Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Short Call (Naked Call) and Collar options trading strategies. Find similarities and differences between Short Call (Naked Call) and Collar strategies. Find the best options trading strategy for your trading needs.

| Short Call (Naked Call) | Collar | |

|---|---|---|

|

|

|

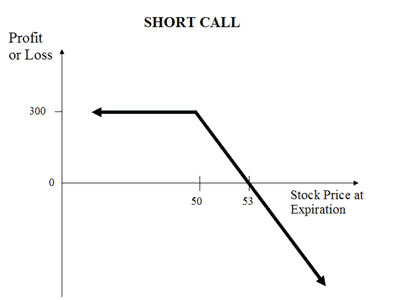

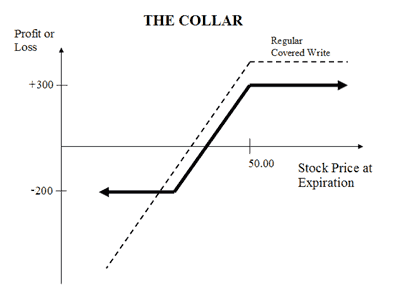

| About Strategy | Short Call (or Naked Call) strategy involves the selling of the Call Options (or writing call option). In this strategy, a trader is Very Bearish in his market view and expects the price of the underlying asset to go down in near future. This strategy is highly risky with potential for unlimited losses and is generally preferred by experienced traders. The strategy involves taking a single position of selling a Call Option of any type i.e. ITM or OTM. These naked calls are also known as Out-Of-The-Money Naked Call and In-The-Money Naked Call based on the type you choose. This strategy has limited rewards (max profit is premium received) and unlimited loss potential. When the trader goes short on call, the trader sells a call option and e... Read More | A Collar is similar to Covered Call but involves another position of buying a Put Option to cover the fall in the price of the underlying. It involves buying an ATM Put Option & selling an OTM Call Option of the underlying asset. It is a low risk strategy since the Put Option minimizes the downside risk. However, the rewards are also limited and is perfect for conservatively Bullish market view. Suppose you are holding shares of SBI currently trading at Rs 250. You can deploy a collar strategy by selling a Call Option of strike price Rs 300 while at the same time purchasing a Rs 200 strike price Put option. If the price rises to Rs 300, your benefit from increase in value of your holdings and you will lose net premiums. If the price falls... Read More |

| Market View | Bearish | Bullish |

| Strategy Level | Advance | Advance |

| Options Type | Call | Call + Put + Underlying |

| Number of Positions | 1 | 3 |

| Risk Profile | Unlimited | Limited |

| Reward Profile | Limited | Limited |

| Breakeven Point | Strike Price of Short Call + Premium Received | Price of Features - Call Premium + Put Premium |

| Short Call (Naked Call) | Collar | |

|---|---|---|

| When to use? | It is an aggressive strategy and involves huge risks. It should be used only in case where trader is certain about the bearish market view on the underlying. |

The Collar strategy is perfect if you're Bullish for the underlying you're holding but are concerned with risk and want to protect your losses. |

| Market View | Bearish When you are expecting the price of the underlying or its volatility to only moderately increase. |

Bullish When you are of the view that the price of the underlying will move up but also want to protect the downside. |

| Action |

|

|

| Breakeven Point | Strike Price of Short Call + Premium Received Break even is achieved when the price of the underlying is equal to total of strike price and premium received. |

Price of Features - Call Premium + Put Premium |

| Short Call (Naked Call) | Collar | |

|---|---|---|

| Risks | Unlimited There risk is unlimited and depend on how high the price of the underlying moves. |

Limited You will incur maximum losses when price of the underlying is less than the strike price of the Put Option. Max Loss = Purchase Price of Underlying - Strike Price of Long Put - Net Premium Received |

| Rewards | Limited The profit is limited to the premium received. |

Limited You will incur maximum profit when price of underlying is greater than the strike price of call option. Max Profit = Strike Price of Short Call - Purchase Price of Underlying + Net Premium Received |

| Maximum Profit Scenario | When underline asset goes down and option not exercised.

|

Underlying goes up and Call option exercised |

| Maximum Loss Scenario | When underline asset goes up and option exercised.

|

Underlying goes down and Put option exercised |

| Short Call (Naked Call) | Collar | |

|---|---|---|

| Advantages | This strategy allows you to profit from falling prices in the underlying asset. |

It protects the losses on underlying asset. |

| Disadvantage | There's unlimited risk on the upside as you are selling Option without holding the underlying. Rewards are limited to premium received only. |

The profit is limited |

| Simillar Strategies | Covered Put, Covered Calls, Bear Call Spread | Covered Put Bull, Call Spread, Bull Put Spread |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|