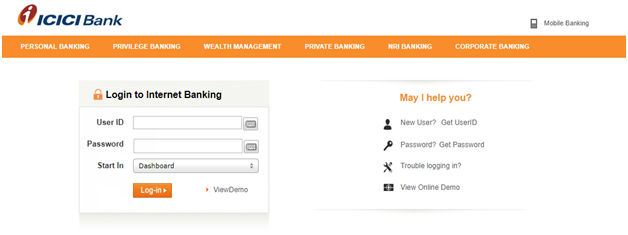

In the next screen, login using your ICICI account user ID and password.

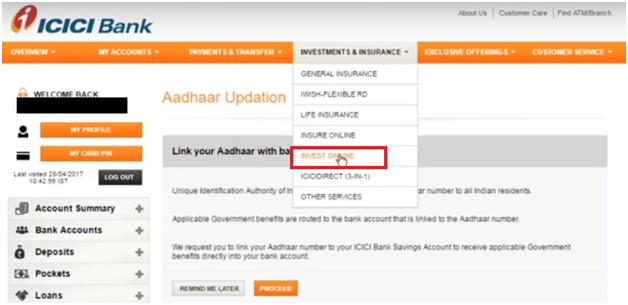

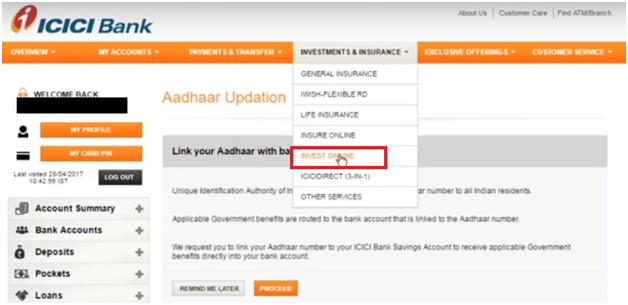

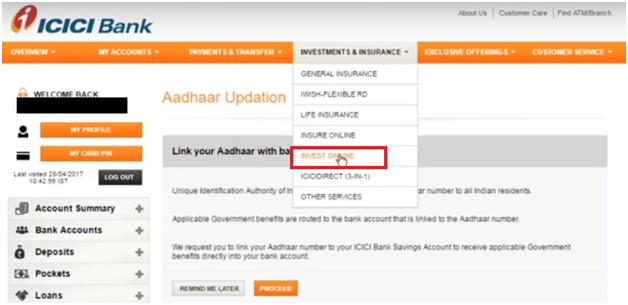

Click on 'Investments & Insurance' tab on the top menu. Then click on 'Invest Online' on the dropdown menu.

On your account page, on the top menu, click on 'Investments & Insurance' tab and then on 'Invest Online on the dropdown menu.

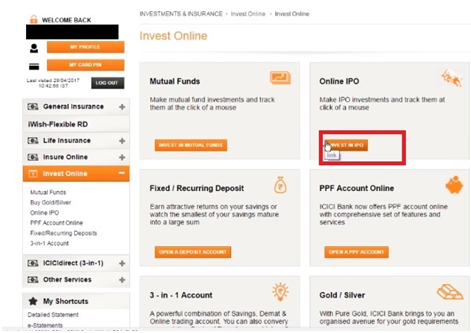

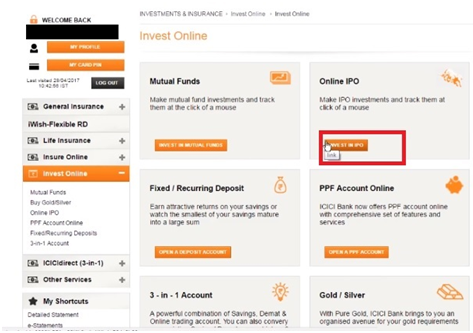

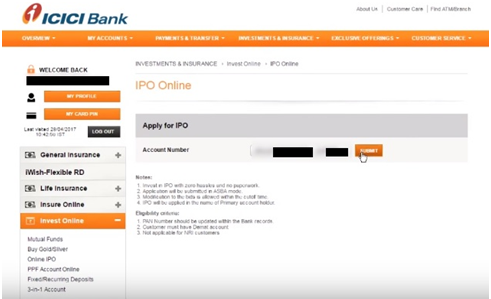

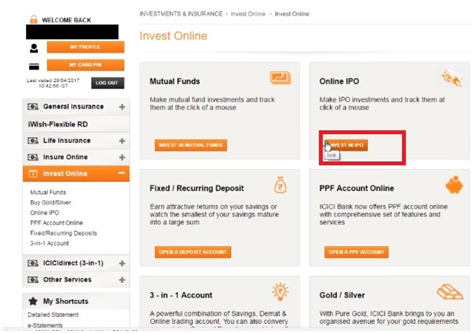

Go to 'IPO online' box and click on 'Invest in IPO'.

In the next screen, click on 'Invest in IPO' button under Online IPO section.

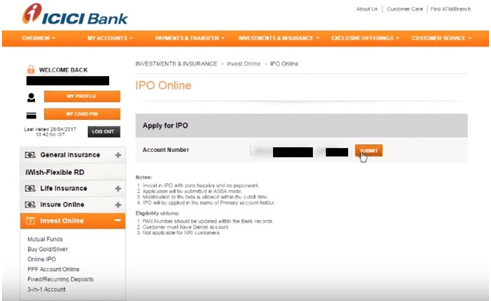

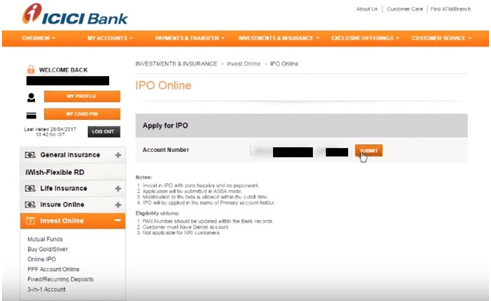

Select your account number from the dropdown and click 'submit'.

In the next screen, select the account number from which you wish to apply and click 'submit'.

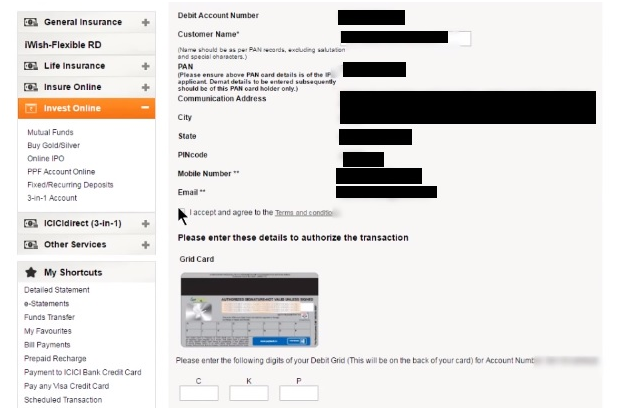

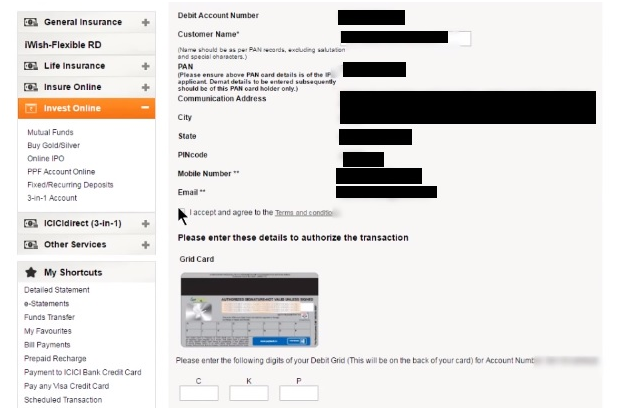

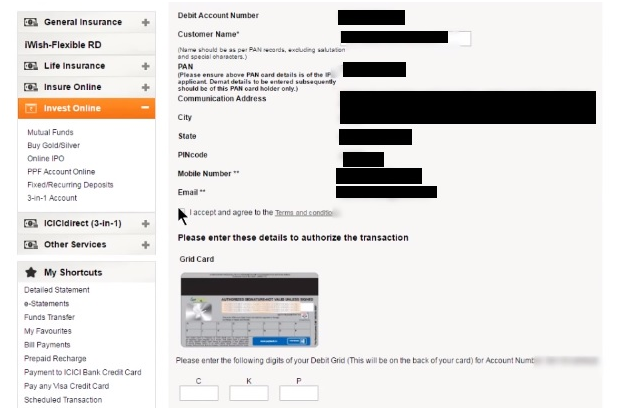

Enter and confirm your personal details and authorize your transaction.

In this screen, some of your details will be auto-filled while you need to enter some details. Check the 'terms and conditions' box and authorise the transaction using the grid printed on the backside of your debit card.

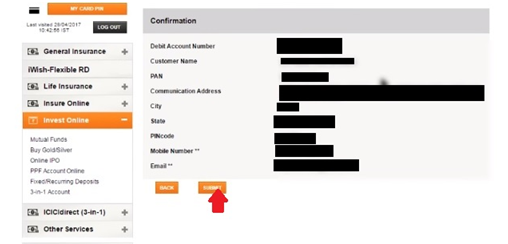

Check and confirm your details by clicking 'submit'.

Select the IPO

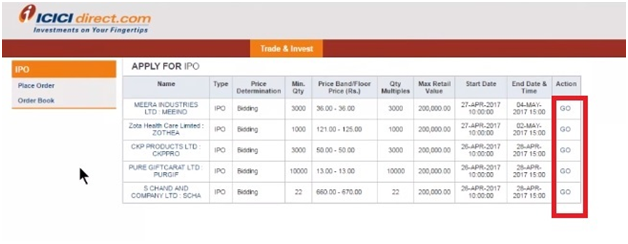

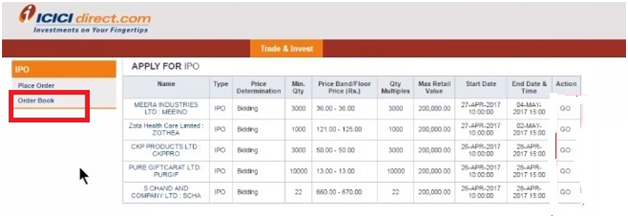

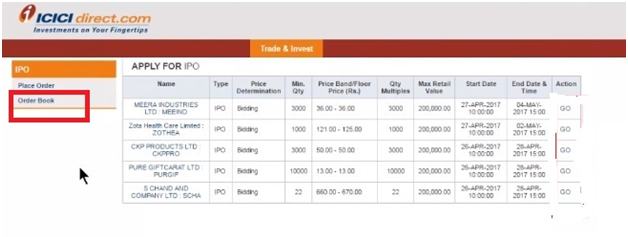

The next screen will provide you with a list of live IPOs at that time with important information like minimum quantity, price, start and closing date etc. Choose the IPO you wish to apply and click on 'Go' next to it.

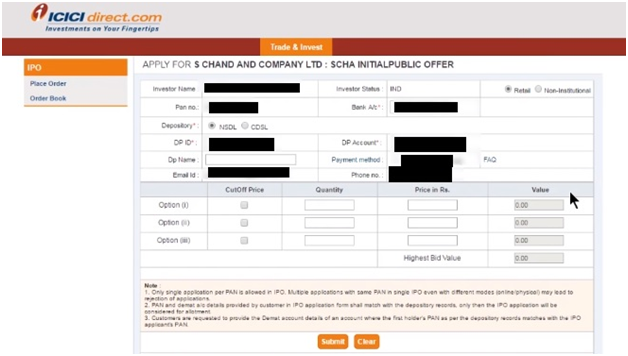

Enter IPO details and click on 'Submit'.

Enter Investor name and other details. You need to select the 'Investor Category';. Select 'retail'; if you are investing below Rs 2 lakhs and 'NII'; if above Rs 2 lakhs.

You can make up to 3 bids. Enter quantity of shares you wish to apply for. Every IPO has a minimum quantity of shares, also called market lot, to bid for and to bid more you need to do it in multiples of the minimum quantity. So if the minimum quantity is 15 shares then you can bid for 15, 30, 45 etc.

There is a checkbox for Cut Off Price. The cut-off price is useful in Book Building issues. Book building IPO issue unlike Fixed Price issue don';t have a fixed price. These issues have a price range determined by the company. Investors have to select a price within that price band. The company then decides on a price at the time of allotment and investors who have bidded for price equal to or above the decided price are allotted shares.

The cut-off price is an option given to retail investors. Opting for cut-off price means you are giving consent to buy the shares at the price decided by the company during allotment. It saves you from bidding race and ensures that you';re eligible for allotment at the price decided by the company.

After filling all the details, click on 'Submit'.

Verify and Confirm the details.

The next screen will showcase all the bid details of the IPO you have filled to verify and confirm. Check all the details and confirm. You will get a success message on confirmation.

Eligibility- Who can apply for an IPO online through ICICI Bank netbanking?

To apply for an IPO through ICICI bank net banking, you should-

Be above 18 years

Find more detail at:

Open a 3-in-1 account with Neo Plan for:

Interested in opening a trading account? Open Instant Account Now

Yes, ICICI is a member of SSCBs (Self Certified Syndicate Banks). SSCBs are allowed by SEBI to accept online IPO applications from investors. If you are a savings or current account holder with the ICICI Bank and have a demat account then you can use ASBA method to apply for an IPO using ICICI netbanking.

Yes, you can modify/edit/update your IPO application details online during the IPO bidding window. Revision is not possible after the closure of bidding process. To revise or edit details of an existing IPO in ICICI bank, take the following steps:

No, ICICI mobile app currently doesn't provide IPO application facility.

You can cancel the IPO applied using ICICI netbanking, however cancellation or withdrawal of an IPO is only allowed before the end date of the IPO bidding. To cancel or withdraw an IPO, take the following steps:

The application amount marked as lien is released in one working day after the allotment is finalized. If you are allotted shares then the amount will be credited to the company account else it will be unblocked.

You can make only one application with three bids in that application.

The ICICI Bank Online IPO Application is only for resident individuals who are ICICI Bank Net-Banking customers. The IPO applications are not allowed on behalf of a Minor.

A Minor bank account holder doesn't have access to net-banking. It is operated online using the customer ID of the guardian. Minor doesn't get a net-banking User ID or customer ID.

The Online IPO Application of ICICI bank is only for resident individuals. You cannot apply in IPO on behalf of a Corporate, HUF, Trust, Minors, etc through ICICI Bank online IPO facility.

ICICI Bank allows 1 IPO application per bank account to resident individuals only. Unlike SBI, ICICI Net-banking customers cannot apply for multiple IPO applications.

ICICI bank also doesn't offer an online IPO facility to NRI, Corporate, Trust, HUF, and Minor accounts.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|