Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Monday, June 21, 2021 by Chittorgarh.com Team

Zerodha Account Opening

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

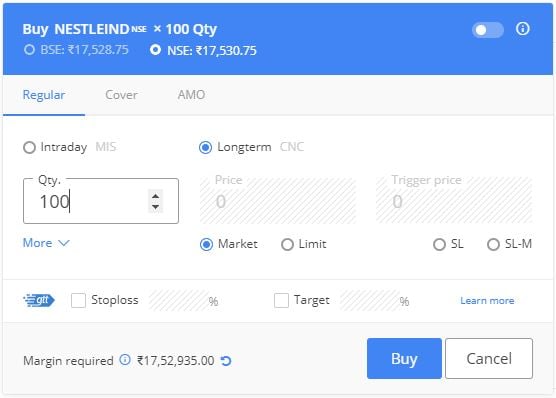

Zerodha offers various order types and product types to choose from while executing the buy/sell orders. The order type and product type help specify instructions/methods an investor wishes to adopt while placing an order. You can select the order type and product type that best suits your trading objective.

Zerodha Kite has all the basic order types like Market Order, Limit Order, and Stop-loss order. It also has other advanced order types like Cover Order and Good Till Triggered (GTT) orders and validity orders like day order and IOC order. Zerodha Kite does not provide Bracket Orders.

Order Types in Zerodha Kite

|

Order Type |

Parameters to Input |

Order Type Detail |

|---|---|---|

|

Market Order |

• Quantity |

• Zerodha does not allow market orders for option stocks. |

|

Limit Order |

• Quantity • Price |

• A limit order gets executed as a market order when • Buy Limit Price > Best available offer price. • Sell Limit Price < Best available bid price |

|

Stop-loss order (SL) |

• Quantity • Price • Trigger Price |

• For Sell SL orders, Trigger Price > Limit Price • For Buy SL orders, Trigger Price < Limit Price • Zerodha does not offer a trailing stop-loss order. |

|

Stop-loss market (SL-M) order |

• Quantity • Trigger Price |

• Zerodha does not allow SL-M orders for options stocks. |

|

GTT |

• Quantity • Limit Price • Trigger Price • Stop Loss • Target Price (Trade parameters may vary based on the basic order type chosen) |

• Allowed only for Equity Delivery, Bank Nifty, and Nifty F&O contracts. |

|

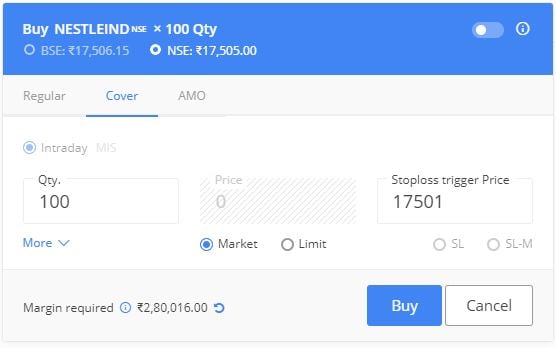

Cover Order |

• Quantity • Stoploss trigger • Price (based on whether it is a limit order or market order) |

• Allowed only for intraday trading. • Allowed only for NSE. • Not allowed for stock options and currency options. |

|

Regular Order |

• Based on the order type chosen i.e., limit, market, or stop loss |

• Used to place an order during pre-market, market hours and post-market hours. |

|

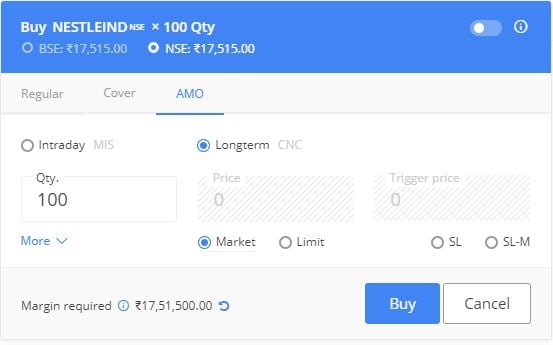

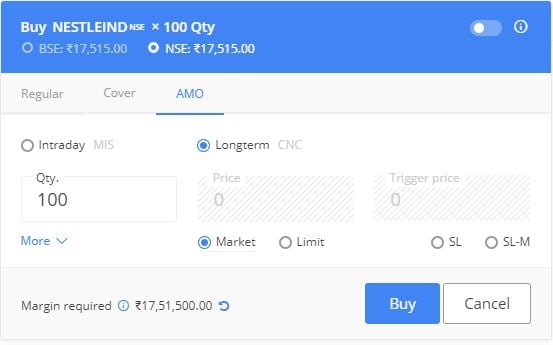

AMO order |

• Based on the order type chosen i.e., limit, market, or stop loss |

• Cannot be used to place orders during market hours. • No additional charges to placed AMO order in Zerodha • Not allowed for Cover Order • On weekends and trading holidays, AMO orders can be placed at any time. |

|

Day Order |

• Based on the order type chosen i.e., limit, market, or stop loss |

• Remains valid till the end of trading hours |

|

IOC |

• Based on the order type chosen i.e. limit, market, or stop loss |

• Useful to place an order in large quantities. • Gets cancelled immediately if not executed. |

|

Basket Order |

• Based on the order type chosen i.e. limit, market, or stop loss |

• Can place a maximum of 20 baskets with 20 trade orders in each basket. |

A market order in Zerodha helps to execute an order instantly at the prevailing market price. In a market order, you do not need to input many trade parameters. You are required to specify only the transaction type as Buy/Sell and enter the quantity.

The market orders in Zerodha can be placed as intraday market orders or for delivery-based trading with or without stop loss. Zerodha does not allow market orders for option stocks.

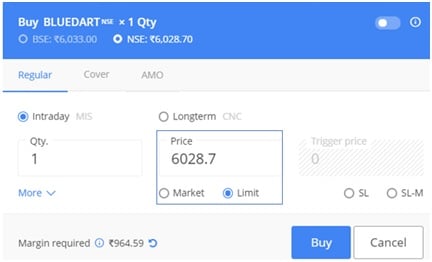

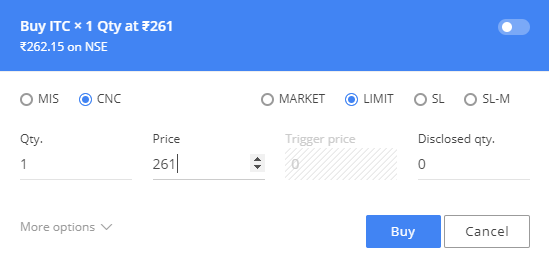

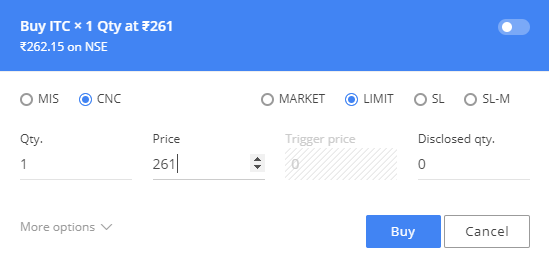

A limit order in Zerodha helps to place an order at a preferred price. Using a limit order, you get/exit the stock at a price as expected or a better price. However, order execution is not guaranteed.

In a limit order, along with transaction type and quantity, you also need to specify the limit price at which you would like the transaction to get executed.

Points to remember:

A limit order gets executed as a market order when

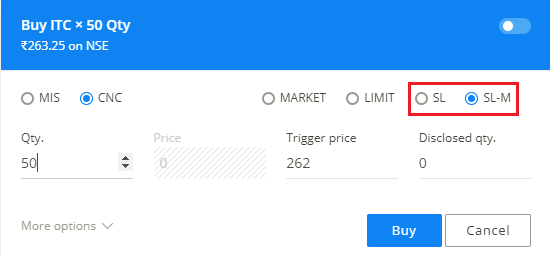

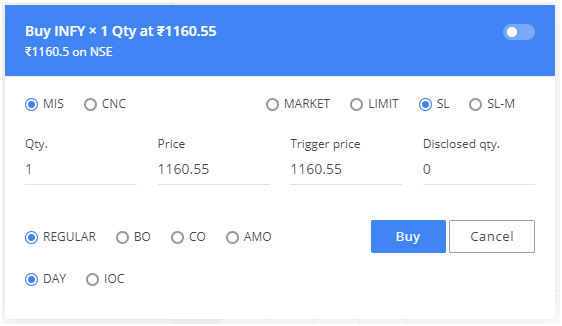

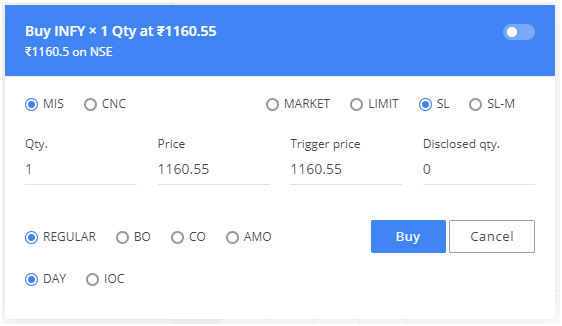

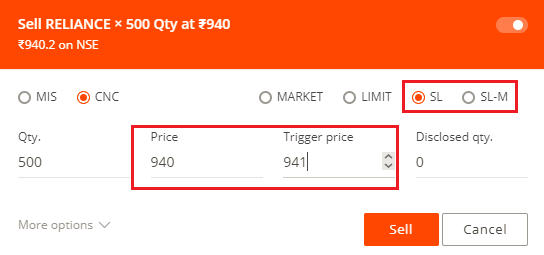

A stop-loss order in Zerodha helps to place an order at a preferred price with a stop-loss to limit the losses. You are required to input the below trade parameters in an SL order:

When the trigger price gets breached, the SL order gets placed with the exchange as a limit order. Zerodha rejects the SL order if the trigger price and limit price do not get set up correctly.

The rule for Trigger Price and Limit Price in an SL order:

Zerodha does not offer a trailing stop-loss order.

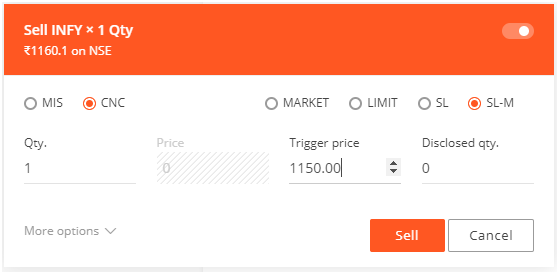

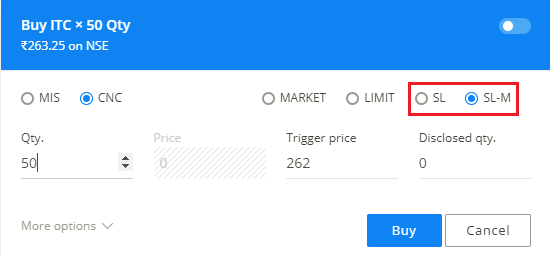

A stop-loss order can be placed as a stop-loss market order in Zerodha.

In an SL-M order, you need to input only the trigger price. You do not have to specify the trade price. Once the trigger gets breached, the order gets placed with the exchange as a market order.

Zerodha does not allow SL-M orders for stock options.

AMO order is an order placed after the market hours. There are no additional charges to place an AMO order in Zerodha. You can place AMO orders for any segment, product type, and exchange.

AMO order timings in Zerodha

|

Segment |

AMO Order Timings |

|---|---|

|

Equity |

3:45 PM to 8:57 AM for NSE, [3:45 PM to 8:59 AM for BSE] |

|

Currency |

3:45 PM to 8:59 AM |

|

Futures & Options |

3:45 PM to 9:10 AM |

|

Commodity (MCX) |

Anytime during the day |

A cover order in Zerodha is an advanced order type that has an in-built risk mitigation mechanism to reduce the risk of unlimited loss. In a cover order, two individual orders (a limit/market order and a Stop loss order) get placed simultaneously.

To place a cover order in Zerodha, you need to input:

Points to note:

Zerodha provides a unique facility to its customers to place GTT orders for Equity Delivery and Nifty and Bank Nifty F&O contracts. You need to set a trigger condition in GTT order that remains valid for a year or till the trigger condition gets hit, whichever is earlier. GTT order is an alternate to GTC order. Zerodha is the only broker in India to provide GTT orders.

Read GTT in Zerodha for more details.

The basket order in Zerodha offers its customers to place multiple orders at one go. You can place a maximum of 20 baskets per client ID with 20 trade orders in each basket.

The basket order feature in Zerodha is available in the Orders tab in Zerodha Kite web and mobile app.

Steps to place basket order in Zerodha:

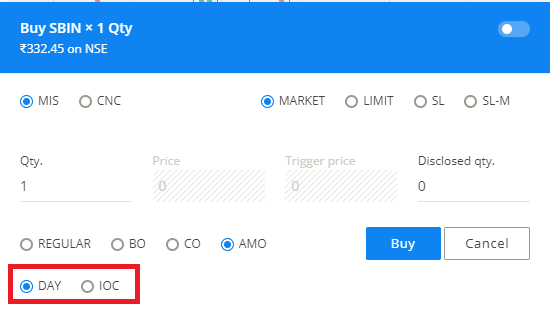

The validity orders in Zerodha decide the time till which the trade order remains open in the market. There are two types of validity order:

To find the validity order in Zerodha, click on More in the order window.

A day order remains valid till the end of the trading day.

As the name reads, the IOC order gets immediately released into the market on its placement. If there is no matching order found, the IOC order gets auto-cancelled at the same time. The IOC order in Zerodha is generally beneficial in placing orders in large quantities.

The product types help to specify whether you intend to do intraday trading or delivery-based trading. You can find the product codes in the order window while placing a buy or sell order. There are three product codes available in Zerodha.

Product Types in Zerodha

|

Zerodha Product Types |

Features |

|---|---|

|

CNC - Cash and Carry |

• Used for Equity delivery trading • No leverage offered. • Cover Order not allowed • Intraday brokerage applicable if trades are squared off the same day. |

|

MIS - Margin Intraday Square off |

• Used for intraday trading. • Trades get auto-squared if positions are not squared off within stipulated timelines. • Auto square-off charges get applied. • Decent leverage facility offered. |

|

NRML |

• Used to take an overnight position in F&O. • No leverage offered. |

The CNC product type in Zerodha gets used for delivery-based trading in the Equity segment. There is no leverage available for CNC product code. You need to maintain 100% of trade value as an upfront margin before placing orders with CNC codes. You cannot place a sell order in Zerodha using CNC product code if you do not hold shares in your Demat account. However, Zerodha allows BTST trading using CNC product code that utilizes T1 holdings.

CNC order charges in Zerodha

There are no brokerage charges for CNC trading in Zerodha. However, if you square off the trades on the same day, intraday brokerage gets applied.

MIS order in Zerodha gets used for Intraday trading in Equity, F&O, and Commodity. You can avail yourself up to 6 times of leverage for Equity trading and up to 1.3 times for F&O trading. You cannot use MIS to trade in currency options.

The MIS positions get auto-squared off 10 to 15 minutes before the market gets closed. Zerodha charges Rs.50 as auto square off charges per squared-off position.

Zerodha Auto Square off Timings

|

Segment |

Timing |

|---|---|

|

Equity |

3:20 PM |

|

F&O |

3:25 PM |

|

Currency Derivatives |

4:45 PM |

|

Commodity |

25 minutes before market close |

MIS order charges in Zerodha

When you place an MIS order in Zerodha, you get charged with a lower of Rs. 20 or 0.03% of trade value as intraday brokerage.

The NRML product code is used to take an overnight position in F&O and Currency. The trades with NRML product code do not auto squared off. You do not get any leverage to trade using NRML product code.

Zerodha allows order placement during the pre-market hours, regular market hours, and after the market hours.

Pre-market orders are placed between 9:00 AM to 9:15 AM when NSE and BSE conducts a pre-market session. These orders are only available in the Equity Segment.

Zerodha Pre-Market Orders Timing

|

Transaction |

Timing |

|---|---|

|

New order, modify or cancel the order |

9:00 AM and 9:08 AM (8 Minutes) |

|

Orders matched and trades confirmed |

9.08M to 9.15 AM |

Technically you can place orders only for the first 8 minutes.

A regular order in Zerodha is the order put during the normal market/pre-market hours of 9.00 AM to 3.30 PM. A regular order can be either a market order, limit order, stop-loss order, stop-loss market order, cover order placed for intraday or delivery trading,

You can also place regular orders in Zerodha in the closing session of 3.40 PM to 4.00 PM for Equity delivery trades using the CNC product type. The orders placed in the closing session get placed with the exchange at the closing price. The post-trading session is, however, not very active.

An AMO order is an order placed after the market hours. You can place AMO orders in Zerodha for any segment, product type, and exchange.

Zerodha After Market Order Timings

|

Segment |

AMO Order Timings |

|---|---|

|

Equity |

3:45 PM to 8:57 AM |

|

Currency |

3:45 PM to 8:59 AM |

|

Futures & Options |

3:45 PM to 9:10 AM |

|

Commodity (MCX) |

Anytime during the day |

A Zerodha after-market order charge is Rs 0 (Free). Zerodha doesn't charge any additional fee for placing AMO orders.

Zerodha order types and product types help the customers to achieve their trading objective. Zerodha has all the basic order types like limit order, market order, and stop-loss orders. All other types emerge from these basic order types. The product type decides the leverage offered to you and the order type decides your entry and exit point in trade.

This is a limited time offer. Open an instant Zerodha account online and start trading today.

Order type in Zerodha is a set of specific instructions used while placing trade orders to enter or exit a trade as per trading goals.

Zerodha has basic order types like limit, market, and stop-loss orders. It also offers advanced order types like Cover Order and GTT. The order types in Zerodha are available in the order window.

You can also place orders in Zerodha anytime during the day as regular orders or after-market orders.

The product type in Zerodha decides the extent of leverage offered to you for trading.

There are three product types available in Zerodha:

CNC product type is used for equity delivery trading (trade to take the delivery of shares in demat account or sale shares from your demat holdings). There is no leverage offered for CNC trades. The CNC trade is offered brokerage-free at Zerodha.

MIS product type is used for intraday trading. Trades get auto-squared if positions are not squared off within stipulated timelines. Decent leverage facility offered.

NRML product type is used to take overnight position in F&O. There is no leverage offered for NRML product type at Zerodha.

A regular order in Zerodha is an order placed during the market hours or the pre-market hours.

You can place a regular MIS or CNC order in Zerodha using any of the Basic or advanced order types in Zerodha like Limit order, Market order, Stop-loss order, GTT order as day order, or IOC order.

A Normal order in Zerodha refers to an order placed using the NRML product code.

The NRML product code is used for overnight trading of Futures & options and Currency. You do not get any leverage for trading using the NRML product code.

You can place a sell MIS order in Zerodha even when you do not have stock in your Demat account. However, you need to ensure to square off the position within the stipulated timeline.

If you have placed an MIS buy order first, you need to sell your MIS order in Zerodha within the timelines stated below. If you do not square off your MIS open position within the stated timelines, Zerodha auto squares off the open positions and charges Rs.50 per position squared off.

|

Segment |

Auto Square-off Timings |

|---|---|

|

Equity |

3:20 PM |

|

F&O |

3:25 PM |

|

Currency Derivatives |

4:45 PM |

|

Commodity |

25 minutes before market close |

NRML in Zerodha stands for NORMAL orders. NRML is a product code used for overnight trading of Futures & options and Currency.

When you use the NRML product type, you do not get any excess leverage for trading. The trades with NRML code do not get auto-squared off unlike, the Intraday orders.

NRML is very similar to CNC. CNC is for delivery-based trading of Equity whereas, NRML is for delivery-based trading of futures and options and currency.

No, you cannot short sell using the CNC product code in Zerodha unless you hold the shares in your Demat account.

CNC refers to Cash and Carry used for Equity delivery-based trading. Zerodha does not offer STBT (Sell Today Buy Tomorrow). Thus, if you place a sell order in Zerodha using CNC code without holding the shares in your Demat account, the order gets rejected.

You can short sell using MIS (Margin Intraday square off) product code without holding stock in the Demat account. The MIS code triggers auto square-off by the system if you do not close the intraday position yourself within stipulated timelines. However, when you use the CNC code, the system does not trigger auto-square off and thus you cannot place a sell order first without actually holding the stock.

MIS is an abbreviation for Margin Intraday Square off. It is a product type used for trading Intraday orders in Equity, F&O, and Commodity. The MIS orders get squared-off automatically by the system at the end of the day if the investors do not square off the positions by the stipulated time. Zerodha charges an additional Rs 50 per executed order over and above the brokerage (Rs 20 or 0.03% whichever is lower) for intra-day positions squared-off by the system.

Using the MIS product code, you get attractive intraday leverage facilities across all products except for buying Options.

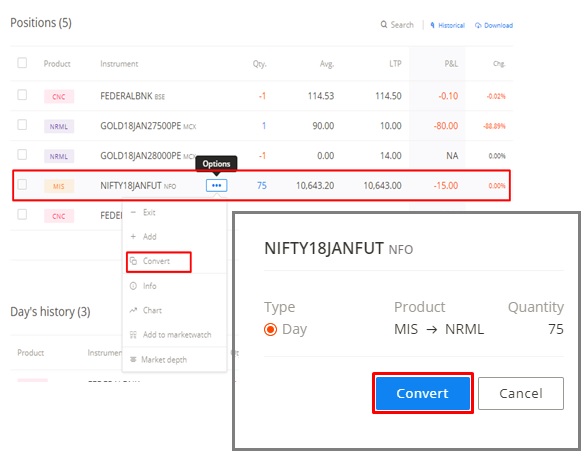

Zerodha allows its customers to convert MIS positions to CNC/NRML provided they have sufficient margins and holdings (in case of sell) in their accounts.

Zerodha offers the facility to place AMO orders. These orders are placed after market hours for the next trading day in advance.

After Market Order (AMO) allows customers to place online buy/sell order before the stock exchanges open for trading. The order time for AMO order differs by the trading segment.

| Segment | Order Time |

|---|---|

| Equity | NSE: 3:45 PM to 8:57 AM BSE: 3:45 PM to 8:59 AM |

| Equity F&O | 3:45 PM to 9:10 AM |

| Currency | 3:45 PM to 8:59 AM |

| Commodity | Anytime during the day* |

* If MCX AMO order is placed during the market hours the order will go through the next day at 9 AM.

AMO in Zerodha Kite stands for After Market Orders. It is a facility provided for people who can't actively track the markets from 9:15 am to 3:30 pm. Zerodha AMO orders can be placed only during the following time duration:

Note:

No, Zerodha doesn't have any additional charges for aftermarket orders (AMO). You can place AMO orders for all product types (CNC/MIS/NRML) at the following time:

| Segment | AMO Order Timings |

|---|---|

|

Equity |

3:45 PM to 8:57 AM for NSE, [3:45 PM to 8:59 AM for BSE] |

|

Currency |

3:45 PM to 8:59 AM |

|

Futures & Options |

3:45 PM to 9:10 AM |

|

Commodity (MCX) |

Anytime during the day |

CNC is an abbreviation for Cash and Carry. It is an order type used for delivery-based orders. If you want to buy a stock and want to hold it for more than two days, then you need to use the CNC order type. Zerodha offers brokerage free delivery trading that means all CNC orders are free of brokerage.

It is important to note that CNC is a product code. CNC code does not restrict you from selling the stock the same day if desired. But the sell quantity cannot be more than the buy quantity. There is no penalty if you sell the shares on the same day. However, in such cases, these trades will be treated as Intraday trades, and brokerage applicable for Equity Intraday trades will get applied.

Using CNC product code, you do not get any leverage nor, your position gets auto squared off. You cannot sell using the product code CNC without holding the particular stock in your DEMAT account unless you buy and sell the same day.

Zerodha does not offer a trailing stop-loss order currently.

Earlier, the trailing stop-loss order was available in Zerodha as part of the Bracket Order (BO). With the BO facility removed, the investors now do not have access to place trailing stop-loss orders. In a trailing stop-loss order, the stop-loss moves up/down by the number of ticks set by the trader depending on the price movement.

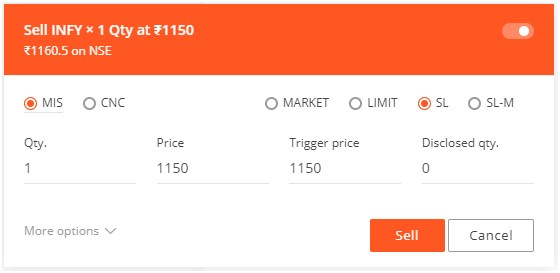

A Stop Loss (SL) order in Zerodha is used to minimize the extent of losses in intra-day trading. The stop-loss orders are placed along with buy or sell orders. Zerodha automatically executes the SL order once it reaches the set price of the stock.

So for example, if you have bought a stock at Rs 200 and you want to limit the loss at 190, you can place an order in the system to sell the stock as soon as the stock comes to 190. Such an order is called a 'Stop Loss', as you are placing it to stop a loss more than what you are ready to risk.

There are 2 types of Stop-Loss orders in Zerodha Kite:

IOC stands for Immediate or Cancelled Orders in Zerodha Kite. IOC orders allow customers to buy or sell a security as soon as the order is published on the market. If no matching order is found, the order is automatically cancelled immediately.

If IOC orders are not matched, the system cancels unmatched orders and displays error 16388.

Example: You place an IOC order to buy 50 shares of XYZ at Rs 271. If a matching order for 30 shares is found at this price, the order for 30 shares will be executed immediately and the order for the remaining 20 shares will be automatically canceled.

Steps to use the IOC function in Zerodha Kite:

You can put a sell MIS order in Zerodha using any order types like a limit order, market order, or stop-loss order. You can also place a cover order for a sell MIS order.

To place a sell MIS order in Zerodha, you need to select the product type as MIS while placing the order. The trade parameters will vary based on the order type chosen.

You can use the AMO order facility in Zerodha to place orders before the market opens.

AMO in Zerodha stands for After Market orders. The AMO facility allows the users to place the trade orders for the next trading day post the trading session gets closed.

You can place pre-market orders in Zerodha between 9.00 AM to 9.08 AM only in the Equity segment.

The pre-market order window closes anytime between 9.07 AM to 9.08 AM. You can place only limit or market orders using product code MIS or CNC.

A cover order in Zerodha gets placed with the exchange as two trade orders:

The cover order in Zerodha is allowed only for intraday trading and on NSE for Stocks, Equity Derivative Futures, and Currency Futures.

Steps to place Cover Order in Zerodha Kite:

The intraday trading in Zerodha is restricted on certain stocks due to regulatory or risk management reasons.

The MIS orders on some scrips are blocked in Zerodha on account of the below reasons:

Zerodha maintains a consolidated list of stocks that are allowed for MIS on their website under Downloads & Resources.

If you place an order for the scrip that is not on the list, the system pops up an error as 'MIS orders are currently blocked for XXXXX'. You are required to place CNC orders for such stocks.

If you choose to place a cover order in Zerodha, you will not see the CNC option in Kite web, as the cover orders are allowed only for intraday trading.

In the Kite mobile app, the CNC option gets blocked while placing cover orders.

You can convert MIS positions in F&O and Currency to Normal if you have sufficient margins in your account.

Steps to convert MIS order to Normal in Zerodha

The validity of a CNC order in Zerodha depends on the validity order type chosen while placing the order.

If you have placed a CNC order using Day order, the order remains valid till it gets executed or till the end of the trading day whichever is earlier.

If you have placed a CNC order using an IOC order, the order gets immediately cancelled if not executed. IOC orders are generally used to place the order in bulk quantities.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|