Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Wednesday, August 29, 2018 by Chittorgarh.com Team | Modified on Saturday, October 3, 2020

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Introduced in 2018 by SEBI, ASBA has become a popular way to apply for IPOs among retail investors. ASBA offers many benefits to an investor like

This article aims to explain the process to apply for IPO online using Axis bank netbanking.

Axis Bank is one of the members of the SCSBs (Self Certified Syndicate Banks). SCSBs are allowed by the SEBI to accept online IPO applications from investors.

Steps to online IPO application through Axis bank

The process to apply online for an IPO through Axis internet banking involves following steps-

Details of ASBA application from Axis bank

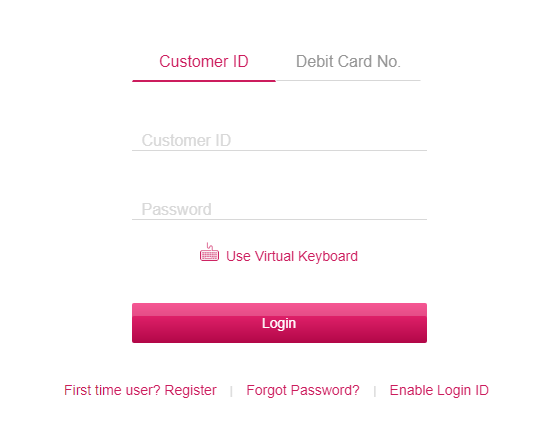

Visit www.axisbank.com and click on login button on the right side. In the next screen, login using your Axis account user ID and password.

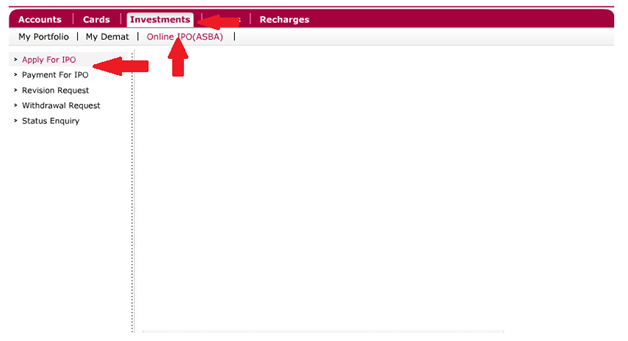

On your account page, on the top menu and click on 'Investments' and then on 'Online IPO (ASBA)', Click on 'Apply for IPO' on the left menu.

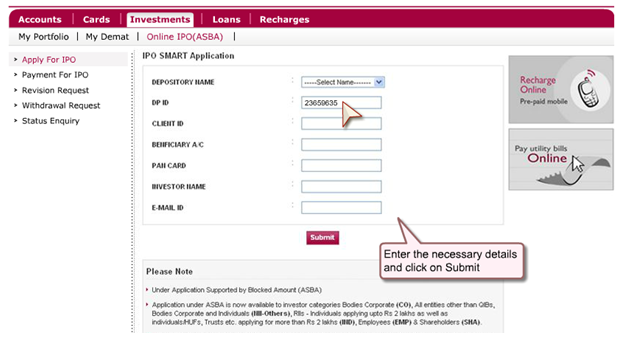

You need to register as an applicant in case you have not already done so. Enter the necessary details and click on 'submit'. Remember, your Demat Account number has 16 characters together, the 8 characters make the DP ID while the last 8 are Client ID.

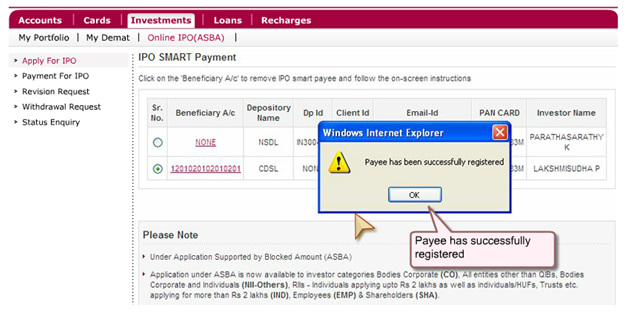

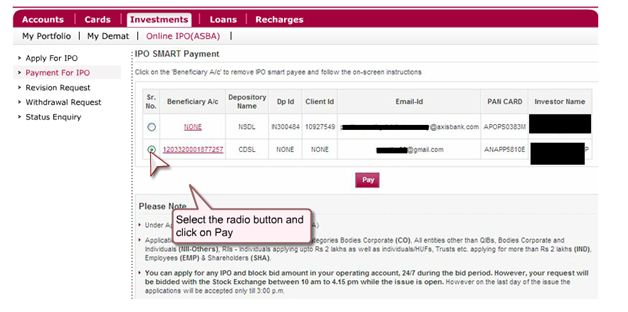

Click on 'Payment for IPO' on left menu. You will be presented with the list of registered applicants in your account. Select the radio button next to your A/C number and click on 'Pay'.

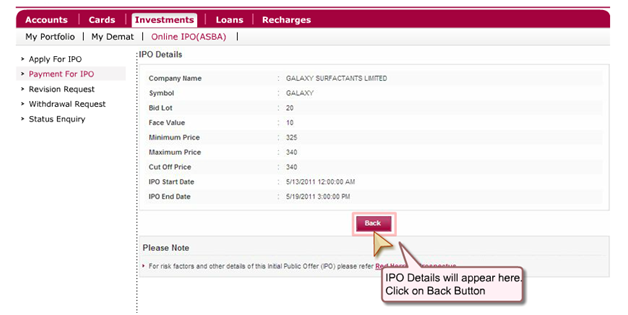

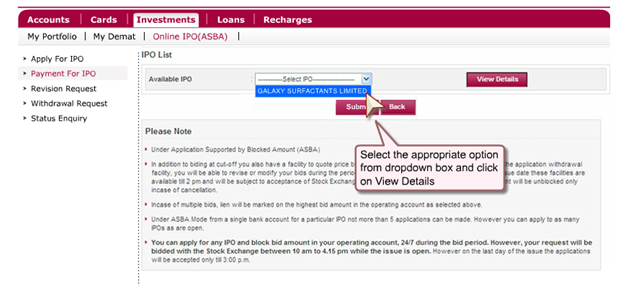

To know the details about the IPO, select the IPO name and click on 'View Details' button available on the right side. Know the details and then click on 'Back' button to return to the previous screen.

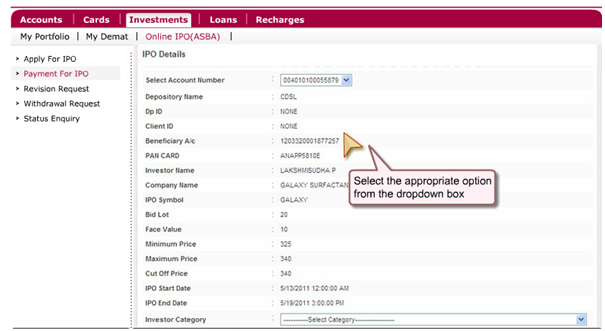

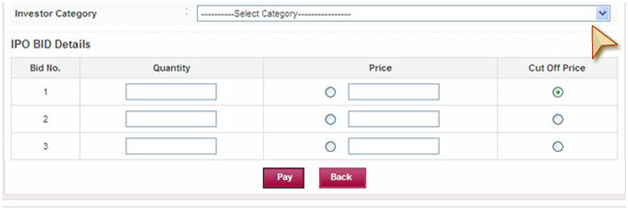

Select your Beneficiary A/c number and most of the information will be automatically populated in the screen. You need to select the 'Investor Category'. Select 'retail' if you are investing below Rs 2 lakhs and 'HNI' if above Rs 2 lakhs.

You can enter up to 3 bids. Enter quantity of shares you wish to apply for. Remember, every IPO has a minimum number of shares to bid for and if you want more you need to bid in multiples of that. So if the minimum number is 12 then you can bid for 12, 24, 36 etc.

Another important consideration is on selecting the Cut Off Price. The cut-off price is useful in Book Building issues where you have to bid within a price range given by the company. The company then decides on a price at the time of allotment and investors who have bidded for price equal to or above the decided price are allotted shares.

The cut-off price is an option given to retail investors. Opting for cut-off price means you are giving consent to buy the shares at the price decided by the company during allotment. It saves you from bidding race and ensures that you're eligible for allotment at the price decided by the company.

After filling all the details, click on 'Pay'.

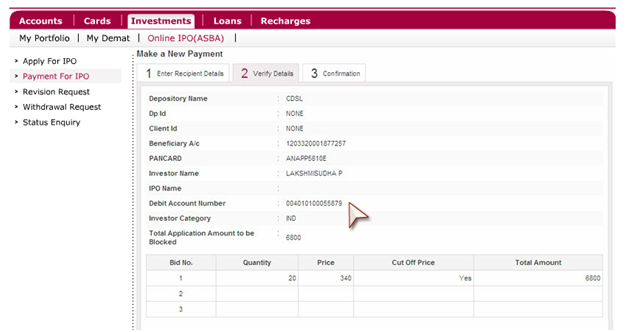

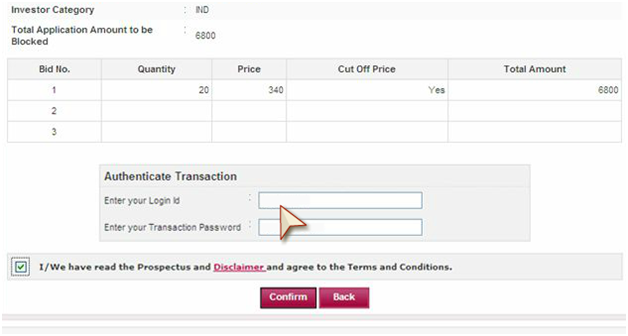

On the next screen, you will be provided with all the details of the IPO to verify and confirm. Go through all the details. If you need correction on any detail, click on 'Back'. If everything is OK, authenticate the transaction using your login ID and password and checking the 'Terms and Conditions' box.

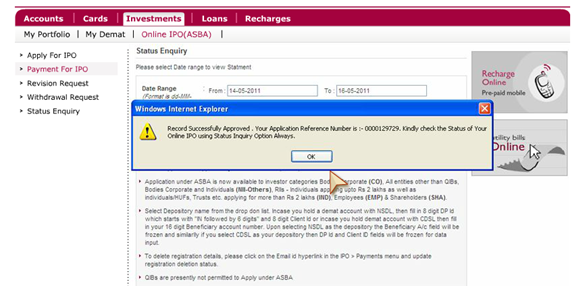

Wait for the confirmation popup to appear on screen. Click on 'OK' and your application is complete.

Eligibility- Who can apply for an IPO online through Axis Bank netbanking?

To apply for an IPO through Axis bank net banking, you should-

Be above 18 years

Yes, Axis is a member of SSCBs (Self Certified Syndicate Banks). SSCBs are allowed by SEBI to accept online IPO applications from investors. If you hold a savings or current account (single or joint) with Axis Bank and have a demat account then you can apply for an IPO using Axis netbanking.

You can withdraw your application under the ASBA facility during the IPO bidding window. Withdrawal is not possible after the closure of bidding process. To withdraw an IPO application in Axis bank, take the following steps-

No, Axis app doesn't currently provide IPO application facility.

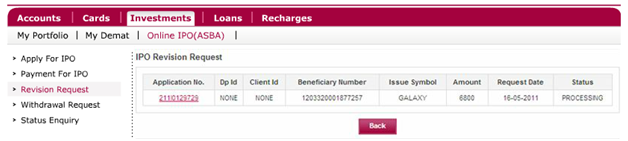

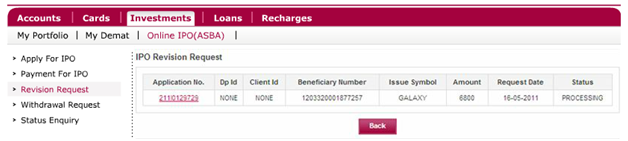

You can edit your IPO details under the ASBA facility during the IPO bidding window. Revision is not possible after the closure of bidding process. To revise or edit details of an existing IPO in Axis bank, take the following steps:

The application amount is kept blocked or marked as lien till the allotment is finalized. If you are are allotted shares, then this amount is credited to the company account. In case you are not allotted shares, then the amount is unblocked on the next working day.

You can apply once with 3 bids in an application.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

In new axis bank net banking, now only RII category is flashing in the category menu. How to apply for HNI ctaegory using axis bank ASBA.