Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

6.65% 7,884,365 Clients

Zerodha Account Opening Enquiry

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Zerodha is India's leading stockbroker. It is among the largest and most reputed brokers offering online flat fee discount brokerage services to invest in Equity, Currency, Commodity, IPO, Futures & Options, Bonds, Govt. Securities, and Direct Mutual Funds.

Zerodha charges Rs 0 brokerage for equity delivery trades and direct mutual funds. For intr... ![]()

Do you have questions about Zerodha share trading account or Zerodha Demat account?

Get all your share trading doubts and questions answered by reading the Zerodha demat, trading account information FAQ. All Zerodha questions, Zerodha q&a, Zerodha faq and Zerodha questions and answers.

This is a limited time offer. Open an instant Zerodha account online and start trading today.

To trade or invest in India Stock Market, you need 3 accounts; trading, demat and bank account. Zerodha offers trading and demat accounts. The Zerodha trading account is required to place buy & sell orders. The Zerodha demat account is required to hold bought securities in electronic form. Both trading and demat accounts are linked to the bank account (with any bank).

Zerodha is an online discount broker. Discount brokers are those brokers who offer only online broking services at a very low-cost. They use the latest computer technology to offer online trading services to millions of customers. They usually do not offer many add-on services like research, advisory, portfolio management, neighborhood branches, personal relationship managers, etc. The brokerage charge for discount brokers is significantly less than traditional full-service brokers.

Find more detail at:

Zerodha is an online discount broker that offers both trading and demat accounts. These accounts are for trading in stocks, derivatives and bonds, etc. The demat account also holds Mutual Funds. Zerodha offers a 2-in-1 account which is a combination of trading and demat accounts linked together for seamless online transactions.

Yes, Zerodha offers trading in forex (currency). You can trade in currency derivatives at BSE and NSE exchanges using the Zerodha trading account. The customer has to enable the Currency trading segment before start trading in the currency.

Yes, Zerodha offers brokerage free equity delivery trading and Mutual Fund investment. Brokerage for Intra-day and F&O trading charged at Rs 20 per executed order 0.03% whichever is lower.

Note:

Check Zerodha Brokerage Charges for more detail.

Zerodha is a privately held company. It is not listed in any stock exchange.

However, it is a registered member of SEBI, NSE, BSE, MCX, NCDEX and CDSL. Zerodha Commodities Pvt. Ltd. is a subsidiary of the company.

Zerodha works on an online discount brokerage model wherein only online trading services are offered to customers. It heavily uses technology to serve its customers and has very few branches & offices. Technology helps them to scale and reduce the operational cost which in-tern helps them to maintain huge profits despite offering low-cost trading.

Zerodha means No-barriers.

Zerodha is made of two words; Zero and Rodha. Rodha is a Sanskrit word. It means barrier (blockade, obstacle, hurdle or difficulty).

The word Zerodha shows the company's commitment to offering the cheapest brokerage to Indian investors.

Zerodha started its brokerage business on 15th August 2010.

Yes, Zerodha is good for long term investors. It offers Equity delivery brokerage at free that brings down the trading costs thereby helping a lot of money in the long term. Zerodha also offers commission-free direct mutual funds which result in additional earning of 1% yearly.

Zerodha doesn't offer home pickup of account opening forms. You will have to courier the forms to Zerodha Bangalore office. The forms can be filled online.

No, Zerodha doesn't give interest on the money held in the trading account. Zerodha also doesn't accept personal FDs as margin for trading.

Once Zerodha receives the form; the equity trading and commodity trading accounts are opened within 48 hours.

The Zerodha customer support is open till 2:00 PM on Saturdays. The sales and customer service don't work on Sundays and Market Holidays.

Zerodha is an online broker. Almost all its services are offered online.

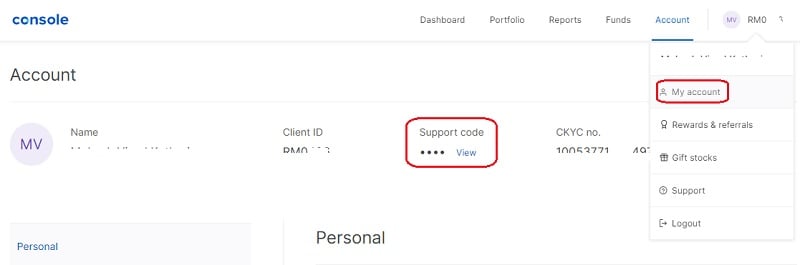

The Zerodha 4-digit support code (Z Pin) is a customer's personal identification for placing orders through the Call & Trade desk and for raising support requests. The support code is the new name for the telephone code (Z Pin).

Every time you call Zerodha customer support or Call & Trade desk, you need to authenticate yourself using the support code to allow faster customer support.

The support code gets assigned at the time of account opening. You can find your support code under your profile in Console/Kite. You can reset the support code any time by logging in to Console from your Account page by clicking on View and Reset under the Support Code tab.

F&O trading in Zerodha is trading in derivatives (Futures & Options) contracts. In F&O trading, the contracts for the underlying asset like stocks are bought and sold. You can trade in the equity, currency and commodity derivatives with Zerodha.

To change the bank account linked with your Zerodha account, you need to submit the 'Account Modification Form' along with a bank proof document. Here are the steps to change Zerodha bank account-

Zerodha charges Rs 0 (free) brokerage on equity delivery trades and Mutual Fund investments. It charges flat Rs 20 or 0.03% (whichever is lower) per executed order brokerage for trading in Intraday and F&O across Equity, Currency and Commodity segments.

Zerodha Charges

|

Trading Segment |

Brokerage Fee |

|---|---|

|

Equity Delivery |

Zero Brokerage |

|

Equity Intraday |

Flat Rs 20 or 0.03% (whichever is lower) per executed order |

|

Futures (Equity/Currency/Commodity) |

Flat Rs 20 or 0.03% (whichever is lower) per executed order |

|

Options (Equity/Currency/Commodity) |

Flat Rs 20 per executed order (on Turnover) |

|

Mutual Fund |

Rs 0 (Free Unlimited Direct MF) |

Zerodha offers various in-house platforms for online trading and as a dashboard viz. Kite, Coin and Console.

Note: Zerodha doesn't provide installable trading terminals.

UCC in Zerodha stands for Unique Client Code. Every Zerodha customer gets a UCC which helps the system and exchanges identify the customer. Recently, SEBI has asked brokers to map UCC with the demat accounts.

Yes, Zerodha provides advance technical charts on its free Kite trading platform. Technical charts offered in Kite are among the best in the industry.

Zerodha offers 3 fund transfer options. Before you transfer the funds please note:

Zerodha Kite

Kite is Zerodha's flagship trading platform. To transfer funds (Pay-in or pay-out) using kite follow below steps:

Console

Zerodha back-office 'Console' provides a facility to check statements and withdraw funds from the Zerodha trading account. Follow the below steps to manage your funds through the console:

NEFT/RTGS from Bank Account

You can transfer funds to your trading account from any linked bank account [Only Zerodha Linked Bank Account] using NEFT/RTGS fund transfer facility from your banks net banking facility.

To transfer funds from your linked bank, you have to add Zerodha as a payee and then transfer funds. Once Zerodha is confirmed as a Payee, you need to make an online fund transfer and send them an email [to fundtransfer@zerodha.com] giving Zerodha the details of the transaction reference number. Zerodha will update your trading limits as soon as the funds are available in its account and send you an SMS confirming the same.

Zerodha Bank Account for NSE/BSE (Equity, F&O, Currency)

Zerodha Bank Account for MCX (Commodities)

No, Zerodha doesn't offer a trading account on minor's name.

No, Zerodha doesn't charge any fee if the instant fund transfer fails in-between for any reason.

Note that Equity delivery brokerage is Rs 0 with Zerodha. So you don't pay anything.

For intraday, the brokerage is charged for every 'successfully executed order'.

In the example you gave above, if both the transactions are part of 1 order then you pay only Rs 20. It doesn't matter how many transactions order is completed in exchange.

If they are part of different orders placed, then separate brokerage of Rs 20 for each order is charged.

SMS facility is optional and charged at Rs 1 per SMS sent.

It doesn't matter as long as you have enough 'margin money' to trade.

Zerodha required its customers to open a demat account along with a trading account. Zerodha doesn't allow linking its trading account with a demat account from some other depository participant (DP).

Note:

No. you don't have to keep any minimum balance in Zerodha Trading Account.

Yes, BTST (buy today - sell tomorrow) facility is available with Zerodha. This facility allows traders to sell shares (bought using equity delivery order type) before they deposited into your demat account on T+2 days.

No, STST(sell today buy tomorrow) facility is not available with Zerodha in the equity cash segment. This facility allows customers to sell the shares in the cash segment (shares which are not in his demat account) and buy them the next day.

The STBT facility can be used while trading in Equity futures and Commodity futures by maintaining normal margin amounts required to take this position. These short positions can be either squared off the next day or held till expiry.

No. None of the online stock brokers offers CDSL Easiest facility to its customer. The reason is, when you register for CDSL Easiest, the broker loses the POA (Power of Attorney) over your Demat Account. This means that you cannot sell shares from your holdings using your trading platform because the broker will no longer be able to debit your shares from Demat.

They recommend using DIS (delivery instruction slips) for share transfers to another Demat account.

Note that CDSL Easiest is to submit off-market, on-market, inter-depository and early pay-in debit instructions from their DEMAT account using CDSL online portal.

You can transfer shares from Zerodha demat account to another broker using delivery instruction slips provided by Zerodha. If you are closing your demat account with Zerodha, you could request the transfer of existing holdings in the account closure form itself.

To transfer shares in an off-market transaction, you have to fill the paper slips, sign it, and send it to the Zerodha office for this. Zerodha customer can request for DIS slips by sending a signed form available in the download section of their website.

Zerodha doesn't offer an online transfer of shares from its demat account for off-market transactions.

Buying stocks on Zerodha is a simple and easy process. You can buy stocks in Zerodha through the Zerodha Kite website or mobile app.

Steps to buy stocks on Zerodha:

Zerodha provides a powerful trading platform called Kite that allows to buy and sell shares in Zerodha. To access Zerodha Kite website or mobile app, you need to open a trading and Demat account with Zerodha.

To buy and sell in Zerodha, you need to add the scrips to your market watchlist and place the required buy/sell orders for desired scrips. You can place a market order, limit order, stop-loss, or stop loss market order on a delivery or intraday basis (CNC/MIS).

You can buy today and sell tomorrow (BTST) in Zerodha. However, Zerodha does not allow STBT (Sell Today Buy Tomorrow). You need to have shares in your Demat account before you place a sell order on a delivery basis.

Zerodha charges Rs 0 (Free) Annual Maintenance Charge (AMC) for a trading account and Rs 300 for a Demat account. AMC is charged to maintain the accounts.

Zerodha charge Rs 0 (Free) for equity delivery trade. These trades are also known as cash & carry trades or CNC.

Espresso customer also has to pay taxes, demat debit transaction fee (Rs 13.5 per trade) and exchange transaction charges.

Zerodha charge Rs 20 per executed order or .03% whichever is lower for intra-day trades. These orders are also known as Margin Intraday Square-up or MIS orders. All open intraday orders are auto squared-off at the end of the day. Extra leverage is offered for these trades.

In addition you have to pay taxes and exchange transaction charges.

Zerodha charge Rs 20 per executed order or .03% whichever is lower for equity, currency and commodity futures trading.

Zerodha charges Rs 20 per executed order for equity, currency and commodity options trading. Options are highly leveraged derivative products. Options trading is used in many ways including hedging or to reduce the risk exposure of the portfolio.

Zerodha brokerage charges for commodity futures is Rs 20 per executed order or .03% whichever is lower and commodity options is Rs 20 per executed order. Commodities futures are agreements to buy or sell raw material (food, energy or metal) at a specific date in the future at a particular price. Commodity options contracts are the right to buy (call option) or sell (put option) underlying commodity futures at predetermined prices on the date of contract expiry.

Zerodha charge Rs 20 per executed order or .03% whichever is lower for currency futures trading and Rs 20 per executed order for currency options trading.

Transaction Charges (or Exchange Turnover Charges) is a fee charged by the stock exchanges for trades done through them. Most brokers include clearing charges to it. These charges can be seen in the contract note.

| Segment | Transaction Fee |

|---|---|

| Equity Delivery | NSE Rs 297 per Cr (0.00297%) | BSE Rs 375 per Cr (0.00375%) (each side) |

| Equity Intraday | NSE Rs 297 per Cr (0.00297%) | BSE Rs 375 per Cr (0.00375%) (sell side) |

| Equity Futures | NSE Rs 173 per Cr (0.00173%) | BSE Rs 0 |

| Equity Options | NSE Rs 3503 per Cr (0.03503%) | BSE Rs 500 per Cr (0.005%) (on premium) |

| Currency Futures | NSE Rs 35 per Cr (0.00035%) | BSE Rs 45 per Cr (0.00045%) |

| Currency Options | NSE Rs 3110 per Cr (0.0311%) | BSE Rs 100 per Cr (0.001%) (on premium) |

| Commodity | Group A - Rs 260 per Cr (0.0026%) |

Yes. Zerodha offers online IPO applications to its customers. Initial Public Offer (IPO) offers an early opportunity to buy shares of companies that are not previously traded publicly.

Yes. You can buy/sell Mutual Funds if you have an account with Zerodha.

No. Zerodha doesn't provide margin funding.

Zerodha auto square-off all open intraday positions at Eq Cash: 3:15 PM | Eq F&O : 3:25 PM | Currency: 4:45 PM | Commodities: 25 min before close.

No. Zerodha doesn't provide trading tips for stock and commodity trading to its customers.

Zerodha Account Opening Enquiry

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Zerodha Order Types & Product Types Explained

Zerodha Order Types & Product Types Explained Zerodha Account Closure Online - Explained

Zerodha Account Closure Online - ExplainedInformation on this page was last updated on Friday, October 4, 2024

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|