Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

-19.85% 1,869,925 Clients

ICICIdirect Account Opening Enquiry

ICICIdirect Neo Plan - Flat Rs 20 per trade brokerage (Intraday and F&O) + Free Account Opening + Get funds in 5 minutes from sell orders + Free trading tips. Open Instant Account Now

ICICIdirect account opening charges are Rs 0 (Free) for a trading account and Rs 0 (Free) for Demat account. ICICIdirect charge Rs 300 (from 2nd year) AMC for Demat account.

| Transaction | Charges |

|---|---|

| Trading Account Opening Charges | Rs 0 (Free) |

| Account AMC Charges | Rs 0 (Free) |

| Demat Account Opening Charges | Rs 0 (Free) |

| Demat AMC (Yealy) | Rs 300 (from 2nd year) |

ICICIDirect (ICICI Securities Ltd) is the largest stock broker in India offering retail trading and investment services. ICICI offers a 3-in-1 account, the most convenient way to invest in the share market in India. The 3-in-1 account is a combination of a savings bank account, trading account and demat account opened and linked together for seamless transactions between these accounts.

To invest or trade in the stock market with ICICI Bank, you have to open a 3-in-1 account with them. If you already have a demat or bank account with ICICI Bank, these can be linked to make it a 3-in-1 account. Note that with ICICI it's compulsory to open all 3 accounts with them. You cannot link other bank accounts or another demat account with the ICICI trading account.

Once you open a trading account with ICICIDirect, you can invest in Equity, IPO, Mutual Funds, Derivative Products (Equity F&O and Currency F&O), Systematic Investment Plans (SIP), Fixed Deposits, NCDs etc.

Note minimum balance of Rs 5000 (Monthly Average Balance) has to be maintained in the ICICI Bank Saving Account linked with a 3-in-1 account.

To open an account with ICICIDirect, you could follow one of the steps below:

Note that while ICICI executives say that it usually takes 2 to 3 working days for a 3-in-1 account to open once you submit all the forms and supporting documents, in most cases, it may take up to 7 working days.

Once you submit the account opening form at the ICICI Bank branch or fill out the application online, you can check the status of the account opening online by visiting the 'See Your Application Status Online' on the Customer Service page of icicidirect.com. You would need 'Application/Form Number' and 'Date of Birth' to check the application status online.

Note that it takes a minimum 2 days to update the ICICI Bank account opening status.

If you have registered online and didn't get the executive to visit your home, you can always visit the local ICICI Bank branch or call the customer services helpline to prioritize the ICICIDirect account opening process.

ICICIDirect Account Opening Forms are available in ICICI Bank branches. You could also call the ICICI Bank sales helpline to arrange an executive visit to your home and he will bring the forms along with him.

You can close the ICICIDirect trading account and the demat account. ICICIDirect trading account can be closed online and the demat account can be closed offline.

To close a demat account, follow the steps given below:

To close the ICICIDirect trading account follow the below-mentioned:

The procedure for closing an ICICIdirect trading account involves several steps. To complete the settlement of your trading account, please follow these steps:

Note:

Along with the Demat account closure form, you need to provide the following details:

Open a 3-in-1 account with Neo Plan for:

Interested in opening a trading account? Open Instant Account Now

ICICI Direct account enables customers to buy Shares, Mutual Funds, NCDs, ETFs, Loan and Insurance. It also allows customers to do intra-day and derivatives (F&O) trading at BSE and NSE stock exchanges.

ICICI Direct account is a 3-in-1 account, a combination of saving bank account, stock trading account and a demat account. The ICICI 3-in-1 account facilitates smooth trading with the real-time transfer of money from the bank to the trading account and automatic debit/credit of securities from the demat account.

ICICI Direct account also provides research reports, trading tips and recommendations to its customers for free. You could get services related to your ICICI Direct account online as well as offline through a relationship manager or a local branch.

Note that ICICI Direct doesn't offer Commodity trading at MCX or NCDEX.

You can open an ICICI Direct account online as well as offline by visiting the local branch of ICICI. ICICI opens a 3-in-1 account, which consists of a bank account, trading account and a demat account. All these 3 accounts are opening together and linked for seamless stock market investment.

ICICI offers an online 3-in-1 account opening (paperless) but it requires In-person verification (IPV) done by a local ICICI bank representative. NRI's can also open ICICI Direct NRI 3-in-1 Account online.

Steps to open an online ICICIDirect Account

If you already have a bank account with ICICI Bank and would like to open a demat and trading account with ICICI Direct, you will have to follow the old paper-based account opening process as below.

Steps to open an offline ICICIDirect Account

Steps to Check ICICIDirect Account Opening Status

Yes, you can open an ICICI Direct account online. The account is opened as a 3-in-1 account, which consists of a bank account, trading account and a demat account. The online 3-in-1 account opening is paperless but it requires In-person verification (IPV) done by a local ICICI bank representative. NRI's can also open ICICI Direct NRI 3-in-1 Account online.

Steps to open ICICI Direct Account Online

If you already have a bank account with ICICI Bank and would like to open demat and trading account with ICICI Direct, you will have to follow the old paper-based account opening process as below.

Steps to open ICICI Direct Offline

ICICIdirect accounts can be closed by submitting two separate closure forms to the ICICI branch. The ICICIdirect account closure process is offline.

Steps to close ICICIdirect account

On receipt of the account closure form by the broker, you receive an SMS with an account closure request number. You can use this unique number to track the account closure request.

It could take up to 7 days to close the account with ICICI Direct. There are no charges for account closure.

Note:

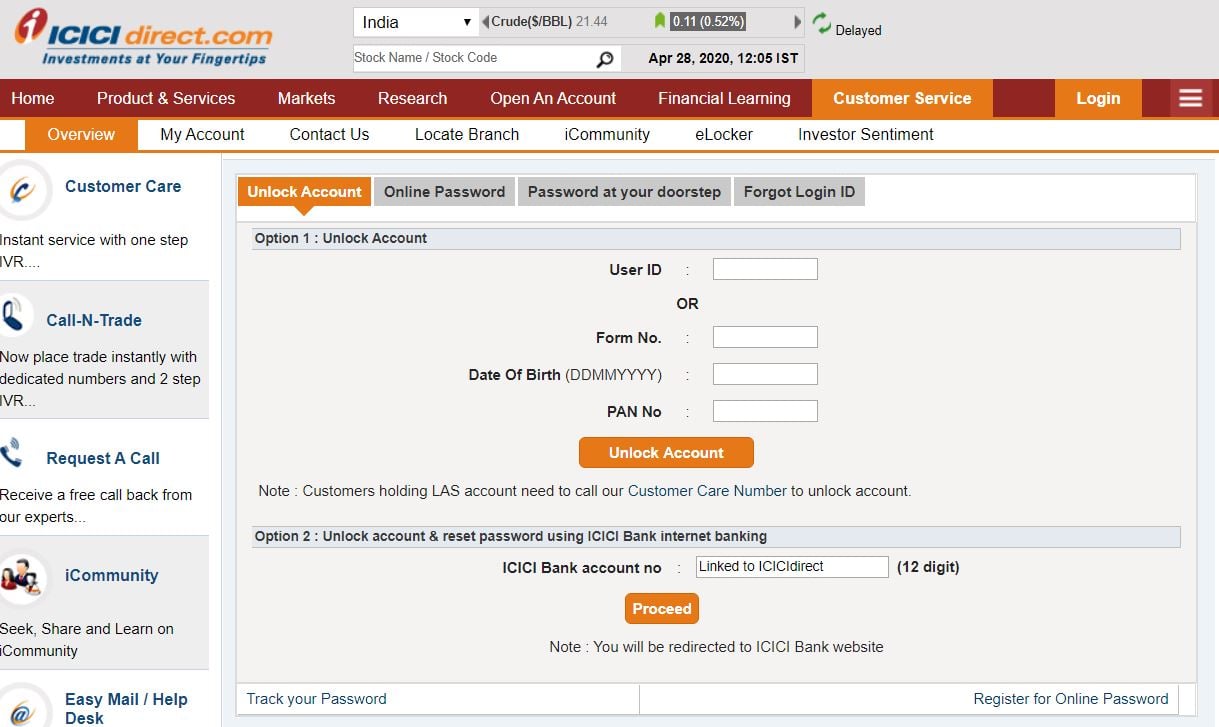

You can unlock your ICICI Direct trading account online in just a few steps.

Steps to unlock ICICI Direct Account

The ICICI Direct account gets automatically deactivated if it is not used for 6 months. However, it will continue to attract charges. So, if you are thinking of deactivating your account for a few days or a couple of months then it doesn't make much difference whether it is active or deactivated.

If you want to deactivate it for a longer period than 6 months to a couple of years then it is advisable to close the account and save on paying charges & fees.

If the customer does not do any trades for 6 months, the ICICIDirect trading account becomes 'Inactive' or 'Dormant' trading account. The account remains on the customer's name and the broker keep charging Annual Maintenance Charges (AMC) on this account. To reactivate the ICICIDIrect account, the customer has to contact ICICI Bank.

If customers are not using the ICICIDirect's trading and demat account, it is recommended to close the account to avoid almost Rs 1000 per year AMC. ICICIDirect customer may close the accounts with ICICI Securities at any point of time.

DP ID of your demat account in ICICI Direct is a depository identification number allocated to ICICI by NSDL or CDSL depositories.

The DP id is part of your demat account number which is a 16 digit alphanumeric code. The first 8 digits represent the DP ID and the last 8 digits is your client ID.

You could find ICICI Direct DP ID for your demat account by looking at your unique demat account number.

Steps to check DP ID in ICICI Direct

Example:

For demat account number IN303028 - 51120994, the DP ID is IN303028.

ICICI Direct customers can change the phone number online at any time by login into the ICICIDirect.com website or ICICI Direct mobile app. The process is simple and doesn't require you to submit any physical documents or visiting the branch.

Steps to change phone number in ICICI direct

Note:

ICICI Securities customers can change their email address online at any time by login into the ICICIDirect.com website or ICICI Direct mobile app. It doesn't require you to submit any physical documents or visiting the branch. It also can't be done on phone by customer service.

Steps to change phone number in ICICI direct

The easiest way to change your address in ICICI Direct is by visiting an ICICI Bank branch with the original PAN Card and new address proof. They will give you a form to fill, get the document attested, and take your application.

ICICI Securities customer has to fill a physical paper form to change the communication address. You cannot change the address online or by calling the call center.

Steps to change the address in ICICI direct

ICICIdirect Account Opening Enquiry

ICICIdirect Neo Plan - Flat Rs 20 per trade brokerage (Intraday and F&O) + Free Account Opening + Get funds in 5 minutes from sell orders + Free trading tips. Open Instant Account Now

Information on this page was last updated on Friday, November 17, 2023

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|