Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

-19.85% 1,869,925 Clients

ICICIdirect Account Opening Enquiry

ICICIdirect Neo Plan - Flat Rs 20 per trade brokerage (Intraday and F&O) + Free Account Opening + Get funds in 5 minutes from sell orders + Free trading tips. Open Instant Account Now

ICICIdirect is one of the largest retail stock brokers in India. It is part of the ICICI Group. It offers online trading and investment services to over 50 lakhs customers. The services offered include equity, commodity, and currency trading at BSE, NSE, and MCX. The company also offers Mutual Fund & IPO, Fixed deposits, Bond, NCD, wealth products,... ![]()

Do you have questions about ICICIdirect share trading account or ICICIdirect Demat account?

Get all your share trading doubts and questions answered by reading the ICICIdirect demat, trading account information FAQ. All ICICIdirect questions, ICICIdirect q&a, ICICIdirect faq and ICICIdirect questions and answers.

Open a 3-in-1 account with Neo Plan for:

Interested in opening a trading account? Open Instant Account Now

You can log in to your ICICI Direct account on the web, desktop and mobile app using your User ID, password, Date of Birth or PAN. The user ID and password are sent with the welcome kit. If you forgot your ID, you could get it online by visiting the customer service menu on ICICI Direct website.

Steps to Login to ICICI Direct Website

Note:

The ICICIDirect login id is your user ID to access ICICI Direct website and mobile app. The user ID along with the password is sent with the welcome mailer while opening the account. In case you forgot the login ID, you can get it online on ICICI Direct website.

Steps to get the forgot login ID in ICICI Direct

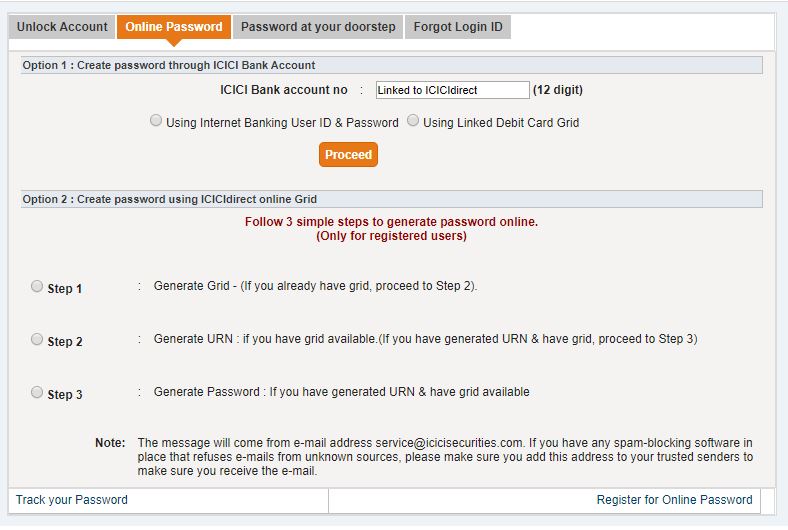

You can reset the password online by visiting ICICI Direct website or using the ICICIDirect Mobile app. You could also get the ICICI Direct password reset by calling customer service and get the password delivered at your registered address.

Steps to reset ICICI Direct password online

Steps to reset ICICI Direct password offline

To place a request for a physical password to be delivered at your address, call ICICIDirect customer service or follow the below steps:

Cash buy-in ICICI Direct is a trade that is completely funded by the trader. You have to pay the total trading amount upfront when the trade is placed and executed. It is opposite to margin buy wherein traders only need to pay a fraction of the trading amount and rest before the delivery of the shares.

Cash buy is commonly known as Equity Delivery trades or Cash & Carry trades.

ICICI Direct customers can check the bonus shares online using either ICICIDirect.com website or ICICI Direct Mobile app. You also get an intimation on your Email and SMS of bonus shares credit in your demat account.

Steps to check bonus shares in ICICI Direct

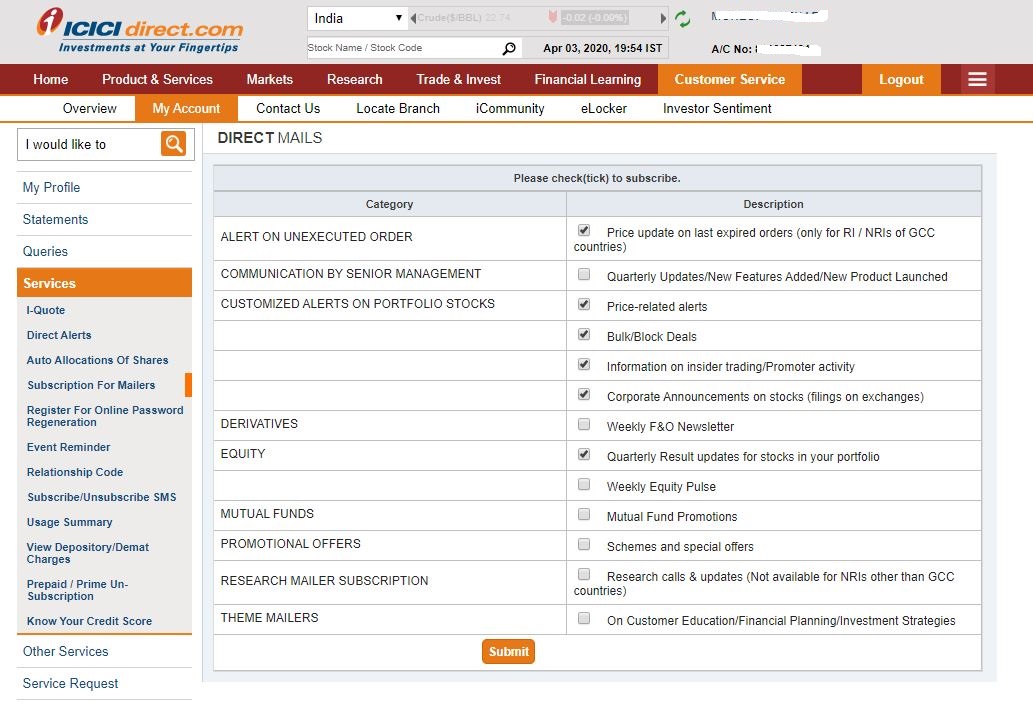

You could unsubscribe email newsletters by login into ICICIDirect.com and submitting a request to remove yourself from the mailing list.

Steps to Unsubscribe ICICI Direct Emails

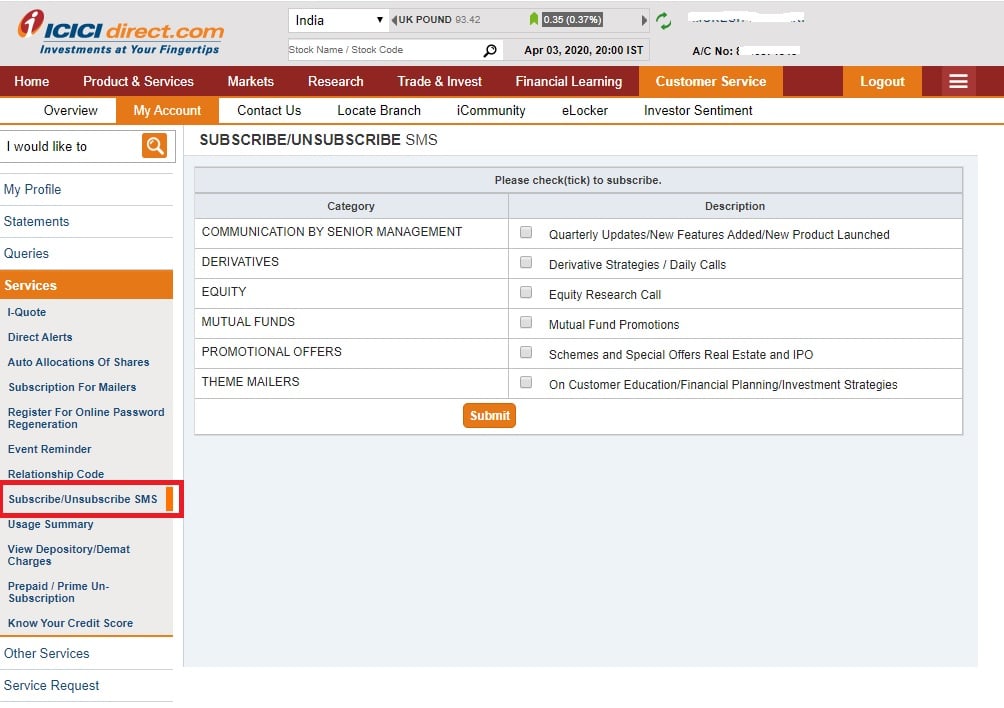

To stop SMS from ICICI Direct, login to ICICIDirect.com and submit an online request to unsubscribe from SMS by category.

Steps to stop ICICI Direct SMS Alerts

ICICI Direct provides online access to various account statements including capital gain statements to download. The capital gain statements are required for taxation.

Steps to get capital gain statements from ICICI Direct

To update the address in ICICI Direct you have to submit a paper form along with new address proofs. This cannot be done online.

Note that you can update mobile number, email and GST number online on ICICIDirect.com.

Steps to change address in ICICI Direct

The address will automatically in your demat and trading account.

Realized profit or loss in ICICI Direct is the actual profit or loss made after a trade is completed. Unrealized profit or loss is something you are making while holding the shares.

For example, say you buy 100 shares of a company at Rs 50. In a week, the price of the stock moves to Rs 60. You are still holding the shares. Your unrealized profit would be (Rs 60 - Rs 50) X 100 = Rs 1,000.

Now next week, you sell the shares at Rs 63. Whatever money you make or lose after the trade is complete is your realized profit or loss. In this case, when you sell shares at Rs 63, your realized profit would be (Rs 63 - Rs 50) X 100 = Rs 1,300.

Your DP ID is a part of your demat account number. The demat account number is a 16 digit number. The first 8 digits of the demat account number is your DP ID and the rest 8 is your client ID. To know your ICICI Direct DP ID, take the following steps:

Example:

ICICI Direct OptionPLUS is an intraday product for Options Trading wherein you can place 2 orders simultaneously.

The first will be a market/Limit order for buying Options contract and the second order is placed to limit the loss on the position by specifying the Stop Loss Trigger Price (SLTP) and a Limit Price. The system automatically places the contract order at the limit price on reaching the SLTP price.

Example:

You buy NIFTY PUT trading at Rs 20 with a strike price of Rs 7000 in the expectation that the price will rise. However, in case the price falls, you would like to limit your losses. To cover your losses, you place a limit sell order specifying a Stop loss trigger price of Rs 15 and a limit price of Rs 10. Once the contract price touches or crosses Rs 15, the order gets converted into a limit sell order at Rs 10.

Steps to place ICICI Direct OptionPLUS order

Note that only selected contracts are available under the OptionPLUS facility.

FuturePLUS is an intraday product in the F&O segment. The facility is available in selected stocks. It is available in 2 versions:

In this, you can take buy/sell positions in future contracts with the intention of squaring off the position on the same day. In FuturesPLUS, you need to deposit less margin than normal Futures trades.

In this facility, you place two orders simultaneously, a market/Limit order to take a position in the market and a second order to limit your loss by specifying the Stop Loss Trigger Price (SLTP) and a Limit Price.

Steps to place ICICI Direct FuturePLUS with SL Limit Margin product

You can place both Fresh and Cover SLTP orders simultaneously from the same page.

The ICICI Direct order book provides details like price, quantity and status etc of the orders placed by you. The report is updated in real-time. You can also modify or cancel unexecuted orders from the order book.

The ICICI Direct Trade Book provides details of only the executed orders. The details are updated on a real-time basis. It also contains details of the money required to be paid for each order.

ICICI Direct account can only be closed offline by following the below steps:

Ensure that all holdings & positions are cleared off and settled before submitting an account closure request. Also, there should be no unpaid dues on your account.

ICICIdirect charges Rs 0 (Free) Annual Maintenance Charge (AMC) for a trading account and Rs 300 (from 2nd year) for a Demat account. AMC is charged to maintain the accounts.

ICICIdirect charge 0.55% for equity delivery trade. These trades are also known as cash & carry trades or CNC.

Espresso customer also has to pay taxes, demat debit transaction fee (Rs 13.5 per trade) and exchange transaction charges.

ICICIdirect charge Rs 20 per order for intra-day trades. These orders are also known as Margin Intraday Square-up or MIS orders. All open intraday orders are auto squared-off at the end of the day. Extra leverage is offered for these trades.

In addition you have to pay taxes and exchange transaction charges.

ICICIdirect charge Rs 0 (Free) for equity, currency and commodity futures trading.

ICICIdirect charges Rs 20 per order for equity, currency and commodity options trading. Options are highly leveraged derivative products. Options trading is used in many ways including hedging or to reduce the risk exposure of the portfolio.

ICICIdirect brokerage charges for commodity futures is Rs 20 per order and commodity options is Rs 20 per order. Commodities futures are agreements to buy or sell raw material (food, energy or metal) at a specific date in the future at a particular price. Commodity options contracts are the right to buy (call option) or sell (put option) underlying commodity futures at predetermined prices on the date of contract expiry.

ICICIdirect charge Rs 20 per order for currency futures trading and Rs 20 per order for currency options trading.

Transaction Charges (or Exchange Turnover Charges) is a fee charged by the stock exchanges for trades done through them. Most brokers include clearing charges to it. These charges can be seen in the contract note.

| Segment | Transaction Fee |

|---|---|

| Equity Delivery | NSE Rs 325 per Cr (0.00325%) | BSE Rs 375 per Cr (0.00375%) (each side) |

| Equity Intraday | NSE Rs 325 per Cr (0.00325%) | BSE Rs 375 per Cr (0.00375%) (sell side) |

| Equity Futures | NSE Rs 190 per Cr (0.0019%) | BSE Rs 0 |

| Equity Options | NSE Rs 5000 per Cr (0.05%) | BSE Rs 3700 per Cr (0.037%) (on premium) |

| Currency Futures | NSE Rs 90 per Cr (0.0009%) | BSE Rs 90 per Cr (0.0009%) |

| Currency Options | NSE Rs 4000 per Cr (0.04%) | BSE Rs 100 per Cr (0.001%) (on premium) |

| Commodity | Group A - Rs 260 per Cr (0.0026%) |

Yes. ICICIdirect offers online IPO applications to its customers. Initial Public Offer (IPO) offers an early opportunity to buy shares of companies that are not previously traded publicly.

Yes. You can buy/sell Mutual Funds if you have an account with ICICIdirect.

Yes. ICICIdirect provide margin funding.

ICICIdirect auto square-off all open intraday positions at 3:30 PM.

Yes. ICICIdirect provide trading tips for stock and commodity trading to its customers.

ICICIdirect Account Opening Enquiry

ICICIdirect Neo Plan - Flat Rs 20 per trade brokerage (Intraday and F&O) + Free Account Opening + Get funds in 5 minutes from sell orders + Free trading tips. Open Instant Account Now

Information on this page was last updated on Friday, November 17, 2023

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|