Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

| Exchange | NSE, BSE |

| Segments | Equity Derivatives |

| Products | |

| Order Types | Limit, Market, StopLoss, StopLoss-Market |

| Website | Yes |

| Mobile App | No |

| Installable Trading Terminal | Yes |

| API's | No |

| Online IPO | No |

| Mutual Funds | No |

| Integrated Backoffice | Yes |

| Chart Types | |

| Chart Indicators | |

| Charts in same window |

|

Pros |

Cons |

|

Brings the best of a strategy engine and trading platform |

Filtering of strategies based on risk and reward is not possible. |

|

Packed with useful features like Option Analyzer, Futures Conversion, Event Calendar etc. |

Traders need a good understanding of option strategies to optimally use the platform |

|

Makes executing complex strategy simpler with a single click |

Platform pricing makes it unsuitable for small and occasional traders. |

|

Sleek and simple interface |

Sensibull is an options trading startup founded by Abid Hassan, along with Abhimanyu, Rs 2.5 crores in it. The company has recently launched an 'Options trading platform' that promises to make Options trading easier and faster for small traders. The platform suggests a list of strategies based on a trader's market view. Further, it provides you with all essential information like trade, strike prices, risk, profit and loss potential etc. You can also compare different Option strategies to find the right one for you.

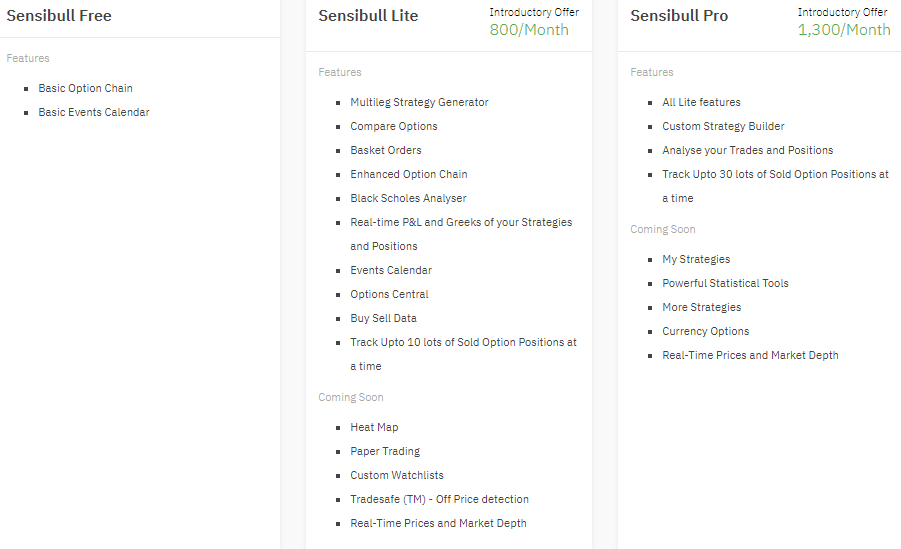

The platform is available in 3 versions- Free, Lite and Pro.

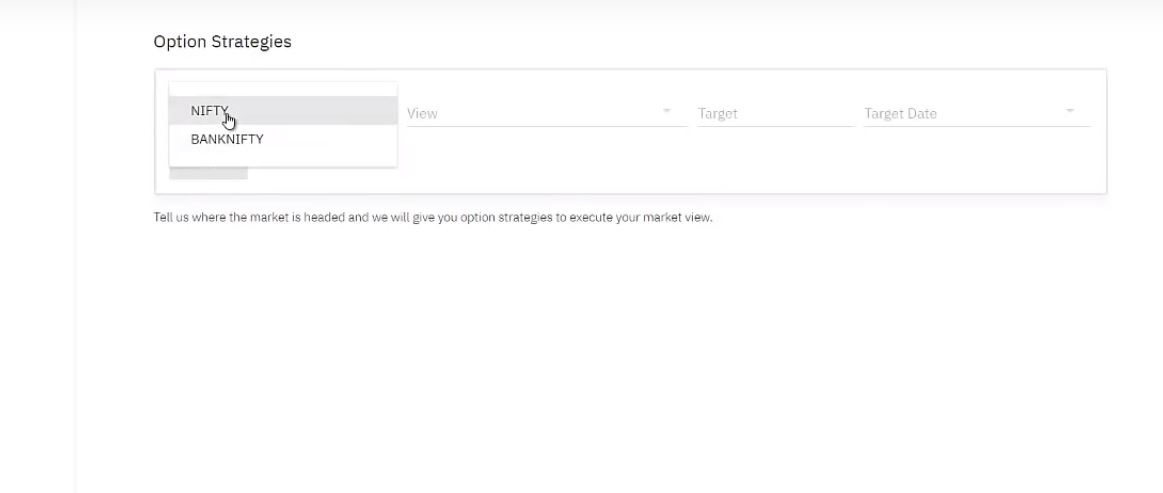

Let's say you think Nifty will be up by 100 points in the next couple of weeks. You need to enter following details-

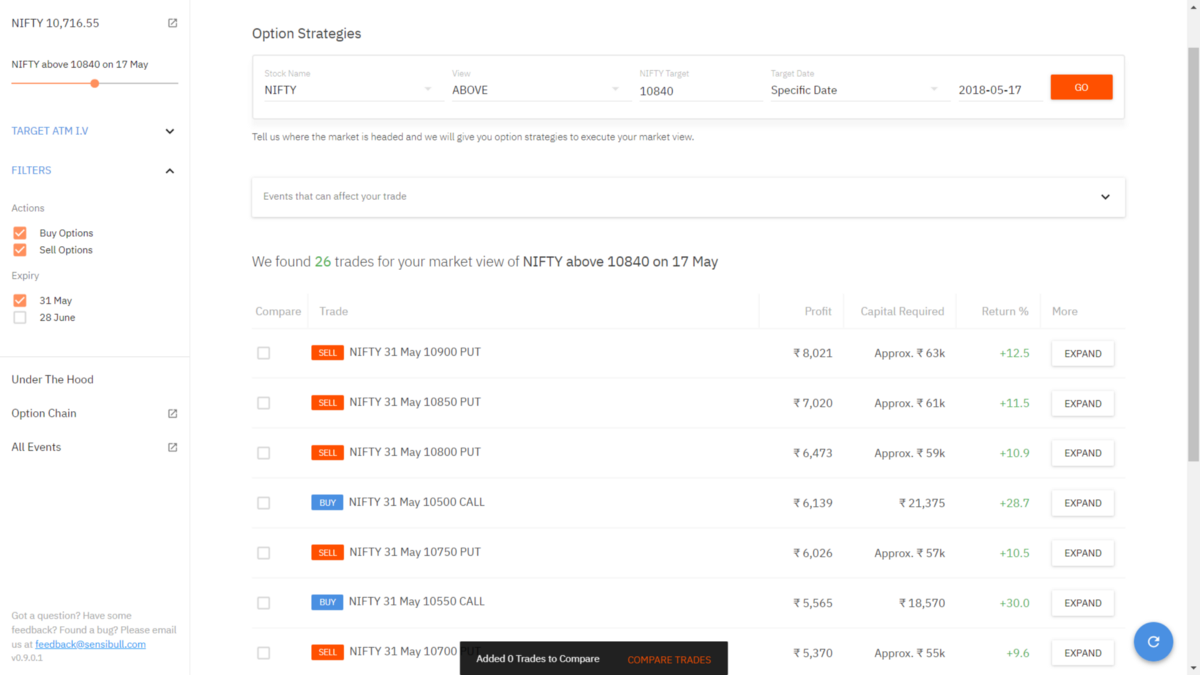

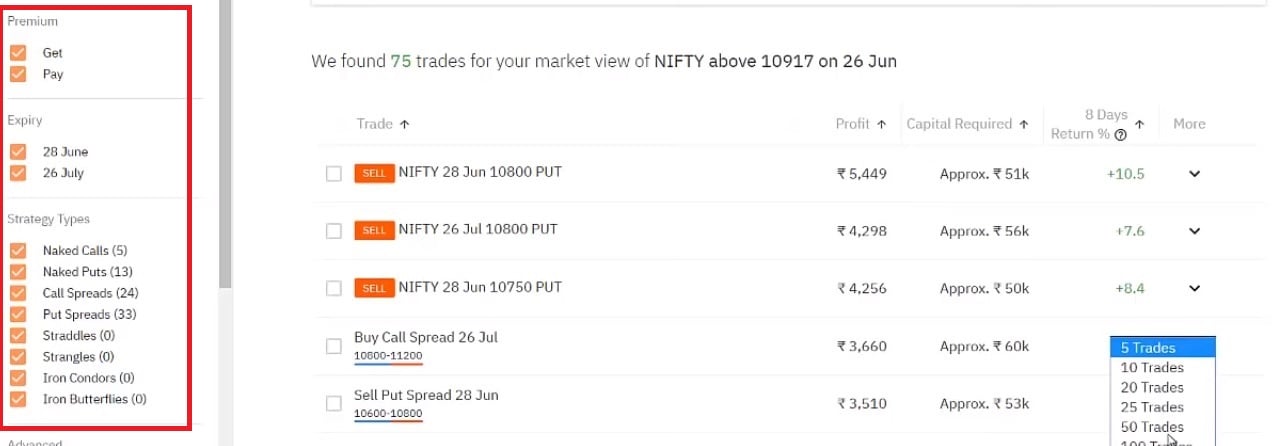

Hit 'Go' and you will be presented with a list of Options trading strategies appropriate for your market view along with profit potential, capital required, return percentage etc,. You can further know more on each strategy by hitting the 'Expand' button wherein you can know more about the number of legs in the strategy, risk and reward potential etc.

You can also filter the recommended strategies based on Actions- Buy or Sell and Expiry Date of the instrument.

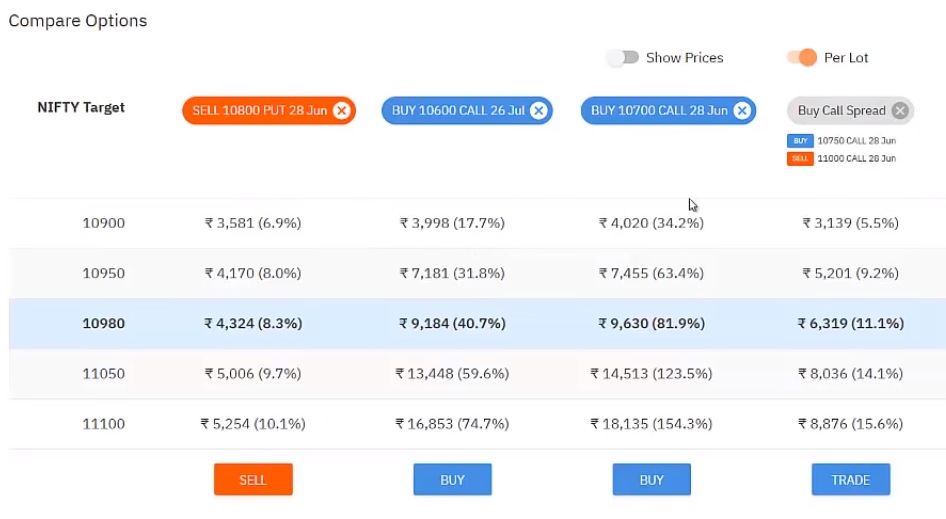

The platform allows you to compare suggested strategies and assess the P&L at various scenarios. You can change spot, dates, IVs etc., of each strategy to pick the best strategy for your trade.

Once you have picked the strategy, you can place and order directly from the platform.

Sensibull also offers other useful features for Option traders like-

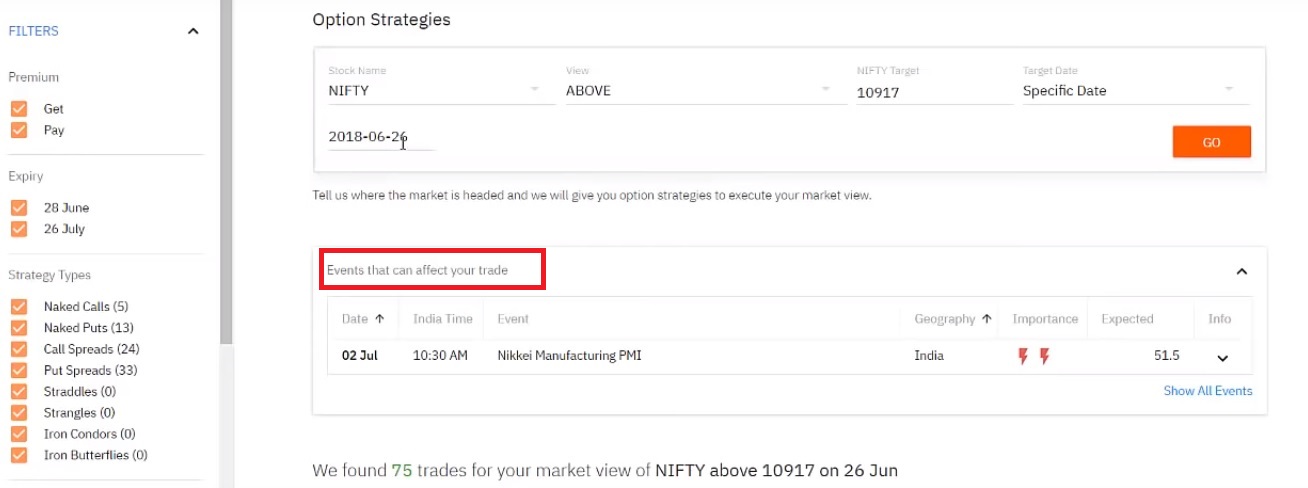

Event Calendar- The calendar focuses on the most important events, FnO results and global events, that can impact your trade and notifies you about the event risk across the site. It tracks macro events, as well as FNO results.

Predictive Securities Transaction Tax (STT)- It tells traders the likely STT charges on option contract expiring in ITM.

Option Analyser- It does a deep analysis of an Options contract with Option Greeks, Option Chain, Scenario analysis and trading P&L.

Futures Conversion and Implied Weekly Futures- It converts an option to relevant futures for your target day based on the given spot price. For Bank Nifty, as weekly Options do not have weekly futures contracts, it derives the implied weekly futures.

Enhanced Option Chain- The Option Chain gives you the entire OI buildup picture in a glance with great visualization. It comes with real-time Greeks, built-in events notifications, IV Percentile, PCR, etc.

Option Central- It helps traders to identify options trading opportunities by analyzing IV percentiles, OI Buildups, PCR, Events, Volume Breakouts, etc.

Sensibull options trading platform not only suggests you the best options strategies based on your market view but also allows you to trade and place your orders. Here's how to trade, buy and sell Options using Sensibull.

Login to the platform using ID and password. You will be directed to the dashboard.

Here you need to enter your market view by-

Once you hit the 'Go' button, the first thing you will see information on events that can affect your trade. The events can be expected policy announcements, corporate results, interest rate increase/decrease etc. It will also tell you the importance of the event and how impactful it is for your trade. So consider the events affecting your trade before going forward.

Next, you will be presented with a long list of recommended strategies as per your market view. For each strategy, you will get information on expected profit, capital requirement, returns rate etc.

To make your job easier, you can use the filters available on the left of your screen. Let's discuss the filters a little-

In addition, there are 4 advanced filters-

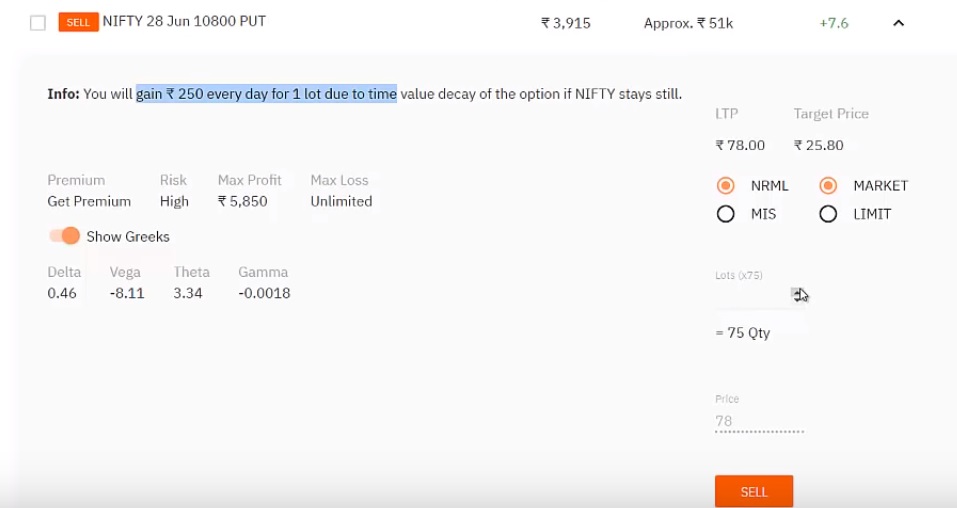

Once you have filtered the options strategies, you can then know more about each option strategy by clicking on the 'downward arrow' button available on the last column of each strategy.

Here you will get more information about a particular strategy including data on Option Greeks.

You can also compare various option strategies. Selecting the options strategies you want to compare by clicking on the box and then clicking on the 'compare' button appearing on your screen.

Place an Option order

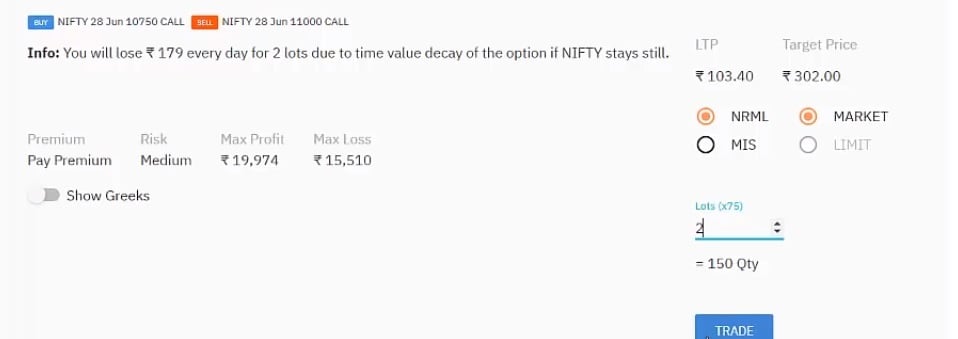

You can place a BUY or SELL order from both individual strategy page or comparison page. Let's see how to place an order in sensibull from the strategy page-

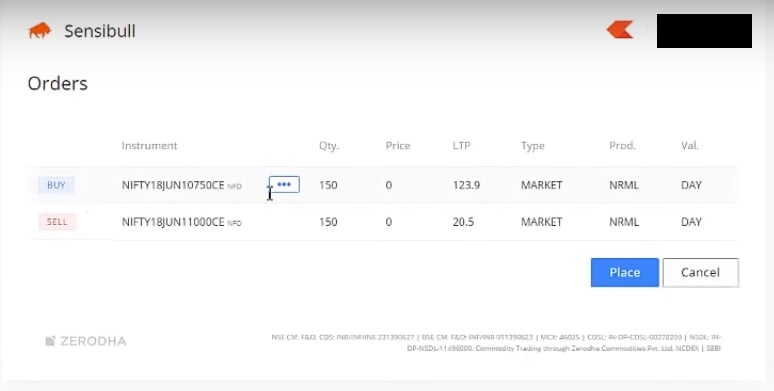

To place an order, you need to enter 2 things- Order Type and Lot Size. And, then hit on the trade button.

If you wish to modify the order then you can do so by hovering on the trade you wish to change and a 3-dotted box will appear. Click on it and modify the details.

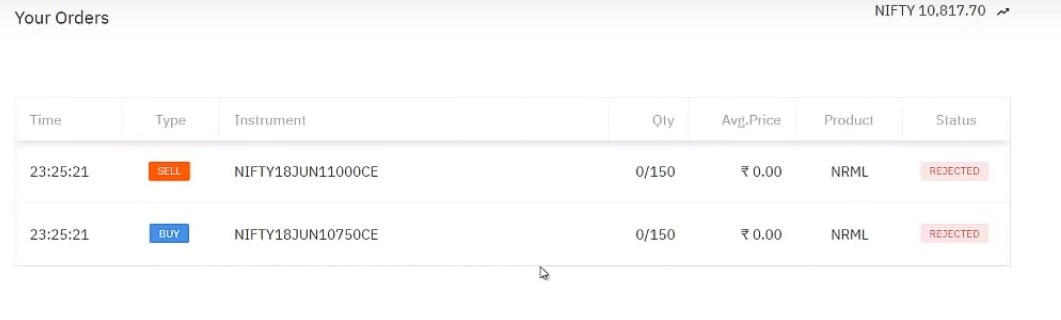

Click on the place button and the order will be sent to Zerodha's Kite. You will be taken to 'Your Order' page where you can check the status of your orders.

The basic version of Sensibull platform is available free of costs. However, traders need to pay a fee to access higher versions of the sensibull options trading platform. Sensibull Lite comes at an introductory offer of Rs 800/month while Sensibull Pro is available at Rs 1300/month.

Conclusion

Sensibull, the options trading platform does make life a lot easier for an Options Trader. The good thing about the platform is that it combines features of a strategy engine that recommends option strategies to traders with a trading platform that enables executing the strategy. It also makes executing complex strangle strategies like strangles, straddles etc., easier with a single click. In simple words, the platform cuts a lot of math and technical details to make trading simpler and easier.

This webpage provide review of Sensibull by Sensibull. Get detail info about Sensibull .

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|