Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

| Exchange | BSE, NSE, MCX, NCDEX |

| Segments | Equities, Commodities, Currency, Derivatives |

| Products | NEST Trader, NEST Web, NEST Mobile |

| Order Types | Limit, Market, StopLoss, StopLoss-Market |

| Website | Yes |

| Mobile App | Yes |

| Installable Trading Terminal | Yes |

| API's | Yes |

| Online IPO | No |

| Mutual Funds | No |

| Integrated Backoffice | Yes |

| Chart Types | 5 |

| Chart Indicators | 50 |

| Charts in same window | 5 |

Omnesys NEST is one of the most popular trading platform used in India. It is developed by Bengaluru based Omnesys Technologies Pvt. Ltd. In 2013, Omnesys was acquired by Thomson Reuters Corporation.

NEST is an abbreviation for Next Generation Electronic Securities Trading platform. It offers a variety of trading tools for institutional and retail brokers, proprietary desks and exchanges.

For retail brokers, NEST supports web and mobile trading. The platform offers key functions such as order management, risk management, order routing, and franchise and branch management related software.

NEST supports trading in equity, currency, commodity and derivatives markets. NEST offers a range of solutions for retail trading such as-

| Pros | Cons |

|---|---|

|

|

Headquartered in Toronto, Canada, Thomson Reuters is a global multinational mass media and information company. In 2013, Omnesys Technologies was acquired by Thomson Reuters. Omnesys Technologies is a Bangalore based software development company. Omnesys NEST trading platform was developed by Omnesys Technologies.

Over 200 retail brokers in India use NEST or NEST based platforms. The NEST is a fast, user-friendly and powerful trading platform for trading at BSE, NSE, and MCX. Some of the major highlights of the Omnesys NEST trading platform are:

Omnesys NEST is a leading trading platform catering to the needs of traders in India. The platform offers integrated trading and risk management. Some of the major features of the NEST Trading Platform are:

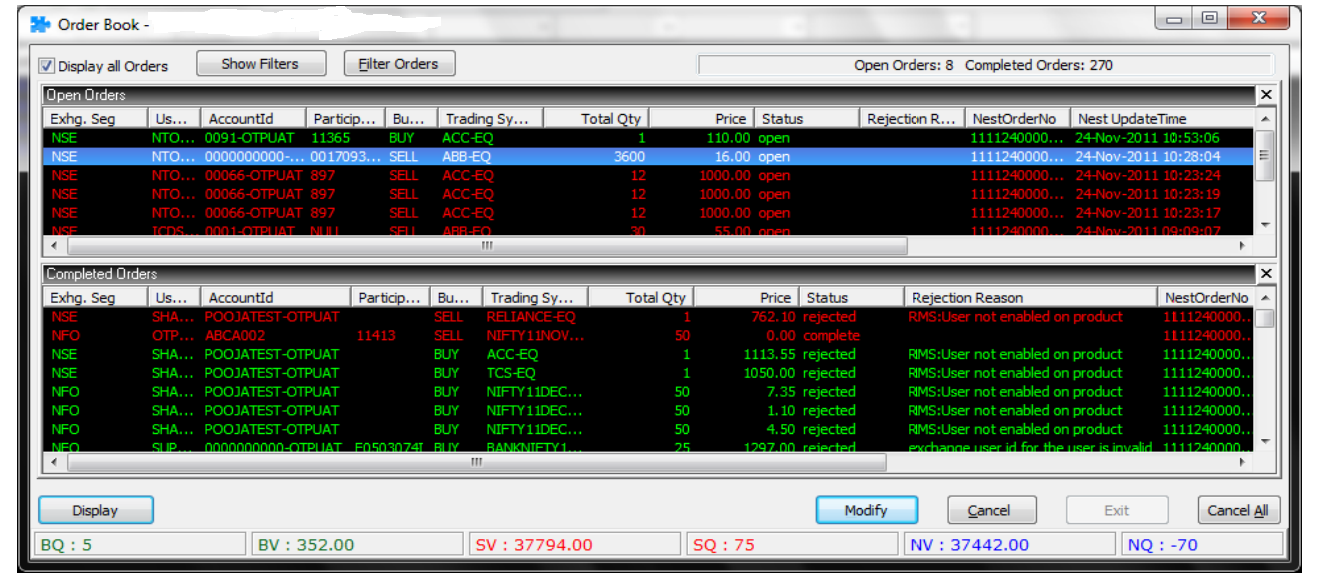

Reports: Omnesys NEST offers a wide range of reports including Order Book, Trade Book, Net Positions, Spread Order Report, Order History, Bulk Trades, Modified Trades, View RMS Limits, View Holdings/Collateral Values and View T1 Holdings.

Traders can also generate Order Reports and Trade Reports and save it.

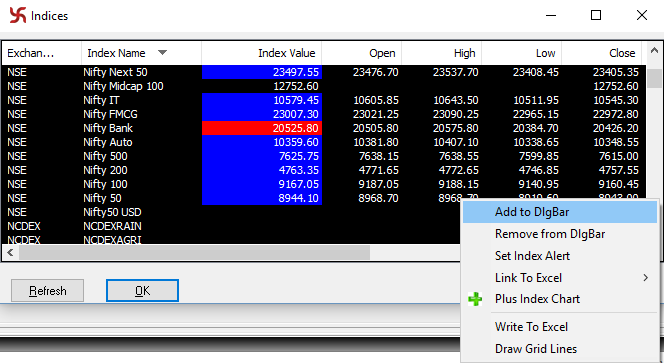

Market Watch: Traders can create multiple MarketWatch in which scrips are added as per convince. Users can call some important features of the market watch by using assigned shortcut keys. Major features that can be called from market watch are: Order Entry Window, Market Depth, Order Book, Trade Book, Net Positions, scrip comparison, scrip properties, heat map, ticker, expression builder, intraday charts, market picture charts, Gridlines, write to excel, setting up of the font style in the market watch, insert space in market watch, etc.

Advance Charts: Nest offer some excellent charting features like intraday charts with back data of up to a week and configurable intervals in minutes. You also get access to Historical Charts with daily data since inception. It offers over 50 technical indicators with multiple charts view.

Most customers love Omnesys Nest for its wide availability with multiple brokers and reliability. Some customers have pointed out on the interface issues.

NEST Trader

NEST Trader platform is a front-end downloadable application that users to trade in multiple exchanges and multiple segments. Some of the major features of NEST Trader are:

NEST Web

Nest Web is a browser-based interface. Some of the major features of NEST Web are:

NEST Mobile

NEST Mobile is a mobile application that facilitates trading on the move. Some of the major features of the app are:

Source: Omnesys

NEST offers a range of customization preferences to users to suit their trading requirements. Some of the customization choices available to users are-

NEST provides a wide range of reports to traders like.

Users can download and save reports as well as create custom reports by using filters. All the historical data gets saved in back office. Traders can access backoffice to get other reports.

Brokers pay a licensing fee to Omnesys Nest to use their platform. Some brokers charge a fee from their customers while other make it available for free.

This webpage provide review of Omnesys NEST by Thomson Reuters International Services Private Ltd. Get detail info about Omnesys NEST .

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|