Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

| Exchange | BSE, NSE, MCX, NCDEX |

| Segments | NSE, BSE, NSE FNO, Currency, MCX and NCDEX Commodity |

| Products | CNC, MIS, NRML, BTST, BO, CO, BTST, MTF |

| Order Types | RL, SL, ST, AON, MF, MIT |

| Website | Yes |

| Mobile App | Yes |

| Installable Trading Terminal | Yes |

| API's | Yes |

| Online IPO | Yes |

| Mutual Funds | Yes |

| Integrated Backoffice | Yes |

| Chart Types | |

| Chart Indicators | 100 |

| Charts in same window |

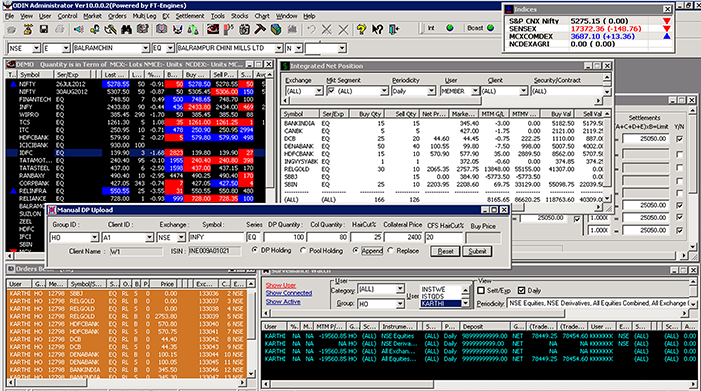

ODIN is the leading online trading platform in India. Developed by Financial Technologies in 1998, ODIN trading software has the largest share of a trading platform in India for over 2 decades.

As of Dec 2019, 1000+ clients across 400 cities and over a million active end users. The market share of ODIN is falling drastically since 2013 after the fraud at NSEL was surfaced in 2013.

The parent company 63 moons is still going through the fraud at NSEL. This adversely affected the ODIN platform. In April 2018, the prosecutors attached the intellectual property rights of ODIN to this case. The freeze on ODIN IPR means that the revenue received from the sale of trading technology terminals to brokers would not be accessed to the company.

ODIN, The Brokerage Technology Solutions

The Multi-Exchanges, Multi-Currency Dealing Desk, and Risk Management System ODIN is a technology platform that allows online trading in multiple segments across multiple exchanges. The platform has inbuilt order management and risk management components.

ODIN is popular among traditional stock brokers in India. It works really well in the sub-broker / franchise business model.

ODIN is the abbreviation for the Open Dealer Integrated Network.

ODIN trading software offers a number of tools for trading. These tools are categorized under Exchange Technology Solutions, Brokerage Technology Solutions, and Risk Solutions.

For Brokerage Technology Solutions, ODIN offers online trading, order management, risk management, order routing, and franchise and branch management related software.

ODIN is a trading platform with the facility to trade in cash, derivatives, mutual funds, IPOs, currencies, and commodities. A user can trade in all these segments from one single screen. ODIN offers to trade at BSE, NSE, MCX, and NCDEX.

The product offering for retail customers:

| Pros | Cons |

|---|---|

|

|

63 moons is a trading technology provider for financial exchanges. The company was incorporated in 1995 as Financial Technologies and later rebranded as 63 moons in 2016. The company provides a range of technical and software solutions for online trading.

Mr. Jignesh Shah is the founder and chairman of the 63 moons group. Under Mr. Jignesh Shah, the Group launched the Multi Commodity Exchange of India (MCX), India's first commodity exchange in 2003 and is currently the world's 6th largest commodity futures exchange.

NSEL, a spot commodity exchange, went insolvent in July 2013 after about two dozen counterparties defaulted on payments to 13,000 investors. The outstanding monies owed to the investors amount to Rs 5,300 crore. 63 Moons own 99.99% of NSEL's equity capital. Mr. Jignesh Shah was jailed.

The company sold its holding in MCX, IEX, and other exchanges in the year 2014 after an order from market regulators.

ODIN trading software is used by over 1000+ brokers / financial institutes in India. It is a stable, fast and a powerful trading platform for trading at BSE, NSE, and MCX. Here are a few key highlights of the ODIN Diet:

ODIN had a monopoly in the trading solutions business until 2013. The growth of the product stalled after the owner got caught in 2013 fraud at NSEL. The company's fate is in limbo as the prosecutors are trying to recover over Rs 5000 Cr.

ODIN Diet is a comprehensive trading tool. It offers to trade in equity, currency, and commodity, all under one screen and with one login. You can trade at BSE, NSE, MCX, and NCDEX.

ODIN Diet is built for frequent trader and for dealers who place orders on behalf of customers. Other than the standard trading features, here are some of the key features of the ODIN Trading Platform:

Most customers like the ODIN Diet trading platform as they are using it for years. It works well and has all the features a trader need.

Few complaints:

Positive words:

ODIN offers a range of products for trading.

For trading Equity in the delivery segment.

For intraday trading in equity and F&O segments. All MIS trades are squared off automatically at the end of the trading session if not closed by the customer.

Normal orders are used for an overnight position in Equity F&O, Currency F&O, and Commodities F&O. Orders placed under NRML products are not squared off at the end of the day.

A Bracket Order is an advance order which allows traders to take an intra-day position and take advantage of extra exposure while being protected through a stop-loss order and a profit booking order.

A cover order is an advance order in which the buy/sell order is automatically placed along with a stop-loss order in a single click. CO allows trading with higher exposure as it minimizes the risk.

Also known as PTST (Purchase Today Sell Tomorrow) or ATST (Acquire Today Sell Tomorrow). This order allows the trader to sell shares one day after the buy order, without waiting for shares being credited to the demat account from buy order. In this case, the trader doesn't have to wait for T+2 days to sell. Technically, the BTST order give 2 extra days to the intraday traders. This increases the probability of a better return. In simple words it allows you to sell before getting delivery of the stock to your demat account.

MTF orders allow the trader to carry delivery position beyond 7 days, by paying only a small percentage of the security's value known as margin amount.

An order that has no special condition associated with it is a Regular Lot Order. They are also known as NRML or Normal orders.

These orders are placed for minimizing/restricting the loss.

All or none means that if someone is placing a big quantity order and he doesn't want to get less quantity to be executed, and then he can place an order that either all the quantity should get executed or none.

In the case of minimum fill which means that at least this much of minimum quantity should get executed or none. It is also used for the buyback of shares.

All the orders having either AON (all or none) or MF (min fill), come under the category of ST.

ODIN is highly customizable trading software. Hundreds of settings are available to the user for the personalized experience. Some of these settings include:

ODIN provides a number of orders and trade reports.

Traders can check the status of all orders in the order book. The order book reflects pending, rejected and executed order status for buy/sell orders for the current trading day.

All trades done on a particular day can be viewed in the trade book window. Trade book gives details of the order executed at the exchange along with the execution details such as Traded Quantity and Traded Price.

It provides the details of the cash segment delivery based holdings available in the pool account.

In ODIN, you can access the back office reports directly from the trading application.

ODIN is a third party trading software made available by brokers to customers. The fee for using ODIN varies by the broker.

The brokers pay a hefty licensing fee to offer this trading platform to its customers. Some brokers bear the cost while others pass it over to the customers who use the software for trading.

Traditional Brokers:

Discount Brokers:

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|