Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

1.87% 117,603 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Ventura Securities is a full-service broker providing trading and investment services to NRI investors. The broker offers online trading facility to make equity delivery, derivative and mutual fund investments fast, transparent and hassle-free for NRIs.

Investors can open the Ventura NRI 2-in-1 account including an NRI trading and NRI Demat account with the broker.

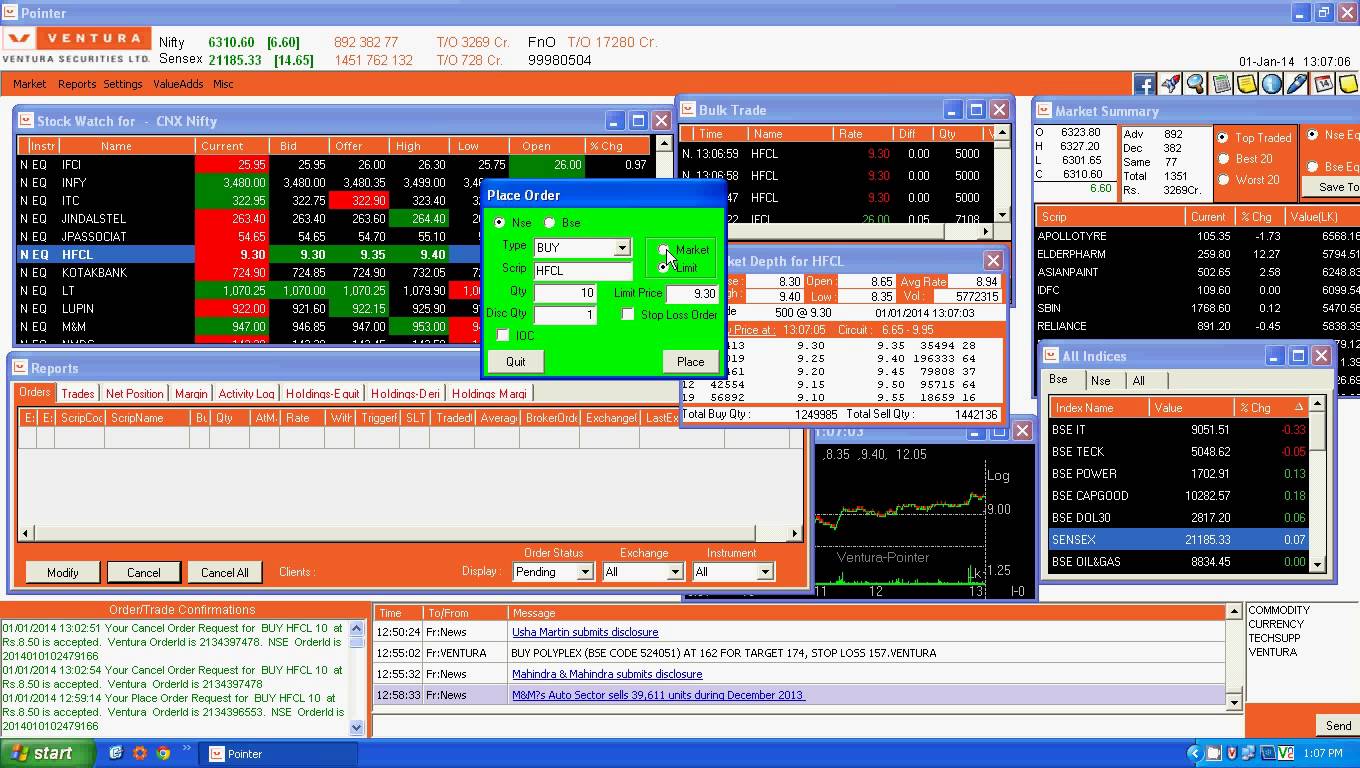

NRIs can invest through it's mobile app and web-based trading platforms. Ventura also offers its flagship online trading platform 'Pointer' to NRIs. Ventura has a dedicated research team that offers fundamental & technical analysis on Equities & Mutual Funds to NRI customers.

Ventura has a wide presence in Dubai and India. The broker also provides NRI services to clients in the UK, US, East Africa, and Australia, etc.

To trade/invest in Indian Stock Market with Ventura, a NRI needs the following accounts:

NRI Bank Account is the first step towards investment in India for NRIs. NRI Bank Account is classified in NRE and NRO Bank Account.

Ventura has a tied-up with Axis Bank for NRI Bank Account. NRIs have to obtain PIS permission from RBI to invest in the Indian stock market. The bank can help in getting the PIS permission.

For investing in the equity delivery segment, NRIs are required to open NRE Bank Account under the PIS scheme.

For investing in Equity Derivatives and Mutual Funds, NRIs are required to open NRO Bank Account. PIS permission is not needed for this account.

NRIs need a custodian account to trade and invest in the Equity Derivatives (F&O) segment at BSE and NSE.

Demat account is an online account to hold securities (stocks, mutual funds, bonds, NCDs, and ETFs, etc.) in electronic form. Demat Account is a mandatory account to invest in the Indian Stock Market.

Ventura is a depository participant (member) of CDSL and NSDL, the central depositories. While the demat accounts (and securities held in them) remain with CDSL/NSDL, Ventura works as a service agent for the demat account.

The NRI demat account is linked with an NRI Bank Account. Dividend and interest earned from investments in stocks and mutual funds are automatically credited to this linked bank account.

Note:

Visit NRI Demat Account - Online Opening Procedure, Charges, Rules for more detail.

An NRI needs a trading account to place buy/sell orders at BSE/NSE. The trading account is offered through Ventura's trading membership with BSE and NSE stock exchanges.

The NRI Trading Account is linked with NRI Demat Account and NRI Bank Account. When an NRI buys shares through the NRI Trading Account, the money is withdrawn from the linked NRI Bank Account and shares are deposited to the linked Demat Account. The same thing happens in reverse when NRI sells the shares.

Ventura offers online investment services across equity, derivatives and mutual funds to NRIs. Once you have an NRI trading account in place, you can trade with Ventura online from anywhere and at any time.

Place a buy/sell order through Ventura NRI trading software online. Ventura trading system will check the availability of funds in the linked NRI bank account in case of buy order. And, NRI Demat account will check the availability of shares in the Demat account when it is a sell order. If they have sufficient funds or shares in Demat account, the order is sent to the stock exchange. At the exchange, if a match is found, the order gets executed.

Ventura sends contract notes to the bank at the end of the day. Ventura sends 2 contact notes to the bank, one of all buy orders in the day and another for all sell orders.

In the case of buy orders, on the receipt of this contact note, bank transfers the funds to the broker.

In the case of sell orders, the bank receives funds from the broker.

In the case of sell orders, the broker withdraws the shares from the NRI Demat Account and transfers them to the buyer.

In the case of buy orders, the shares are credited to the demat account in T+2 days.

The bank reports all the transitions in NRI PIS Bank Account to RBI daily.

Ventura NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹5000 |

| NRI Account AMC | ₹0 |

| Equity Delivery Brokerage | 0.40% |

| Equity Future Brokerage | 0.40% |

| Equity Options Brokerage | 0.40% |

| Other Charges |

Ventura offers advanced online trading software in mobile and web versions to NRIs.

Read Ventura Trading Software Review to know in detail about the platforms.

The investment options available to an NRI at Ventura.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | No |

| Others |

NRI account opening with Ventura is a manual process where an NRI has to fill the paper forms, attach the required document and send them to Ventura. It takes around 10 days to open all the accounts once the forms are received.

Prerequisites for account opening:

Ventura can assist the client to open the PAN Card and opening the NRI bank account with Axis Bank.

Note:

| Feature | Status |

|---|---|

| 3-in-1 Account | No |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

Ventura NRI customers can invest in mutual funds online through Ventura Wealth mobile trading app. They can buy, switch and redeem mutual funds online.

Ventura's website provides a range for tools to NRIs including Fund Screener, MF Performance Tracker, Fund Compare and Fund Ranking.

Ventura NRI customers can invest in Mutual Funds on a lump-sum basis or through a Systematic Investment Plan (SIP).

|

Scheme Category |

Upfront Brokerage |

Trail Brokerage |

||

|---|---|---|---|---|

|

Minimum |

Maximum |

Minimum |

Maximum |

|

|

Equity - Tax Planning |

0.50% |

1.50% |

0.20% |

0.75% |

|

Equity Others |

0.50% |

1.00% |

0.20% |

0.75% |

|

Debt - Liquid Funds |

0.00% |

0.00% |

0.05% |

0.15% |

|

Debt |

0.25% |

1.00% |

0.05% |

1.00% |

|

Hybrid |

0.25% |

1.00% |

0.50% |

1.00% |

Ventura NRI Support Desk contact information. Find Ventura NRI contact number.

| Ventura NRI Helpline | Number |

|---|---|

| Ventura NRI Customer Care Number | +91 22 6754 7000,+91 22 6622 7156 , +91 22 6774 75 |

| Ventura NRI Customer Care Email ID | nricell@ventura1.com |

Ventura is a full-service broker that offers personalized services, research, and recommendations. It also provides online trading platform to NRIs. The brokerage charges are on the higher side. Ventura also doesn't offer GTC, AMO and BTST orders which make it difficult for NRIs to place orders in off-market hours.

Yes. NRIs can open trading and demat account without visiting the branch of Ventura. NRIs can send the application form along with the required documents to the branch of Ventura Securities.

Yes, NRIs can open only the Mutual Fund investment account. This account also includes a Demat Account linked with the NRO Bank Account (non-PIS).

You can visit the Ventura Securities website and click on the NRI desk icon on the homepage. Click on the Open an NRI Account tab on the right-hand side of the page. Fill up your details like Name, Email, Mobile No. and Country. A representative from the NRI desk will get in touch with you and assist with end- to- end account opening process.

Yes, you can invest in mutual funds once you have opened an NRI account with Ventura Securities Ltd.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Thursday, November 23, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|