Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

A combination of saving bank, demat and trading accounts opened together and linked to each other for hassle-free online stock market investments.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

A 3 in 1 account is a combination of 3 accounts; demat, trading and savings bank account. This stock market investment account offers the most convenient online trading experience.

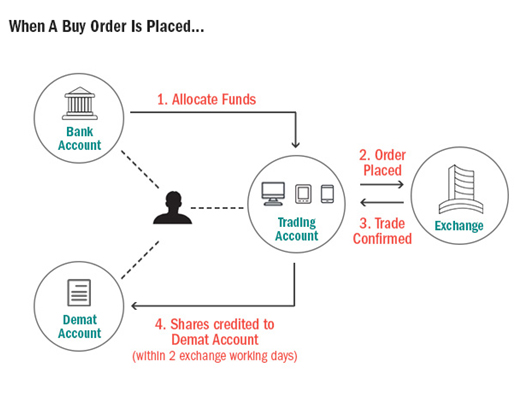

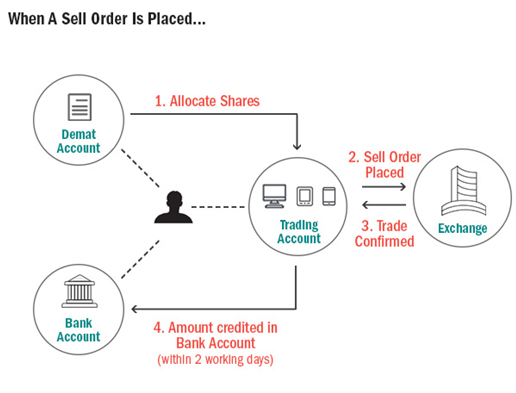

To invest in the Indian stock market, an investor should have 3 accounts:

The demat account is used to hold securities (such as shares, bonds and debentures, mutual fund units) in electronic form.

The trading account is used to buy and sell securities. These securities are credited or debited to the linked demat account.

The payment or receipt of funds for all transactions are done through the bank account linked with the trading account.

In a 3-in-1 account, all these accounts are opened together. They are linked together for seamless transactions among them.

The Best 3-in-1 Trading Account in India

This account is also known as:

Most banks in India offer the 3-in-1 accounts. Some of the popular 3-in-1 accounts include:

Answered on

A 3-in-1 account is a stock market investment account in India. It is a combination of 3 accounts which are linked together for seamless transaction among them. The 3 in 1 account consists of:

All these 3 accounts are mandatory for trading/investing in Indian stock markets. The 3 in 1 account is offered by most of the large banks in India including SBI, ICICI, HDFC, Kotak and Axis.

Read

Most banks offering 3-in-1 account asks for a Minimum Monthly Average Balance (MAB) in the saving bank account. The amount varies from the bank to the bank. For example:

|

Bank |

Minimum Balance |

|---|---|

|

ICICI Bank |

Metro and Urban locations - Rs 10,000 Gramin locations - Rs 1,000 |

|

HDFC Bank |

Metro and Urban locations - Rs 10,000 |

Note: Not maintaining the minimum balance results in penalties by the bank. For example, ICICI Bank charges a penalty of Rs 100 + 5% of the shortfall in required MAB every month. HDFC charges Rs 100 to Rs 600 per month.

Most large banks in India offer a 3-in-1 account, an account for online investment in the Indian stock market. Find a 3-in-1 account comparison page for more detail. Note that most of the 3-in-1 accounts are very similar in terms of services offered and fees. An investor should choose the bank where he is already comfortable with.

The 3-in-1 account is a stock market investment account. It is a combination of a bank, demat and trading account. Though all 3 accounts are opened and managed together, they are technically different accounts. The charges are different for each of these accounts.

Following articles provide detail about these charges:

ICICI Bank and HDFC Bank offer the best 3-in-1 account in India. They have excellent online trading and investment platforms, a wide range of products, a large network of branches and competitive charges.

As of Sept 2019, ICICI Bank has over 10 lakh and HDFC Bank has over 7 lakh active customers using the 3-in-1 accounts.

Other large players offering 3-in-1 online trading accounts include:

The benefits of a 3-in-1 account are:

While the 3-in-1 account is the most convenient way to invest in Stocks, Mutual Funds and Bonds, it also has few disadvantages:

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|