Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

| Exchange | NSE, BSE, MCX |

| Segments | Equities, Currency and Derivatives |

| Products | MIS, CNC, NRML |

| Order Types | Limit Orders, Market Orders, Stop Loss Orders, After Market Order and Cover Orders |

| Website | Yes |

| Mobile App | Yes |

| Installable Trading Terminal | Yes |

| API's | No |

| Online IPO | Yes |

| Mutual Funds | Yes |

| Integrated Backoffice | No |

| Chart Types | 15 |

| Chart Indicators | 80 |

| Charts in same window |

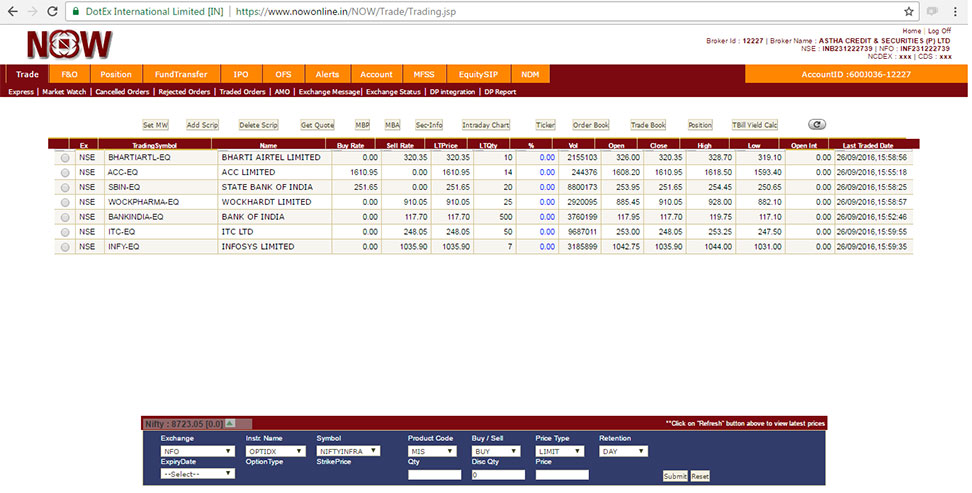

NOW is a trading software build and maintained by NSE, the leading stock exchange in India. NOW offers direct connectivity to the exchange for trade execution and live data feed as the servers are collocated at NSE data centers.

NOW offers to trade through installable trading terminals, web-based browsers and mobile app. The trading platform is offered for free of charge to all the brokers who are the member of NSE. NSE charges a small fee for using NOW to trade at BSE.

NOW support trading in all products traded at NSE. This includes Equity Cash, Equity Derivatives, Currency Derivatives, Debt funds and Mutual Funds.

NOW has a built-in risk management system and the order management system. This makes NOW among the fastest trading platform available in India today.

| Pros | Cons |

|---|---|

|

|

NOW Trading Platform is owned by NSE subsidiary Dotex International Limited. NSE is India's leading national stock exchange. Mumbai based NSE was established in 1992 to offer online trading to investors in India. NSE offers to trade in Equity, derivatives, and currency. NSE is the 4th largest exchange in the world in terms of equity traded volume.

NOW offers a wide range of functions which are critical for trading in the stock market. NOW Website and the Mobile app is designed for casual stock market investors. The trading terminal the powerful trading software for frequent traders. Here are some of the key features of NOW Trading Platform:

Fastest order execution

NSE now offers high-speed performance as servers of NSE NOW are located inside the exchange's premises and has Direct connectivity. As the servers are closest to order matching system, they have the lowest latency compared to trading servers of other brokers. This allows it to offer fastest order execution in India.

How to use NOW Trading Platform

Margin intra-day square off the product, is for intraday trading in Equities Cash, Equity Derivatives, Commodity and Currency Derivatives. You square off the position the same trading day under this product. If positions are not closed by the trader, they are automatically squares off the same 30 min before the closing of market hours.

Cash & Carry is used when trader would like to take the delivery of Equity shares. No leverage is given under this product by most brokers.

Normal Product is used for trading in Equity, Commodity and Currency Derivatives (F&O) trading.

A limit order allows place an order of buy/sell at a specified price. A limit order to buy can only be executed at the specified limit price or lower. A limit order to sell will be executed at the specified limit price or higher.

A market order is a buy/sell order to be executed immediately at current market prices.

This is an order placed to sell a security when it reaches a certain price called trigger price. A stop-loss order is designed to limit an investor's loss on a position in a security. In stop loss order, a trader needs to give both limit price and trigger price.

AMO orders allow trader to place an order for stocks beyond regular market hours. The orders get queued up and sent out once the markets open the following day.

A Cover Order is a market or limit order that is placed along with a Stop Loss Order. In a Cover Order the buy/sell order is always accompanied with a compulsory Stop Loss order, in a specified range as pre-defined by the system. These orders give you higher leverage by ensuring that you place a stop loss. This is beneficial only for intra-day trades.

Note: Bracket order is not available on NOW trading platform.

NSE charges a fee from brokers.

Almost all discount brokers and many traditional brokers offer NOW trading platform.

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|