Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Friday, August 31, 2018 by Chittorgarh.com Team | Modified on Friday, March 20, 2020

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

ASBA (Applications Supported by Blocked Amount) has made applying for IPOs easy. And that's why, since its introduction in 2018 by SEBI, ASBA has become popular among retail investors. ASBA offers many benefits to an investor like-

This article aims to explain the process to apply for IPO online using Kotak Bank netbanking.

Kotak Bank is one of the members of the SCSBs (Self Certified Syndicate Banks). SCSBs are allowed by the SEBI to accept online IPO applications from investors.

Steps to online IPO application through Kotak Bank

The process to apply for an IPO through Kotak internet banking involves following steps-

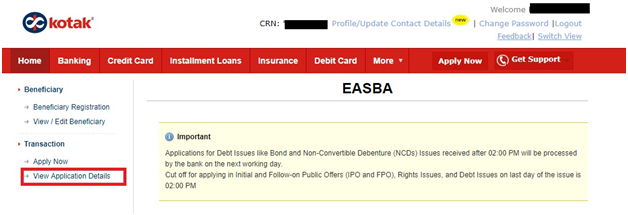

Details of ASBA application from Kotak Bank

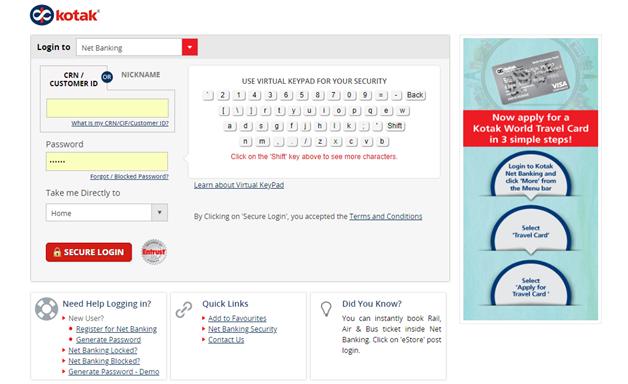

Visit www.kotak.com and and click on login button on the top-right side. In the next screen, login using your Kotak Bank CRN/ Customer ID and password. The CRN (Customer Relationship Number) is a 8 digit numeric code printed on your debit and credit card. Click on 'Secure Login', enter the OTP received on your email and mobile.

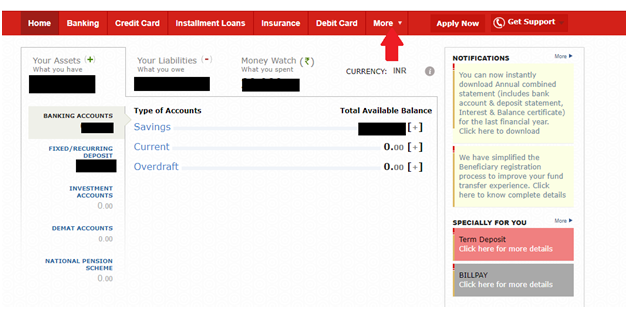

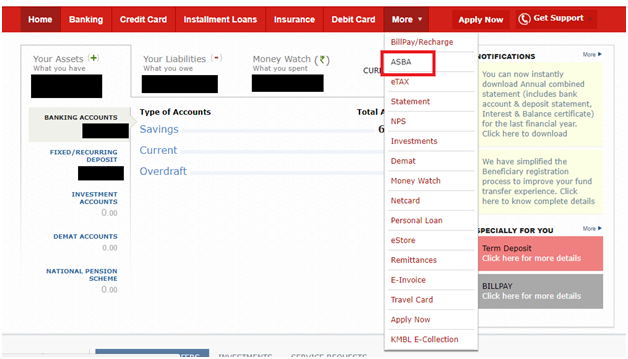

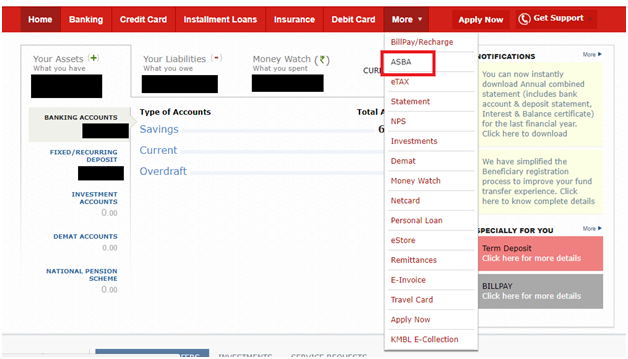

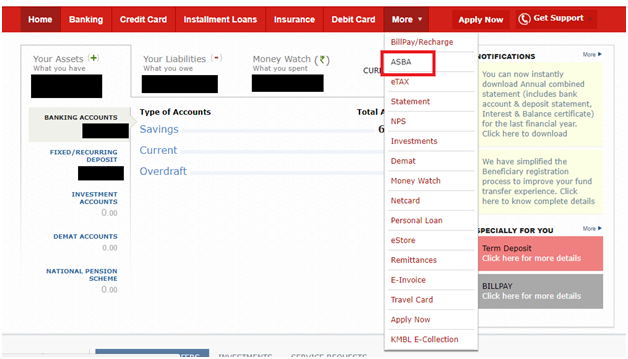

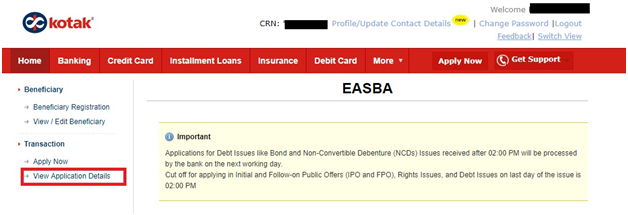

On your account page, on the top menu and click on 'More' and then on 'Online IPO (ASBA)', Click on 'Apply for IPO' on the left menu.

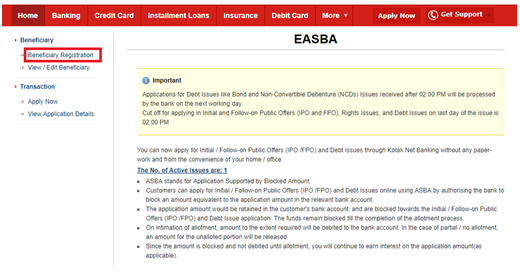

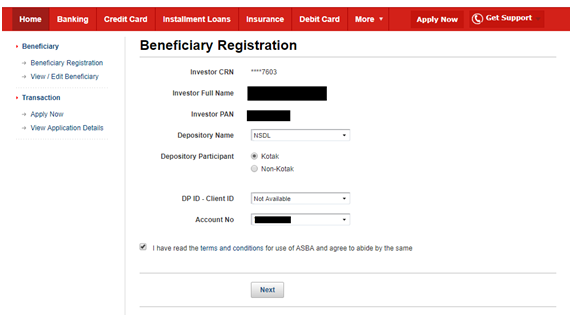

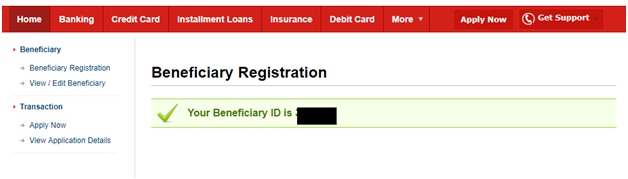

You need to register as a beneficiary in case you are already not registered. Click on 'Beneficiary Registration' on the left side menu of the page.

Details like 'Investor CRN', 'Investor Name' and 'Investor PAN' will be automatically filled. You need to select-

Remember, your Demat Account number has 16 characters together, the 8 characters make the DP ID while the last 8 are Client ID. Click 'Next' after checking the 'terms and conditions' box.

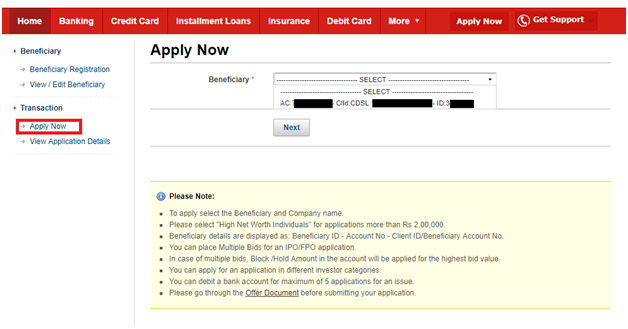

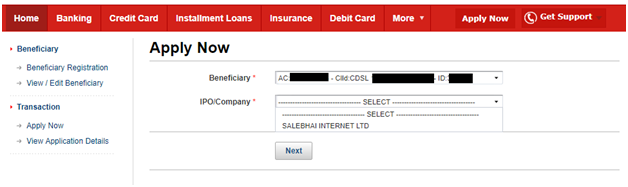

Click on 'Apply for IPO' tab on the left side menu of the page. Select the beneficiary.

Now select the IPO, you wish to apply for from the dropdown list

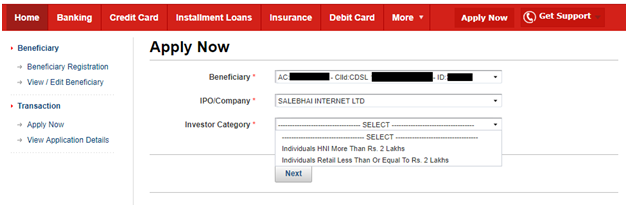

Select your 'Investor Category' based on your investment amount. Click on 'Next'.

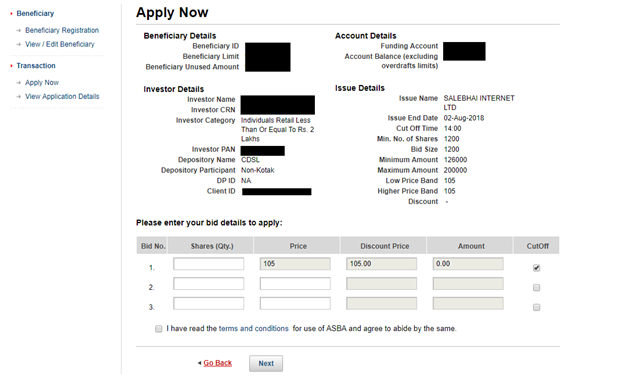

Here, 'Beneficiary Details', 'Account Details', 'Investor Details' and 'Issue Details' is automatically filled. Go through 'Issue Details' to understand the key requirements of the issue like minimum no shares, bid size, minimum and maximum amount, price band etc.

You can enter up to 3 bids. Enter the number of shares you wish to bid for. Remember, every IPO has a minimum number of shares to bid for and if you want more you need to bid in multiples of that. So if the minimum number is 1200 then you can bid for 1200, 2400, 3600 etc.

Another important consideration is on selecting the Cut Off Price. The cut-off price is useful in Book Building issues where you have to bid within a price range given by the company. The company then decides on a price at the time of allotment and investors who have bidded for price equal to or above the decided price are allotted shares.

The cut-off price is an option given to retail investors. Opting for cut-off price means you are giving consent to buy the shares at the price decided by the company during allotment. It saves you from bidding race and ensures that you're eligible for allotment at the price decided by the company.

After filling all the details, check the 'terms and conditions' box and click on 'Next'.

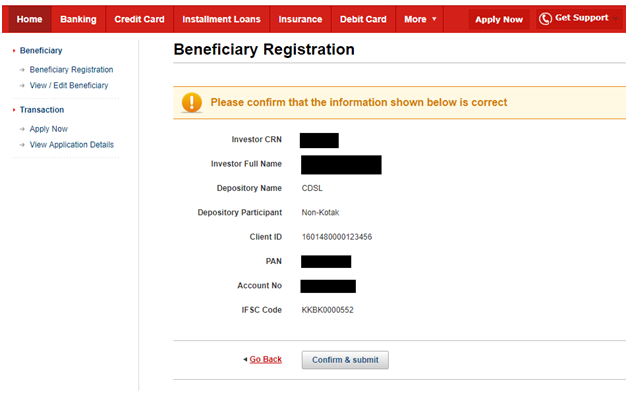

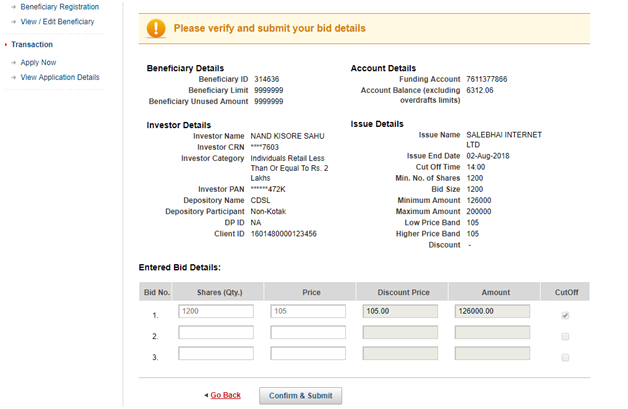

On the next screen, you will be provided with all the details of the IPO to verify and confirm. Go through all the details. If you need correction on any detail, click on 'Go Back'. If everything is OK, click on 'Confirm & Submit'.

Wait for the confirmation message to appear on screen. Your application is complete.

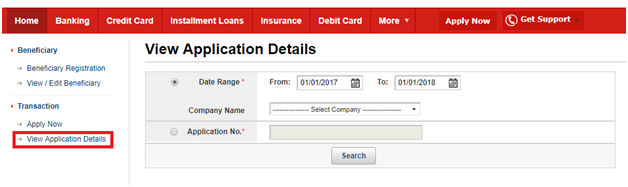

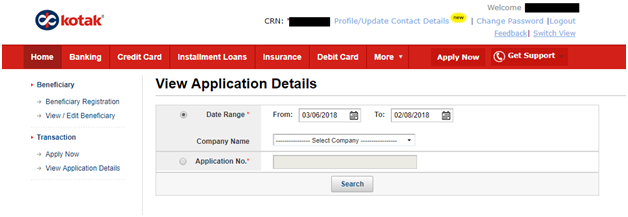

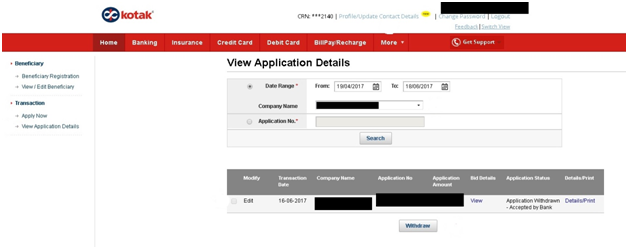

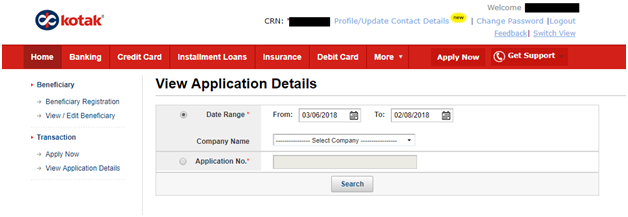

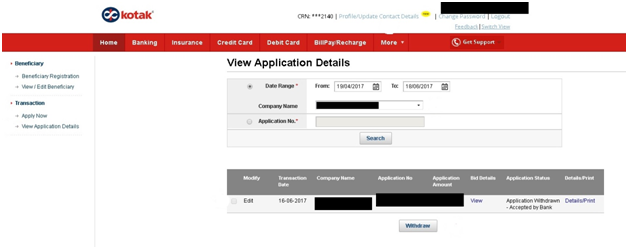

You can view your IPO application details by clicking on 'View Application Details'. You can search by Date Range or enter your Application Number.

Eligibility- Who can apply for an IPO online through Kotak Bank netbanking?

To apply for an IPO through Kotak Bank net banking, one should-

Be above 18 years

Yes, Kotak Bank is a member of SSCBs (Self Certified Syndicate Banks). SSCBs are allowed by SEBI to accept online IPO applications from investors. If you hold a savings or current account (single or joint) with Kotak Bank and have a demat account then you can apply for an IPO using Kotak internet banking.

You can edit an IPO application in Kotak bank with the following details-

Withdrawal of an IPO is only allowed while the bidding process is on. You can withdraw an IPO application in Kotak bank with the following details:

Yes, you can apply for an IPO through Kotak Bank app. However, you need to contact the bank to get this facility activated in your app.

The application amount is blocked or marked as lien when you apply for an IPO using kotak bank ASBA process. The blocked amount while applying for the IPO is released on the next working day of finalization of the allotment.

Every investor can make one application. However, he can make up to three bids on the application.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|