Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

15.98% 177,541 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

SMC Global is a diversified financial service provider offering a wide range of financial products and services to resident and non-resident Indians (NRI) investors. NRIs can invest in Equity, Debt, Derivatives and Real Estate Funds with SMC. NRIs can also invest in Mutual Funds and IPO through SMC Global.

Incorporated in 1990, SMC Global is one the largest full-service broker offering its services in 500+ cities through 2500+ sub-brokers.

SMC's NRI trading services are available to PIS account holders of HDFC Bank, Axis Bank, Yes Bank, IndusInd and Federal Bank. The company is also a SEBI registered portfolio manager-providing client-specific portfolio & wealth management services to NRIs.

SMC Global is a TCM (Trading-cum-Clearing) member with stock exchanges. The company offers custodian services to NRI clients to clear and settle trades in equity derivatives.

SMC Global has a dedicated research desk that offers trading recommendations and expert insights on stocks, market and economy.

SMC Global charges brokerage fee on Equity Delivery at 0.50% and Equity Futures at 0.05% of the value of the trade to NRIs. The brokerage fee for Equity Options is ₹75 per lot for NRI customers.

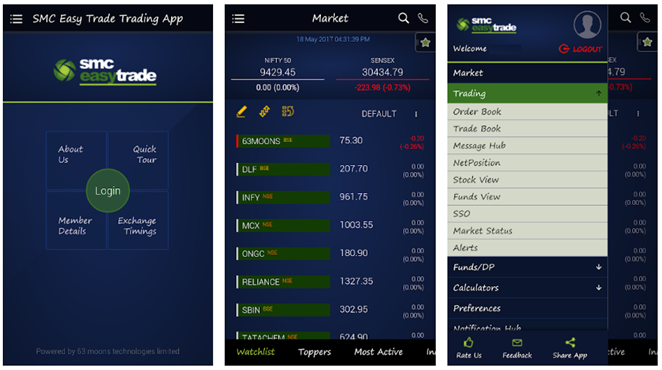

SMC offers powerful trading platforms for free. This includes trading website, mobile trading app, and desktop trading terminal. It also offers SMC AUTO TRENDER, a unique trading tool that provides fast and rich insights on market-based upon technical and quant research.

To invest in India Stock Market, an NRI need 3 accounts.

SMC Global NRI Account is a 2-in-1 account. This account includes a trading and a demat account, linked together for seamless transactions. The NRI Bank Account has to be opened with a bank like HDFC.

SMC Global doesn't provide NRI Bank Accounts as it doesn't have a banking license. Before opening SMC Global NRI account, an NRI needs to open an NRI Bank Account and get PIS certificate from RBI.

SMC Global has a partnership with HDFC Bank, Axis Bank, Yes Bank, IndusInd and Federal Bank for NRI Bank Account.

Note that to trade and invest in the Indian share market, NRIs are required to obtain PIS permission from RBI. The bank with you has opened NRI Bank Account can help you in getting PIS permission. The bank will report on all trading transactions made under PIS certified bank account to the RBI.

The trading account with SMC Global allows investors to buy and sell securities in electronic format. NRIs can invest across equity, debt funds, mutual fund, IPOs and equity derivatives segment through the trading account.

It also offers online trading platforms for NRIs with advanced charting and technical analysis. The NRIs are allowed to invest through a mobile app, website and software-based trading platforms.

SMC Global offers NRI Demat account services through its membership with NSDL and CDSL. The NRIs can hold Indian securities (shares, bonds, mutual funds etc.) in electronic format in Demat account. It works like a bank account but instead of money, it holds equity shares or units of mutual funds.

Note:

Note: SMC Global is registered as a clearing and settlement member with SEBI to work as a trading settlement member for NRIs. So, NRIs are not required to open a custodial account and get CP Code with other 3rd party clearing companies.

SMC Global NRI customers can trade online or by calling the trading desk. The process is easy, simple and convenient. Below are high-level steps for NRI Trading with SMC Global:

Transfer funds to NRE PIS Bank Account. Once the funds are available in the PIS Bank Account, the bank informs SMC Global to update the trading limit for the customer.

Log in to one of the trading software and place buy or sell order. You could also call the trading desk and place the order. The order is validated and sent to the stock exchange.

If a matching order is found in the exchange, the order gets executed.

Based on buy or sell order, the corresponding NRI bank account is debited or credited with money, respectively. Contrary, the Demat account is debited or credited with shares depending on sell or buy order. It takes T+2 days for settlement of the trade.

At the end of the day, the broker sends the buy and the sell contract note separately to the bank. The contract note is an invoice with the detail of the transaction, fees and taxes. Bank settles the transactions with the broker based on this contract note.

Bank reports all the transactions in NRI PIS Bank Account to the RBI daily. It's important to note that PIS enabled NRI bank account should only be used for investing in the stock market to avoid any wrong reporting.

SMC Global NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹1000 |

| NRI Account AMC | ₹0 |

| Equity Delivery Brokerage | 0.50% |

| Equity Future Brokerage | 0.05% |

| Equity Options Brokerage | ₹75 per lot |

| Other Charges | Demat AMC: ₹1180, Min Brokerage: ₹20 |

SMC Global, a leading full-service broker, offers 3 online trading software:

The investment options available to an NRI at SMC Global.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others | Debt Funds, Bonds, ETF, Insurance |

An NRI needs 3 accounts to invest/trade in Indian Stock Market.

As SMC Global doesn't offer NRI Bank Account, the NRI has to open this account with one of the banking partner i.e. Axis Bank, Yes Bank, Indusind Bank, HDFC Bank or Federal Bank. NRI also have to take the PIS permission on this account through the bank.

SMC Global offers a 2-in-1 account which includes trading and demat account. Below are the steps to open the account.

Note: You could also send a soft copy for scanned form and supporting documents to the broker before you send the paper form. This is to ensure that all the information, sign and attestation are done correctly.

To open an NRI account with SMC Global, following documents along with the client registration form is required:

All the documents are required to be attested by any competent authority such as Any Court/ Local Banker/ Magistrate/ Notary Public/ Consulate General/ Judge of the residing country or by the Indian Embassy.

| Feature | Status |

|---|---|

| 3-in-1 Account | No |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

SMC Global offers online Mutual Fund investment services to NRIs. Through the online mutual fund platform, NRIs can invest online in schemes from different fund houses. Mutual fund units are held in the NRI Demat account. NRIs can invest in a wide range of Mutual Funds including liquid, gilt, debt, equity and balanceded funds.

SMC Global Research and Advisory team provide weekly and monthly research reports about Mutual Funds. These reports provide industry & fund update, info about new fund offers and performance of equity funds, balance fund, debt fund, funds of fund and gilt funds.

Key Features

SMC Global NRI Support Desk contact information. Find SMC Global NRI contact number.

| SMC Global NRI Helpline | Number |

|---|---|

| SMC Global NRI Customer Care Number | +91-11-25754371, 91- 9650988009 |

| SMC Global NRI Customer Care Email ID | nridesk@smcindiaonline.com |

SMC comes across as a good choice for NRI investors who are looking for a company that offers a wide range of financial products under one roof and investment recommendations. The broker offers a good online trading platform. It also provides wealth management services to NRIs. It has a corporate office in Dubai which makes it easy for NRIs residing in the city to avail various services through branch visits. The brokerage charges of SMC Global are high in comparison to discount stock brokers.

No, you cannot open NRI trading and Demat account with SMC Global if you have NRI Bank Account with ICICI Bank.

SMC Global has a partnership with Yes Bank, Axis Bank, HDFC Bank, Indusind Bank, and Federal Bank for NRI Account.

Yes, SMC Global offers custodial services for NRIs as it is a registered Trading-cum-Clearing member.

A custodial account is necessary for NRIs who want to invest in the equity derivatives segment. With SMC offering custodian services, it reduces the charges to be paid to the 3rd party by NRIs for clearing the trades.

For opening an NRI trading account with SMC Global, you need to have an NRI bank account with the following banks:

SMC Global charges AMC for NRI demat and trading account in 2 ways- Annual Plan and Advance AMC Scheme (5 Years). In the annual plan, the AMC is Free for the first year and Rs 1180 from Second Year Onwards. In the Advance AMC scheme, NRIs have to pay Rs 2950 for 5 years.

The brokerage charged by SMC Global is as follows:

|

Segment |

Brokerage Charges |

|---|---|

|

Equity Delivery |

0.50% |

|

Equity Options |

0.05% |

|

Equity Options |

Rs 75 per lot |

Yes. NRIs can borrow against shares or other securities held in NRI Demat Account.

NRI PIS bank account is a repatriation account. This account is designed to invest NRI foreign earnings in India. Every transaction in this account is reported to RBI. You should not use this account for any other purposes except investment on a repatriation basis.

To invest out of borrowed funds from India, an NRI could use NRO bank account. The NRO bank account is designed for NRI investment in India on a non-repatriation basis. Transactions in this account are not reprinted to RBI. This account is used commonly by NRIs to receive earnings in India like rental, pension etc.

No. For NRIs, all transactions of sales and purchase must be delivery based. Short selling is not permitted to NRIs. NRIs are also not permitted to trade in Intraday and Commodity Derivatives.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Thursday, November 23, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|