Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

1.11% 13,339 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Trustline Securities is a full-service broker offering trading and investment services in equity, F&O, mutual fund, FDs, and bonds to both resident and non-resident Indian investors. The broker offers customized investment solutions across wealth management, insurance, financial markets, bullion and real estate.

The broker charges 3 paise per executed order as a brokerage in equities, 30 paise in futures and Rs 75 per lot for options.

Trustline offers a web-based trading platform T5, and iTrust Mobile, a mobile trading application for NRI investors to make trading and investing easy. The broker also allows US and Canada based NRIs to trade and invest through the Trustline NRI trading platform.

NRIs can invest in mutual funds through a separate mobile application named trustmutualfunds. Trustline also facilitates the IPO application facility for all investors.

The stock broker has 100000+ clients and 400+ offices across India.

NRIs need to open the following accounts to trade and invest in India:

NRIs must have a PAN number to trade and invest in India. In case, you do not have a PAN Card, you can apply online. You need to apply for PAN number by filling Form 49AA through the websites of UTIITSL and NSDL.

Note - The PAN card is the same for NRIs and Resident Indians. If you already have a PAN Number as resident Indian, you don't need a new PAN number as an NRI.

Trustline doesn't offer banking services to investors. The broker allows the NRI Bank account with Axis bank only. NRIs have to open NRI bank account with Axis Bank before opening accounts with Trustline.

After opening the NRI SB account, non-resident Indian investors have to get PIS permission with the help of the bank. PIS permission is necessary for NRIs to invest in the Indian stock market. To trade and invest across the derivative segment, NRIs will not need a PIS account.

Trustline works as a trading cum clearing member with the stock exchange. All the trades placed in Equity derivatives segments are settled by Trustline Securities.

Trustline offers a Demat account under both the depositories (CDSL and NSDL). In India, a Demat account is necessary to hold the securities in the dematerialized format.

NRIs have to open a trading account with Trustline to place buy and sell requests across BSE and NSE. The broker offers a trading platform to invest across equity, Mutual Fund, FDs, bonds, and the F&O segment.

Following is the step by step process for trading in the equity delivery segment.

Transfer funds from your NRI bank account to the PIS account. The bank informs the broker regarding the fund allocation. The trading account investment limit is updated based on the fund allocation amount.

Through the Trustline NRI trading platform, place a buy or sell order. After receiving the order, the system checks the availability of funds or shares. If everything is correct, the order is executed in the stock exchange and an order confirmation alert is sent.

If it is a buy order, the Demat account is credited with shares and the NRI bank account is debited with money. When it is a sell order, the Demat account is debited with shares and the NRI bank account is credited with the money.

At the end of the day, all the transactions are reported to RBI by the bank through separate buy and sell contract notes.

Trustline NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹0 |

| NRI Account AMC | ₹1000 + GST |

| Equity Delivery Brokerage | 0.03 (3 paise) |

| Equity Future Brokerage | 0.30 (30 paise) |

| Equity Options Brokerage | ₹75 per lot |

| Other Charges |

Trustline offers mobile and web-based trading software to NRIs for online trading. The broker doesn't allow algo trading and AMO (After Market Order) facility.

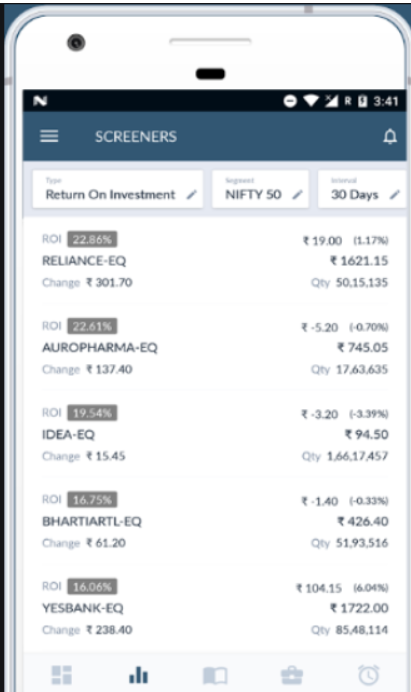

It is a front-end mobile app allowing investors to perform the following functions:

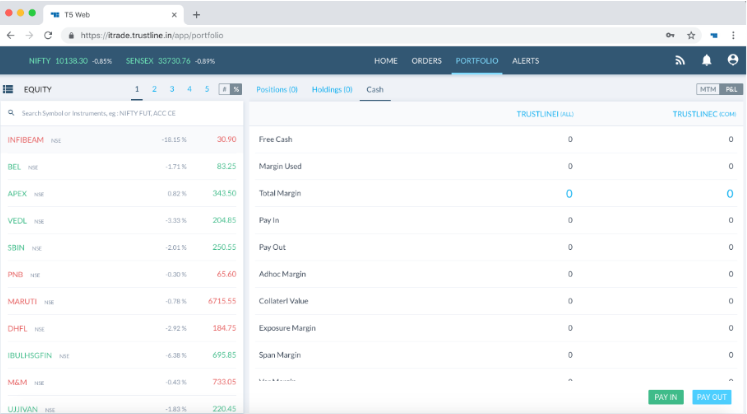

You can use a web-based trading platform from your mobile or laptop. Here are the features of T5 web-based trading platform:

The investment options available to an NRI at Trustline.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | No |

| Others |

If you are present in India, you can visit the nearest branch of the Trustline and open the NRI account. But if you are out of India, you can follow the steps below for NRI online trading account:

If IPV is not feasible, authorized photocopies by the competent authority may also be permitted by Trustline for document verification.

Note:

PIS Permission letter provided by the designated bank.

| Feature | Status |

|---|---|

| 3-in-1 Account | No |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

Trustline offers mutual fund investment option for resident and non-resident Indian Investors (NRIs). They can invest in mutual funds through a mobile app named trustmutualfunds which is available for Android and iOS users.

Trustline NRI Support Desk contact information. Find Trustline NRI contact number.

| Trustline NRI Helpline | Number |

|---|---|

| Trustline NRI Customer Care Number | (0120) 4613-888 |

| Trustline NRI Customer Care Email ID | helpdesk@trustline.in |

Trustline Securities is a good choice for both casual and frequent traders. The full-service broker offers depository services and research tips for NRIs. It also allows US and Canada based NRIs after filling FATCA and FEMA declaration form. The brokerage charges are quite low as compared to other full-service brokers in India. The broker also offers good web and mobile trading platforms in addition to a dedicated mobile app for mutual fund investments. Call n Trade facility and IPO application services are other features that make Trustline a good choice as an NRI stockbroker. The only major disadvantage with the broker is that it only allows Axis Bank accounts to be linked with its trading account. So, if you have Axis NRI bank accounts then its an excellent choice else you have to transfer your bank accounts to trade with Trustline.

Yes, Trustline Securities have a research desk to help resident and NRI investors in taking investment decisions.

The research desk provides recommendations and research tips in the equity segment. The recommendations offered by Trustline are available on the homepage. The investors can also subscribe to get mobile text messages on their registered numbers.

Trustline securities offer two NRI trading platforms which are:

You can invest in stocks, futures and options segments across NSE and BSE. iTrade mobile and web platforms are available free of cost for NRIs.

When you open the NRI trading account with the broker, it provides trading ID and password to access the platforms.

Trustline NRI mutual fund investment option is available separately through a mobile app named trustmutualfunds.

The brokerage charges for equity 3 paise per order. The brokerage for Futures is 30 paise per orders and for Options, it is Rs 75 per lot.

Yes, Trustline offers it's trading and investment services to NRIs based in the US as well as Canada. However, the NRIs need to comply with FATCA regulations while trading and investing in India.

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Thursday, November 23, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|