Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Monday, October 8, 2018 by Chittorgarh.com Team | Modified on Monday, July 18, 2022

| Pros | Cons |

|---|---|

|

Part of an established brand in the financial services industry. |

The brokerage is higher when compared to discount brokers. |

|

Good trading platforms on desktop, web, and mobile |

|

|

Offers 3-in-1 account |

|

|

Single platform to invest in stocks, F&O, IPOs, Mutual Funds etc. |

|

|

Robust research and portfolio management service. |

|

|

Offline presence across the country with 1281 branches |

Incorporated in 1994, Kotak Securities Limited is a full-time service broker. The company is a subsidiary of Kotak Mahindra Bank, a reputed name in the banking industry.

Kotak Securities offers broking services in Stocks, Mutual Funds, Equity, and Currency Derivatives as well as investment services in IPOs, Mutual Funds, Bonds etc. It also offers commodity trading services through a separate entity 'Kotak Commodities'. In addition, it also offers portfolio and research services.

As on 31st March 2019, Kotak securities has-

The company is a corporate member with the BSE, NSE and a depository participant with NSDL and CDSL.

Kotak securities have won many awards and recognition for its broking and research services. Some of the major awards are-

Kotak Securities offers traders with multiple ways to trade through its desktop, mobile and web platforms.

Website- The company's website - www.kotaksecurities.com offers traders full trading services. The site can be accessed by any browser and is packed with good features for reliable and fast trading.

Xtralite- Specially designed for traders who have slow internet connectivity or access the website on mobile phones, Xtralite offers most of the features available in the website at a good speed.

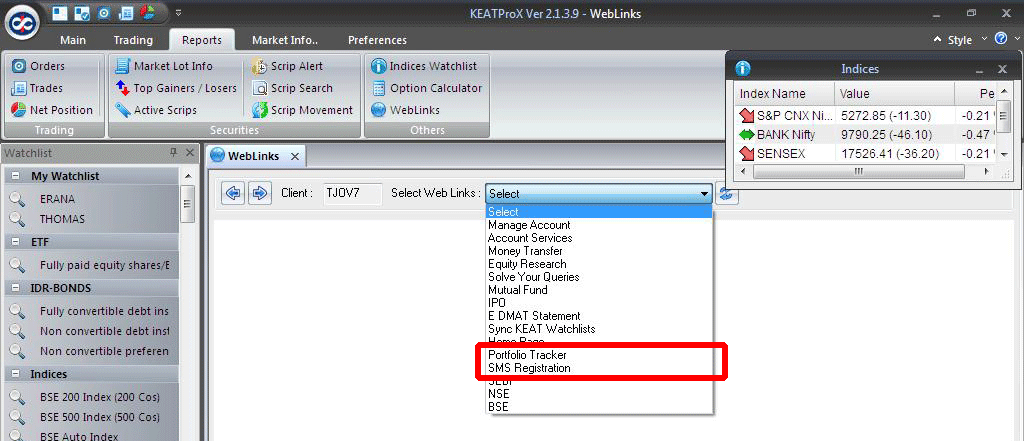

KEAT Pro X- It is an installable trading platform that traders can download on their personal computers and trade from there. The platform offers all the trading tools and features to trade, analyze and manage your trading portfolio.

FastLane- It is a light Java-based applet which works as an alternative KEAT Pro X

in situations when you cannot run the platform for some reasons.

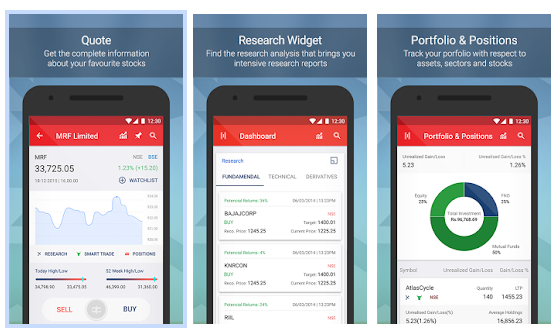

StockTrader- It is a mobile trading app available on iOS, Android, BlackBerry, Symbian, Bada and Java platforms. The app allows traders to trade, track the markets and manage their portfolio from anywhere, anytime.

In addition to the above platforms, you can also trade using Call & Trade services offered by Kotak. The facility allows you to trade in stocks, derivatives, IPOs and mutual funds over the phone.

Kotak Securities Account Types

Trading Account Opening fees = Rs 750

Trading Account maintenance charges = Nil

Demat Account opening fees = Nil

Demat account maintenance charges = Rs 50 per month for resident Indians, Rs 75 per month for NRIs.

Kotak Securities Brokerage Fee

Kotak offers 3 brokerage plans. The brokerage fees are charged as per the plan choosen by the trader. The 3 plans are-

The brokerage charges for various plans are as follows-

Kotak Fixed Brokerage Plan

Rs 300 Per Lot for Equity Options

Kotak Dynamic Brokerage Plan

Equity Options

| Monthly Premium Volume | Intraday Brokerage | Settlement brokerages | Minimum Brokerage Per Lot (Intraday) |

|---|---|---|---|

|

Upto 4 lakh |

2.5% |

2.5% |

Rs 300 |

|

4-11 lakh |

2.25% |

2.5% |

Rs 240 |

|

>11 lakh |

1.8% |

2.3% |

Rs 180 |

| Monthly Volume Slab ( In Crs) | (Volume-Wise Slab & Brokerage for Future & Options) applicable to both sides |

|---|---|

|

0-3 |

Rs 20 Per lot |

|

3-8 |

Rs 18 Per lot |

|

8-15 |

Rs 15 Per lot |

|

15-30 |

Rs 10 Per lot |

|

>30 |

Rs 7.5 Per lot |

| Particulars | PLAN A | PLAN B | PLAN C | PLAN D |

|---|---|---|---|---|

|

Advance Fees |

Rs 5000 |

Rs 10,000 |

Rs 50,000 |

Rs 2,00,000 |

|

+ GST |

( As applicable) |

( As applicable) |

( As applicable) |

( As applicable) |

|

Validity |

12 Months |

12 Months |

12 Months |

12 Months |

|

BROKERAGE DETAILS |

||||

|

Options' |

Rs 225 per lot |

Rs 225 per lot |

Rs 150 per lot |

Rs 150 per lot |

|

Currency Options (Each Leg) |

Rs 12 |

Rs 10 |

Rs 8 |

Rs 8 |

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|