Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Friday, January 4, 2019 by Chittorgarh.com Team | Modified on Sunday, July 18, 2021

UPI means Unified Payments Interface. It is an instant payment system on the mobile platform. It offers inter-bank transfers between any two persons' bank accounts i.e. sending or receiving money in real-time among banks in India. In addition, UPI also allows blocking money for special purposes like IPO applications.

The National Payments Corporation of India developed UPI. It is regulated by the RBI.

In late 2018, SEBI permitted UPI as an alternative payment option for retail investors (Up to Rs 2 Lacs) to invest in IPO.

Important Resources:

UPI is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

Each Bank provides its own UPI App for Android, Windows and IOS mobile platform(s). As of May 2019 IPO through UPI Mechanism in Retail Category is working on only BHIM App.

Note:

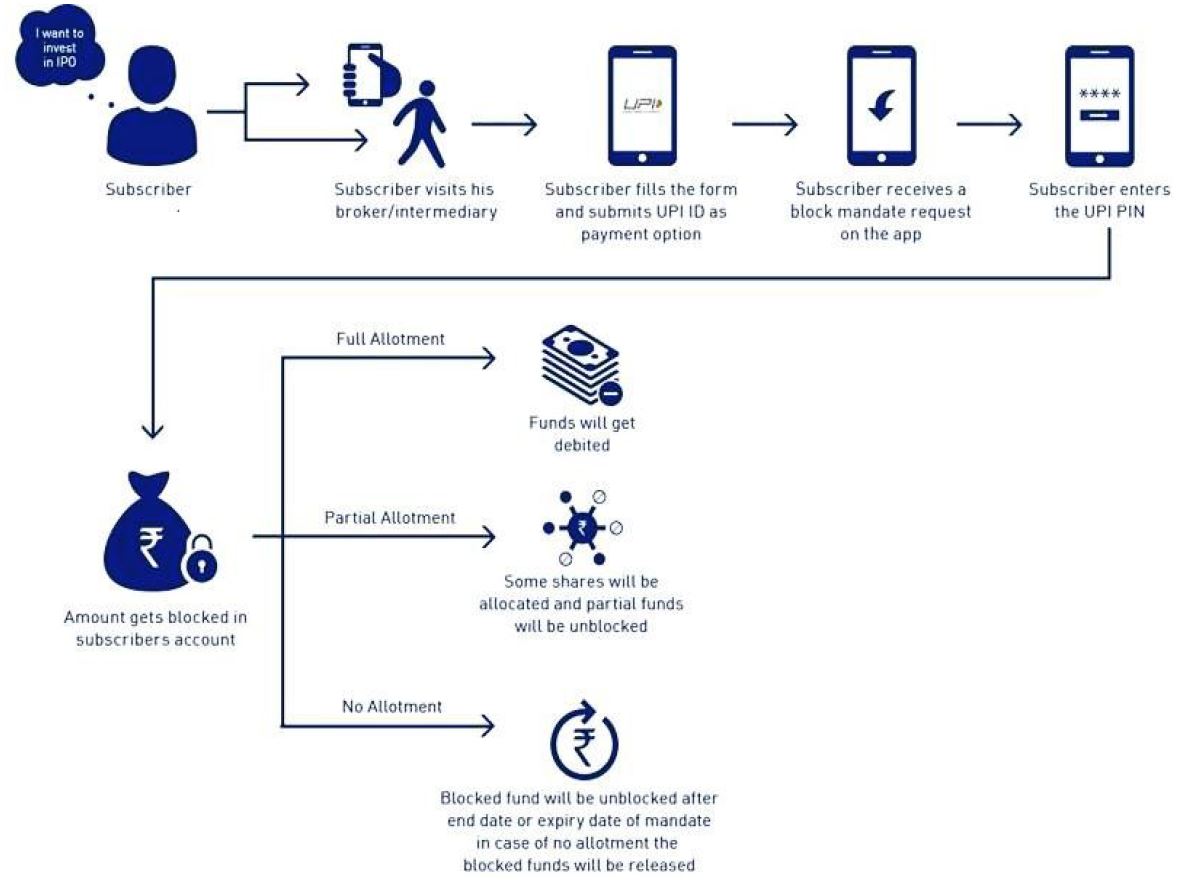

For Investor:

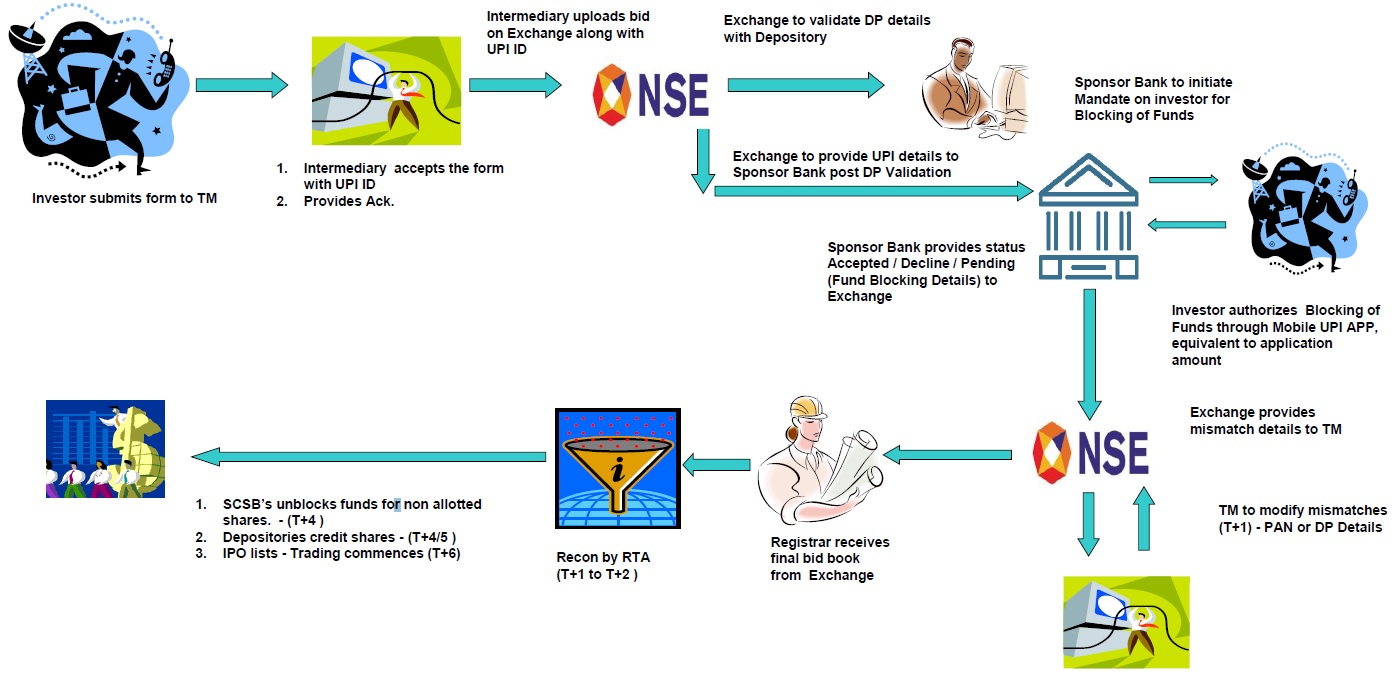

In background:

For Investor:

UPI payment option for IPO application will be implemented in phase as mentioned below:

From January 2019, the UPI is optional for Retail & Shareholder Category Investors. It will work along with the existing ASBA process. The listing of IPO shares will take 6 working days from the date of closure of the IPO.

Apr 03, 2019 As per the SEBI Circular, it has been decided to extend the timeline for implementation of Phase I of the aforesaid Circularby 3 months i.e.till June 30, 2019. The implementation of Phase II and III shall continue unchanged as per the aforesaid Circular from the date of completion of Phase I.

From March 2019 or after 5 mainboard IPO, the UPI will be mandatory for Retail & Shareholder Category Investors. The listing of IPO shares will still take 6 working days from the date of closure of the IPO.

July 01, 2019

SEBI Circular - Implementation of Phase II of UPIKey Highlights

UPI to be mandatory for Retail & Shareholder Category Investors with up to Rs 2 Lacs for all IPO applications. The listing of IPO shares will reduce to 3 working days from the issue close date.

Note:

Unified payment interface (UPI) is an instant payment system developed by the National Payments Corporation of India (NPCI). UPI allows the instant transfer of money between any two persons' bank accounts using a payment address which uniquely identifies a person's bank account.

Note that UPI Mechanism is made mandatory for Retail & Shareholder Category Investors to invest in IPO's for bid value amounting to Rs 2 Lacs and below from July 01 2019.

UPI ID (also called Virtual Payment or VPA) is a unique ID. Individuals need to create a unique payment ID on the app provided by eligible banks/wallet app by adding/linking his bank account details in order to send and accept money via UPI.

UPI or Unified payment interface is an instant payment system. It allows the instant transfer of funds between two bank accounts using a payment address which uniquely identifies a person's bank account.

SEBI has made mandatory for retail investors to use the UPI Mechanism for applying in IPO from July 1st, 2019. Investors applying in an IPO using Retail & Shareholder Category for bid value amounting to Rs 2 Lacs and below has to apply using UPI payment options.

The earlier ASBA payment option to block the funds is no more available to the customers.

As per the SEBI Circular - Revised IPO rules for UPI, page 6 says:

In order to ensure parity across the various channels for submitted applications, it has been decided that an investor making application using any of the aforesaid channel, shall use only his / her own bank account or only his / her own bank account linked UPI ID to make an application in public issues.

It means once the UPI is fully implemented only 1 IPO application will be allowed per bank account. Also, the bank account should belong to the same person who is applying for IPO. This is unlike earlier where banks like SBI use to allow 5 application from one bank account, the new rule will allow only 1 application per bank account in an IPO.

This new rule will put a lot of hardship to Minor Account where online transaction banking is not allowed by most of the banks. It will also make it difficult for investors who apply for 1 application on each family member's name using the same bank account to increase the chance of allotment in an IPO.

In case the IPO Request has expired, the transaction will be declined and needs to be re-initiated by Broker.

Note: As per the SEBI circular on April 03, 2019, the Phase I of UPI implementation is extended till June 30, 2019. This time SEBI didn't set limit of number of IPO in this duration.

You would not be able to apply in IPO using ASBA (net banking) after this date.

UPI is an online fund transfer/payment method similar to NEFT, RTGS or IMPS.

Every time you send or receive money online (using to NEFT, RTGS or IMPS), you have to share the bank account information i.e. Bank Name, Account Number, IFSC code etc.

With UPI, sharing the bank account detail is not required.

Using UPI you could create a unique ID for a bank account. This ID is called Virtual Payment Address (VPA). It's like a personalized email address which you share with anyone whom you would like to transact online. No need to share bank account details with UPI.

Example of VPA: rajivsingh916@icici

This unique code is linked with one of the bank accounts in the background. You have to share only VPA for transfer and not the whole bank account detail.

VPA is unique for each account. If you have 5 bank accounts on your name in the bank, you have to create 1 UPA for each account.

The Virtual Payment Address or VPA is the most important concept of UPI. It is also known as UPI PIN, UPI Code or UPI ID.

VPA is a unique ID which you create for your bank account. This unique ID can be used for online money transfer across the banks in India similar to IMPS, NEFT, RTGS etc.

UPI VPA look like 'rajivsingh916@icici'.

If someone wants to transfer money to you, you just have to provide this ID. No need to provide the bank account number, IFSC code, name etc.

Each banks mobile banking application has UPI as a payment option. Simply log in to mobile banking app and create a new VPA for your account with a choice of your words. That's it. It is as simple as creating an email address.

For ICICI Bank customers, UPI is available in its iMobile App which offers mobile banking.

Steps to setup UPI in ICICI Bank:

One the UPI ID created for the bank account, you can use it for any UPI online fund transfer or payments.

Other banks including HDFC, Kotak and SBI have similar steps to follows.

UPI as a payment mechanism for IPOs is applicable in all IPOs for which Red Herring Prospectus is filed after January 01, 2019. UPI will be mandatory for retail investors from from 1st July, 2019.

The limit for IPO application is 2 Lakhs per transaction on UPI.

In case your bank is not providing UPI services for IPO, you may make use of your bank account for blocking of funds and depending upon the Phase (I, II or III) in which the application is being made, submit the application with the respective SCSB or intermediary.

The application form for an IPO, now also includes a field for entering your UPI ID as a payment mechanism. Further, you can get in touch with any of the Intermediary who shall be able to guide you on the process in detail.

No. Applications made by retail investors using third party UPI ID or by any category of investors using a third party bank account are liable for rejection.

But in a few cases, people get allotment due to a loophole in the allotment process.

In case the collect request is erroneously declined by you, the transaction will be declined and you will have to initiate a fresh request again. The transaction can be re-initiated by approaching the intermediary where your bid cum application form has been submitted.

Retail individual investors can withdraw bids till issue closure date. During the bidding period you can approach the same intermediary to which you had submitted the application form for withdrawal.

In case of a technical decline, you need to reinitiate the payment process from the IPO Portal. The transaction can be re-initiated by approaching the same intermediary to which you had submitted the application form.

Yes, once the bid details are uploaded on the stock exchange platform, the stock exchange shall send an SMS to you regarding submission of your application, on end of day basis. For the last day of bidding, the SMS may be sent out the next working day.

You may approach the broker to which you had submitted the application form for re-initiating the process. You may also like to check whether the UPI ID recorded is correct or not.

The transaction will be declined with 'Wrong UPI PIN' and you will have to re-initiate the transaction. The transaction can be re-initiated by approaching the same intermediary to which you had submitted the application form.

The Modification/Revoke can be done online or by visiting the respective bank branch before IPO is close for subscription.

Yes. In Phase I, all block / collect requests which have not been acted upon by 12:00 p.m. on T+2 day i.e. two days after closure of the issue, would lapse. In Phase II, all block / collect requests which have not been acted upon by 12:00 p.m. on T+1 day i.e. one day after closure of the issue, would lapse.

The block request from IPO is not fraudulent in case the UPI ID is marked as a 'verified merchant'. Please look out for the indication of a Verified Merchant tag when you receive the request on you App for blocking the amount that you have BID in the IPO. The request is received as a collect request on your UPI enabled App. Further also please verify the details including your Bid-cum application number, amount and other bid details received during the collect request.

You can raise a complaint with the bank/s with the respective Unique Mandate Number provided for the Mandate.

De-registration will not be available from the application until the active mandates are revoked / Executed.

The UPI transaction will be declined in case the account has insufficient funds.

UPI PIN is required only once at the time of creation of the Mandate.

Customer should reach out to their bank with the Unique Mandate Number (UMN) for the respective IPO Mandate / Block request.

You can check www.npci.org.in for the list of Banks available for the IPO Service on UPI.

No, the values cannot be modified for the request received for blocking the funds in your account. Any modification to the bid has to be undertaken by approaching the intermediary through whom the bid was placed.

You could authorize the UPI IPO mandate request for blocking the funds till 5 PM of the issue closing date.

A mandate request once created can be revoked till closure of the issue. The revoke can be initiated through the intermediary with whom the initial application was submitted for bidding.

Revoking an IPO request is cancelation of the IPO Bid and the corresponding block mandate.

In such a case, you would need to re-initiate the revoke request. Such re-initiation of a revoke request can be done initiated through the Intermediary with whom the initial application was submitted for bidding.

In case of part allocation, money will be debited for the allocation value and the residual amount will be unblocked to your account.

In case the shares have not been allotted to you and money is not unblocked / reinstated in your account, you may raise a complaint through the UPI App.

UPI mechanism is made mandatory for retail investors for IPOs (Mainboard and SME) starting from July 01, 2019. Below is the Step-by-Step UPI Process applying in IPO using UPI.

As per the bank guidelines:

Only minor above the age of 15 with a bank account as a single (not joint) are eligible for UPI.

Minor below the age of 15 years or a minor who is a joint account holder is not eligible for UPI.

Please consult with your bank for more detail.

Why banks and stockbrokers are not ready with UPI Payments for IPO applications?

National Payments Corporation of India provides UPI API to banks. Banks today are using UPI 1.0 version of API.

The lean marking feature (blocking the funds in a bank account) is made available in UPI 2.0 API. As UPI 2.0 API have massive changes over the 1.0 version, the banks require enough time to test the application before they move to UPI 2.0.

The fund transfer limit is increased from Rs 1 lakh per transaction to Rs 2 lakhs in UPI 2.0. This also put banks at higher risk in case something goes wrong.

Unless bank upgrades their system to UPI 2.0, they can't provide their UPI 2.0 enabled bank API to their customers including brokers. So brokers cannot implement UPI 2.0 based payment for IPO until banks provide them the upgraded API's. Once the bank releases the feature, it will take some time for brokers to test and implement it.

Other challenges with the UPI implementation planned for phase 1:

As none of the banks are ready yet, it won't be easy to meet extended phase 1 SEBI imposed timelines.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

We want to know whether Retail Investor can make IPO Application (using UPI Mechanism) from Current Account opened with the SCSB?