Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Wednesday, April 18, 2018 | Modified on Wednesday, June 5, 2019

| Strategy Level | Beginners |

| Instruments Traded | Call |

| Number of Positions | 2 |

| Market View | Bullish |

| Risk Profile | Limited |

| Reward Profile | Limited |

| Breakeven Point | Strike price of purchased call + net premium paid |

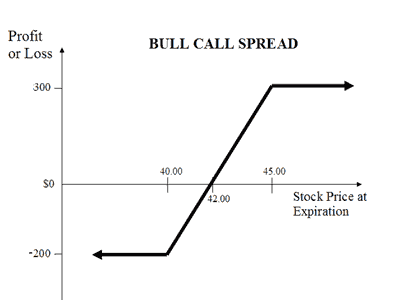

A Bull Call Spread (or Bull Call Debit Spread) strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. The strategy involves taking two positions of buying a Call Option and selling of a Call Option. The risk and reward in this strategy is limited.

A Bull Call Spread strategy involves Buy ITM Call Option and Sell OTM Call Option.

For example, if you are of the view that NIFTY will rise moderately in near future then you can Buy NIFTY Call Option at ITM and Sell Nifty Call Option at OTM. You will earn massively when both of your Options are exercised and incur huge losses when both Options are not exercised.

A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future.

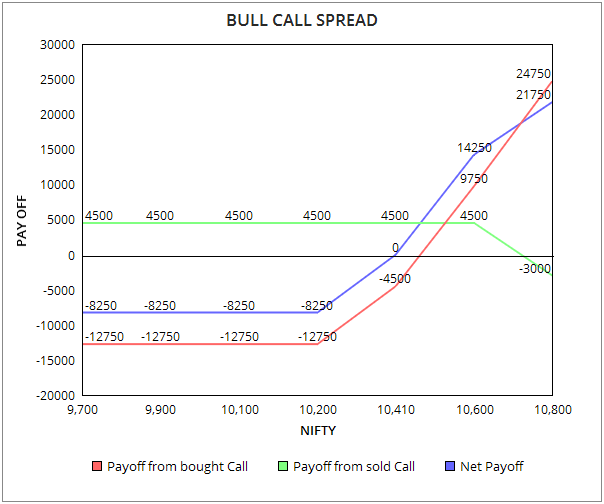

Suppose you are bullish on Nifty, currently trading 10,500, and expecting a mild rise in its price. You can benefit from this strategy by buying a Call with a Strike price of 10,300 at a premium of 170 and selling a Call option with a strike price 10,700 at a premium of Rs 60. The net premium paid here is Rs 110 which is also your maximum loss.

| Current Nifty | 10,500 |

| Option Lot Size | 75 |

| Strike Price of Call Option | Rs 10,300 |

| Premium Paid | Rs 170 |

| Strike Price of short Call Option | 10,700 |

| Premium Received | Rs 60 |

| Net Premium Paid | Rs 110 |

| Break Even Point (Strike Price of bought call + Net Premium) | 10,410 |

The Bull Call spread strategy has done 3 things:

Bull Call Spread Strategy Payoff Schedule

| Payoff from | |||

|---|---|---|---|

| Nifty on Expiry | Long Call Option (SP-BEP) BEP = 10,470 Max Loss = 12750 | Short Call Option (BEP-SP) BEP = 10,760 Max Profit = 4500 | Net Payoff(Rs ) |

| 9,700 | -12750 | 4500 | -8250 |

| 9,900 | -12750 | 4500 | -8250 |

| 10,100 | -12750 | 4500 | -8250 |

| 10,200 | -12750 | 4500 | -8250 |

| 10,410 | -4500 | 4500 | 0 |

| 10,600 | 9750 | 4500 | 14250 |

| 10,800 | 24750 | -3000 | 21750 |

When you are expecting a moderate rise in the price of the underlying.

A Bull Call Spread strategy involves Buy ITM Call Option + Sell OTM Call Option.

For example, if you are of the view that Nifty will rise moderately in near future then you can Buy NIFTY Call Option at ITM and Sell NIFTY 50 Call Option at OTM. You will earn massively when both of your Options are exercised and incur huge losses when both Options are not exercised.

Strike price of purchased call + net premium paid

The trade will result in a loss if the price of the underlying decreases at expiration. The maximum loss is limited to net premium paid.

Max Loss = Net Premium Paid

Max Loss happens when the strike price of Call is less than or equal to price of the underlying.

Limited To The Difference Between Two Strike Prices Minus Net Premium

Maximum profit happens when the price of the underlying rises above strike price of two Calls. The profit is limited to the difference between two strike prices minus net premium paid.

Max Profit = (Strike Price of Call 1 - Strike Price of Call 2) - Net Premium Paid

Both options exercised

Both options unexercised

Instead of straightaway buying a Call Option, this strategy allows you to reduce cost and risk of your investments.

Profit potential is limited.

Buy back the sold call options and sell the bought call options

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|