Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Thursday, April 4, 2019 by Chittorgarh.com Team | Modified on Sunday, August 9, 2020

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

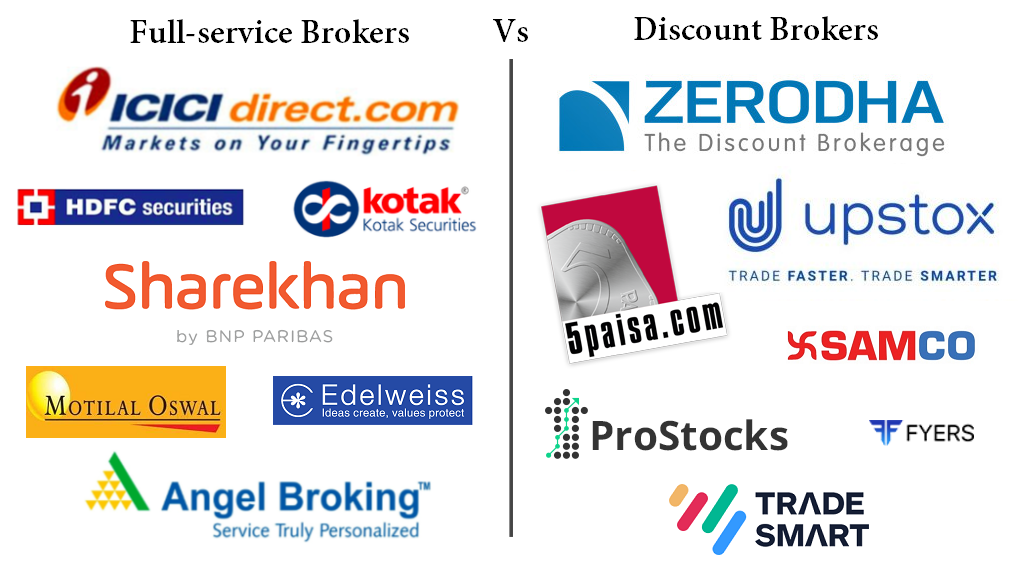

Stock brokers can be classified into 2 types; Discount broker and Full-Service broker. Choosing the right broker type as per your trading requirements will help you get good value for money. This article will discuss discount broking and full-service broking, the difference between the two and when to choose a discount broker and when to opt for a full-service broker.

Stock trading has gone online. This has led to the emergence of a new breed of brokers called discount brokers in India. The discount brokerage firms are getting popular among the traders owing to their low, fixed brokerage plans wherein they charge a fixed brokerage fee irrespective of the trade value. For example, Bengaluru based discount broking company Zerodha charges a brokerage fee of Rs 20 per order on equity intraday. So whether your trade value is Rs 10,000 or Rs 10 lakhs, the brokerage charged will be the same.

Many retail traders wonder how discount broking companies charge low brokerage fees. It is because they work on a different business model than full-service broking firms. Unlike traditional brokers, they offer limited services at a cheaper price. They offer their services online and have a very limited physical presence which helps them save money on employees and infrastructure.

The services offered by discount broking companies vary but most of them do not provide research services, IPO application services, and investment services in Mutual Funds, Bonds, FDs etc. This also helps them save money on licensing and resources.

Advantages | Disadvantages |

|---|---|

|

|

A full-service broker (also called traditional broker) is a licensed broker that provides a range of services to its customers including research advisory, investment services, wealth management and Portfolio Management Services. Unlike online discount brokers, full-service brokerage firms offer their services both online and offline. They have branch offices in their area of operations, offer dedicated Relationship Managers (RM) to customers and employ a lot of people.

Full-service stock brokers have a dedicated research team that conducts technical and fundamental analysis and publishes various reports on stocks, companies and markets.

As they offer a range of services, the brokerage charged by them is higher than discount share brokers. And, most brokers, offer lower brokerage for high volume traders. For example, ICICIDirect charges 0.75% brokerage (under I-Saver Plan) for trade turnover of less than Rs 10 lakhs per calendar quarter. The brokerage percentage decreases with increase in trade turnover with 0.25% brokerage charged for trade turnover of above Rs 5 crore per calendar quarter.

Advantages | Disadvantages |

|---|---|

|

|

Full-service Broker | Discount Broker | |

|---|---|---|

Brokerage | Generally, charge a percentage of the trade value. Offer low brokerage for high volume traders. | Charge a flat fee on each executed order irrespective of trade value. |

Brokerage Charges | 0.25% - 0.75% | Generally Rs 10- Rs 20 per order. |

Services | Broking Services, Research, Wealth Management, PMS, Depository services etc. | Broking Services with a few brokers offering Mutual Fund services. |

Suitable for | Frequent traders who need research and investment advisory services. | Online savvy traders who want to save on brokerage and have limited trading needs. |

Physical Presence | Strong presence in areas of operations with branch offices in multiple locations. | Zero branch offices. |

Customer service | Email/Call/Branch Servicing/Doorstep servicing etc. Generally, offer dedicated RMs for assistance. | Online services email/chat/phone No RM services. |

Examples | ICICI Direct, Kotak securities, Sharekhan, HDFC sec, Axis direct, Edelweiss etc | Zerodha, Upstox, Trade Smart Online, SAS online, Tradejini, etc. |

How to solve the traditional vs discount broker dilemma? It may look puzzling but it is important to decide when to choose a discount broker and when to pick a traditional broker for the following reasons-

You don't want to pay a higher brokerage to a full-service broker when you don't need research and other add-on services.

If you don't have time or expertise to pick stocks then the low brokerage fee of a discount broker will not help much as poor trading decisions can result in much higher losses.

So how to decide? There's no perfect answer to this question. However, to assist you in your decision, you can begin with a simple exercise to decide whether you need a discount broker or a full-service broker:

If your answers to all of the question is a 'Yes' then a full-service broker will be the right choice.

If your answers to all of the question is a 'Yes' then an online discount share broker will be the right choice.

If you are still undecided after doing the above-mentioned exercise then begin with understanding your trading needs, look at the advantages and disadvantages of discount and full-service brokers, compare services and then make a decision.

Here are a few helpful resources to make an informed decision:

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|