Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Thursday, September 20, 2018 by Chittorgarh.com Team | Modified on Monday, July 18, 2022

| Pros | Cons |

|---|---|

|

Zero brokerage on all segments |

Relatively new in the market. |

|

Free Call and Trade facility |

Scanners are not available on platforms. |

|

Powerful platforms and tools |

|

|

First-time access to Blitz Trader to retail customers |

|

|

No hidden charges |

Incorporated in 2013, Finvasia Securities Private Limited is a leading Fintech company. The company offers a range of services including brokerage services, asset management, investment banking, and research. It offers brokerage services in commodity, cash and derivative segments across NSE, BSE, and MCX. It also offers investment services in IPOs and Bonds.

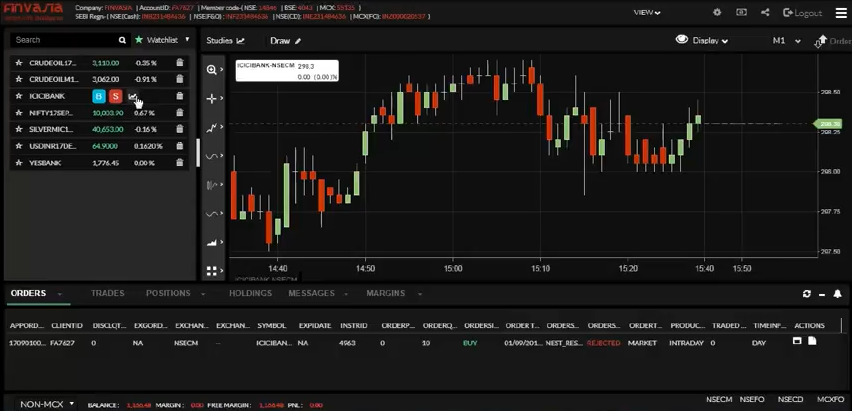

Finvasia is a tech-savvy company. It offers a range of trading platforms and tools to its customers. On trading platforms, customers can choose from ScalperT, Omnesys NEST, NSE NOW, Blitz Trader, Ami Broker, and Presto. Finvasia customers also get access to many trading tools like HFT Trading, IOB, Algo Plugins, Fix Engine, and Latency Sensitive API.

Finvasia gives its customers access to multiple trading platforms, both in-house developed and platforms from partners. Trading platforms offered by Finvasia are-

ScalperT- It is an in-house developed web & Mobile based trading platform. Some of the key features of the platform include :

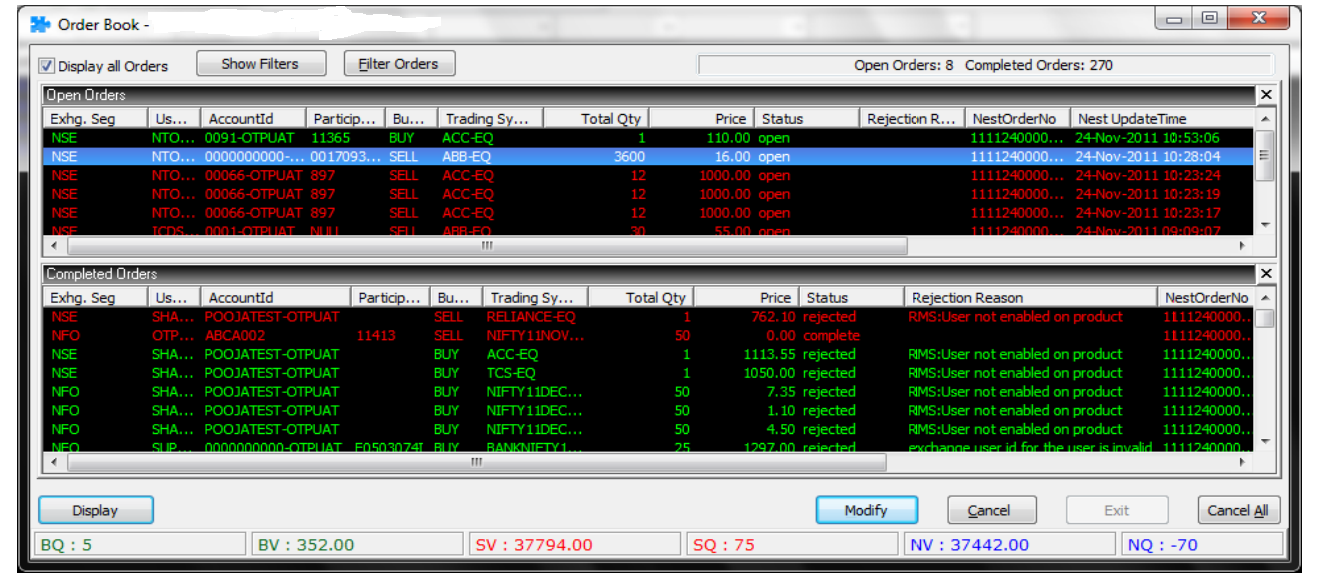

OmnesysNEST- It is an installable trading developed by Omnesys. The platform is now owned by Thomson Reuters. Omnesys Nest gives traders access to features like-

NSE NOW- It is developed by the National Stock Exchange (NSE). The trading platform is available in installable, web and mobile versions. NSE NOW offers features like-

Blitz Trader- An Algo trading platform available to retail customers for the first time. It is widely used by Proprietary Traders, Investment Managers, and Arbitrageurs. Some of the salient features of the platform are-

Presto- It is a platform to for automated trading algos to trade on MCX, NSE, and BSE. Presto is a product of Symphony Fintech, a Mumbai based solution provider of Automated Trading Systems for equities, futures, options, commodities, and forex. Presto is designed for small Traders to sophisticated Hedge Funds. This platform is to Design, Test, Deploy, Execute and Monitor fully automated trading or execution algos.

AmiBroker- It is an automated trading platform and offers features like-

Fox Trader- It is the latest offering from Finvasia. The platform offers features like-

HFT Trading- The tool helps to execute a large number of orders at high speeds. It leverages complex algorithms to analyze multiple markets and execute orders based on market conditions.

Institutional Order Book- It is a tool meant for sell-side brokers who need to execute large orders at a time. It allows brokers to take advantage of intraday volatility and price differential across instruments and exchanges with about 50+ Pre Approved strategies.

Brokerage Calculator- Finvasia offers brokerage calculators for equity, derivatives, commodities and currency trading to help you calculate your brokerage and assess your trade profitability.

Margin Calculator- It helps you calculate and maintain margins for your trades.

| Scalper T | Free |

|---|---|

|

NSE NOW |

Free |

|

Omnesys NEST |

NSE-INR 49 BSE-INR 49 MCX- INR 49 Bracket Order- INR 99 (Monthly Charges, Taxes Extra) |

|

Presto |

Monthly ID cost-INR 1599+ Taxes License fees extra (Monthly, Quarterly, Annually) |

|

Blitz Trader |

Monthly ID cost- INR 2999 (Taxes Extra |

|

Fox Trader |

Free |

Finvasia Securities Options Brokerage 2019

| Account Charges | Amount |

|---|---|

|

Trading Account Opening Charges |

Nil |

|

Trading Account Maintenance Charges |

Nil |

|

Demat Opening Charges |

Nil |

|

Demat Account Maintenance Charges |

Nil |

| Finvasia Options Charges | Equity Options | Currency Options |

|---|---|---|

|

Brokerage |

Zero |

Zero |

|

Call and Trade Charge |

Zero |

Zero |

|

Securities Transaction Tax (STT) |

0.05% on Sell Side on premium amount |

No STT |

|

Transaction / Turnover Charges |

NSE Rs 7500 per crore BSE Rs 1 per trade on premium |

NSE Rs 4000 per crore or 0.04% on premium |

|

Goods and Services Tax (GST) |

18% on (Brokerage + Transaction Charge) |

18% on (Brokerage + Transaction Charge) |

|

SEBI Charges |

Rs 5/Crore |

Rs 5/Crore |

|

Stamp Charges |

As per rates in the residential state of the investor |

As per rates in the residential state of the investor |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|