Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Thursday, March 25, 2021 by Chittorgarh.com Team

Zerodha Account Opening

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

GTT (Good Till Triggered) is an order type that remains valid for a year or till the trigger condition gets hit, whichever is earlier.

The GTT feature is useful for investors who do not trade actively or do not have time to track the markets daily. Such investors can put a GTT order at their target price in mind and do not bother to input the order daily. However, there are certain GTT limitations that one should keep in mind. Read the section on the GTT limit in Zerodha to know more about this.

Key Features

GTC (Good Till Cancelled) is an advanced order type that remains valid till it executed or cancelled by the customer. GTC orders get released to exchange daily. In case the order doesn't get executed on that day, the same order gets placed on the exchange the next day. This process of order placement to exchange continues till the order gets executed, canceled by the investor, or expired.

The maintenance of GTC orders and its daily placement to the exchange is costly and thus difficult for the discount brokers to offer this service. Zerodha does not provide GTC facilities to its customers. To overcome this challenge, Zerodha launched the GTT orders as an alternative to GTC.

GTT in Zerodha remains valid for one year or till the trigger condition is hit. Unlike GTC, GTT orders get placed to the exchange only when the set trigger condition gets hit. The execution of the order is not guaranteed as it is dependent on the order price. In such a case, the GTT order needs to be placed again.

The GTT in Zerodha is available only for Equity Delivery trades and Bank Nifty and Nifty F&O trades. Zerodha offers to use the GTT feature in Zerodha Kite web and Zerodha Kite app except for Nifty and Bank Nifty GTT as that is currently available only on the Kite web.

Zerodha offers to place various types of GTT orders

You can place a sell GTT order in Zerodha to sell your existing holdings. The sell order can be a single trigger order wherein you can just put the target price and order price. You can also place an OCO order wherein you require a stop-loss price and a target price. When either of the triggers of the condition gets hit, the other trigger condition gets canceled.

You can place a buy GTT order in Zerodha to enter new positions. The buy order can be put as a single trigger wherein you can put a target price at which you would like to buy the stock.

The stop loss feature in GTT helps to limit the losses. The GTT stop-loss option is available under the OCO trigger type, where you need to input the stop loss trigger price and stop loss limit price. Zerodha offers to input the stop loss trigger price as price or in terms of percentage.

Zerodha does not offer trailing stop loss for GTT orders. It has only stop-loss GTT orders.

Using GTT in Zerodha, you can only place GTT limit orders in Zerodha. You cannot place a GTT market order. However, you can set the limit order in such a way that it acts as a market order. For a limit order to work as a market order, set the buy limit price much above the trigger price and the sell limit price much below the trigger price.

Following are GTT order limitations:

You can use GTT in Zerodha app or on the Zerodha Kite web. The GTT feature order for Nifty or Bank Nifty is currently available only on the Kite web. Creating GTT in Zerodha is a simple and easy process.

Steps to create GTT order in Zerodha

Points to Note for GTT trade Zerodha:

In this section let us see the examples for both trigger types using the Sell transaction type.

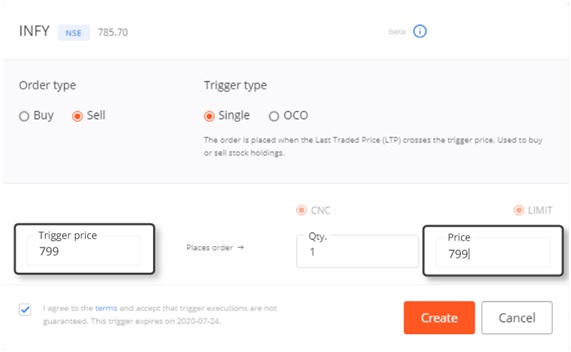

Say, the current price of Infy is Rs 785.70. You set a trigger price of Rs 799 and a limit price of Rs 799. (The trigger and limit price set is higher than market price as it is a sell trade)

In this case, if the price of INFY reaches Rs 799, the trigger price of Rs 799 gets hit on the exchange and a limit sell order at Rs 799 gets placed. The order gets executed if there is sufficient stock in your Demat account and a price match at the set limit price is found.

If the limit price in the above example was Rs 805, the execution would be possible only if the stock reaches that price. But if the stock price on that particular day does not go over Rs 802, the GTT triggered order gets canceled and needs to be placed again.

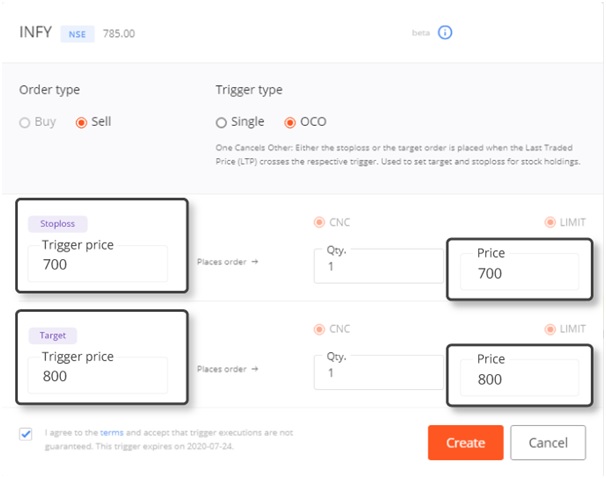

Say, the current price of Infy is Rs 785. You set a target trigger price and target limit price of Rs 800 and stop-loss trigger price and the stop-loss limit price at Rs 700. (The Target trigger and limit price is set higher than the market price as you have a target in mind to sell the shares at that price. But in the worst case, if the market is not in your favor and you have an option to set a stop loss to limit your losses.

In this case, if either trigger price of Rs 700 or Rs 800 gets hit on the exchange, a limit sell order at the corresponding limit price is placed. This order gets executed if you have the stock in your Demat account and a buyer is available to purchase at that price. Once either of the triggers gets hit, the other trigger gets canceled.

Zerodha does not require any margins at the time of GTT order placement. However, when the order gets triggered, Zerodha checks for margin and holdings before placing the order to the exchange. The GTT orders get rejected in case of insufficient margins or holdings as applicable.

The most common concern observed in the GTT Zerodha order is GTT triggered but not executed. This is ideally not an error but this is the way a GTT order in Zerodha works. A triggered GTT does not guarantee trade executions. A GTT order allows only limit orders to be placed at the exchange. Once the GTT is triggered but, no match is found at the specified limit price, the GTT order gets canceled at the end of the day.

To increase the probability for trade executions, the buy limit orders should be above the trigger price and the Sell Limit orders should be below the trigger price.

Sometimes it happens so that the GTT gets triggered and reaches the limit order price but gets rejected if the T Pin is not authorized. You are required to pre-authorize the trades using T-Pin for seamless transactions in case of sell trades. A T-Pin remain valid for 90 days. In case the TPIN gets expired, the order gets rejected.

Zerodha GTT orders placement does not require any margins. However, when the order gets triggered, you need to ensure to have sufficient margins or stocks as the case be, failing which the order gets rejected.

It is important to note that GTT is for as a long-term stop-loss or target. Thus, the difference between trigger and LTP should be at least 0.5% of the stock value. In case, the difference is lesser than the expected limit, the order gets rejected.

Zerodha GTT time limit is one year from the date of order placement or GTT trigger whichever is earlier.

Once the GTT is triggered, the validity of the GTT order gets expired irrespective of its execution.

The GTT orders for the stocks with corporate action get canceled by the system before the ex-date. Such orders are required to be placed again.

The GTT sell order in Zerodha requires Zerodha GTT authentication by way of CDSL TPIN authorization. You can pre-authorize your holdings that will remain valid for 90 days. At the end of 90 days, if you fail to authorize it again, the GTT order gets canceled or rejected when triggered.

In case you have submitted a POA, you do not require to authorize the TPIN.

GTT trigger Zerodha is an innovative feature introduced by Zerodha to substitute GTC. The GTT offers passive stock market investors an opportunity to book profits and limit losses without actively tracking the markets. However, there are still certain features of GTC that GTT does not offer. Hence, Zerodha should look to add more features to bring it at par with GTC.

Read more about Zerodha

Zerodha Streak Review - Algo Trading for Retail Investors

Zerodha Streak Review - Algo Trading for Retail Investors NFO (Nifty Futures & Options) in Zerodha

NFO (Nifty Futures & Options) in Zerodha GTT in Zerodha Kite (Zerodha GTT guide)

GTT in Zerodha Kite (Zerodha GTT guide) Direct Mutual Funds Explained (Meaning, Charges & Taxation)

Direct Mutual Funds Explained (Meaning, Charges & Taxation)This is a limited time offer. Open an instant Zerodha account online and start trading today.

There are no extra charges for GTT in Zerodha.

Zerodha had introduced the GTT feature to be offered free of cost to all its clients as part of its introductory offer. Thus, currently, there are no GTT charges in Zerodha. In the future, Zerodha may decide on the charges/pricing for using the GTT feature.

Yes, GTT orders are free in Zerodha.

GTT was introduced as a free service as an introductory offer by Zerodha. The company intended to start charging for GTT post 3 months of launch. However, Zerodha still offers GTT at no cost.

You get charged brokerage, DP charges (in case of sell trade), and other transaction charges as in case of any other Equity Delivery trade.

No, Zerodha does not have any GTT calculator.

GTT is a feature offered by Zerodha to place Buy and Sell orders that remain active till the trigger condition gets hit. You can use the Zerodha calculator to calculate the brokerage and other transaction charges applicable to the executed GTT triggered trade.

A Zerodha GTT order requires a trigger price and a limit price. Sometimes it may happen so that the trigger condition gets hit and the order gets placed to the exchange. However, the order may or may not get executed based on the limit price set.

A GTT-triggered order does not guarantee execution.

To increase the chances of trade execution, you need to set the buy limit orders above the trigger price and the Sell Limit orders below the trigger price.

A Zerodha GTT order has no checks at the time of order placement. You need to set the trigger price, limit price, stop loss (if opted for OCO order). However, there are certain scenarios when the orders may get rejected, canceled or may not get executed even when triggered.

Common scenarios when a GTT order gets rejected or canceled:

A GTT sell order can be placed either as a single trigger or OCO.

Steps to place a GTT sell order in Zerodha:

The GTT orders in Zerodha can be canceled any time before they get executed.

You can cancel the order once the trigger gets hit. If you want to cancel the order before the trigger condition gets hit, you have an option to delete the trade.

Steps to cancel GTT orders in Zerodha:

You can remove GTT order in Zerodha from the GTT tab under the Orderbook window. To remove the GTT, click on the Delete button for the desired order to be removed.

The orders get displayed under the GTT tab until the trigger condition gets hit. Once the trigger gets hit, the orders move to the Pending order window. You can cancel an order from the Pending Order window.

You can view GTT in Zerodha under the GTT tab in the Kite Orderbook. All orders placed using Create GTT option get displayed under the GTT tab.

Initially, the status of all orders under the GTT reflect as Active. Once the trigger set for GTT gets hit, the order status will get changed to Triggered, and the order moves to the Pending tab.

You can check the status of these Pending orders under the Pending tab of the order book. The order is kept open for the entire day till the matching price is found on the exchange. Once the price matches, the order gets executed and moves to Executed tab. In case the price match is not found, the order gets canceled by the system at the end of the day. Once the order gets canceled, it is required to be placed again. You can modify the order if required before it gets executed.

You can place a buy or sell GTT order in Zerodha either through the Zerodha Kite web or Zerodha Kite mobile app.

To place the GTT order in Zerodha Kite, you need to click on the desired scrip and create GTT by inputting the trigger price and the order price for the desired quantity.

The feature to place GTT orders on stocks for Equity Delivery trading is available on both - the Kite web and the mobile app. However, for Nifty and Bank Nifty F&O, the GTT feature is currently available only on the Kite web and is soon planned to be launched on the mobile app.

Yes, GTT in Zerodha is free.

There are no charges to use the GTT feature in Zerodha. However, when the GTT order gets executed, you need to pay the applicable brokerage, Demat charges, and exchange transaction charges.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|