Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

13.25% 137,634 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Finvasia offers online trading services to NRIs in equity, mutual funds, IPOs and equity F&O. It offers 2-in-1 account, combining a trading and a demat account, to NRIs to invest in various securities across NSE and BSE.

Finvasia is the only broker in India who doesn't charge any brokerage fee for trading in any segment at BSE and NSE. The brokerage free trading is available to all kind of investors including NRIs, HNI, retail clients, Foreign Institutional Investors, and high-frequency traders.

However, the company charges technology cost from customers to access some of the trading platforms. Its flagship trading platform 'SCALPERT' is available for free of charge to all.

Finvasia is a SEBI registered broker for BSE and NSE, Clearing Member and Depository Participant with CDSL. Finvasia has offices in Canada, UK and India.

To invest in the Indian stock market, NRIs are required

Finvasia offers NRI trading and Demat account opening facility. The NRIs have to open the NRI Bank account with one of the following banks:

Note: Finvasia is also a clearing member registered with NSE. The broker works as a custodian for NRIs to clear trades made under the equity derivatives category. This saves the trading cost for NRIs as 3rd party Custodian Account is not required for trading in Equity F&O.

Finvasia is an online stock broker offering 2-in-1 NRI Account. The 2-in-1 account includes an NRI Trading Account and an NRI Demat Account.

The NRI trading account allows NRI investors to buy/sell securities online. The trading account is offered through Finvasia's trading membership with BSE and NSE stock exchanges.

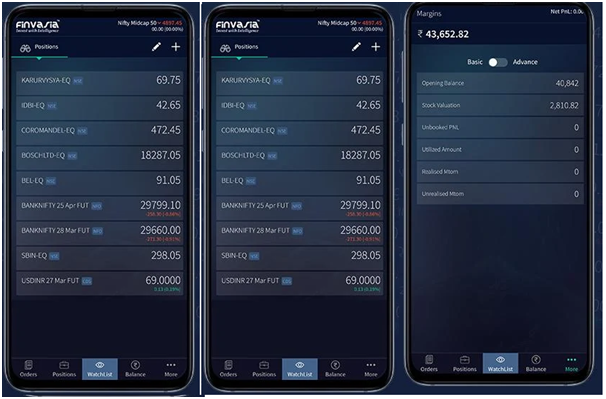

Finvasia offers a range of trading platform, some are free while others are paid, to NRI customers. This includes in-house developed Scalpert, website and mobile app based trading software available for free to all. The advance 3rd party trading software and tools are made available on a paid subscription basis.

The NRI Demat account holds the securities purchased across equity, mutual fund and derivatives segments in an electronic format. The Demat account works like a bank account for holding shares and mutual funds in an online account.

Finvasia offers NRI Demat account services through CDSL (Central Depository Services (India) Ltd) membership. The Demat Account opening fee and demat account Annual Maintenance Charges are free with Finvaisa.

Note:Read about NRI Demat charges, procedure and rules in detail in our post.

NRIs can invest in equity delivery segment through NRE Bank Account under PIS. Here is the step by step process of trading in equity delivery:

To trade-in equity, NRIs have to transfer the funds to NRE PIS Bank Account linked with Finvaisa Trading Account. Once funds are available, the bank informs the stockbroker. The broker now updates the trading limits on its trading platform.

Note that margin funding to not available as of September 2019.

NRIs can place buy or sell orders through the trading software provided by Finvasia. The orders are sent to the corresponding exchanges. The orders are either executed or rejected before the end of the trading day.

At the end of the day, the broker sends buy and sell contract notes separately to the bank. Depending on the buy or sell order, the NRI bank account is debited or credited.

In the case of the buy order, the stocks are credited in the Demat Account in t+2 days. T is for the date of trading. In the case of the sell order, stocks are withdrawn from the demat account and delivered to the buyer.

Note: Intraday trading/short-selling is not allowed for NRIs. They can only place sell request when they have shares available in the Demat account.

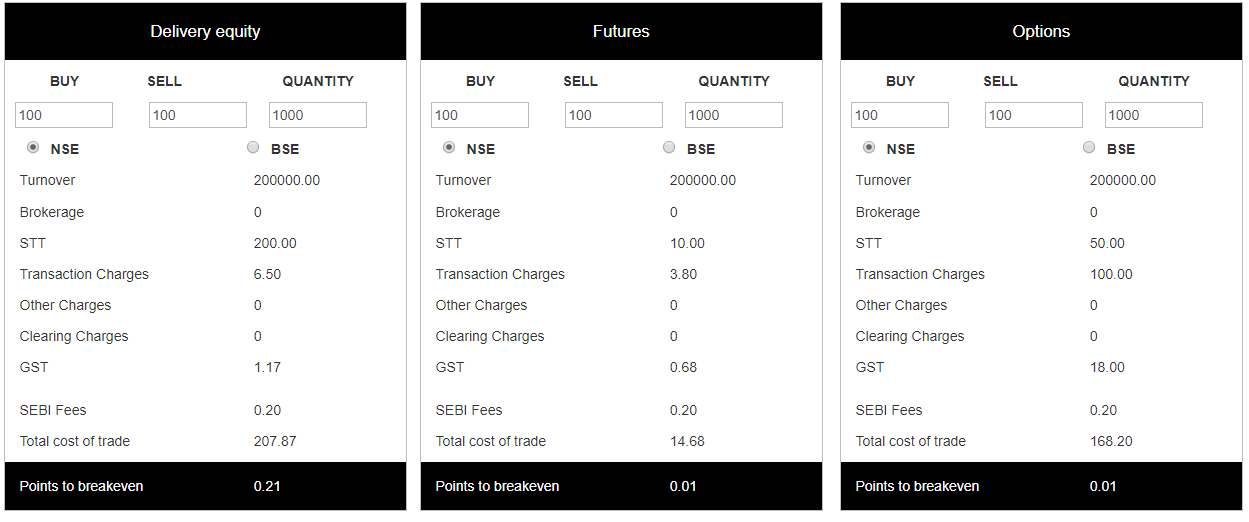

Finvasia NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹199 |

| NRI Account AMC | ₹0 |

| Equity Delivery Brokerage | ₹0 |

| Equity Future Brokerage | ₹0 |

| Equity Options Brokerage | ₹0 |

| Other Charges | ₹0 |

Finvasia offers a range of trading software to NRIs. All the software's available to resident Indians are available to NRIs. However, it charges technology cost or a subscription fee for access to some of the platforms.

Read Finvasia Online Trading Software Review for a detailed understanding of the features and pricing of the platforms.

The investment options available to an NRI at Finvasia.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | No |

| Others |

To trade and invest in the Indian stock market, the NRIs need to open:

Finvasia is an online stock broker offering 2-in-1 accounts (Demat + Trading). Finvasia works as a trading and clearing member for NRIs. The broker accepts linking NRI Bank Account with HDFC, Axis, Yes, PNB and ICICI banks under non-PIS. For PIS account, they have tied up with Yes and Axis banks.

Online account opening is not available to NRIs. NRIs have to submit the signed paper forms to open the account. The steps for offline account opening are:

Note: It's important to send the softcopy of the form to the account opening team to verify it before sending the paper forms to Finvasia Chandigarh office.

Finvasia NRI Account Opening Documents

NRIs have to send the application form along with photocopies of the following documents to the Finvasia for opening a Demat & trading account.

| Feature | Status |

|---|---|

| 3-in-1 Account | No |

| Free Research and Tips | No |

| Automated Trading | Yes |

| Other Features |

Finvasia offers both equity and debt mutual funds to NRIs. Through Debt mutual fund, NRIs can invest only in fixed-income securities. For investing in stocks listed on the stock exchanges, the NRIs have to invest in equity mutual funds.

Finvaisa offers Mutual Fund research and investment though 'SMART PORTAL'. Both lump sum and SIP options are available.

Finvasia NRI Support Desk contact information. Find Finvasia NRI contact number.

| Finvasia NRI Helpline | Number |

|---|---|

| Finvasia NRI Customer Care Number | +91 172 667 0000 |

| Finvasia NRI Customer Care Email ID | contactus@finvasia.com |

Finvasia is an excellent choice for frequent NRI traders as it doesn't change any brokerage fee. The online trading platform it offers is the industry standard. Advance trading tools are also available. It also offers Algo trading platform to NRIs. Finvaisa also provides demat account and clearing services at a very low price. Finvasia has offices in the UK and Canada.

Finvasia doesn't offer online account opening to NRIs. The NRIs have to fill the paper application form and send it to Finvasia office along with the supporting documents. It usually takes around 8 to 9 days for opening an NRI Demat and trading account after receiving documents. Here are the steps for Finvasia NRI account opening:

Yes, NRIs/PIO can invest in Mutual Funds with Finvasia on full repatriation basis or on non-repatriation basis.

Power of Attorney | Rs 199 |

Demat Debit Transaction Fee | Rs 9 per transaction |

Bracket Orders in NEST | Rs 99 per month |

Taxes | STT, Turnover Charges, GST, SEBI Fee, Stamp Duty - As applicable. |

Trading Platform | Charges (Monthly) |

|---|---|

Scalpert | Free |

NOW (NSE) | Free for trade at NSE. Rs 150 per segment for BSE. |

BEST (BSE) | Free |

NEST (Omnesys) | Rs 49 Per exchange, Rs 99 for Bracket Order |

Presto | Rs 1599 |

Fox Trader | Rs 1500 Per exchange |

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Thursday, November 23, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|