Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Saturday, February 26, 2022 by Chittorgarh.com Team | Modified on Tuesday, July 19, 2022

Bank of Baroda is a SEBI registered Self-certified Syndicate Banks (SCSB). They provide online IPO applications (ASBA) through the Bank of Baroda Net Banking service.

Bank of Baroda customer who has access to net banking can apply in IPOs online using the net-banking website. Note that the online IPO application facility is not available on its Mobile App (Baroda M Connect).

BoB IPO time is 9 AM on Issue Open Date until 3 PM on Issue Closing Date. Bank of Baroda IPO application using net-banking is available to apply/modify/cancel from the day the public issue opens until 3 PM IST on the last day.

Note:

Bank of Baroda offers an easy, simple, and secured ASBA IPO application. Below are the steps to apply in IPO through BoB net-banking:

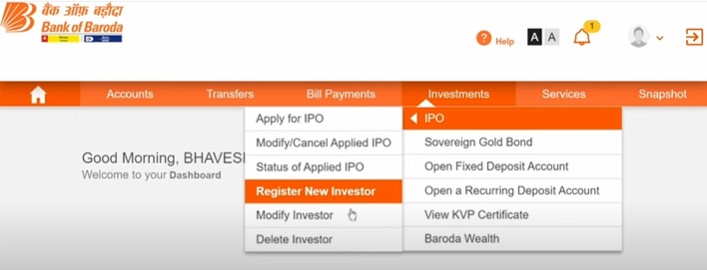

Login to the Bank of Baroda net banking website and go to Investment >> IPO Tab.

Go to Investments >> IPO >> Register New Investor to register, modify or delete up to 5 IPO applicants.

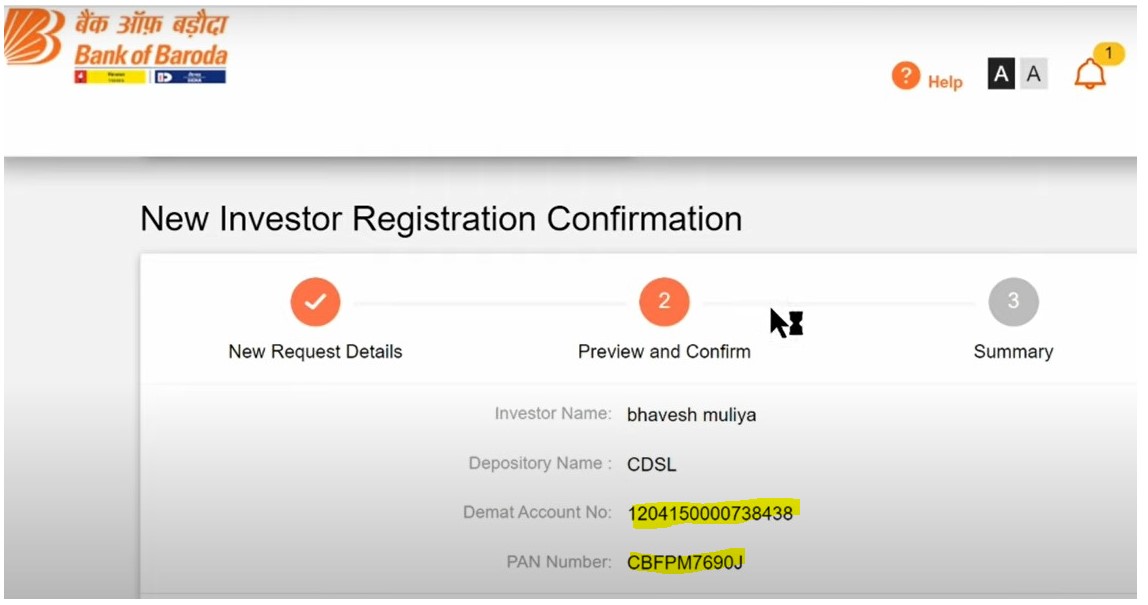

It is a one-time process that requires entering the Applicant name, Depository name (CDSL or NSDL), Demat account number (in case of CDSL), Client ID, and DP ID (in case of NSDL), and PAN to register a new investor. These details get auto-filled whenever you apply for an IPO by selecting the applicant's name.

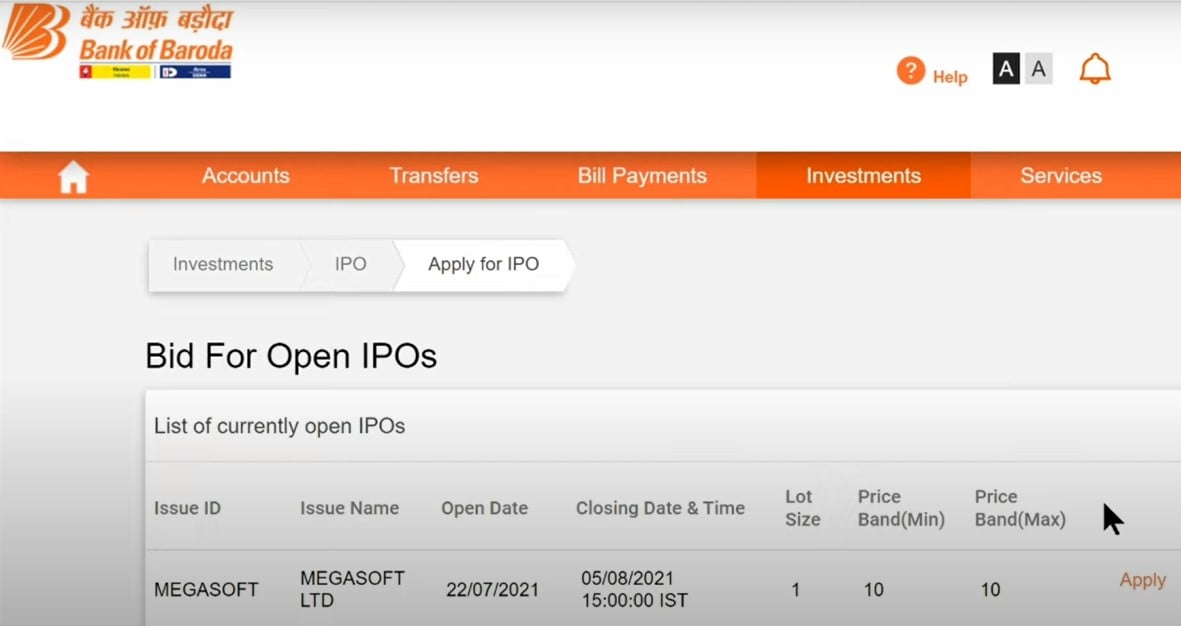

To apply for an IPO, go to the Investments tab and click on "Apply for IPO". Select the desired IPO from the list of open IPOs and click on Apply.

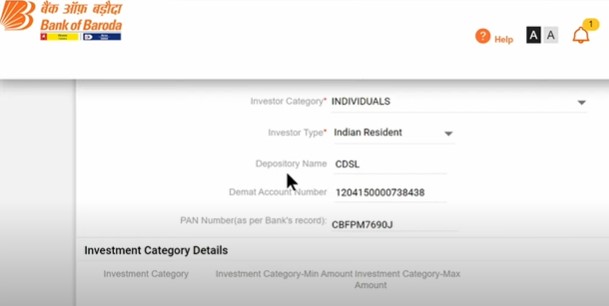

Select the Investor name, Account number, Investor category (individuals or others), and Investor type (Indian resident or NRI) from the drop-down.

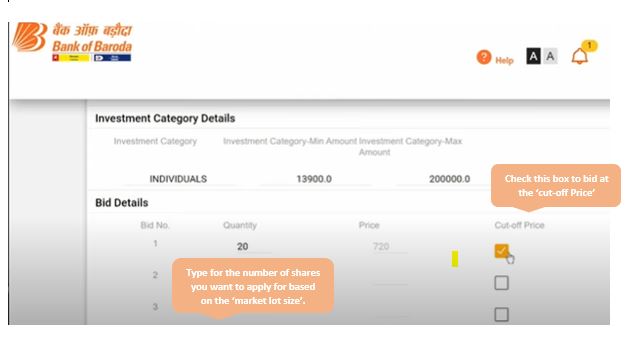

After filling in the applicant details, you need to fill in the subscription details. You can place up to three bids in an application. Enter the bid quantity in the number of shares. You can either enter the bid price within the price band or tick the 'cut-off' price.

The cut-off price means that you accept the allotment at the upper price point of the price band given by the company. Please note only retail investors can bid at cut-off price.

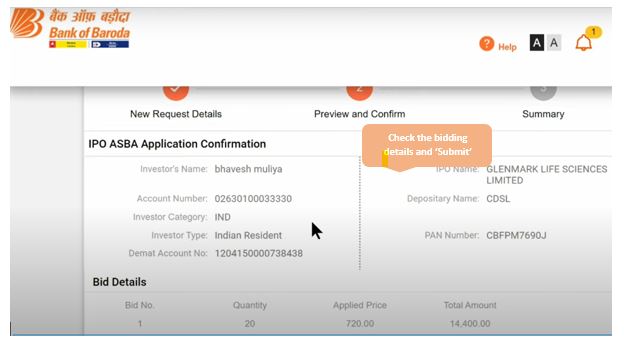

Review all the application details like applicant name, account number, PAN No., bid quantity, price. In case of any changes, go back and update the required data. The bid quantity and price modification are allowed at a later stage as well. However, you are not allowed to update applicant details later. It may require you to cancel the entire application and apply for a new one.

Once all the details are verified, click on continue.

Click on submit as the last step to complete the IPO application process. Once you click on Submit, the bid amount gets blocked from your account.

You can submit the IPO bids anytime from the IPO open date till 3.00 pm on the IPO closure date.

Bank of Baroda offers an ASBA IPO Application to its customers to apply for an IPO using the BOB Net Banking services. You can apply, modify, cancel the bids at your convenience while the IPO window is open at no extra cost.

Yes, you can easily apply for an IPO online through the Bank of Baroda Net Banking facility.

Bank of Baroda is one of the SEBI-identified SCSBs that provides ASBA services to its customers to allow online IPO applications. You need to have an account with Bank of Baroda and Net Banking facility with transaction rights to access the online IPO functionality.

You should have a bank account with the Bank of Baroda (BOB) along with access to the Net-Banking facility to apply for an IPO in BOB.

Steps for applying in an IPO through BOB Net banking

The bid amount gets blocked once you click on Submit and a message gets displayed on the screen confirming the successful IPO application.

The Bank of Baroda Mobile App (BOB World) does not offer online IPO application functionality.

Bank of Baroda customer who has access to a net-banking facility has to use the bank's net-banking website to apply for an IPO.

Steps to apply in IPO using BoB Net-banking Website

You can easily modify an IPO bid in Bank of Baroda through the Net Banking facility while the IPO window is open.

Steps to modify IPO bid in Bank of Baroda are:

It is important to note that, in case of downward revision of the bid amount, the original amount remains blocked till the finalization of allotment. However, in case of the upward revision, the bank blocks the additional amount from your account.

You also have an option to withdraw/cancel the bid through the same menu while the IPO window is open.

To apply for an IPO through the Bank of Baroda, users need to register investor details as a one-time process. Once the details get added, you only need to select and add these details from a drop-down while applying for future IPO applications.

Steps to add investors in Bank of Baroda account:

Bank of Baroda supports one IPO application per bank account. The primary bank account holder and the primary demat account holder should be the same (same PAN numbers) for a valid IPO application through Bank of Baroda.

You have the option to cancel/withdraw an IPO application while the IPO is still open. You can cancel your IPO bid in Bank of Baroda through its Net-banking website.

Steps to cancel IPO application in Bank of Baroda

After cancellation, the bid amount blocked in your bank account also gets unblocked for use.

Bank of Baroda Mobile app (Baroda M Connect) does not offer the facility to apply in IPOs. However, you can easily apply for an IPO through the Bank of Baroda Net Banking website.

Bank of Baroda offers an online IPO application through its website. Note that the online IPO facility is not available on BoB mobile app.

Follow the below steps to apply for an IPO through the Bank of Baroda:

BOB Mobile App (Baroda M Connect) does not offer online IPO applications. For applying for an IPO, you can use the Bank of Baroda ASBA facility, offered through their Net Banking website.

Bank of Baroda (BoB) allows its customers to apply for IPO through BoB net banking facility. BoB bank account holders can apply one application from one bank account in an IPO. The primary account holder's PAN Number in Bank Account and Demat Account should be the same.

Steps to apply IPO through BOB net banking

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|