Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Friday, June 10, 2022 by Chittorgarh.com Team

UCO Bank allows its customers with net-banking access to invest in IPOs online (through the ASBA facility). Retail customers can use both the online and offline modes to apply for IPO through the UCO Bank.

UCO Bank's online ASBA IPO Application facility is available to all its customers free of cost. Using this facility you could apply for IPO shares instantly using the funds in your UCO bank saving bank account and your demat account with any broker.

The UCO Bank IPO application is a simple process and can be processed within a few minutes. Before beginning the IPO application process, UCO Bank account holders must have the following information on hand: PAN card number and Demat account number (16 digits).

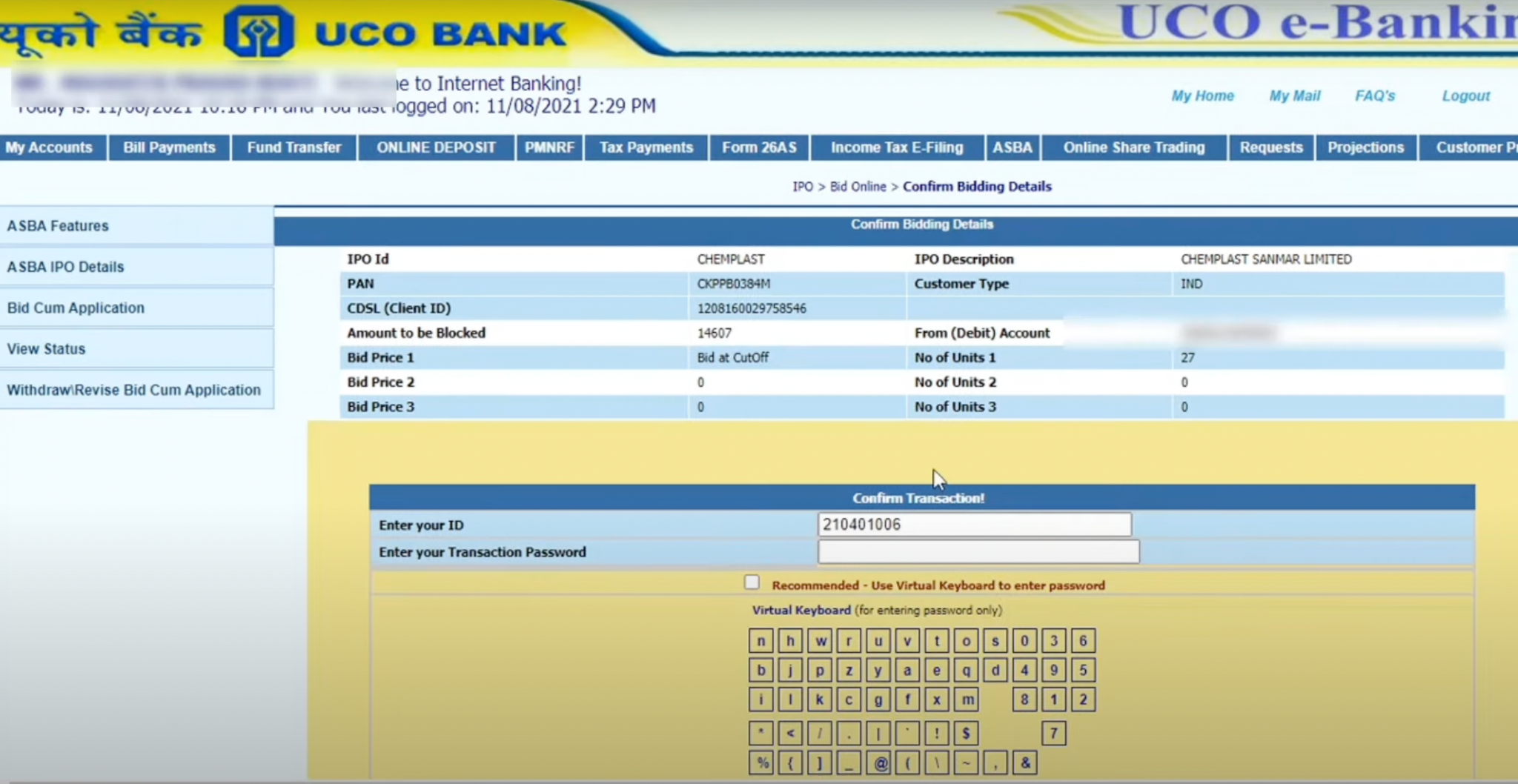

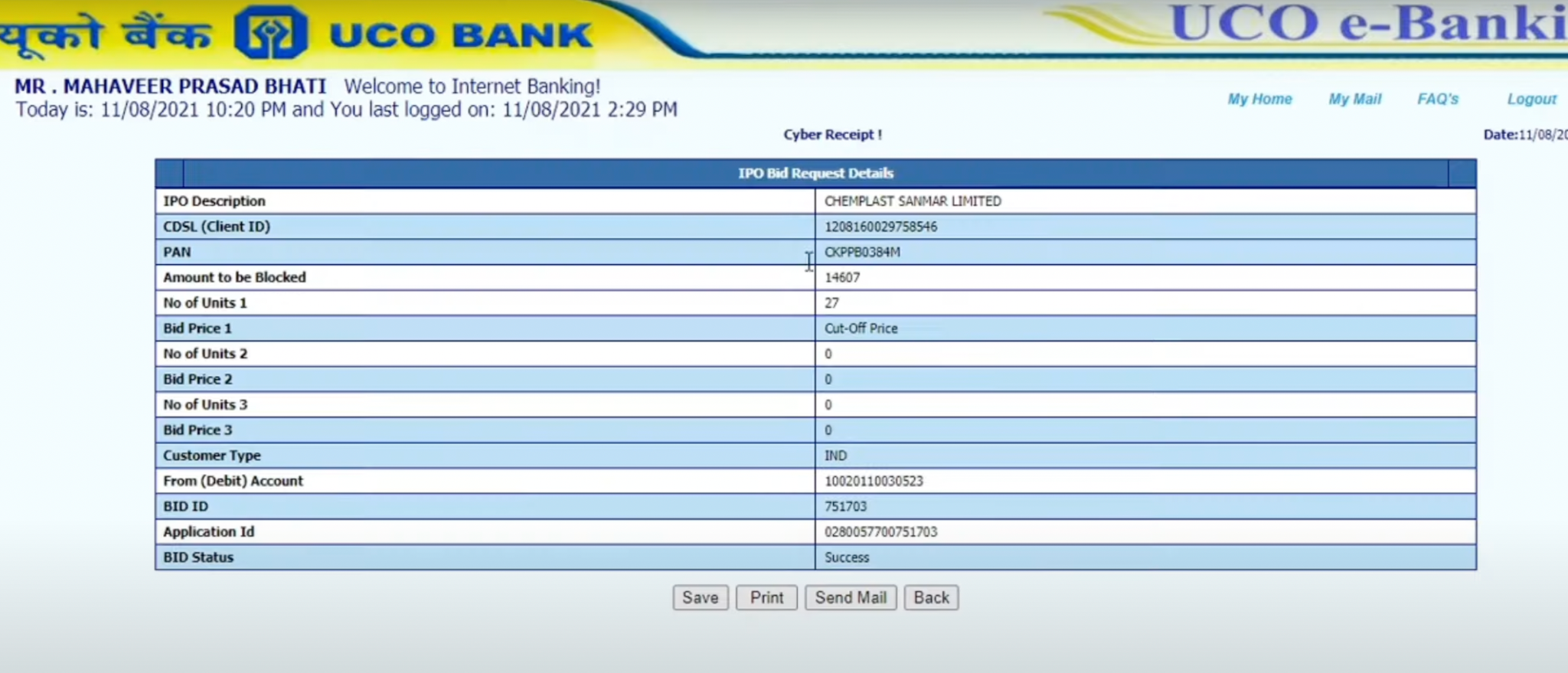

Following are the steps to apply for IPO online through UCO Bank:

Select IND RII (Retail Investor) if you are investing below Rs 2 lakhs and 'NII'; if above Rs 2 lakhs.

There is a checkbox for Cut-Off Price. The cut-off price is useful in Book Building issues. The companies set a price range for these issues. Investors must choose a price within that range. At the time of allotment, the corporation sets a price, and investors who bid for a price equal to or higher than the set price are given shares.

A cut-off price is an option given to retail investors. Opting for a cut-off price means you are giving consent to buy the shares at a price decided by the company during allotment. It saves you from a bidding race and ensures that you're eligible for allotment at the price decided by the company.

You can submit up to 5 applications for each IPO from a single account, each with different details. Enter the number of shares you wish to apply for. Every IPO has a minimum amount of shares, also called a market lot, to bid for and to bid more you need to do it in multiples of the minimum quantity. So if the minimum quantity is 15 shares, you can bid for 15, 30, 45 etc.

For offline IPO Applications, customers need to fill out a retail e-banking request form and send it to their local UCO Bank Branch.

Yes, you can apply for IPO through UCO net banking. UCO bank account holders who have active savings or current accounts can apply for IPOs through the e-ASBA facility. UCO Bank is one of the members of the SCSBs (Self Certified Syndicate Banks). SCSBs are allowed by the SEBI to accept online IPO applications from investors.

Yes, you can modify/edit/update your IPO application details online during the IPO bidding window. Revision is not possible after the closure of the bidding process. To revise or edit details of an existing IPO in UCO Bank, take the following steps:

Follow the below-mentioned steps to withdraw the IPO application:

No, there are no additional or hidden charges associated with using the ASBA facility through UCO Bank. This is a completely free service.

Customers' accounts will only be debited when the allotment is made, however, the amount will remain blocked in the account. For the time it is blocked, the blocked sum will earn interest.

From a single bank account, an investor can submit 1 application in an IPO. The bank account holder's PAN number and the PAN number on the Demat Account used in IPO application should be same.

Yes, UCO Bank m-Banking mobile app provide an IPO application facility.

Following are the steps for IPO Application through UCO Bank:

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|